darcsherry

PremiumHere’s my outlook on gold (XAUUSD) for the week of August 4–9, 2025. Last week’s move was shaped by strong early dollar momentum, a 3% U.S. GDP report midweek, and Friday’s sentiment shift after the surprise tariff announcement. Price is now sitting near the $3,380 supply zone, a structure that’s been in play since April. I highlight: ✅The key demand zone...

In this pre-recorded video, I unpack one of the most overlooked reasons why traders blow their accounts over and over again, and it’s not about your system, strategy, or signal. It’s about risk capacity, the internal threshold your nervous system can handle before fear, greed, or shutdown kicks in. This is part of my ongoing series on YouTube “Rebuilding the...

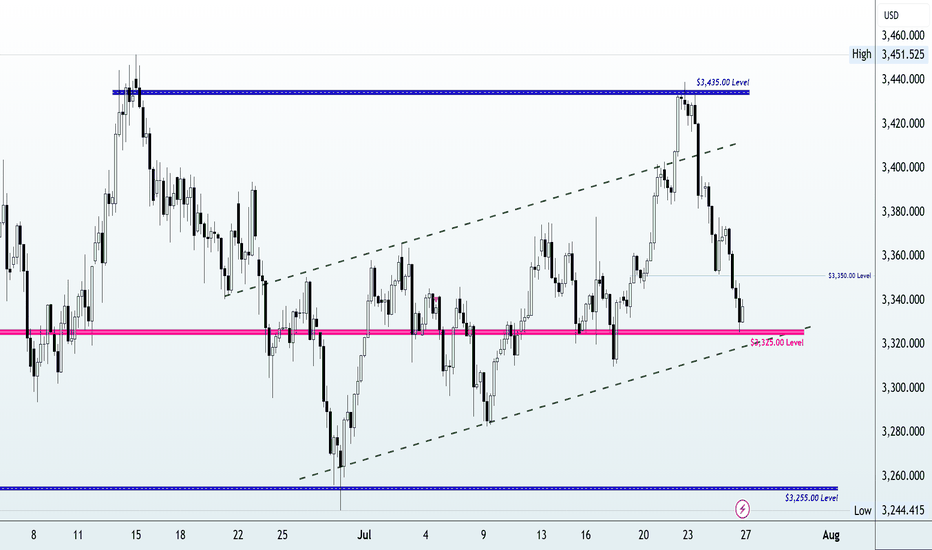

In this video, I break down everything that moved the price of gold last week, from the early-week rally toward $3,430 to the sharp midweek drop toward $3,325. We go beyond the surface, diving into what caused the reversal, and how I'm approaching next week’s market using a simple ascending channel on the 4-hour chart. With major events like the FOMC rate...

In this video, I break down the recent gold price action and what to expect in the coming week. We’ll review how gold responded to last week’s FOMC minutes, why $3,360 remains a key decision zone, and what upcoming U.S. economic data (CPI, PPI, Retail Sales) could mean for price movement. 👉 If you find this content valuable, don’t forget to Vote, Comment, and...

In this video, we dive deep into the gold market analysis for the week of July 7 to July 11, 2025. I break down everything you need to know from last week’s price action — including the surge to $3,360, the impact of the U.S. tax cut and spending bill, and the 2.2% weekly gain despite consolidation. We also look ahead at what to expect this week, including: 📅...

In this video, I break down last week’s gold price action and give you a detailed outlook for the week ahead. With gold closing around $3,260 and major macroeconomic shifts unfolding—including the Israel-Iran ceasefire talks, rising US dollar strength, and concerns over the US Q1 GDP contraction, we are at a turning point. 📉 Will weakening economic data force the...

Will XAUUSD resume its bullish trend, or is more downside ahead? In this video, I break down last week’s gold price movement and the current market reaction to rising geopolitical tensions between Iran and Israel, now with the U.S. joining the conflict. We also assess the impact of the Fed’s recent rate hold, weak retail sales, and upcoming high-impact U.S....

In this video, I break down the recent surge in gold prices, what drove the momentum, including rising tensions between Israel and Iran, and the impact of weaker U.S. inflation data that’s pushing Fed rate cut expectations. Gold is now sitting just below the all-time high of around $3,500. With major U.S. economic events like Retail Sales and the Federal Reserve...

In this video, we dissect how gold traded last week (May 26–30), why the price hovered near the top of a descending channel, and what’s driving market indecision. From geopolitical tensions to Federal Reserve interest rate uncertainty, we connect the dots between fundamentals and technical structure, enabling you to make better-informed trading decisions. 📅 Key...

In this video, I’m diving into the USDJPY setup ahead of a high-impact week filled with major economic news like the NFP, ADP Employment, and speeches from the BoJ Governor. We’ll walk through the technical zones I’m watching, discuss potential buyer and seller reactions, and outline the key catalysts that could move the market. 🔔 Don’t forget to like the video...

Gold prices surged last week, ending with a strong 3.9% weekly gain, closing around the $3,365 zone after bouncing back with conviction on Friday. In this video, I break down why gold rallied, what key events influenced price action, and how I’m reading the current chart structure to strategically position for the next move. Here’s what’s driving the gold market...

Gold ended last week under pressure as investors booked profits following improved risk appetite, driven by easing trade tensions and a strong U.S. labor market report. 📰 NFP came in at +177K in April, with the unemployment rate steady at 4.2%, matching forecasts—possibly keeping the Fed cautious on policy easing. Technically, Gold remains bullish but is now...

After testing a fresh record high around the $3,500 zone, gold made a sharp U-turn, erasing much of its gains and dropping toward the $3,260 support zone. This reversal came as the US Dollar found fresh strength, following US President Trump’s major backtracking on tariffs against China and the dismissal of Fed Chair Powell. Markets have since stayed volatile,...

Last week, Gold briefly hit an all‑time high of $3,357 before profit‑taking drove it back to around $3,320 zone📉 Ongoing uncertainty around US‑China trade relations and a weaker dollar drove traders into safe‑haven assets, supporting bullion bids despite the pullback. Meanwhile, Fed Chair Jerome Powell’s hawkish speech on Wednesday capped the rally for now,...

In this video, I break down the key forces pushing gold to record highs. Learn how factors such as US-China trade tensions, global inflation pressures, and geopolitical uncertainty—combined with a weakening US Dollar and safe-haven demand—are reshaping the gold market. In this quick analysis, we cover: 🔹 Inflation & Economic Uncertainty: How rising prices and...

The price of gold (XAUUSD) surged to a new all-time high last week following former President Trump’s announcement of reciprocal tariffs, only to face a strong retracement that plunged it to a 7-day low of around $3,015. The market then saw a recovery after Fed Chair Jerome Powell hinted that inflation could reaccelerate due to the economic impact of tariffs. In...

Gold surged to a record high of $3,086 last week as investors dumped Equities and Crypto for safe-haven assets. With rising inflation concerns and uncertainty surrounding Trump’s tariffs, fears of a US recession or stagflation are driving the market. 📈 Will Gold continue its rally, or is a pullback coming? In this video, I break down my thought process and how...

Oil prices are showing signs of recovery after a strong bearish move, with $68.00 as a key level that will play a significant role in guiding our trading decisions for the new week. 📌 Key Technical Outlook: 🔹 Oil is currently trading within an ascending channel on the 4H timeframe. 🔹 I’ll be watching for a breakout/retest of the channel resistance and $68.50...

![Gold Weekly Analysis | Will $3,360 Break or Hold? [July 14–18] XAUUSD: Gold Weekly Analysis | Will $3,360 Break or Hold? [July 14–18]](https://s3.tradingview.com/p/PVmcODvA_mid.png)