mtraderz

EssentialThis is a poor performing company with challenging short term outlook. Stock is currently overbought due to recent speculative LNG news. Keep in mind long term the company balance sheet could improve given the made LNG deals made recently. However, this is a long term performance speculation and not supported by any previous promising performance in maintaining...

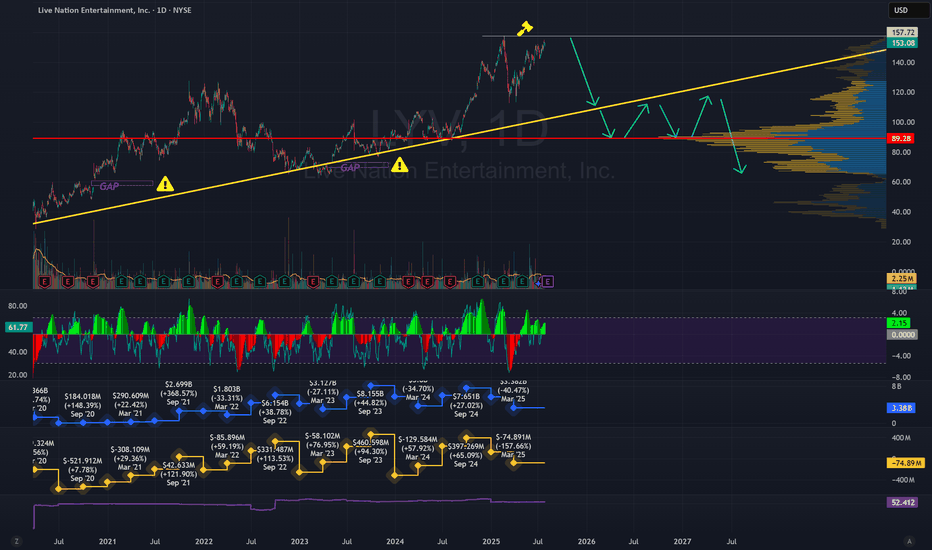

This is a speculative position. The stock could still go up and there is no resistance. However, any negative news pertaining trade deals might bring the price down to test the upward trend from 2020.

This stock is being traded at +50 P/E, if the upcoming report shows EPS YOY declines then the stock is significantly overvalued and it better to close any long position before it starts going downhill. This is not a short position but rather an a warning to get out.

Currently at strong support level, should close the gap above with greater upside potential.

This name has popped up a lot lately. Just be careful not to be the bag holder when the music stops!

UNH took a beating, earnings might surprise tomorrow. speculative pending positive earnings report. Target and stop loss on the chart.

Potential short position setup. Target and stop loss on the chart.

If we go above the yellow resistance with good volume, potential target prices are indicated. Practice safe stop loss (-10%) in these speculative moves.

Broke long term trend, find the next support around $213.

Independent oil operators are under tough oil market prices NYMEX:WTI1! As long as WTI remains above $55, it is a good idea to accumulate in NYSE:SM for a long term investment opportunity. This company is undervalued at 4 P/E compared to 10-15 average in this sector. Healthy balanced sheet but surprised stock due to oil prices which could prolong for more...

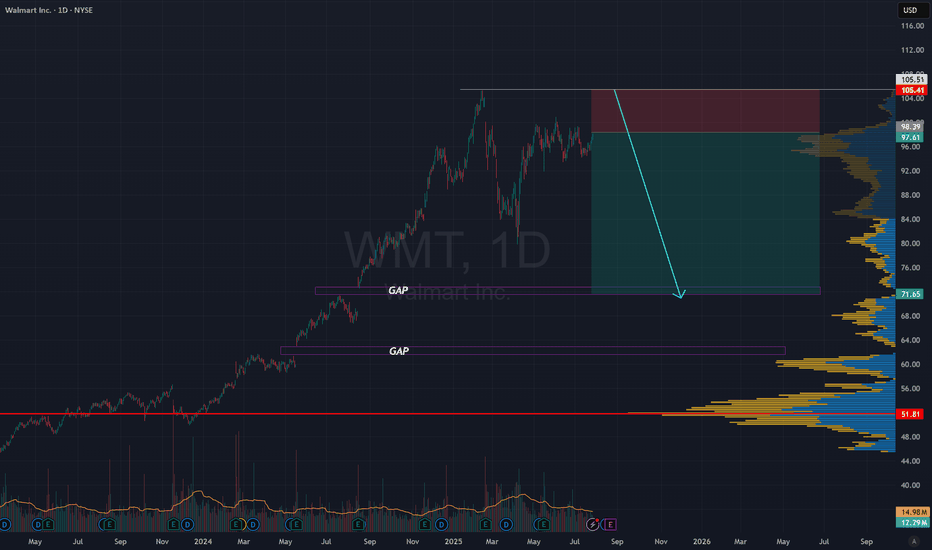

Walmart CEO is selling a chuck of his stocks at this golden opportunity. Target price and stop loss indicated on the chart. This might take months to mature.

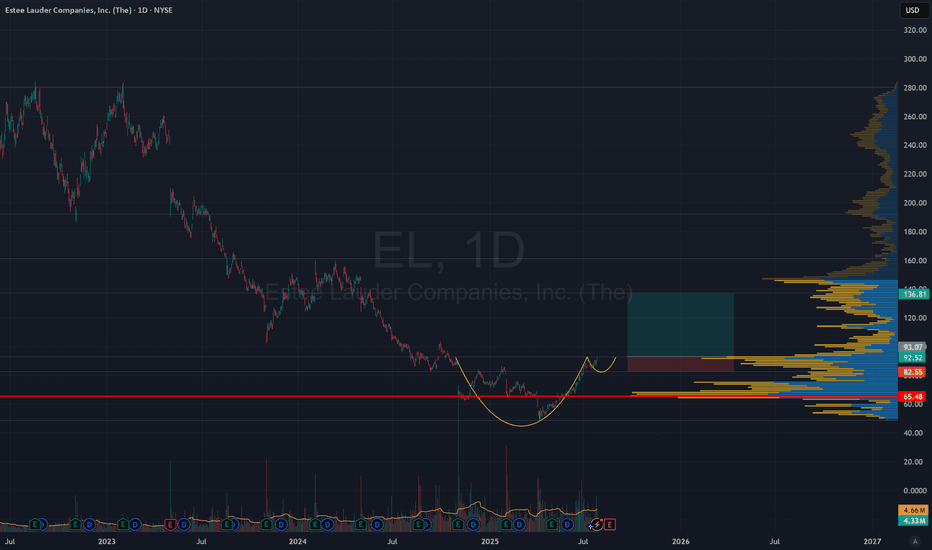

Broke downward trend and forming a cup and holder pattern. upside potential 40%, Stop loss at -10%.

At current stock price, the P/E is extremely inflated above 70 ! SEDG has no reason to be trading at these prices whatsoever, once the last impulsive wave #5 is completed, the sell will come like a tsunami! Good luck to bag holders!

Short term- buy and consolidate position Long term- bullish

Wave 3 is approaching the maximum potential (3900-4000) then a mulit-year correction abc (wave 4) is expected

Over extended beyond Bollinger bands, should retract before shooting up again. Where can I buy a double cheese burger with my overweight fat Bitcoin?