creengrack

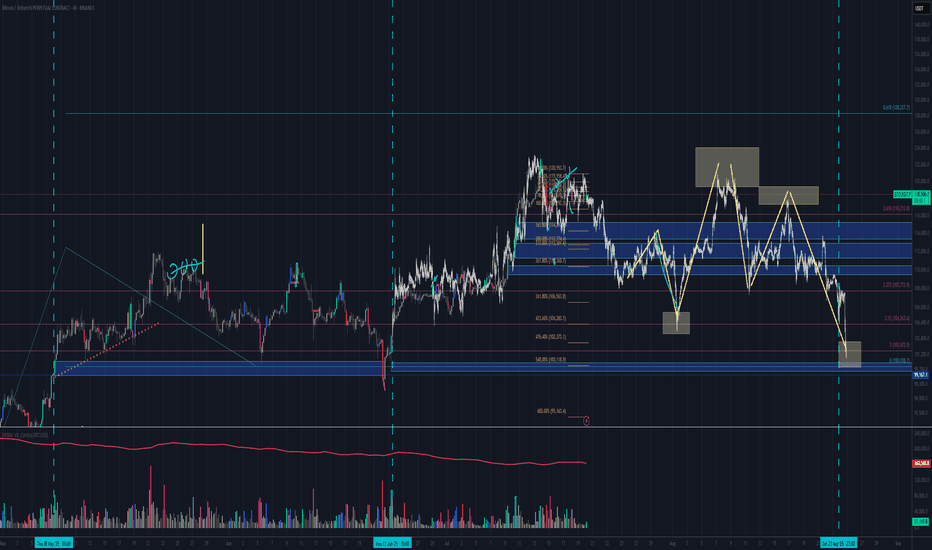

A leg of our strategy says price will return to broken threshold candle price levels. Meaning the corresponding price candle to the volulme bar that broke threshold will have price back within that candles open and close range; at some point in time. Things get kind of shaky below 15minute with my script but nonethe less we will use our stop loss just below the...

Easily invalidated. We are using the patterns from the price action post threshold break (redline in bottom pane) These breaks are unseen on this time frame The volume instabilities are between the 15 minute and the 1 hour. I would look for breaks under 15 minutes, too much noise at that level. Go ahead and test it yourself. See my script posted on trading view...

we use the threshold breaks to determine targets AKA areas of liquidity. we also utilize pattern detection paired with the threshold breaks to validate cycles and where we are in said cycle.

using hourly btc analysis we can breakdown this move and its time cycles pvsra volume threshold breaks indicating price instability allows us to break down these moves starting point present past pattern repeating barpattern-overlay

May 08 2025 a bullish candle's parallel volume bar broke the threshold in the below pane; indicating price instability, or unfilled orders if you will. June 22 price returns to that full candle body and dips $500 below it, to feel the opposing force and realize orders have been filled and we are in equilibrium. This set up is usually set up and finished in 1-2...

If history rhymes, we should see: A 6–7 000‑point gentle climb (blue “2”) off the 17 000 springboard into ~23–24 000. Followed by a sharper 8 000‑point blow‑off (blue “3”) into the low‑30 000s. Of course, any big exogenous shock (geopolitics, Fed surprise) can alter the timing—but structurally the chart wants to repeat its 1→2→3 cycle into 2026.

Until we close daily above lower bollinger band, we are in big trouble, as it sits now, band is around 84k

As we are gearing to go into thursday, bitcoin is looking ripe for higher prices as chop continues. We know most moves during nyse open on fridays/ mondays are traps, so we will analyze price and time on friday; above is a cheat sheet for the coming weekly micro cycle. I apologize for not posting as our v6 pvsra vol detector caught every move. I cant update here...

This BTC/USDT 4H chart shows key resistance and support levels. Price is at $95,650, testing a critical zone. A breakout above GETTEX:98K within 3.25 days is crucial for bullish momentum toward the daily Bollinger top band at $105K. Failure to close above this could lead to a bearish drop. A potential rejection is marked with a red zone, indicating a downward...

Alt season has arrived and my metrics for it met. Alts looking ripe to run here and btc to follow in the spring, will update in early spring late winter if nothing changes

leaning more towards an alt winterseason as btc holds high value level, as our sideways motion begins to define itself expect alts to run, waitimg for btc to solidify the 94-98 level, investors need to see strength in the high 90s and an alt season is sure to ensue. trade invalidated above 100750 alt season invalidated above 100750 alt season invalidated...

will reasses the ratio once bitcoin slows above 100k

eth/btc and btc.d are great ratios to measure, but to fully enter an alt season a couple things have to happen 1] BTC can not go above 100k or else money will be pulled from alts to be put into btc 2] BTC can not close a daily candle below 89k or else money will be pulled from all markets due to fear. 3] BTC holds high value level at 95k region BTC going past...

Im going to use this post for my volume and structure analysis of my indicators and for tuning my 'strategy' which is still unknown, this study will just be an analysis of my strategy and findings. Emmett and Vera, if you ever see this, your dada loves you very much and my work will always be here for you to see.

midline - vwma 55 st dev - 1.618 TF - Daily As you get to smaller tfs make the vwma longer and the st dev greater, for example: 1hr, vwma 300, st dev 2.9

Bitcoin will follow. Bitcoin top est. 102-1-6k for next impulse wave up, Eth could have a 20% day as well as i believe it will lead the charge

happy alt season everyone, load ur bags, you saw it here first! thanks trump

Watching the little brother, eth, tempting to take this up to the .618 but our target is the slanted blue line. Also PSX:POL looks prime for a 100% gain week