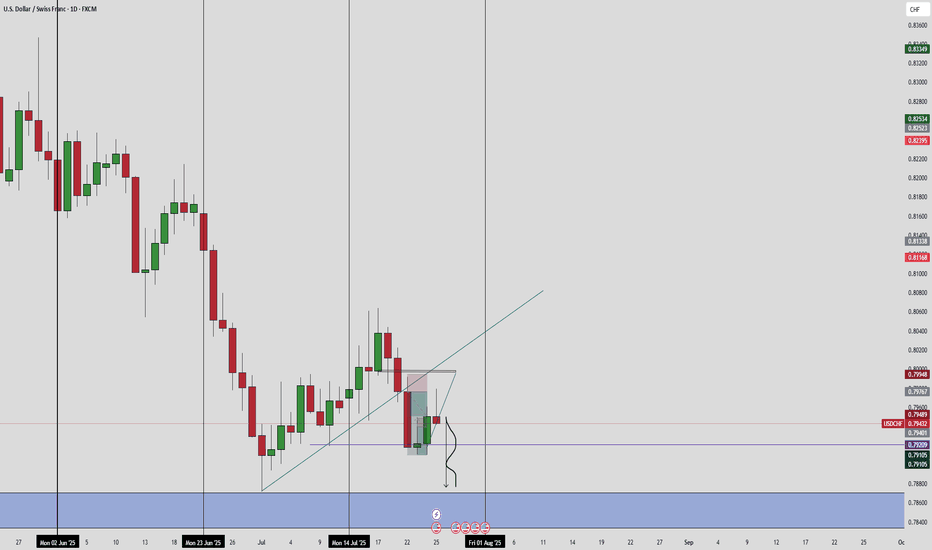

USD/CHF is showing clear bearish sentiment heading into the early part of the week. The pair exhibits signs of a potential sharp decline, with momentum favoring the downside. Traders should keep a close watch on this pair for possible breakdown opportunities throughout the week.

The DXY looks set to take out the immediate low — all eyes on that level. Once it’s cleared, we’ll watch for signs of a possible retracement or reversal to the upside. If no such move occurs, the DXY is likely to continue its decline."

"I’m expecting overall bullish momentum for EUR/USD in the coming weeks. We might see some short-term bearish moves, but they could just be setups for a larger bullish push. Fingers crossed!"

"The S&P 500 is showing a bullish trend on the monthly chart, which means as we enter a new month (June), we're looking for a healthy pullback to position for long entries. Fingers crossed!"

USDJPY remains under pressure, and top-down analysis suggests continued downside momentum. All signs point to a potential extension of the current bearish move, fingers crossed.

EURUSD has gained strong, one-sided momentum with no immediate signs of slowing. The pair appears poised for a continued rally, with the potential to surge even higher in the coming days and weeks.

"GBPUSD shows strong bullish momentum with no immediate signs of slowing down, especially following a period of consolidation. The pair appears to be targeting the next key resistance zone to the upside. The question now is whether the dollar has enough strength to shift sentiment or are we set to see continued upside? For now, we watch and wait for any signs of...

"Is GBPJPY gearing up for a potential downtrend? Price action appears increasingly hesitant to push higher, suggesting buyer exhaustion at current levels. If this reluctance persists and key support zones begin to break, we could be looking at the early signs of a shift toward bearish momentum. A confirmed lower high followed by a break of structure could set the...

EUR/USD opened the week with notable bullish momentum, but with liquidity swept above recent highs, the question now is whether price will reverse and push lower in the coming days. Eyes on potential bearish follow-through — fingers crossed.

Watching for bullish momentum to continue on USD/CHF — a move toward a key resistance level could offer clarity on whether broader trend bias leans bullish or bearish.

Keeping a close eye on gold in the weeks ahead — price action suggests a potential move toward the $3,038/oz level.

Yeah, BTC has been facing repeated rejections around that key resistance level, which could signal a potential short-term bearish move if it fails to break through convincingly. If sellers continue to defend that zone, we might see a pullback or consolidation before another attempt. On the flip side, a strong breakout with volume could push BTC into a bullish...

"EUR/JPY shows potential for a temporary upward move. Further confirmation in the new week will be key to determining the strength of its bullish momentum. Stay patient and analyze carefully! 📈✨ #ForexTrading #EURJPY"

"EUR/USD is steadily pushing downward, presenting a clear direction for a sell setup. The pair breaking the first target provides strong justification to aim for the second target. Stay disciplined and watch for confirmations! 📉💡 #ForexTrading #EURUSD"

Just as predicted, USDCAD sees rejection from that zone, and could see more bearish momentum in the following weeks

USDCAD seems to be at a premium price getting ready for sells, over the past weeks USDCAD have experienced major bullishness. Well it seems that the bullishness is coming to an end as USDCAD approaches key resistance, A major rejection confirms sells from that POI

Being in an uptrend, EU looking like it is ready to go up, as it has stalled over the week, we could see the continuation of the overall trend.

could AUDUSD make lower lows before going higher, its a matter of time now, However should DXY see more highs or more lows, what are your thoughts??