juliakhandoshko

PremiumLet’s also consider semiconductor firms, with a focus on those I’m currently monitoring. The initial company is Skyworks Solutions NASDAQ:SWKS . I recall observing it previously, and recently, I noted its price has dropped further than expected. The stock has declined from a high of $200 to a low near $50, occasionally dipping below, representing a nearly...

I’ll address a topic that might have warranted attention a few years back, during its peak relevance. This concerns firms offering cloud-based software and tools designed for management purposes. The renewed focus stems from a growing interest in examining companies with clear upward trajectories, particularly within the high-tech sector. Let’s begin with...

Let’s remember, that gold was all over the headlines, by surpassing $3,500 per ounce in April, a 25% rise within the year’s first half. A steady climb from $1,000 to $2,000 over 12 years, culminating in 2020, and a swift advance to $3,000 in the subsequent five years. As of August, the price hovers near this peak, prompting interest in investment strategies and...

Red Cat Holdings NASDAQ:RCAT operates in the expanding drone technology sector, focusing on military, government, and consumer applications. Listed on NASDAQ since its April 2021 IPO, the company’s stock has risen about 200% over the past year, that shows to us rising interest in its contracts. With a market cap of approximately $504 million in early 2025, Red...

Expanding Market Presence with Dual Listing Eurasia Mining PLC (LON:EUA), a London-based mining company, has established itself in the exploration and production of platinum group metals (PGMs) and gold, recently expanding its reach through a dual listing on the Astana International Exchange (AIX) in Kazakhstan. The accomplishment was achieved in this year's...

Cryptocurrency ecosystem is actively maturing and investors are increasingly drawn to infrastructure providers that underpin the decentralized economy. Consensys is a leading blockchain software company, stands out with its flagship MetaMask wallet and a suite of Ethereum-focused solutions. With a robust business model and global adoption, Consensys offers a...

Silver prices hit a 14-year peak in Q2 of 25 due to global uncertainties and a tight supply-demand balance. Although it shares some similar drivers with gold, silver has carved its own path, which one charged by robust industrial demand and its safe-haven appeal amid economic and geopolitical turbulence. Silver’s Price Journey The quarter kicked off with a dip,...

The Q 2 Rally: A Response to Global Uncertainty Gold prices hit new heights in the second quarter of year, breaching the $3,500 per ounce mark for the first time amid a wave of global instability. After climbing steadily from $2,658.04 on January 2 to $3,138.24 by April 2, the precious metal faced a brief dip below $3,000 in early April. However, it quickly...

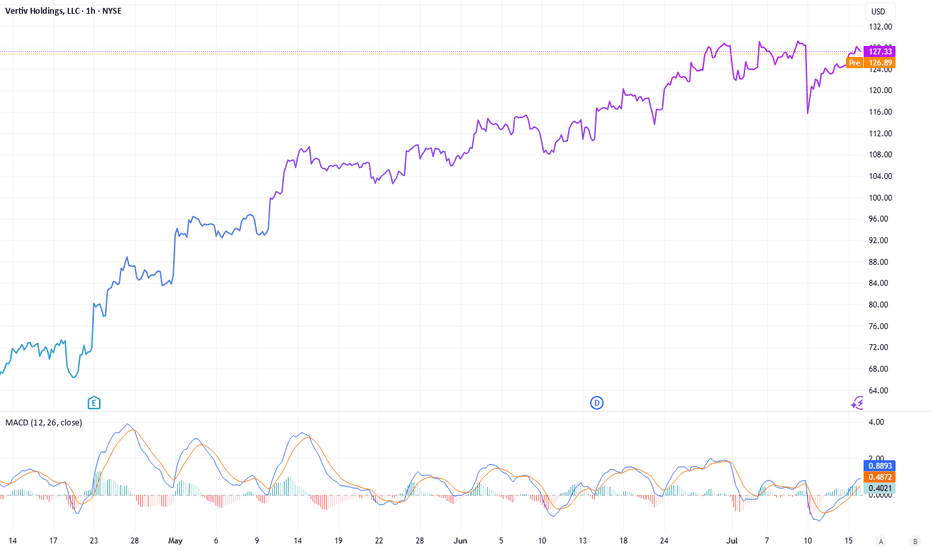

NYSE:VRT NASDAQ:NVDA NASDAQ:META NYSE:ETN NASDAQ:CEG While investors are engaged in a race “identify the next major microchip manufacturer”, a quieter opportunity is emerging at the crossroads of artificial intelligence (AI), infrastructure, and long-term demand. Vertiv Holdings (VRT), a company often overlooked amidst the hype, could be the backbone of...

The future of Apple stock remains a hot topic among investors and analysts. For today’s July, the company’s market capitalization has climbed to $3 trillion, up from $2.9 trillion (a year ago, on May 2024). But can this tech giant continue to deliver significant returns for shareholders over the next decade? Let’s take a quick look on it. AI’s Take on the Future...

Duolingo, the language-learning app that took the world by storm, has evolved from a free tool into a powerhouse since its 2021 IPO. With a market cap nearing $11 billion and its stock quadrupling in value, the company stands out as a rare profitable player in the edtech space. But what fuels its success, and what challenges could temper its rise? Here’s an...

Samsara NYSE:IOT , a trailblazer in the Internet of Things (IoT) for fleet management, has been turning heads since its 2021 IPO. With a market cap hovering around $17 billion and its stock quadrupling since debut, the company is riding high on analyst optimism. But beyond the hype, what’s driving Samsara’s ascent-and what risks lie ahead? From Startup to IPO...

Mexico’s digital banking industry is gaining momentum, and Plata, a fast-emerging fintech player, is making waves with its debut bond issuance. Targeting $120 million (with the potential to scale up to $200 million) marks a turning point for a company transitioning from a credit card issuer to a full-fledged digital bank. For us, it’s a chance to tap into the...

NASDAQ:DKNG OMXSTO:EVO The North American online gambling sector is experiencing a surge, with companies like DraftKings and Evolution emerging as standout performers. In the past month, Evolution’s stock rose an impressive 15%, while DraftKings continues to show strong potential in the sports betting arena. As legal licenses expand across U.S. states, this...

Petróleos Mexicanos, commonly known as Pemex, is Mexico’s state-owned oil and gas company and a cornerstone of the nation’s economy. Fully owned by the Mexican government, Pemex extracts oil from the northeast, southeast, and the Gulf of Mexico regions. But the company faces a challenge, it’s a massive debt load nearing $90 billion, making it one of the most...

OKX:TONUSDT OKX:TONEUR In the fast-paced world of cryptocurrencies, TON (The Open Network) stands out as a project with a compelling backstory and bold ambitions. Born from the vision of Telegram’s founders, the Durov brothers, TON was initially designed to bring blockchain technology into one of the world’s most popular messaging apps. Despite early...

In the volatile world of mining, where geopolitical risks and market fluctuations often overshadow opportunities, two companies stand out for their potential to deliver significant returns: Ferro-Alloy Resources and Eurasia Mining. Both are focused on critical minerals-vanadium and platinum group metals (PGMs), respectively-that are essential for the global energy...

OMXSTO:EVO CAPITALCOM:USDSEK FOREXCOM:EURSEK The allure of casinos has always been a double-edged sword-promising riches, but delivering some risks at the same time. Yet, for savvy investors, there’s a way to tap into this lucrative world without rolling the dice. Evolution is introducing itself as a Stockholm-based leader in online casino solutions, whose...