rtlustymen

EssentialA pattern I've used multiple times with Apple, looks like the same setup as April 2024 earnings.

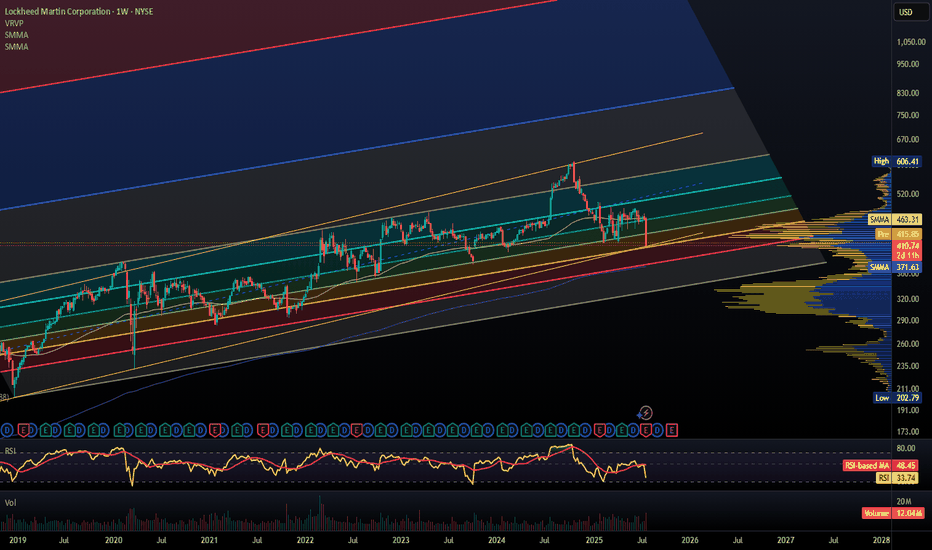

By my technical analysis we can expect LMT to bounce back by 10-15% at least.

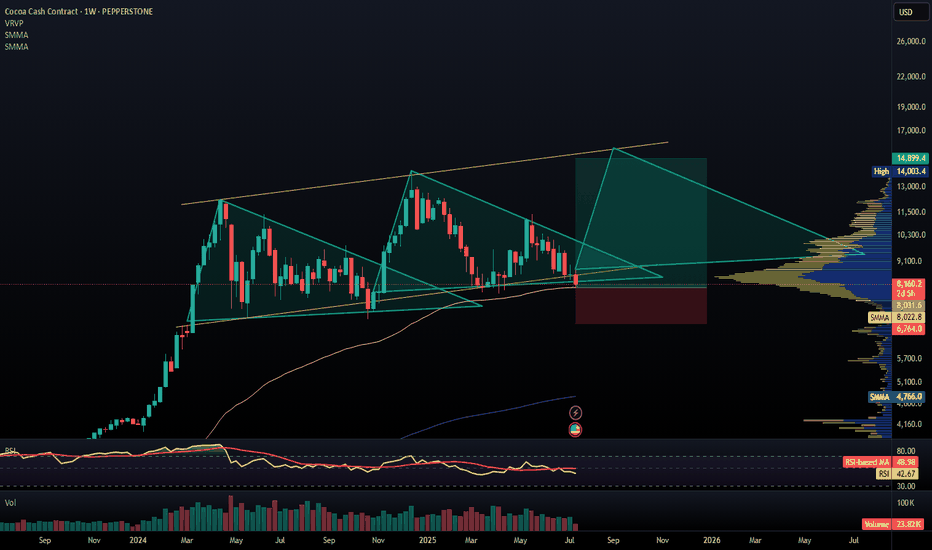

By my technical analysis I predict that Cocoa will hit new ATH, probably around 15k usd, by the end of the year.

I believe Nasdaq will go down to 18400 range to fill the large gap and then go back to ATH.

Structure is there, one of the best P/E ratios in highest market cap stocks, looking good.

Mid-term trade for maximum few weeks, new tariffs could hit Brasil also and make the pump even stronger.

Trade for 1-2 months, no recession is happening yet.

Lam Research is one of the companies that should benefit the most from the US 500 billion infrastructure investments.

A pattern we see quite often with cocoa, as it still refuses the breakdown to sub 10k prices I believe we'll stay in this range for perhaps months as last year, occasionally having larger spikes up.

Short term trade - if Japan increases interest rates as it did in July, there's a high chance the Yen Carry trade will unwind again, causing a large drop. If Japan doesn't raise them, I'd close the trade soon after that. THE SL is orientational the point of the trade is to hold till the decision on friday.

Short term trade - Yen Carry trade will unwind again, causing a large drop. I expect it during the next week or two but we will see.

Lobby in government is gonna be strong, obviously heading to new highs imo.

Shame I didn't publish this two weeks ago when I originally had the idea, nonetheless: Very clear that Chevron will profit massively from Trump.

Structure is perfect for a large push up/down, if the prices pushes upwards strong, I'd consider switching a short for a long position as we might make new highs. Currently I'm bearish.

Can Trump lower the prices of oil? I think yes. During his first term he held prices in the $40-65 range for most of the 4 years. I believe the prices can go significantly under $60 but we'll see.

Very aggressive trade, I'm skeptical about the Interest rates lowering coming in next months, though it should have a positive effect not just on precious metals but also agrocommodities.

History is repeating itself, Gold wen 45% up in the time of lowering interest rates of September 2007 to March 2008. Interest rates were lowered 5x by 2.25%, from 5.25% to 3%. FED announced plan to reduce interest rates from 5.5% to 3.5% by March 2025.

The unemployment rate has been steadily rising for the past year, which as seen on the comparison regularly precedes major economic downturn.