kventinka

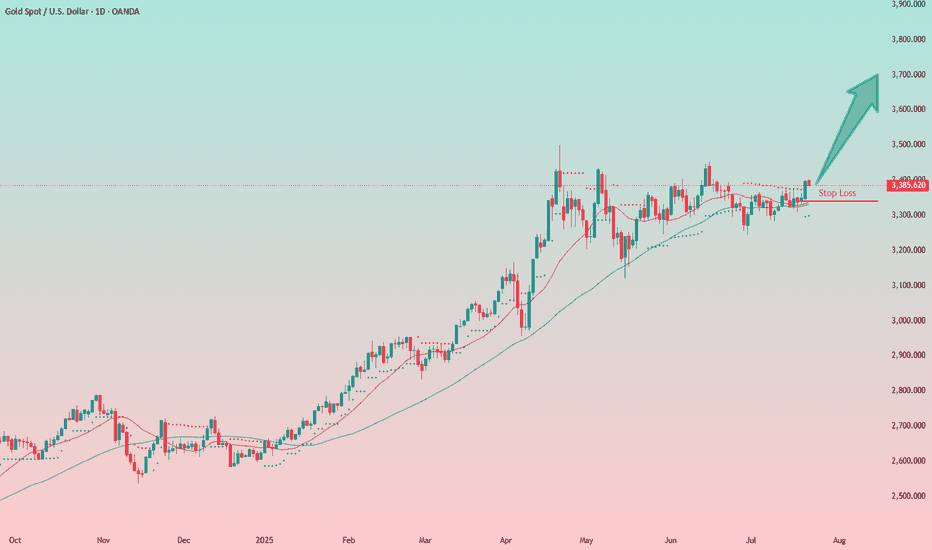

PremiumDespite broad-based pullbacks in both equity and commodity markets, gold continues to show remarkable resilience. Last Friday’s session was particularly telling — not only did gold recover earlier intraday losses, but it also closed the week in positive territory. This strength suggests that institutional players and central banks have been steadily accumulating...

After pulling back from recent highs, copper is showing signs of stabilizing. In my view, this move is more likely a correction within a broader uptrend rather than the start of a deeper decline. I remain optimistic about the commodity sector in the near term, and copper is no exception. From current levels, the odds favor a resumption of the uptrend over a...

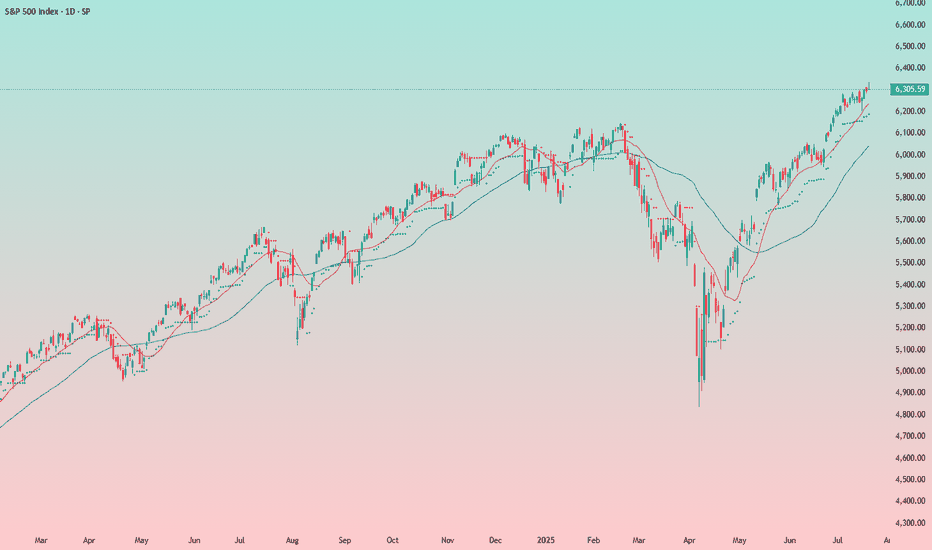

1. Macro Market Overview Last week, the Federal Reserve kept interest rates unchanged, as widely expected. The decision was fully priced in, and the press conference offered no surprises: future rate cuts will depend on incoming economic data. Markets initially reacted with a decline, but I do not see a structural break in the uptrend for commodities. It looks...

Bitcoin has reached a significant support level, coinciding with the 50-day moving average around 112,000. The recent correction appears to have been absorbed by the market, and the broader uptrend remains intact. This area presents an attractive opportunity for long entries, with a recommended stop-loss placed just below Friday’s low. Target levels for the...

So, is the drop beginning? It kind of looks that way, but there’s still no solid setup for entering a short position — and there hasn’t been so far. The trend is still upward for now, and this current pullback might just be temporary. What I like about the short idea is that August is traditionally a weak month for stocks . Could this be the start of a big...

Just like with silver, the potential for further growth in gold remains, despite the setbacks of recent days. It seems the precious metals market didn’t mourn the Fed’s decision and subsequent press release for long. The uptrend remains intact, and the previously supportive factors are still in play. Even amid the negative news, there was no sharp sell-off —...

It seems the precious metals market didn’t mourn the Fed’s decision and subsequent press release for long. The uptrend remains intact, and the previously supportive factors are still in play. Even amid the negative news, there was no sharp sell-off — everything stayed within the trend. This clearly signals that rate cuts are on the horizon, and metals are likely...

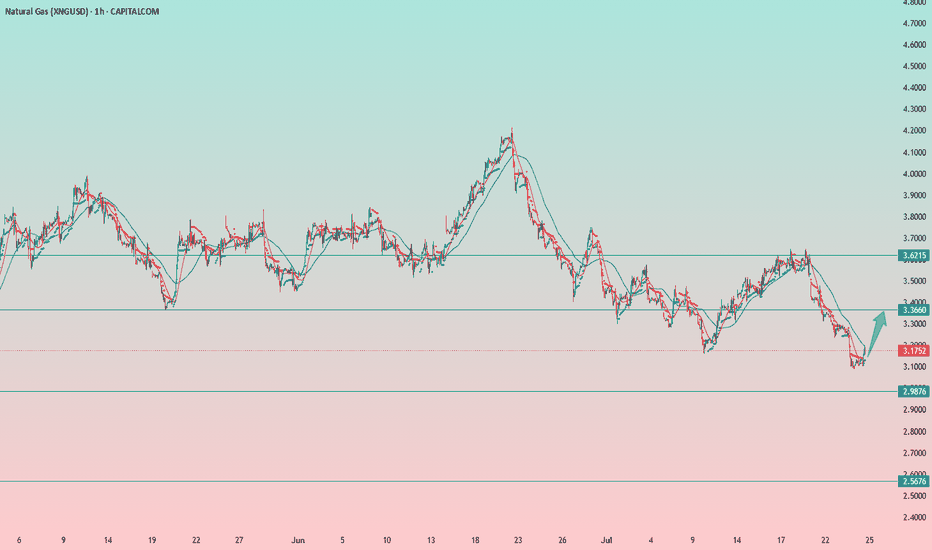

Natural gas has bounced off its strong support level and is showing signs of upward movement, particularly evident on the hourly chart. Dips are being bought up, with the price quickly returning to previous levels. Downsides: The downtrend is still in place (though it may potentially be broken), and there's a relatively long stop-loss below yesterday’s candle...

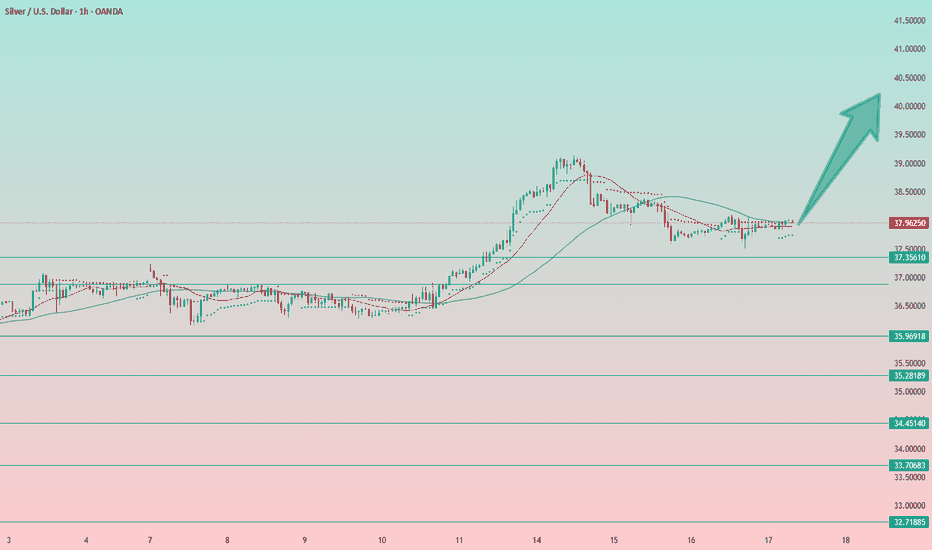

The upward structure of the chart remains intact, and I believe the growth will likely continue in the near future. At the moment, we’re seeing a price pullback, which provides new opportunities to enter a long position. I will place a wide stop at the 37.35 level.

This may not be the best decision right now — I understand that — but it's one of those " I'm exhausted and just want to buy " moments. The setup isn’t fully formed yet, but I have a strong feeling we’re going higher. I like the chart structure: low volatility, a spike to 3430 followed by a pullback to the moving averages without breaking key levels. I also like...

Natural gas has made a decent pullback, and a solid long setup is forming here with a relatively tight stop-loss for gas. If the stop gets hit, the second entry will be from the $3.00 level. Entry is from current levels. 📝Trading Plan Entry: Entry is from current levels. Stop Loss: 3.0855 Target: 3.36

Gold has reached the area of previous wicks. It's the best to close the position here, especially since the price is pulling back from this level. I closed the position I opened yesterday based on the previous trading plan. For the uptrend to continue, we need a breakout above today's high . That level could be used to open a new long position. Alternatively, ...

Nothing interesting is forming on the index so far. My outlook remains neutral. I previously attempted to short it, but those attempts were unsuccessful. Now I need to wait for a more reliable entry point — the chart will show the way. For now, I’m staying on the sidelines. Historically, the start of the Fed’s rate-cutting cycle has always coincided with the...

Gold looks well-positioned for further upside. We've seen consolidation at the current level since April, volatility has decreased over the past few weeks, and yesterday there was a decent breakout to the upside, with price hugging the moving averages. As of the current trading session, the price has pulled back slightly. I believe the chances for continued...

Bitcoin doesn't seem to be slowing down and continues its bullish momentum. Overall, I believe the chart shows a solid setup for further growth. I'm not exactly sure how high we’ll go, so in this case, I’ll be trading with a clear stop-loss strategy. 📝Trading Plan Entry: I’m building a position from current levels. Stop Loss: Stop-loss set at $115,000...

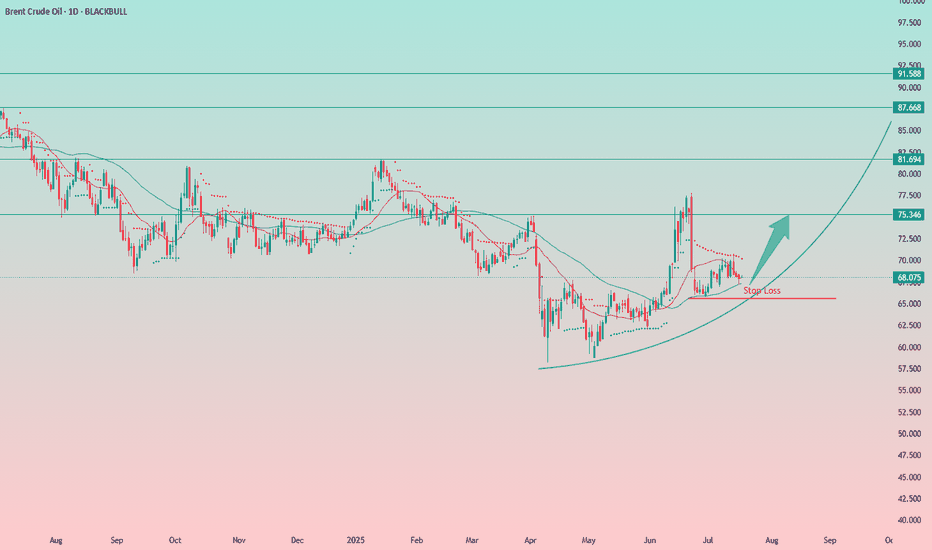

Oil is in an uptrend, and I expect it to continue. At the moment, the stop-loss would be too wide — around 3.5%, which is a bit too much for my portfolio, especially considering I already have a wide stop on palladium. On the 1-hour chart, I’m watching for a possible entry slightly below the current level. For now, just observing.

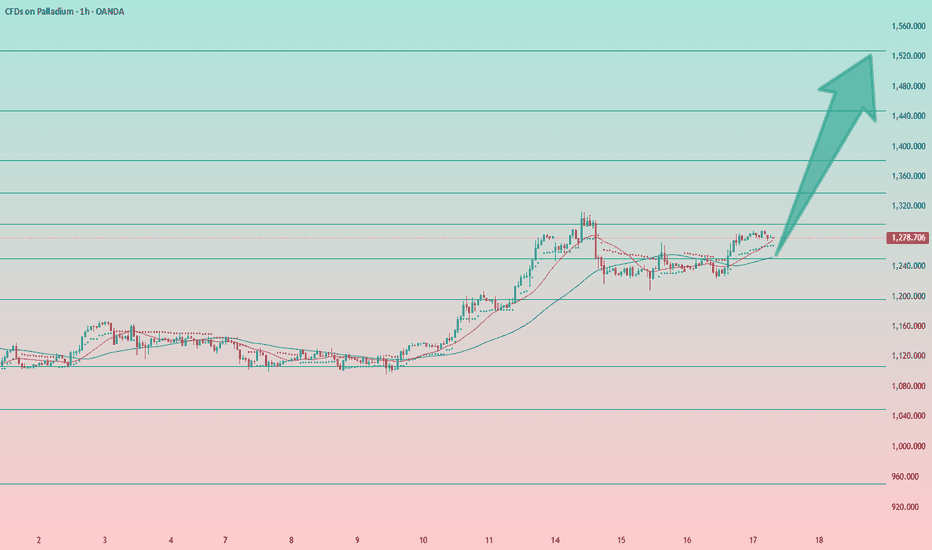

The long setup remains valid. The structure on the daily, weekly, and monthly charts is clearly bullish, and I expect the uptrend to continue. Entering from the current level is tricky, as the stop-loss would need to be placed below the local low — around the 1200 area. A better approach would be either: – Wait for a breakout above the local high at 1314 and...

Silver touched its support level at $37.50 and quickly bounced back into the accumulation zone. From the current levels, I expect an upward breakout. The setup looks very bullish. I'm going long from the current price of $38. Stop-loss is placed just below the local low at $37.50. A break below $37.50 would signal further downside toward the next strong support...