pradyammm

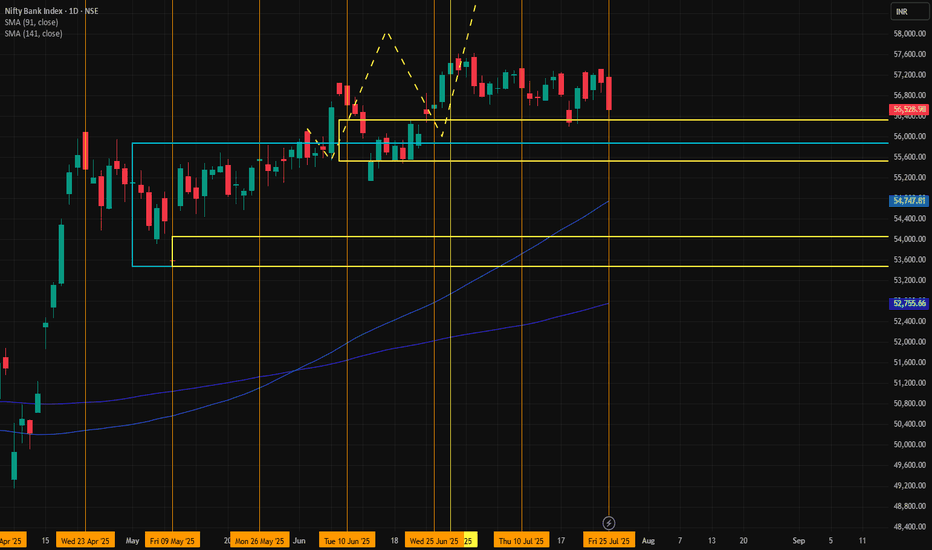

📈 Trade Setup Details 🔹 Trade Plan 1 (MTF-Based Entry) Metric Value Entry 56,223 Stop Loss 55,475 Risk 748 pts Target 63,232 Reward 7,009 pts Risk:Reward 1:9.4 🔸 Comment: A high RR setup using the Daily DMIP zone. Ideal for trend continuation if price respects 55,780–56,223 range. 🔹 Trade Plan 2 (Deep Pullback Entry - ITF Zone) Metric Value Entry 54,054 Stop...

🎯 Trade Setups ENTRY-1 Entry: 24,947 SL: 24,750 Target: 29,331 Risk: 197 pts RRR: ~22.2:1 ✅ Strong RRR, aligned with daily demand ENTRY-2 Entry: 24,164 SL: 23,935 Target: 30,961 Risk: 229 pts RRR: ~29.9:1 ✅ Even better RRR, and sits within deeper Daily DMIP demand zone 📌 Key Insights Structure: Bullish across all MTFs, no breakdown below major...

✅ Updated Trade Plan Summary ✅ Updated Trade Plan Summary Metric Previous Value Updated Value Entry 800 800 Stop Loss (SL) 757 775 Risk 43 25 Target 1256 1256 Reward 456 456 Risk-Reward (RR) 10.6 18.2 🔍 Implications of the Change 🔽 Risk reduced from 43 to 25 points ✅ RR improved significantly from 10.6 to 18.2, showing a more optimized entry 🔐 Stop Loss at 775...

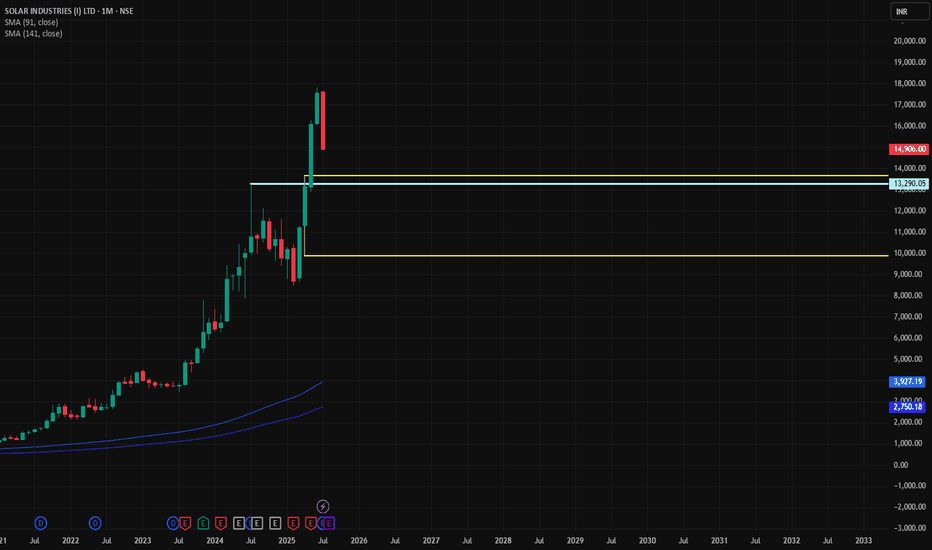

🛒 Trade Plan: Buy Setup Parameter Value Entry 13,290 Stop Loss 11,278 Target 18,992 Risk 2,012 pts Reward 5,702 pts Risk-Reward 2.8 : 1 Last High 16,141 Last Low 13,290 Point Variance 2,851 🧠 Logic: Entry is placed right at strong demand cluster on HTF & Weekly. SL is just below the major Weekly/ITF zone. Target is well above last swing high, offering strong...

📈 Trade Setup: BUY GARDEN REACH Entry Stop Loss (SL) Target Risk Reward RR 1942 1741 4450 201 2508 12.5 Remarks: Entry Zone: 1942 → aligns with Daily/ITF demand zones. SL: 1741 → conservative SL just below the strongest shared demand base. Target: 4450 → ambitious target, likely based on higher timeframe projections or technical structure. RR (Risk-Reward):...

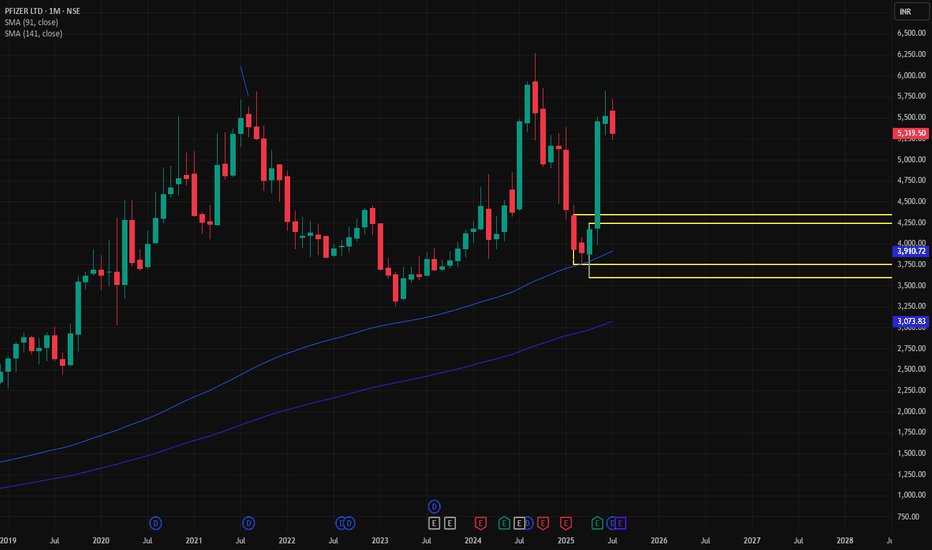

🛒 Trade Plan: BUY Parameter Value Entry 4344 Stop Loss (SL) 3596 Risk 748 pts Reward 4598 pts Target 8942 Risk-Reward (RR) 6.1 🧠 Market Context Metric Value Last High 6269 Last Low 3596 Point Var 2673 ✅ Technical Strengths Strong confluence zone around 358–371 with multiple MTF & ITF demand overlaps. Current price (Entry at 371) sits exactly at the Daily,...

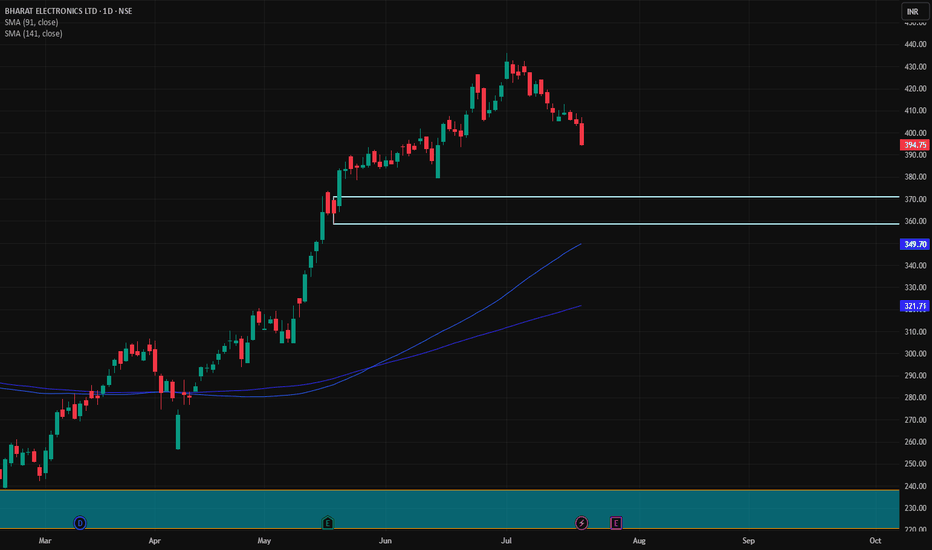

🛒 Trade Plan Summary – Long Entry Parameter Value Entry 371 Stop Loss (SL) 358 Risk 13 pts Target 535 Reward 164 pts Risk-Reward (RR) 12.6 (High Conviction Trade) 🧠 Market Context Last High: 436 – A possible resistance before final target. Last Low: 337 – Still above HTF proximal zone, reinforcing support. Point Var: 99 – Broad range for volatility...

🧠 Technical Logics Highlighted Qtrly BUFL Zone is respected – strong confirmation of demand at 765–705. Weekly ASZ previously formed at 793, reinforcing buyer interest. Engulfing Pattern with DMIP & SOE confirms buying strength. Current price trades above Gann Level (766) – a technical sign of strength. 💼 Trade Plan – Long (BUY) Parameter Value Entry 817 Stop...

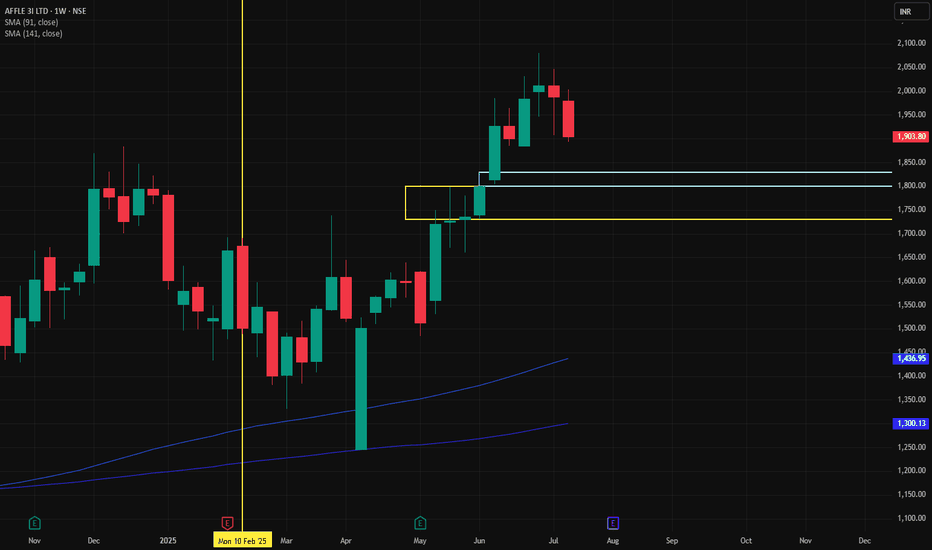

💼 Trade Plan - Buy Setup Parameter Value Entry 1829 Stop Loss (SL) 1730 Target 2542 Risk 99 pts Reward 713 pts Risk:Reward Ratio (RR) 7.2 (Excellent) 📊 Support/Resistance Reference Points Metric Value Last High 1884 Last Low 1226 Point Var 658 🟡 Entry (1829) is near strong weekly/daily/60M demand zones, providing a good base for support. ✅ Conclusion /...

📈 Trade Plan Action: ✅ BUY Entry Point: ₹136 Stop Loss (SL): ₹119 Target (TGT): ₹437 Risk: ₹17 Reward: ₹301 Risk-Reward Ratio (RRR): 🔥 17.7 — Excellent 📊 Key Levels Parameter Value Last High ₹289 Last Low ₹141 Point Variation ₹148 🔍 Interpretation & Strategy All trends align UP, showing strong bullishness across timeframes. Demand zones are tightly packed...

📈 Trade Plan: Entry-1: ₹2408 Stop Loss: ₹2308 Risk: ₹100 Reward: ₹3017 Target: ₹5425 Risk:Reward (RR): 30.2 — extremely favorable if it plays out Last High: ₹3859 Last Low: ₹2293 Point Variance: 1566 ✅ Interpretation & Insights: Trend Confirmation Across All Timeframes: Every timeframe from yearly down to intraday (60M) shows an uptrend, indicating strong...

📈 Trade Setup Parameter Value Buy Entry ₹738 Stop Loss (SL) ₹670 Target ₹1,194 Risk ₹68 Reward ₹456 Risk:Reward 6.7 : 1 Last High: ₹797 — Once broken, can trigger fresh momentum. Last Low: ₹400 — Previous strong base. ⚠️ Key Observations Strong Weekly & Daily Demand just below current price (678–738) supports the buy zone. Entry near BUFL zone → suggests...

📈 Trade Setup: Parameter Value Entry Price ₹6,905 Stop Loss ₹6,643 Target ₹10,274 Risk ₹262 Reward ₹3,369 Risk:Reward 12.9x Last High ₹8,551 Last Low ₹6,828 Point Variation ₹1,723 🧠 Interpretation: Perfect Trend Alignment: UP across all HTFs, MTFs, and ITFs. Entry is within weekly demand zone (6905–6374), giving a low-risk setup. High R:R (12.9x) makes this a...

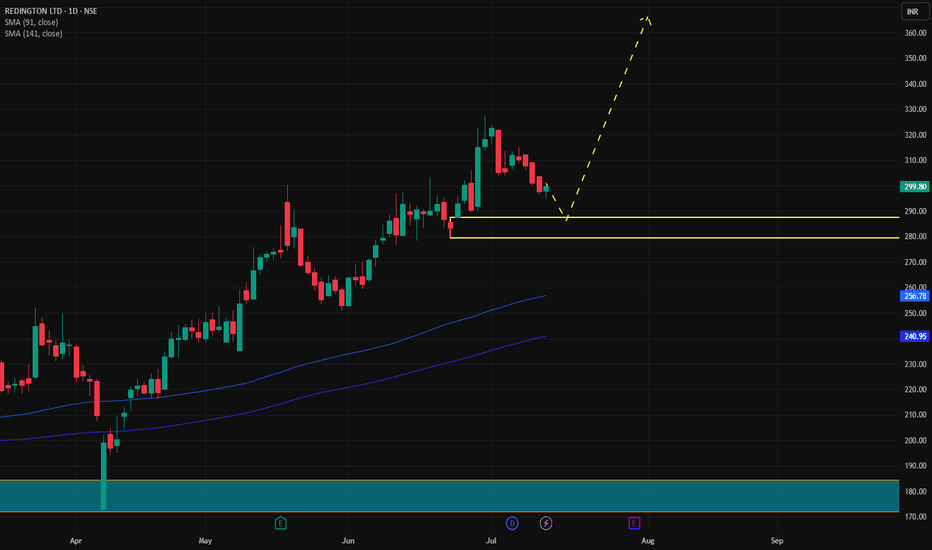

✅ Redington Buy Trade Setup Parameter Value Entry 287 Stop Loss (SL) 278 Risk 9 pts Reward 88 pts Target Price 375 Risk:Reward (RR) 9.8 📍 Other Key Levels Metric Value Last High 327 Last Low 279 Point Variance 48 🔎 Interpretation & Trade Insights 🔼 Trend Confirmation: Every timeframe shows an uptrend, which confirms directional conviction. 🎯 Entry Zone...

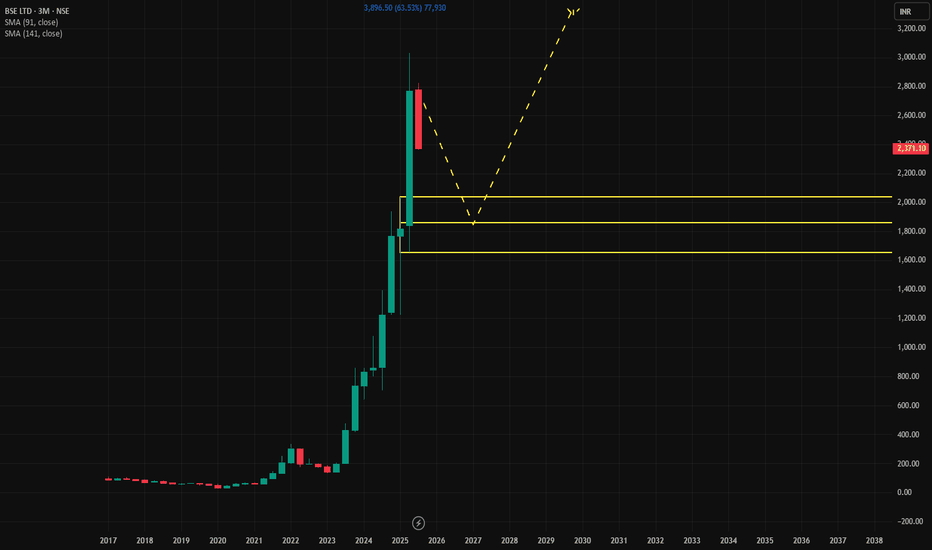

💼 BSE Trade Plan Details Parameter Value Entry Price 2079 Stop Loss (SL) 1861 Risk 218 pts Reward 1924 pts Target 4003 Risk:Reward (RR) 8.8 🔎 Reference Data Last High 3026 Last Low 2049 Point Var 977 ✅ Key Observations & Strategic Notes Trend Strength: All HTF, MTF, and ITF are in a confirmed uptrend. Entry Zone: 2079 is right around the MTF average proximal...

📈 Trade Plan (BUY Setup) Parameter Value Entry Price 8565 Stop Loss (SL) 8365 Risk 200 pts Target (Reward) 10234 pts Target Price 18799 Risk:Reward (RR) 51.2 🔎 Reference Points Last High: 12809 Last Low: 6819 Point Variation: 5990 ✅ Key Takeaways All trend indicators point strongly bullish from long to short term. Entry at 8565 with a tight SL of 8365 offers...

📊 Trade Plan: Long Setup Entry Stop Loss (SL) Risk Target Reward RR 645 601 44 pts 744 99 pts 2.3 📌 Risk-Reward Ratio (RR) of 2.3 is healthy for a swing trade 📌 Entry aligns with 60M demand zone and near Daily/Weekly zones 🔄 Key Reference Points Last High: 603 Last Low: 462 Point Variance: 141 🔔 Potential breakout above 603 (last high) supports further...

📝 Trade Plan Position: Long (Buy) Entry: 800 Stop Loss: 757 Risk: 43 points Target: 1256 Reward: 456 points Risk-Reward (RR): 10.6 – Excellent ✅ Multi-Timeframe Trend & Demand Zone Alignment Zone Trend Demand Logic Avg Demand Zone HTF UP RBR, BUFL 650 MTF UP RBR, DMIP, SOE, BUFL 762 ITF UP DMIP, BUFL 785 Trade Point Avg 732 This shows full timeframe alignment...