rsitrades

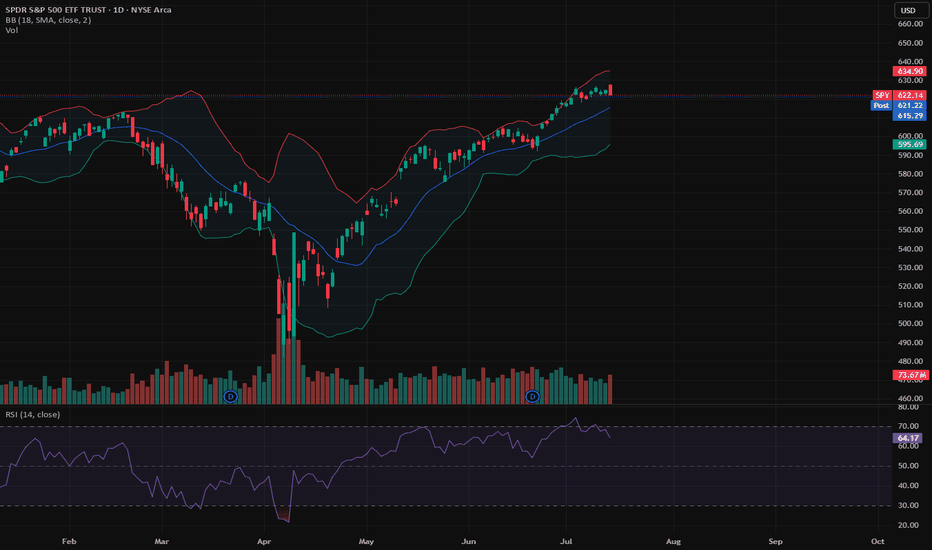

EssentialSPY likely reaches 615 this week, if it gets under it will be a change of character. Gold still choppy, nothing decided just yet. Oil also undecided. Nat Gas may pullback from it's breakout. BTC looks like it may have at least a good pullback.

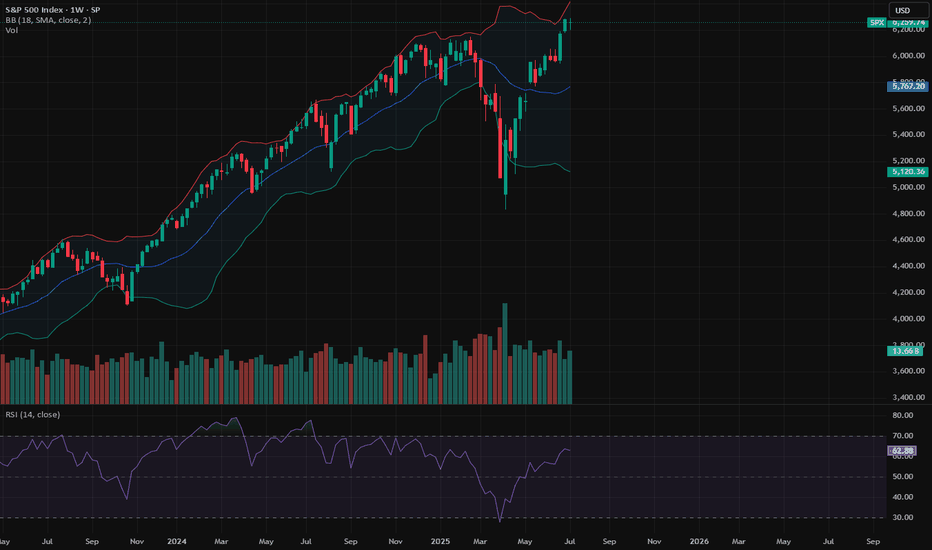

JUst some ideas while looking at weekly charts. We've put in a doji on the week - indecision. A pullback to 6100 would start raising flags about a possible false breakout from balance.

SPX looks like it's consolidating only. Gold has broken above resistance. OIL and Nat Gas looks like they want to go higher. BTC should go higher, but not too much more.

So the gap down looked bearish but the technicals are not confirming it. One more high is likely today or Monday. Gold is at resistance here. OIl found support and looks like a long. BTC rallied and can go higher but it's putting in daily bearish divergences. Natural Gas looks like it will bounce.

market goes higher but I still think a larger correction down is coming. Gold is sideways still. OIl rejected from 68.50- so far. NG looks like it may go a bit higher. BTC is at the top of it's range.

SPY likely put in a C wave this morning, I expect a further move down for the rest of the week. Gold starting to look bullish again. Natural Gas likely keeps dropping towards 2.5. BTC at the top of it's range. USOIL is at resistance. The stock I'm trading - aapl - is showing a bear flag on small time frames

SPY bounces will likely be sold but it needs to break 618 for any real down move. Gold, stuck between support and resistance. USOIL at resistance. NG, difficult to say what is happening. BTC may pop the highs but it would likely be a false break.

SPY is at support after a down day, I expect a bit of a bounce overnight, but maybe not. USOIL is looking better, as Well as GOld. NG not really going anywhere yet. BTC still looks like it will drop.

SP500 may start pulling back, we'll have to see if they can get any downward pressure hapening. USOIL still looks bearish. Gold and Nat Gas both looks like they are going sideways right now. BTC still hasn't broken out above 110k.

SPY got the pop up I was looking for - now the question is - does it hold and continue? Not sure yet. Gold could be bullish if it gets over 3370. Usoil had a pop but nothing screaming reversal yet. NG is in a wedge. BTC is at the top of it's range

An interesting Juncture here for Yields and Bonds. USD/JPY also bear flagging here.

SPY continues to move up and I think a bit higher is likely still, although the bearish divergences are warning that another high may not hold. Gold may be bullish if it can push a bit higher. NG still looks bearish overall. USOIL also looks bearish. BTC is trying to breakout, but might not be able to just yet.

SPX still floating but IWM and DJT are both having strong rallies, which usually means SPX will go higher today or tomorrow. Gold is at resistance. NG is a support. OIl still looks like a bear flag. BTC is pulling back from 107k - again.

The market continues to be biased up, and the target is likely the weekly B. MJ stocks are showing technical signs that a reversal may come. There may be other sectors similar as I think the summer bottom gamblers will start appearing now that everything else is at the highs. Gold looks like it will eventually go lower. Nat gas lost support and is likely to go...

SPY may reverse today, I'm watching IWM for clues. Gold losing support as of now. Oil may come down more and then bounce again. NG is hard to read. BTC still holding below it's channel.

Just a possibility - DJT and IWM have turned down, they often lead the moves. Gold at support and holding. Oil support is holding. Natural gas probably bounces here. BTC at channel resistance

I mentioned yesterday I thought it would be either a large break up or large breakdown, it was a large break up after all. All time highs are very close, so probably this week we will get there, unless something happens overnight or tomorrow. Gold looks bearish but is holding support as of now. Oil is at support. Nat Gas lost support. BTC is in a channel and looks...

SPY is at resistance. OIL looks like a C wave. My feeling is there could be a swift down move on SPX futures overnight. I'm wrong if we open above 602 on SPY tomorrow