ftdsystem

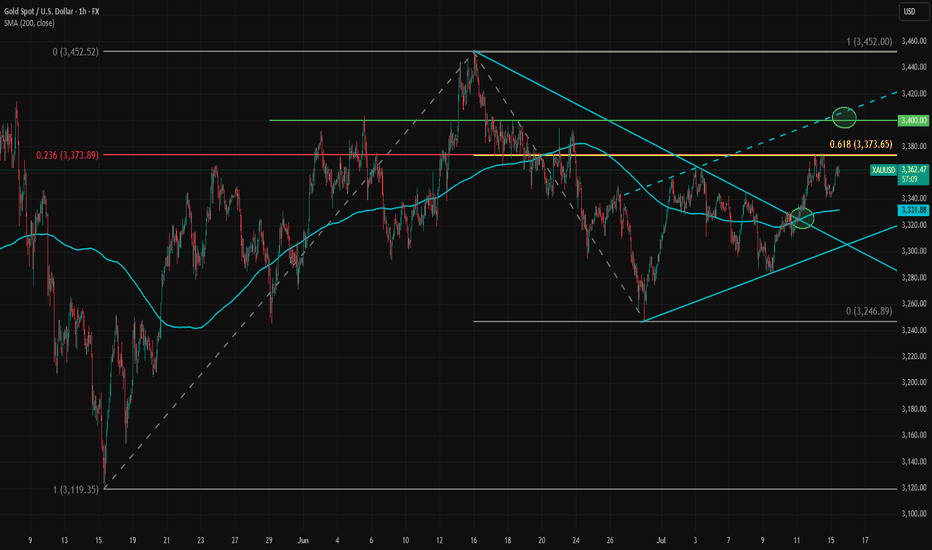

PremiumGold is hovering near 3370 amid a wave of tariff-related headlines over the past few days. After Trump’s threats toward Mexico, Canada, and the European Union, gold has been pushing toward higher levels. The latest warning came over the weekend, targeting both the EU and Mexico with a 30% tariff unless an agreement is reached by August 1. The EU trade commissioner...

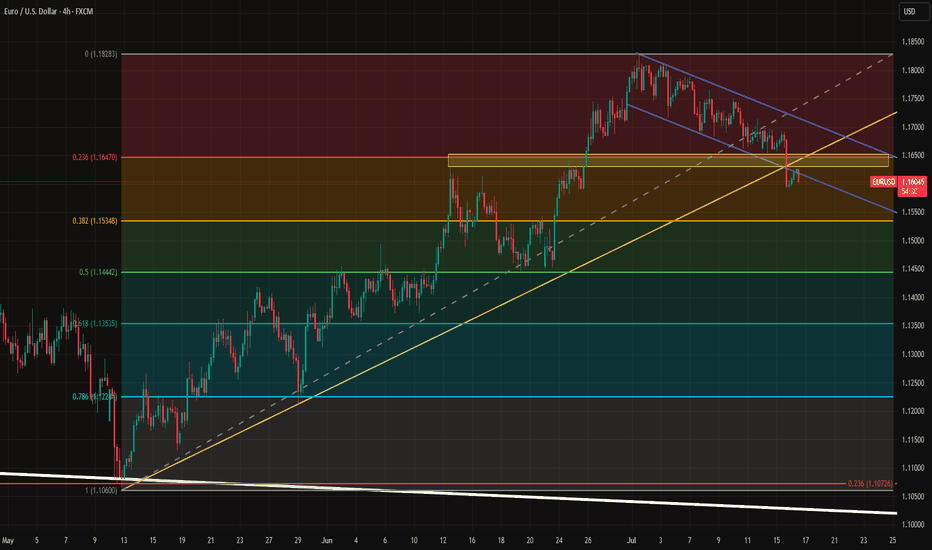

EURUSD is facing renewed downward pressure after rallying from 1.02 to 1.18 in a strong multi-month move. However, diverging inflation expectations between the EU and the U.S. are now weighing heavily on the pair. One major signal comes from real yields. The Germany–U.S. 10-year real yield spread currently sits at -1.1182, the same level seen during the 2024 top...

Yesterday’s U.S. nonfarm payrolls report came in above expectations, but a closer look at the details reveals a less encouraging picture. Despite the headline beat, market reactions quickly faded. For instance, gold initially dropped from 3350 to 3311 in the first 15 minutes after the release but has since recovered more than 75% of that decline. So why is the...

Gold is attempting to find support at the yellow trendline below, which has held since late December. At today’s open, gold quickly found support at that level, which is a bullish signal. However, it may not be over yet. For gold to recover meaningfully, it needs to break above the 3300 resistance first, followed by 3345 to confirm a move higher. This week, the...

The EURCAD rally, driven by a strong euro and a weak Canadian dollar, has created an impressive chart setup. A cup formation has developed just below the 1.5960 resistance level. Whether this pattern will be completed with a handle remains unclear at this stage. If a handle forms, the 78.6% retracement level could serve as a reasonable downside target. In the...

EURUSD is feeling the bearish pressure as geopolitical tensions in the Middle East escalate. These risks are driving traders toward safe havens, particularly the US dollar and US government debt, which still serve as the backbone of global reserves. The sharp decline in the dollar in recent months has added to this dynamic, but it’s not over yet for euro bulls in...

With tariffs and Middle East escalation in focus, central banks have somewhat fallen to the backstage recently. But today’s FOMC meeting might change that. The federal funds rate upper band is most likely to stay at 4.50% with a unanimous vote. However, today’s focus will not be on the interest rate itself but rather on the dot plot and updated economic...

Ether stabilized in a slightly positive trend after breaking the previous uptrend. Since mid-May, this flattish trend channel has continued, offering some trading opportunities within it. When Ethereum approaches the lower line and the 50 EMA crosses above the 50 SMA, an ETHUSDT surge has followed each time since the channel formed. Traders could expect a similar...

Palo Alto Networks (PANW) has technically formed a pattern similar to its 2019–2021 flat period. Back then, after two tops (points 1 and 2) and a sharp bear trap breakdown below the current range (point 3), PANW retested the upper side of the range once more (point 4), which was followed by a massive breakout. From point 3 to the top, PANW rallied 361.8% of the...

ATI broke out above the key $67.35 resistance level in early May and is now attempting to consolidate its recent surge. While the stock has nearly reached the consensus analyst price target—suggesting limited near-term upside—the recent Middle East visit by Trump may have changed the outlook. ATI is a U.S.-based specialty materials and components manufacturer,...

Silver recently broke out above the key 34.85 resistance level, and this could be a game changer for the medium-term outlook. With rising concerns over government debt, trade uncertainty, and escalating geopolitical risks, gold rallied strongly from 2000 to 3500. Gold and silver typically have a high correlation, and silver tends to follow gold. However, during...

Bitcoin is break above the key 106350 resistance and continues to rise. As long as BTC stays above this level, short-term bullish outlook remains intact. The biggest risk for crypto right now is its correlation with the stock market. With the July 9 tariff deadline approaching and the Israel–Iran conflict raising broader market and oil price risks, a potential...

EURUSD attempted to break the upper line of the trend channel yesterday, but with the start of the Israeli attack, a quick selloff followed. Rising geopolitical risks typically increase demand for U.S. debt and the dollar. As a result, EURUSD’s rally is facing short-term bearish pressure. The first key support level at 1.1495 is being tested. If it holds, there is...

Brent crude oil is holding steady around the $60 level, even after OPEC announced another 411,000 barrels per day increase in output, following similar hikes in May, June and smaller one in April. This latest adjustment comes at a time when global economic slowdown concerns are rising, making the decision a risky one. Although the main reason points to...

Gold begins the new day on a bullish note following escalating developments in the Middle East. Yesterday, markets were focused on the US–China deal. Although an agreement was reached, tariffs but overall trade tensions remain elevated. Combined with the lower-than-expected core CPI, gold mostly moved sideways, apart from intraday noise. However, this could change...

Silver is testing the 34.85 level, a critical resistance both in the short and long term. Since 2013, a cup and handle formation has developed just beneath this level. A confirmed breakout could signal sustained long-term bullish momentum. Supporting this outlook, the gold/silver ratio has recently shown a decisive tilt in gold's favor, reaching historically...

Dollar index trading in a tight range ahead of the CPI data. US inflation is expected to rise by 0.1% on a yearly basis for both headline and core figures, reaching 2.4% and 2.9% respectively. Markets expect some of the effects of tariffs to begin showing up in this data. There are both downside and upside risks to the release, but in our view, a slightly...

Gold is trying to move upward on the intraday chart, building on the last top. If the 3340–3342 zone holds, a move toward 3360 could begin today. For now, it’s still a touch-and-go situation. A tame US-China deal, and higher inflation data expectations for today causing this bullish pressure.