javivi

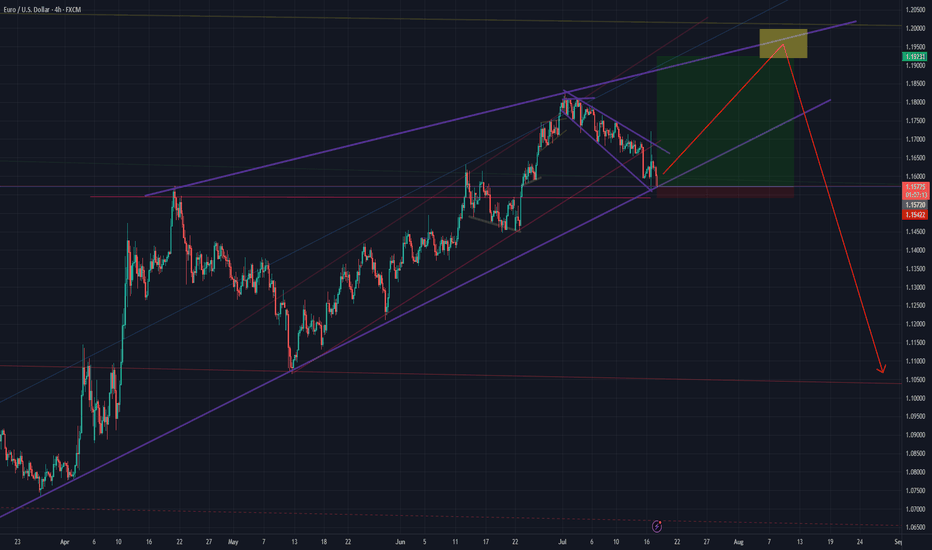

EURUSD is in an important support area, retesting the bottom line of the wedge. I'm loking foward for any sign of reversal from here.

Expecting DXY to make new lows after some retraction and filling some gaps.

I think EURUSD could retrace a bit to the the 1.16 then look for new highs around 1.19-1.20 area, that could be a potential reversal zone: long term target 1.07

a new pullback before going up. 1.14 could be a good spot to place longs

clear bearish structure ready to test and downside continuation

waiting for the triangle to breakout to the upside and retest highs.

Eurusd broke and retested the triangle so we could see some upward movement to test the previous highs around the 1.1550 area.

Waiting for GDP and initial jobless claims to drop the price towards 1.095 in the next days. Retesting the trendline, perfect timing to short.

Dollar is almost getting to the support line of a historic rising channel that started almost 20 years ago, I am selling with targets 98.00-97.00 area. If 97.20 acts a support, I'll be looking for long term longs.

looks like bullish continuation is possible. I'd like to see price retesting the 1.16 area and look for shorts if there is a rejection

Retest of the ascending triangle, might start falling from here.

We might be in front of a fake breakout of the descending triangle formed since long time ago in the weekly timeframe To support this idea we also have a textbook ABCD pattern with perfect Fibonacci proportions

It looks like we have the perfect storm for this pair as macro news will contribute to create some bullish momentum, news liike this one of 2 days ago: "Moody's cuts America's pristine credit rating, citing rising debt" www.reuters.com My technical analysis is pretty clear, we have a descending wedge that has been taking shape for the last 15 years. We had a...

Chart shows a clear support level where it might change direction.

Chart explain itself. -ascending channel -multiple support at 1.1270 -price accumulating for next bullish leg -macro news support it

I would like to see a retest of the broken channel in bigger TFs. If this happens i would look for longs from that red area.

I am paying attention to the breakout of this triangle: That could lead to a correction to key support levels to the 1.118 - 1.12 area After that I'll be looking for longs in the mid term to continue the bullish momentum

bullish Triangle breakout in lower TFs This bullish move might be fueled by the tariff war and could be fast and strong. Hope to see some big news after that to see a major change in the overall trend that would support the big channel.