ember

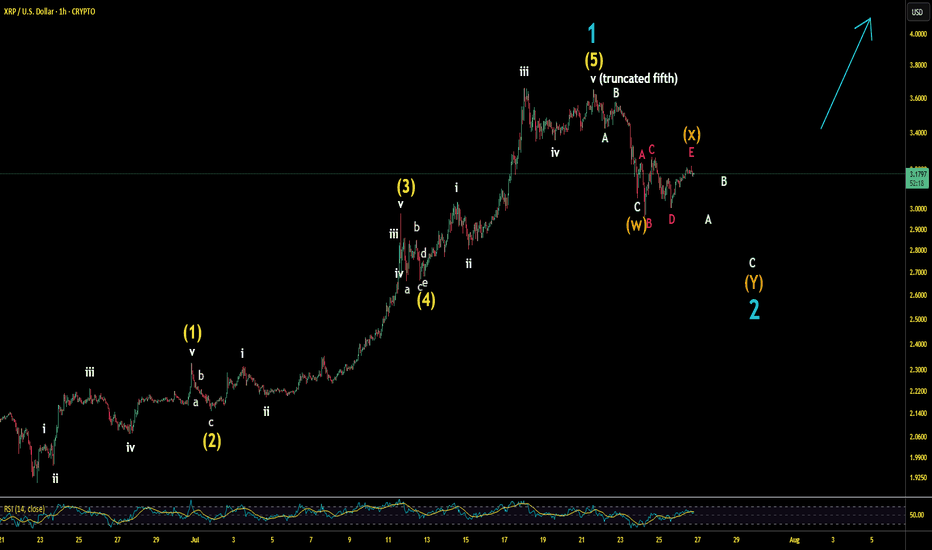

A possible double zigzag pullback scenario correcting June & July's impulsive breakout, upon which normies & bears might say "head & shoulders" but then it climbs the wall of worry for a massive Wave 3 parabola.

CONTRACTING ENDING DIAGONAL beginning in March 2009 with irregular structure, composed of triple zigzags for ALL five waves instead of single zigzags. High confidence in this count and believe its existence to be THE reason why standard impulsive wave counts have been unable to track the bull run since 2009 properly.

Wave count: Supercycle Wave ((I)) for S&P 500 and subsequent Wave ((II)) bear market. 09-28-2023

Counting an impulsive wave from 2009 felt like trying to fit a square into a circle. Something else was at play.