lixing_gan

Silver has climbed into the spotlight, trading more than 40 USD per ounce, its highest level over a decade. Silver benefits from a dual role as it is both a safe haven and an industrial metal. On the defensive side, expectations of a Fed rate cut and heightened geopolitical tensions encourage investors to seek shelter in precious metals. On the growth side, silver...

Gold is pushing toward record highs as several forces come together. Markets' expectations for the Fed to cut interest rates and a weaker dollar support global demand and benefit the dollar-denominated bullion. Inflation risks still linger, keeping gold relevant as a hedge. Central banks, especially in emerging markets such as China, steadily add to their reserves...

GBPJPY could face further downside as central banks’ policy paths diverge. Tokyo inflation slowed to 2.5% YoY in Aug, but underlying price momentum remains solid, keeping the BoJ on track for further hikes and supporting the yen. However, US tariffs weigh on Japan’s Exports and Factory Output, raising downside risks to growth that may temper yen strength. In the...

Political and macroeconomic events weighed on bitcoin's recent decline. President Trump's unprecedented attempt to dismiss Fed Governor Lisa Cook raised fresh concerns about central bank independence and market stability, though the immediate reaction was muted. The political news added to a broader risk-off sentiment, compounded by renewed inflation worries,...

Ether has come under selling pressure in recent days as institutional investors and whales took profits, with on-chain data showing large transfers of 44,431 ETH (~208 mln USD) to Coinbase Institutional and 6,918 ETH (~32.5 mln USD) to Binance earlier in the week. This coincided with the second-largest daily outflow from spot Ether ETFs on Aug 19, totaling 197 mln...

Gold prices may remain under pressure as easing safe-haven demand and shifting Fed expectations weigh on sentiment. Progress in Russia-Ukraine peace talks and signs of easing US-China trade tensions have reduced geopolitical risk demand, while a firmer US dollar adds to gold’s headwinds. Markets are now pricing an 84% chance of a 0.25% Fed rate cut in September,...

Fundamental: Ether continues attracting strong institutional interest, with over 2.3 bin USD flowing into ether ETFs this week alone. Robust buying from major funds and growing use in DeFi and staking underscore ETH’s value as a yield-generating asset and a cornerstone of Web3 infrastructure. Supportive US regulatory developments have further boosted investor...

Silver prices extended their rally this week, buoyed by growing expectations of Fed rate cuts as recent US labor market data pointed to a slowdown. Weaker job numbers have added to the case for a dovish shift in monetary policy, pressuring the US dollar and making non-yielding assets like silver more attractive. Geopolitical tensions also boosted safe-haven...

The US dollar firmed as Trump's escalating tariff threats, from pharma to Indian exports, amplified trade tensions and boosted safe-haven flows. Despite rising global uncertainty, optimism over a possible US-China trade truce extension and a sharply narrower trade deficit also underpinned dollar strength. DXY retreated below the descending trend line and the...

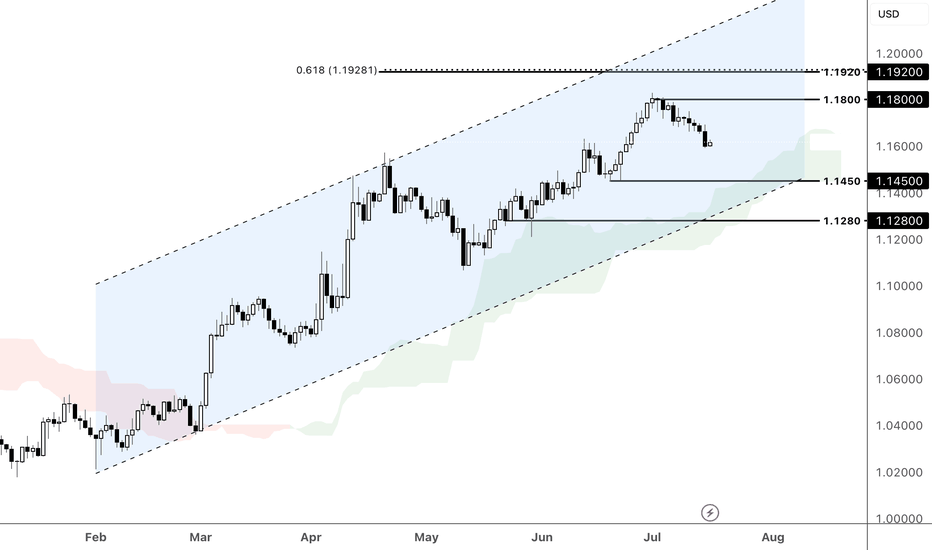

The pound extended its decline amid a stronger dollar and softening UK labour market, which fueled BoE rate cut expectations. From a technical perspective, GBPUSD broke out of the ascending channel and closed below the Ichimoku Cloud. If GBPUSD extends its decline and breaks the support at 1.3100, the price could approach the following swing low at 1.2720....

Fundamental perspective: Gold hovered near $3,330, staying close to a three-week low as easing trade tensions dampened safe-haven demand. The US–EU tariff agreement and signs of progress in other trade talks have calmed fears of broader conflict, reducing gold’s geopolitical bid. The focus now turns to the Fed’s policy decision. While interest rates are expected...

XAUUSD is approaching support at 3330, which aligns with the ascending channel support and Ichimoku cloud. If we see a rebound from this support, the price could gain upward momentum toward the following resistance at 3360. Conversely, a break below this support could prompt a deeper retracement toward the following support at 3250. Gold eased as easing tariff...

The dollar held firm after Trump announced a preliminary trade deal with Japan, setting a 15% tariff on Japanese imports and securing a 550 bln USD investment pledge. The agreement, which includes opening Japan's market to more US autos and agricultural goods, is part of Trump's broader push for "reciprocal tariffs" ahead of the Aug 1 deadline. While details...

Fundamental: The euro slipped as mixed ECB signals and political jitters pressured sentiment. ECB President Lagarde reiterated that borrowing costs will remain restrictive 'as long as needed,' even as inflation eases and economic activity stabilizes. Renewed political tensions in France and soft German industrial data also weighed on the euro, though stronger...

Gold climbed toward $3,320 per troy ounce as trade tensions and Fed uncertainty boosted safe-haven demand. A weaker dollar supported gains after President Trump escalated tariff threats, this time targeting Brazil, deepening concerns about global trade disruptions. Meanwhile, the Fed's June meeting minutes revealed a divided stance on rate cuts as some officials...

Fundamental: BoE Governor Bailey signaled potential rate cuts ahead, with markets expecting a 0.25% rate cut in Aug. Political uncertainty persists as UK PM Starmer scaled back on welfare reforms amid a party rebellion, adding to fiscal caution. Trade tensions intensified as US President Trump threatened new tariffs on Japan and demanded greater agricultural...

Fundamental Analysis: Gold prices dipped but trimmed earlier losses as markets reassessed the durability of the recent ceasefire in the Middle East. Initial relief from the truce eased safe haven demand, but fresh signs of renewed tensions have cast doubt on how long the calm will last, keeping geopolitical uncertainty firmly in play. At the same time, dovish...

Fundamental Perspective Gold prices slipped as a stronger dollar weighed on dollar-denominated assets despite escalating Middle East tensions. Traders are closely monitoring the upcoming FOMC meeting for clues on interest rate direction, with cautious sentiment limiting gold's near-term momentum. However, central bank demand remains a strong tailwind, as a World...