oTokyou

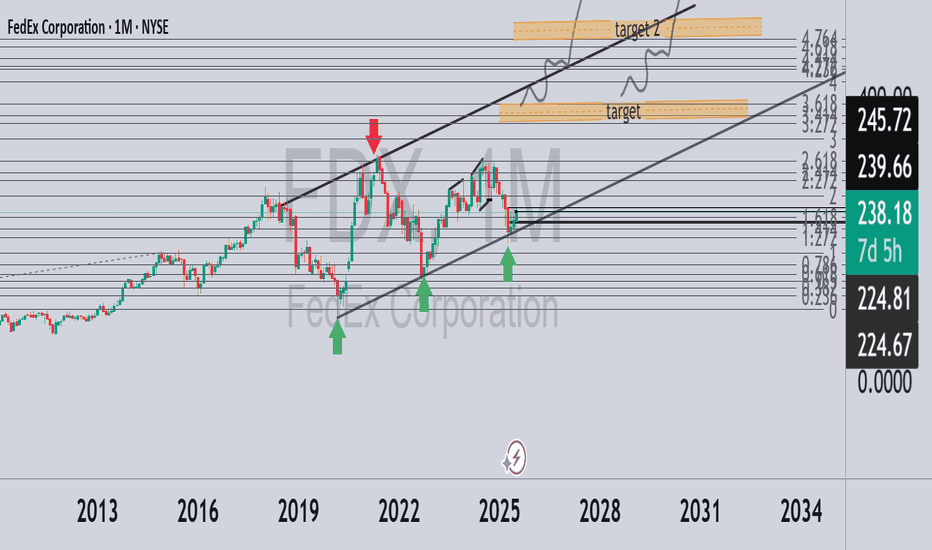

PremiumThe monthly chart of FedEx (symbol: FDX) shows a classic ascending channel pattern, with the price touching the bottom of the channel several times and finding support (green arrows), and on the other hand stopping several times at the upper resistance line (red arrow). In July, we received a strong monthly candle with a jump of almost 5%, right on the central...

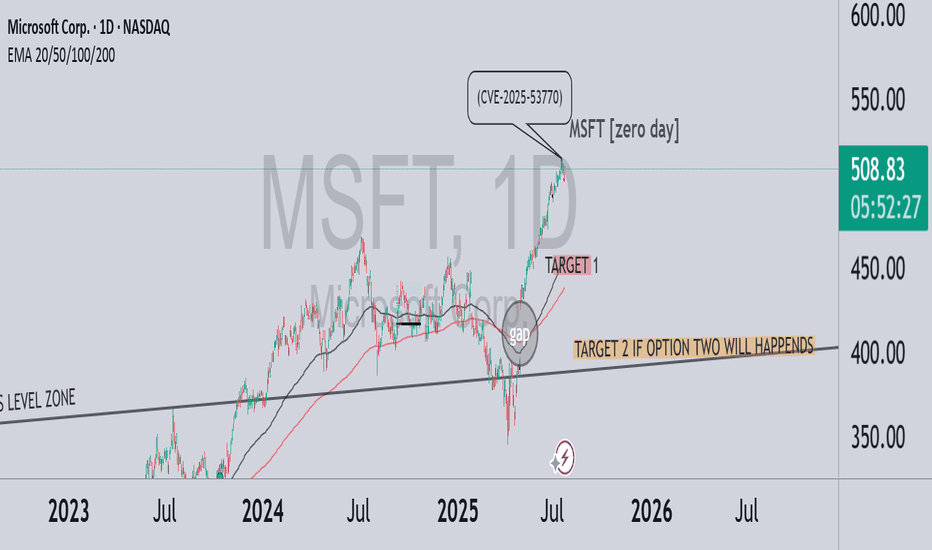

In July 2025, a critical vulnerability in Microsoft SharePoint (CVE-2025-53770) was exploited by threat actors globally. Although the issue was first reported during the Pwn2Own Berlin competition back in May, Microsoft delayed the patch — allowing attackers a significant head start. Over 400 servers and dozens of organizations were breached, including U.S. and...

NVIDIA (NVDA) is forming a bullish continuation pattern on the 1H chart. Price action has broken above key resistance at $141.85, holding steady in pre-market at $142.31. 📈 Technical Analysis Highlights: Fibonacci extensions show a clean breakout setup Measured move targets $157.19 (Fib 3.0), representing +11.74% upside Key support levels: ◾ $140.63 – recent...

🧠 What we’re watching: Trendline break from late March → backtest complete → potential rollover Price is starting to form a lower high – classic reversal structure forming MACRO support eyed at $91,429 (red zone) and then psychological $80K Volume divergence + lower RSI highs pointing to exhaustion 🧯 🪓 The “90K zones again” annotation may become reality...

After a brutal selloff, UNH printed a strong bullish candle today (+6.4%) 📈. Looks like institutions might be stepping in. 🧭 Key Levels: Support turned resistance: $284.88 Immediate Target: $350 🎯 Critical downside levels: $276.29 / $208.07 🕵️♂️ Watch for a retest and confirmation over $285. Patience + Risk Management = 📊📈💰 #UNH #stocks #reversal...

strong bullish structure forming on the weekly timeframe for CMS Energy Corp (CMS). This stock has been respecting a well-defined ascending channel since mid-2022, consistently bouncing from the lower trendline — as highlighted by the green arrows. ✅ Four confirmed touches on the lower trendline (2022, 2023, and multiple in 2024–2025) show strong buying...

GPCR is showing strong potential with recent movements indicating a bullish trend. If you're eyeing growth opportunities, GPCR could be a valuable addition to your portfolio. 💡 Medium/long-term target: $78 easy Get in early and watch your investment grow! 📈 Recent Performance: GPCR has shown consistent growth, reflecting solid market confidence. Bullish...