There comes a point in every trader’s journey when you do everything right, and it still goes wrong. You plan the trade meticulously, plot the levels, define your risk, wait patiently for the setup, and enter with the kind of discipline that would make any textbook proud. You follow your rules. You trust your process. And yet, the market does what it does!...

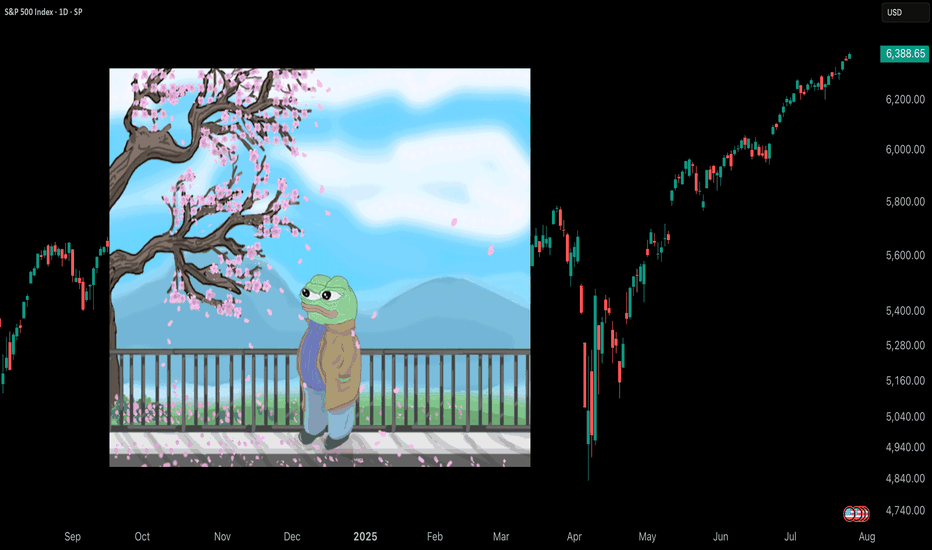

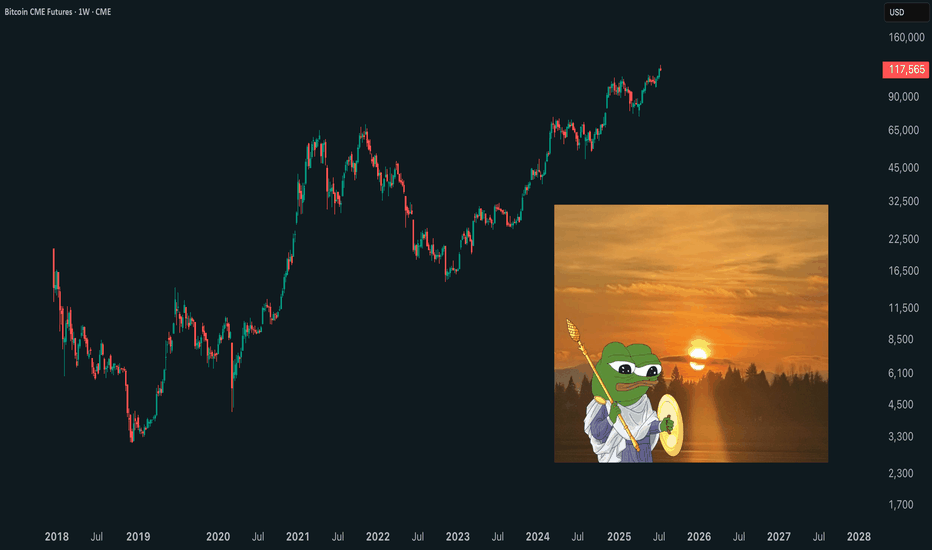

After rallying more than 25% off the June lows, Bitcoin is finally taking a breather with a much-anticipated pullback. But as expected, the fear meter is spiking, especially across CT. Was this cool-off really a surprise? Not quite. The signs were there: price stalling at upper extremes, responsive sellers stepping in at perceived overextensions, and...

There's something the market teaches you over time that no book, course, or checklist ever really prepares you for - “how to live with uncertainty” . It's amazing how quickly the market can make you doubt yourself. You can be doing everything right - following your process, managing your risk, sticking to your plans, and then volatility hits. Suddenly, nothing...

There was once a tree that stood alone at the edge of a cliff, overlooking the vast sea. Some days, the sun shone bright, the winds gentle, the water below calm and peaceful. Other days brought heavy storms, fierce winds, crashing waves, rain so relentless it seemed the skies might never clear again. The seasons came and went. The skies changed again and again....

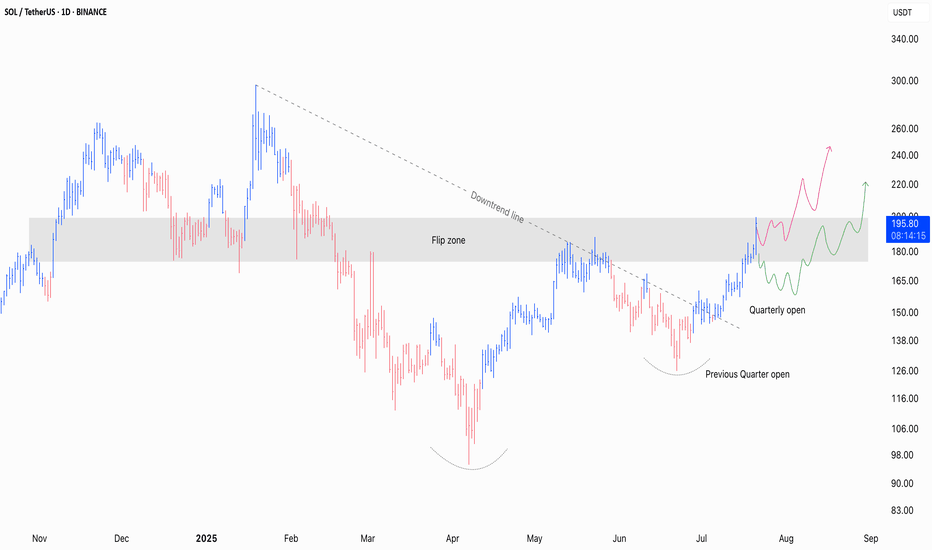

Solana’s been stealing the spotlight again and not just for the memes this time! After months of getting smacked down at key levels, it’s finally reclaiming the lost ground with conviction. Price is grinding its way through zones that had been solid resistance for ages, flipping sentiment along the way. The combination of structure, volume, and market psychology...

SUI is back in focus as price pushes into a critical zone of resistance that has capped previous rallies. With key moving averages reclaimed and volume shifting in favour of bulls, the question now is simple - can it break free, or is this another trap before rotation lower? Let’s break down the current structure and what comes next! SUI is trading at a...

There was once a stone that lay deep in the heart of a flowing river. Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river. For years, the stone resisted. It didn’t want to change. It believed that strength meant standing still, no...

Time Frame: 1H Bias: Long (Bullish Reversal Expected) Setup Type: Reversal from Flip Zone Date: May 27, 2025 🔍 Market Context: The price is currently retracing after forming a short-term lower high. It has entered a prior demand zone (highlighted box) that acted as resistance-turned-support — a classic flip zone. The market has shown responsiveness to...

You think trading should be exciting? That every day should feel like a high-stakes chess match? That if it doesn’t feel intense, something’s wrong? Nope. Good trading is boring. Systematic. Repetitive. Unemotional. You take your setup. You size properly. You respect your stops. You move on. Same rules. Same routine. Same process. It’s not sexy....

Hi everyone, In today’s post, let’s break down the current market structure and potential opportunities in the EUR/USD pair. 🔍 Market Context After nearly a month of consolidation, EUR/USD appears to have stalled around the previous weekly swing highs . Despite several attempts to hold above this level, the price eventually broke down, signalling a shift in...

For centuries, tariffs have played a crucial role in global trade, safeguarding domestic industries, shaping international relations, and influencing economic policies. While they often dominate headlines during trade wars and economic policy debates, many people still don’t fully understand what tariffs are, why they are used, and how they impact the economy. ...

NASDAQ:SMCI delays their 10-K filing for FY2024. The company said that additional time is needed 'to complete the assessment of its internal controls over financial reporting.' Delaying the filing, especially right after Hindenburg’s accusations, raises serious red flags. A $300 target seems like a genuine downside. Disclaimer : This post should NOT be...

Imho, the worse is likely in and even if we get a pullback, we'll chop around somewhere near the POC. - 75% retracement - Tapped the demand zone - Previous swing low defended - Reclaimed 100MA on daily - Reclaimed POC - Time + Price based capitulation likely done - Possible selling climax in If the market stays well, we can expect Popcat to hit $2-$3 in the...

Imho, the worse is likely in and even if we get a pullback, we'll chop around near the lows. - Swing failure at range low - Previous lows and range low defended - Previous year high defended - Reclaimed 200MA on daily - Reclaimed POC - Time + Price based capitulation likely done - Possible selling climax in Disclaimer: This post should NOT be construed as...

Seems like the chance to buy the hat at such cheap prices before it follows the Solana fractal from 2020-2021. Imho, the worse is likely in and even if we get a pullback, we'll chop around near the lows. With BOJ capitulating within 48 hours and taking a U-turn on its stance, there's a good chance that the low is in for majority of memecoins, and the extreme dump...

The CRYPTOCAP:WIF bottom is most likely in, and it'll slowly start to outperform most of the blue-chip memecoins this quarter. It seems like either the underperformance low is already in or is very close in most cases. Look at these ratio charts ⚡ WIFBTC ⚡ WIFBONK ⚡ WIFPEPE ⚡ WIFFLOKI ⚡ WIFDOGE ⚡ WIFSHIB ⚡ WIFMOG ✅ WIFBONK ✅ WIFPEPE ✅ WIFFLOKI ✅...

Pepe coin, a meme coin that’s quickly becoming a legend in its own right, has astonishingly reached the 3B market cap mark, positioning itself as the 3rd meme coin ever to achieve such a feat. This remarkable achievement comes after a staggering 400% gain in just the last week. 🔥 Currently, it stands proudly at the 40th rank by market cap and an impressive ...

Who is Peter Lynch? Peter Lynch is a renowned American investor who is best known for his tenure as the manager of the Magellan Fund at Fidelity Investments from 1977 to 1990. Under Peter Lynch's leadership, the Magellan Fund became one of the most successful mutual funds in history. During his tenure, the fund averaged an annual return of around 29% ,...