ramon_markiewitz

EssentialI am watching this for ages now. At the current state it's an extended model 1 that went over in a model 2. If it wants to create a bigger range here then it would be fine, as long as the 3rd tap stays intact.

I'm watching out for something like this on ADA. A mid time frame accumulation that completes a high time frame distribution. Clean POI's on both sides, let's see what will happen here.

I'm excited to see how this develops. Might be the first proper accumulation since april at the lows.

I'm watching here either for a local model 1 which forms a MTF accumulation model 2 or a model 1 which deviates the range one more time. There is a nice build up of liquidity to the upside but sadly no clear model 2 POI. The technical target if the model gets confirmed will be the range high but i would expect to see a new ATH. Let's see.

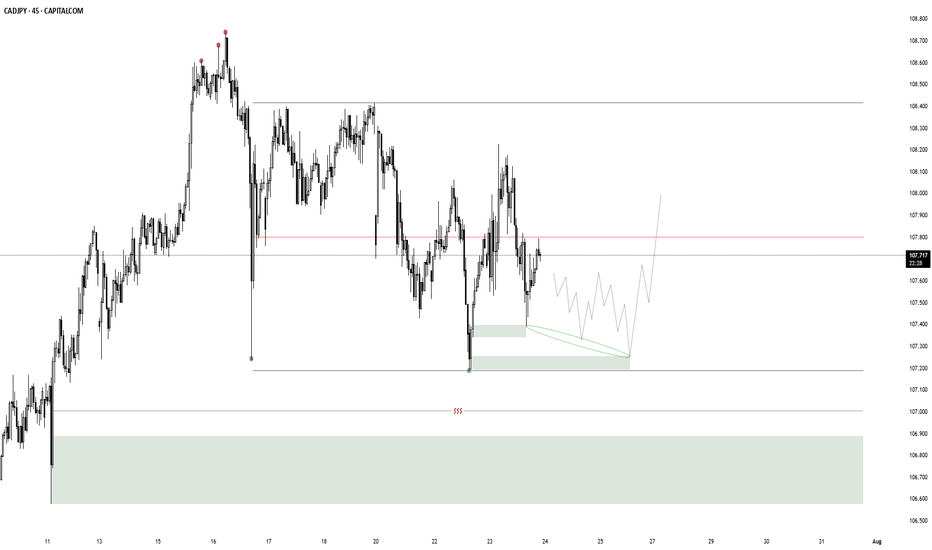

I am looking for reaccumulation here, since we are in a higher time frame model 1 with an orderflow objective of 111.550. My model 2 POI is the extreme demand. In case there is no confirmation i am watching the liquidity+demand below for a model 1. If none of it confirms i will wait for lower levels.

I was to focused on crypto this week that i completely missed that. At the moment it's an confirmed internal model 2 distribution. If i'm lucky i get an entry in a redistribution form up there. Target is the range low, invalidation above the 3rd tap.

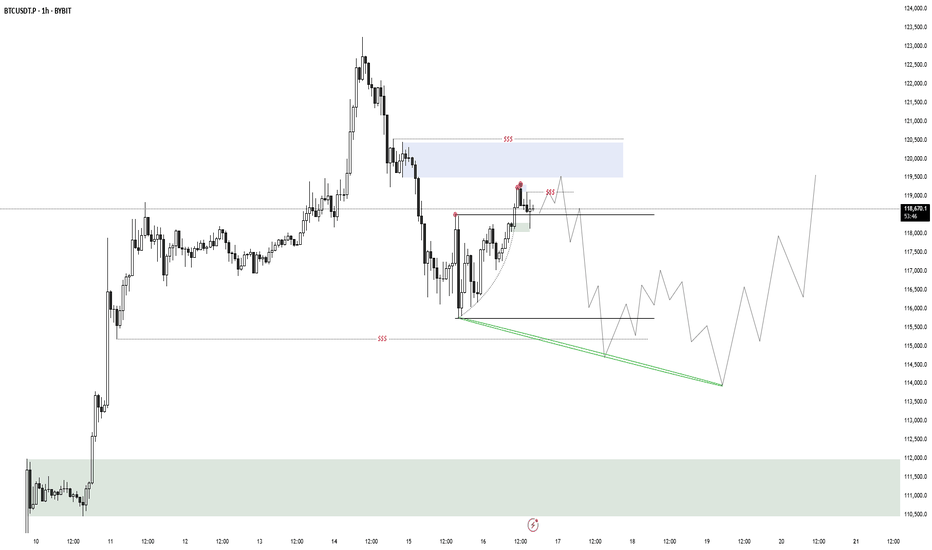

I just had this idea on BTC of a PO3 creation on friday, consolidation over the weekend followed by a sell off into the range demand. I will only be interested in trading something outside of this range, so if BTC decides to do the exact opposite it's also fine, but fridays are perfect for manipulation events like this.(Something like i have drawn here would match...

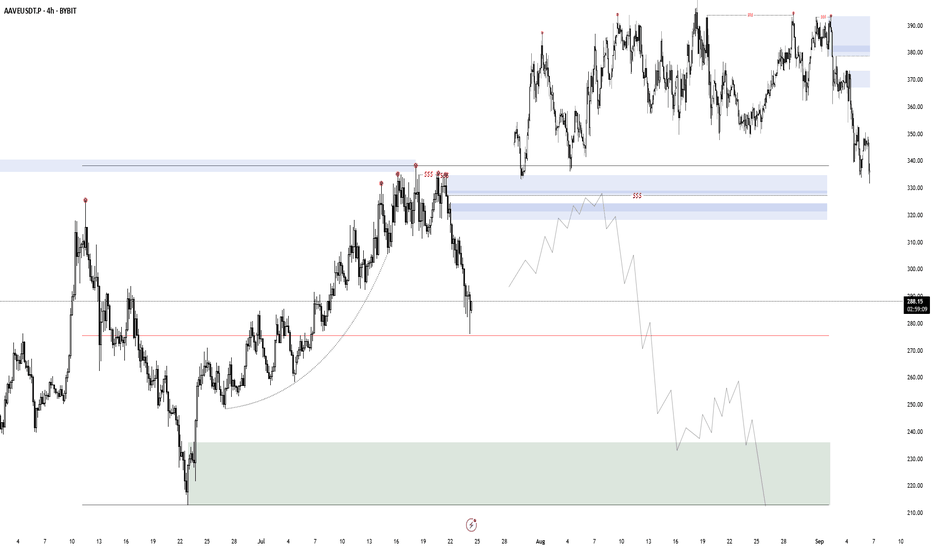

I'm looking for a potential model 2 here after mitigating supply and building a good looking top. It would need confluence with BTC.D and USDT.D, since i am more focused on reaccumulations at the moment. My alert is at the POI, i will decide later if i take it or not.

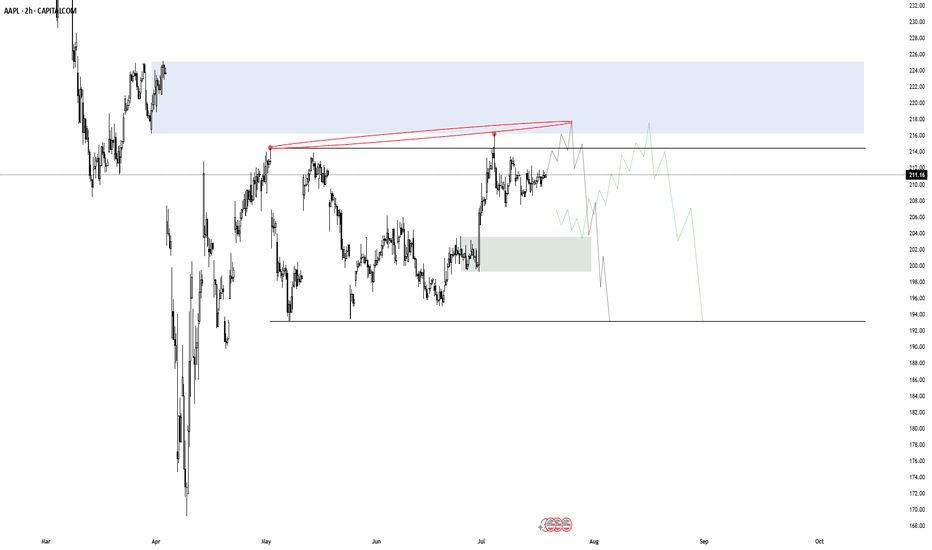

I'm watching this potential apple distribuition for a while now. The demand below is not optimal, but if i see a BOS out of this supply i might give it a try.(a demand mitigation that leaves behing liquidity would be better)

I still keep track of my BTC cycle count, which is a little bit unclear, since the last daily cycle low had a SFP. We will see how it plays out this time.(It's funny that the second one is aligning perfectly with a weeky cycle low, but thats for later)

I'm looking for a Model 2 on XRP, either from the liquidity, extreme demand, or extreme liquidity.

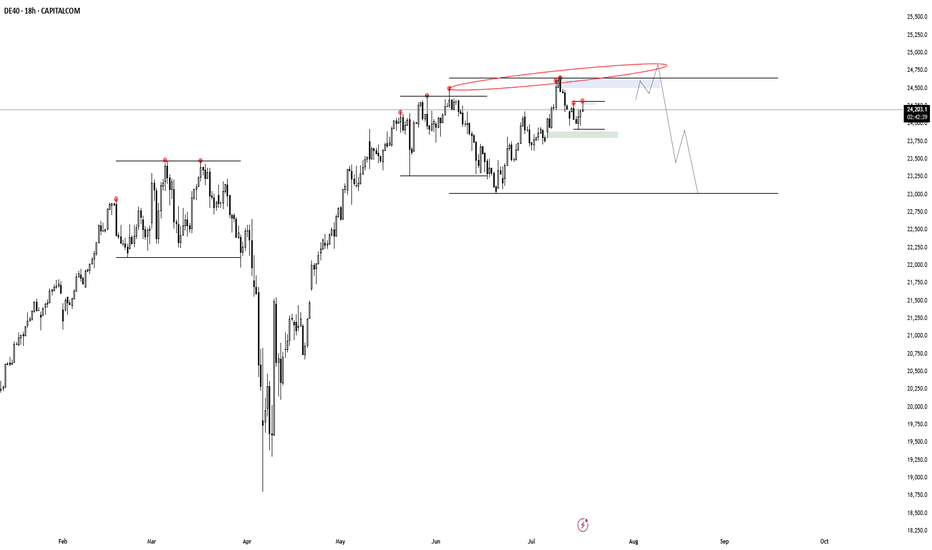

I'm watching the DE40 closely here. It's putting in distribution over distribution, which simultaneously leads to the creation of a potential higher time frame distribution model. There are many other indices with a similar behaviour, but this one looks the cleanest so far. I'm waiting for invalidations/confirmations at the POI's.

Looking for LTF distribution to take out liquidity and create a MTF accumulation to then go higher.

Over the last 2 weeks there was this redistribution model forming, where i yesterday found an entry. The Initial distribution i was looking for in may never hit it's target, so i might be able to ride this trade all the way down. The time displacement on the last tap wasn't the best, so there might be another move into the POI's, where i then have to reenter. It...

I am looking for some accumulation here. The model can already be complete, but i would only take it if it extends into a model 2 from extreme liquidity to create more liquidity for a reversal. The supply above, followed by the strong sell off lowers the quality of this model. A supply mitigation with a slow pullback into the POI would change that.

This is my new outlook for BTC if this 250 day old range is intended to be a HTF Distribution Model 1, which has neither been confirmed nor invalidated. A weekly close above 123.350$ will invalidate this model and likely lead to higher prices. Yesterday we had a perfect rejection from the deviation limit, which now probably creates a new range, that then will...

Beautiful price action in the past 2 weeks. 3408$ is still my POI for a potential rejection to confirm that internal distribution. Im patiently waiting here for what's to come.

A nice distribution model for heating oil was developed this week. I was looking for a mitigation of the OBIF which delivered unfortunately no valid entry. Really nice build up here.