satyam15

🚀 Craftsman Automation: Ready for New All-Time High? 📍 CMP: ₹6900 📉 Stop Loss: ₹5218 🎯 Targets: ₹8000 / ₹9000 / ₹10000 📈 Technical Setup: Rounding bottom breakout pattern visible on daily/weekly charts Strong volume base formed around previous swing low at ₹5200 Ideal for swing to positional traders High SL zone—use limited quantity and add via pyramiding as...

🔄 Aarti Industries: Attempting a Reversal 🔄 📉 CMP: ₹470 🔒 Stop Loss: ₹428 🎯 Targets: ₹554 | ₹604 📊 Technical Setup: ✅ Rounding Bottom Breakout confirmed ✅ Retest completed, providing a low-risk entry zone ✅ Strong base formed after prolonged downtrend This setup offers a good swing trading opportunity as we preempt a potential reversal. ⚠️ Note: Since this...

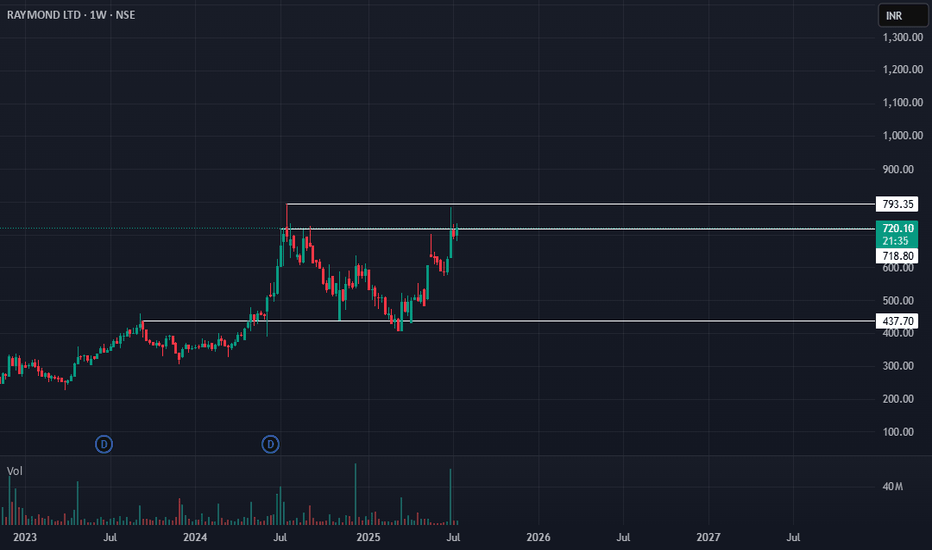

🚀 Raymond: Poised for All-Time High Breakout? 🚀 💰 CMP: ₹722 🔒 Stop Loss: ₹578 🎯 Targets: ₹780 | ₹828 | ₹880 🔍 Rationale: Raymond is showing strong signs of an all-time high breakout with its highest weekly close, a successful breakout, small pullback, and resumption of upward momentum. Range breakout continuation can drive prices higher. 🔔 Notification: Options...

🚀 Cupid Ltd: Strong Weekly Volume Breakout! 🚀 📉 CMP: ₹141 🔒 Stop Loss: ₹88 🎯 Target: ₹220 🔍 Why Cupid Looks Promising? ✅ Rounding Bottom Breakout: Clear breakout on the weekly chart with strong volume support ✅ Volume Confirmation: High volumes indicate genuine buying interest and strength behind the move ✅ Big Stop Loss Strategy: Due to the nature of such...

🚀 LT Foods: Ready for the Next Rally? 🚀 📉 CMP: ₹502 🔒 Stop Loss: ₹460 🎯 Targets: ₹550 | ₹590 🔍 Why LT Foods Looks Promising? ✅ Big Base Breakout: Strong structural breakout with successful retest ✅ All-Time High Zone: Stock is hovering at its all-time high, indicating strength ✅ Double Doji Weekly Breakout: Preempting a breakout after a double doji weekly...

🚀 Biocon: Heading for All-Time High? 🚀 📉 CMP: ₹390 🔒 Stop Loss: ₹330 🎯 Targets: ₹428 | ₹478 | ₹560 🔍 Why Biocon Looks Promising? ✅ Weekly Rounding Bottom Breakout: Breakout triggered above ₹390 ✅ Weekly Box Breakout: Confirmation above ₹398 strengthens the setup ✅ Final Confirmation: A weekly close above ₹402 will validate the breakout for a potential strong...

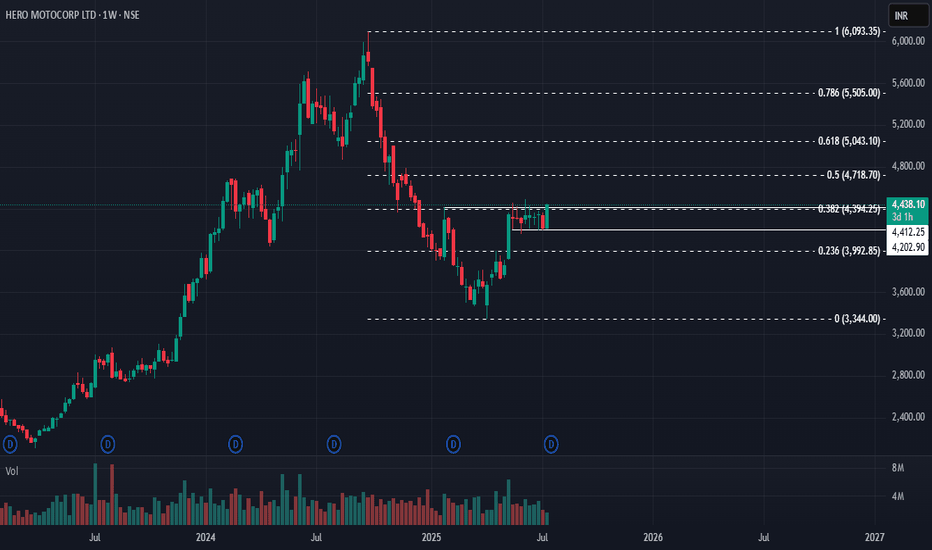

🚀 Hero MotoCorp: Reversal in Sight? 🚀 📉 CMP: ₹4438 🔒 Stop Loss: ₹4090 🎯 Targets: ₹5030 | ₹5700 🔍 Why Hero MotoCorp Looks Promising? ✅ Rounding Bottom Breakout: Weekly close above ₹4412 confirms this bullish reversal pattern ✅ Box Breakout: 8-week consolidation range of ₹4454–₹4202 broken above ₹4460, signalling strength ✅ Flag & Pole Setup: Larger range of...

🚀 Engineers India Ltd (EIL): Rounding Bottom Breakout in Sight! 🚀 📉 CMP: ₹212 🔒 Stop Loss: ₹189 🎯 Target: ₹260 Why EIL Looks Promising? ✅ Rounding Bottom Formation: Strong base pattern on daily chart signals long-term reversal potential ✅ Reversal Signs: Bullish structure with increasing volumes confirms buyer interest ✅ Sector Tailwind: Capital goods & infra...

🚀 LT Foods: On the Verge of a Strong Breakout! 🚀 📉 CMP: ₹436 🔒 Stop Loss: ₹370 🎯 Target: ₹530 🔍 Why LT Foods Looks Promising: ✅ 7-Month Box Breakout Setup: A tight consolidation zone on the monthly chart is set for a potential breakout ✅ Volume Confirmation: Recent price action shows strength—buyers stepping in ✅ Add on Dips: Accumulate confidently till ₹390 if...

🚀 Elecon Engineering: Pre-Breakout Momentum Building! 🚀 📉 CMP: ₹716 🔒 Stop Loss: ₹652 🎯 Target: ₹952 🔍 Why It Looks Promising? ✅ Rounding Bottom Breakout: Strong breakout above ₹652 with a successful retest. ✅ Fresh Upside Move: Momentum picking up—on track to challenge all-time highs. 💡 Strategy & Risk Management 📈 Staggered Entry: Accumulate gradually near...

🚀 Laurus Labs: Short-Term Momentum Setup! 🚀 📉 CMP: ₹624 🔒 Stop Loss: ₹604 🎯 Target: ₹660 🔍 Why Laurus Labs? ✅ Key Fibonacci Confluence: Price hovering around the crucial 62% retracement level. ✅ Derivatives Signal: Highest Call OI at ₹620—now acting as support. ✅ Momentum Watch: The stock is positioned to gain traction in the short term. 💡 Quick Strategy 📈...

🚀 Balrampur Chini: Eyeing All-Time High! 🚀 📉 CMP: ₹619 🔒 Stop Loss: ₹575 🎯 Target: ₹700 🔍 Why Balrampur Chini Looks Promising? ✅ Technical Strength: Trading above 61.8% Fibonacci level post-correction, indicating strong support ✅ Consolidation Base: Tight range between ₹615–₹580 signals accumulation before a potential breakout ✅ Upside Potential: Breakout from...

🚀 PNB: Weekly Rounding Bottom Breakout! 🚀 📉 CMP: ₹111.16 🔒 Stop Loss: ₹99 🎯 Targets: ₹117 | ₹126 | ₹133 🔍 Why PNB Looks Strong? ✅ Technical Breakout: Rounding bottom breakout confirmed on weekly charts ✅ Retest Support: Successful retest at 40 EMA, strengthening bullish bias ✅ Sector Boost: With rate cuts supporting banking, PNB as a laggard may catch up with...

🚀 Canara Bank: Rounding Bottom Breakout in Progress! 🚀 📉 CMP: ₹111.8 🔒 Stop Loss: ₹104 🎯 Targets: ₹126 | ₹140 🔍 Why It Looks Promising? ✅ Rounding Bottom Formation ✅ Breakout Above Key Fibonacci 62% Level ✅ Sectoral Strength: Banking & Financials are poised to lead the next leg of the Nifty rally—and Canara Bank could be a key driver. 💡 Strategy & Risk...

🚀 Greaves Cotton: Gearing Up for Upside Momentum! 🚀 📉 CMP: ₹207.61 🔒 Stop Loss: ₹179 🎯 Targets: ₹253 | ₹290 Why It Looks Promising? ✅ Gap-Up Start: Week began with a gap-up and the stock is holding gains—sign of strength. ✅ 21 EMA Crossover: Today's move above the 21 EMA suggests bullish momentum building. ✅ Key Level Breach: ₹210 was the high on result...

🚀 Bajaj Finserv: Preparing for a Big Move! 🚀 📍 CMP: ₹1798 📉 Stop Loss: ₹1615 🎯 Target: ₹2025 | ₹2500 🔹 Key Insights: ✅ Rounding Bottom Formation: Neckline at ₹2025—confirmation above this level could unlock strong upside potential. ✅ Channel Trading: The stock is moving within a well-defined upward channel. ✅ Macro Factor: Potential RBI rate cuts could act as a...

🚀 Mphasis: Bounce from Long-Term Support 🚀 📉 Current Market Price (CMP): ₹2790📈 Support Level: Long-term support bounce confirmed🔒 Stop Loss: ₹2170📈 Targets: ₹2518 | ₹2732 📊 Key Insights: 🔹 Sector Strength: Nifty IT index showed a strong recovery after an initial 2% gap down, reclaiming losses in the first hour – a sign of sector-wide resilience. 🔹 Technical...

📈 HCL Technologies: Setting Up for a Potential Bounce CMP: ₹1,606 Stop Loss: ₹1,490 Target 1: ₹1,738 Target 2: ₹1,825 HCL Technologies is showing signs of a potential rebound, closely mirroring the NIFTY IT index. The stock has formed a base on the daily chart and recently breached a small resistance, indicating bullish momentum may follow. 💡 Why This...