kellygnd

EURUSD Daily Demand Zone Trade Idea This is an educational analysis based on a daily timeframe structure using supply and demand principles. Price recently made a strong bullish impulsive move, breaking above previous highs. We’re now seeing a retracement into a fresh Daily Demand Zone formed by a Rally-Base-Rally (RBR) structure. This zone also sits outside of...

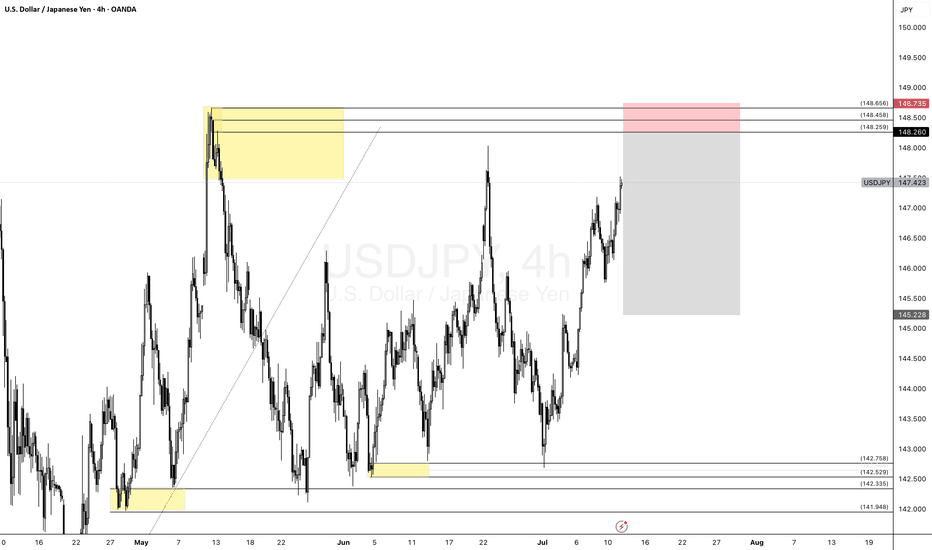

USDJPY – 4H Rally-Base-Drop in Daily Supply Price has rallied into a high-quality 4H Rally-Base-Drop supply zone, which is nested cleanly inside a Daily supply zone—offering strong confluence for a short setup. I'm anticipating a reaction from this institutional imbalance area, with price rejecting from the 148.260–148.735 zone. The target is down toward...

EURUSD – 1H Demand Zone (Outside the Range) EURUSD is currently trading within a clear consolidation range. However, a 1H demand zone has formed outside the current range, indicating potential for a breakout-retest scenario. This demand lies below the consolidation structure, making it a set-and-forget style entry if price sweeps liquidity and returns to this zone.

📈 AUDJPY Swing Trade Setup 🔹 Buy Limit: At Weekly/Daily Demand Zone 🔹 Bias: Bullish (COT-supported) 🔹 Reason: Price is sitting inside a key weekly/daily demand zone, offering a strong long opportunity. COT report shows commercials (smart money) are net long AUD and speculators are net short, indicating potential for a reversal or continued upside. Aligns with...

great example on the 30 min timeframe. drop base drop , fair value. supply identified for a one to three risk to reward.

US30 Supply & Demand Outlook (1H–2H) The market is currently trading within a fair value range (highlighted in yellow), with no clear edge for high-probability entries. I'm waiting for price to move out of this range and into one of the fresh supply or demand zones marked above and below.

📓 Updated Journal Entry – XAGUSD Direction: Buy Entry Zone: Daily CP demand Trend: Monthly, Weekly, and Daily all bullish Target: 2R reward from entry Status: Pending Chart: View Chart Notes: Watching for price to enter the daily CP demand and form a bullish entry signal Will exit at 2x the distance of the stop loss once in Setup aligns with trend-following...

Pair: GBPCHF Direction: Short Chart: View Setup Status: Pending Notes: Daily Trend: Bearish structure in play 4H CP (Continuation Pattern): Formed after daily supply reaction Clean bearish sequence – expecting continuation lower Ideal scenario: price respects 4H CP zone and breaks to new lows

here we have a clear rally base rally outside the range on usd-cad. On the 5 min we had a strong move away. the market then gave us a great fair value. big range allowing us a lot of room for profit. the market tapped into the zone the second time on May 14th 5 days after its creation

The USD is bearish on the monthly, weekly, and daily timeframes, while the EUR is bullish across the same timeframes. You should look for a pullback into the 4H rally base rally to consider entering buys. There are two demand zones to keep in mind for potential entries

Theses are the 1h demand zones Ive on GBPJPY. The market first tapped into a weekly demand. Creating these new zones on the way up. The first zone was touched 2 times. but is still available since it has not been penetrated by 50%

here we have a weekly demand zone highlighted grey. inside of that zone is a nested daily demand. the structure and location suggest a strong imbalance

we are buying gold at 15 min demand , weekly and daily trend is bullish. were using buy limit order.

here on gold we have rally base drop out side of the range 3x profit margin available strong leg in and out of the base it is counter trend