hungry_hippo

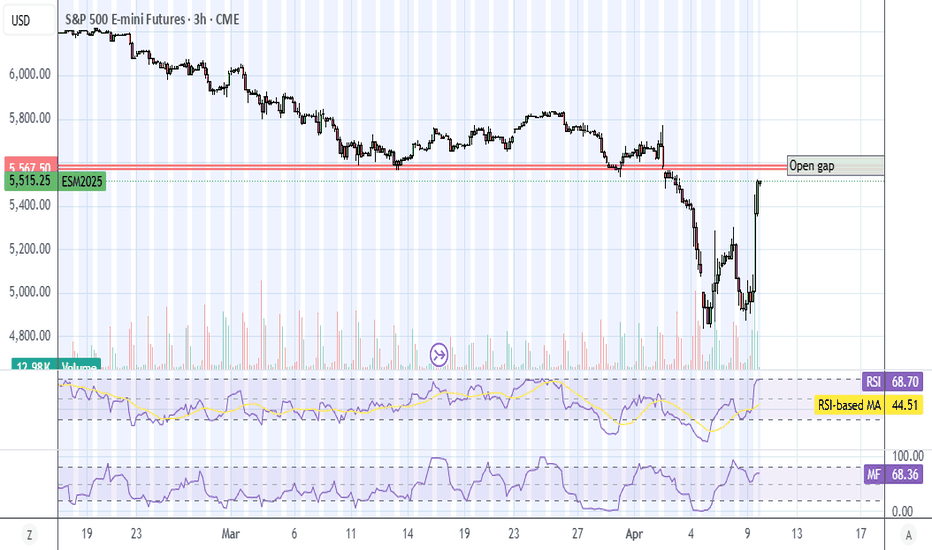

RSI hit overbought so we got a dip. We may get another dip when MFI gets overbought today, or just a bigger dip if it hits overbought premarket. Will we get a melt up instead? I dunno. Keep in mind that China still has tariffs, but also keep in mind he's going to do exemptions. So that rules out shorting AAPL or any sector like auto. We will get another huge...

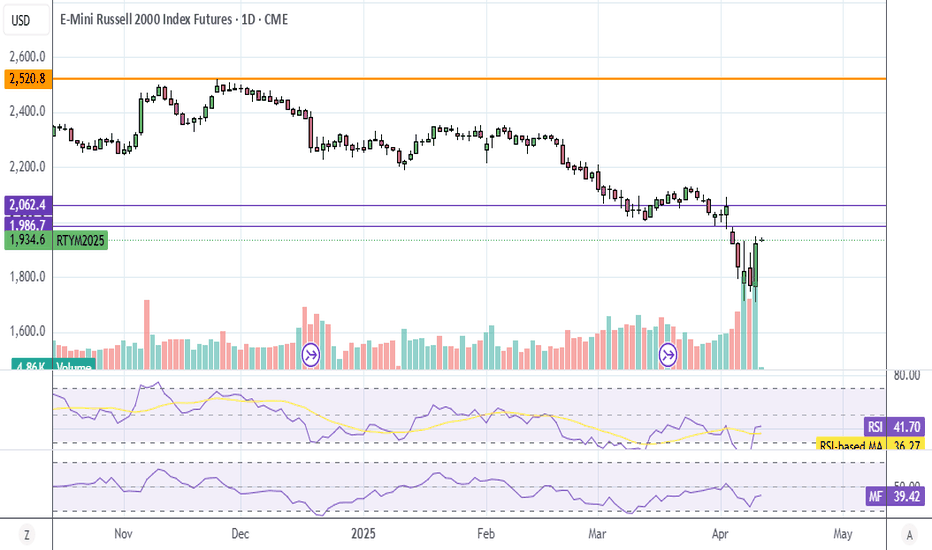

Small caps got hit hardest by the tariffs, fell the most, went up the least today, and has the furthest to go to fill the futures gap and also the all time high (ATH). I think RTY (IWM ETF) will outperform ES/NQ (SPY/QQQ) the next 90 days as Trump unwinds all of the tariffs including the 10%. He'll more than likely repeal the China tariffs in the next week or...

I've been watching this thing through the tank, PCAR has always filled open gaps before, and there's a bunch of them now. I don't expect earnings to be that great, so hopefully they all fill before then. ANyways, it's back to my favorite play. I've made so much money off this stock, I was willing to jump in a bit late and take the risk. I'm up, but not a lot...

Not sure if I will have time to post an update tomorrow morning, futures are red, RSI looks like it's headed to oversold, foreign investors are ditching US assets, nobody trusts Trump. Index futures, stocks, bonds, and the US dollar all selling off. With Trump gaming the market, it's easy to get whipsawed into a loss. Get caught holding puts when "news" comes...

If you look at gold in francs, it's not close to a breakout. Gold looks like it's breaking out because we trade in dollars. I'm only entering the gold trade if the dollar index loses 100 support.

This is what I was talking about... note that the dollar index is inverted (upside down). For the past week, most of the move in gold is due to the movement in the dollar index because we're looking at gold futures in dollars. Dollar tanks, then gold futures goes up in dollars. It may just stay flat in terms of Euros or francs. So basically I got lucky...

Bought some GLD this morning because I couldn't think of any other play, and I'm watching the market drop and bond yields rise. Then I look at the dollar index and saw it dropping too. The Euros are selling off all US assets, that's why the drop happened between midnight and noon. The 2% "pump" wasn't really a pump, the dollar dropped 2% this morning. (Though...

I finally noticed today (haven't been doing my research) that the dollar has been dropping since January. Bond yields rising at the same time as the market dropping and the currency dropping can only mean that the Euros are dumping ALL American assets. Trump has basically ruined confidence in the dollar, there was a 2% drop today. I only noticed because gold...

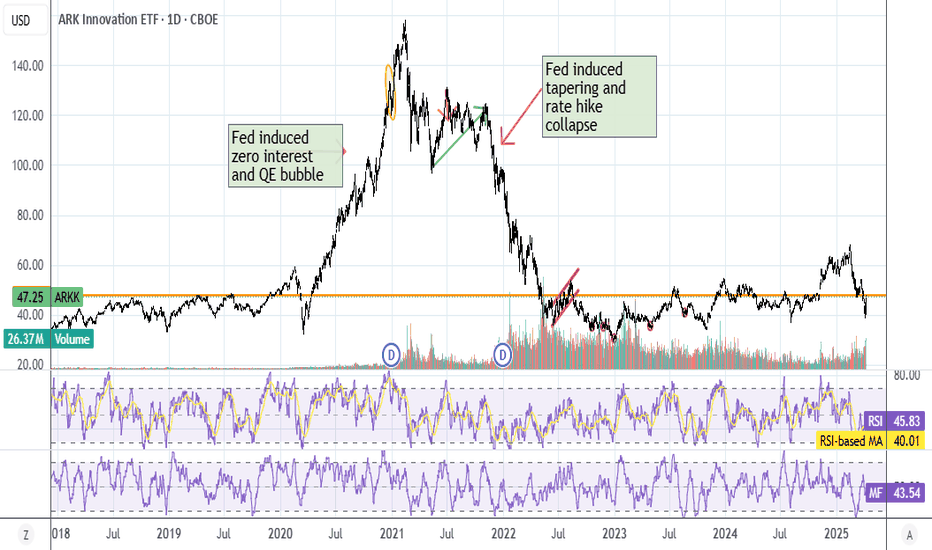

I always like to mock Cathie, so just throwing up a plot for fun. Orange line is today's close after a 10% market day. If you invested in ARKK in 2018, congrats, you broke even today, lol. She got a reputation from picking a bunch of speculative stocks during the COVID days, you can see the performance since just plain out sucks. 12% of her holdings is still...

I don't plan on trading gold because there's better plays right now, but I wanted to fix my chart. I should've known that old resistance would be new support, and drawn the line at the Feb high. I did make money on my GLD puts though, I cashed out yesterday. I "think" it's gonna make a pennant then head towards new highs as Iran is the next market whipsaw. ...

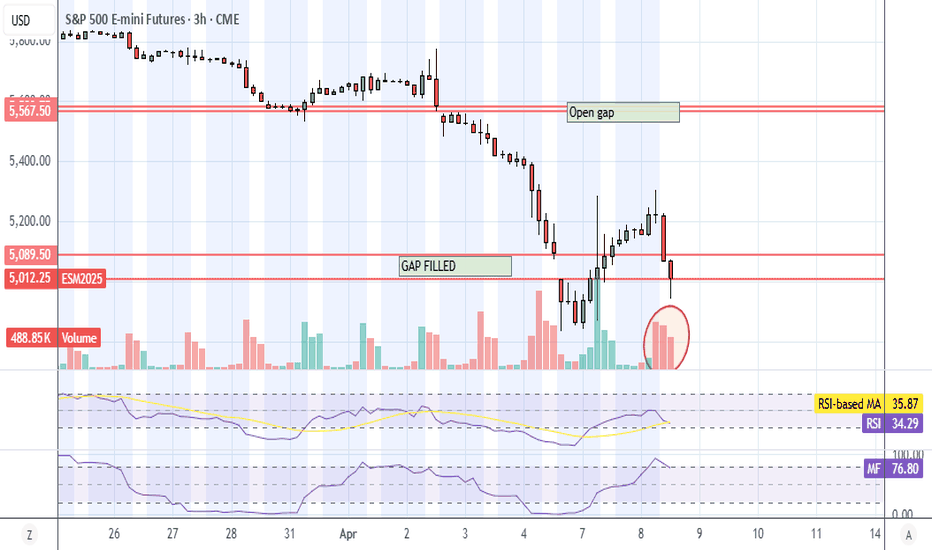

Trump is obviously gaming the market, so there's really no point in even looking at charts or indicators, lol. It's hard to take him seriously now. The gap will fill, maybe as soon as tomorrow morning. Then we get another huge pump sometime within the next week when he repeals the China tariffs and sets then to 10% or something. Just hold your favorite stock...

I won't be able to post before work, so here's an early update.... RSI is barely touching oversold, I expect it to go a bit further, but don't expect a tank. Probably a double bottom because the algos want their money back, lol. Daily and weekly RSI also oversold, and the algos appear to be looking strictly at indicators and not the news. They freakin pumped...

So apparently the reason why gold fell this morning is because gold has 8% tariff premium built in, that is what the March pump was all about. Turns out gold is exempt from tariffs, and so is silver, so silver dumped the entire March pump. So the fact that gold is exempt from tariffs basically means that it basically got pumped 8% today because it didn't drop...

As you can see, MFI hit overbought before open. Unfortunately, I didn't have time to post before work. Stupid algos pumping before bad news again, they even pumped China, so I bought some MCHI (China ETF) puts in the morning. WHy would anyone pump CHina before a tariff announcement?!?! I don't see Xi or Trump backing down, if anyone falters, it'll be COngress....

BTW, what the hell kind of intraday chart is this? Strangest trading day I've ever seen. Did anyone else look at the chart and just laugh? Algos run amok trying their best to prop up the market.

Like I said over the weekend, the algos are definitely on, explains the whipsaw Fri and today. Everything is oversold so they had to pump it and try to get their money back. Problem is, Trump is gonna announce 50% tariff on China tomorrow. CHina ain't backing down, not their style. QUote: "Therefore, if China does not withdraw its 34% increase above their...

All futures gaps will fill... but who knows when? We already had an open gap above. This time around, virtually everything has an open gap. Gold futures have a small open gap, BTC futures have a big ass one, Nikkei, FDAX, the rest of Europe and Asia, oil, silver, and other commodities as well. XLF will complete the H&S pattern tomorrow, so maybe we get a...

Earlier today I commented not to go long today because XLF hasn't completed it's pattern yet. This is the pattern I was talking abut, H&S on the daily chart. So unless congress does something over the weekend to rescind tariffs, XLF will complete this pattern Monday. I didn't short it because I expect congress to do something, but it's a matter of when. When...