vagada

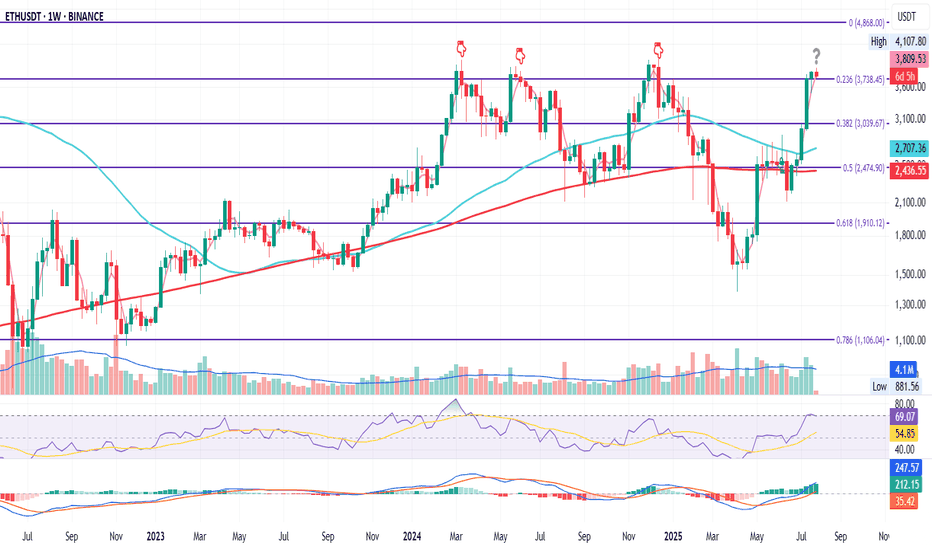

EssentialThis is ETH on the Daily Price action today looks very similar to December 2024. Back then, ETH attempted twice to flip the 0.236 Fib level at $3378.45 — first on Dec 6, then on Dec 12. Both failed. Price found support at the 0.5 (midpoint between the 0.236 and 0.382), bounced, got rejected again at the 0.236, then went lower. Now, we’re seeing a...

SOL/ETH on the Daily On June 17, 2025, a death cross formed — and since then, SOL has been steadily losing ground to ETH. Attempts to pause or reverse the trend at the 0.382 and 0.5 Fib levels have failed. Momentum is strong to the downside. The next potential support is the 0.618 Fib, around 0.04000. In my view, this is closely tied to Ethereum’s dominance...

BTC Dominance pushed into the 200MA on August 2nd. On August 3rd, it got rejected and closed below the 62.25% key resistance. Today, August 4th, that same level is acting as resistance again. If today's candle closes below the BB center (orange), we could see another move back to the bottom of the range with the 0.382 Fib near 60% as the next key level to...

This is ETH/BTC on the daily chart. The golden cross is now confirmed: 50MA has officially crossed above the 200MA. Price reacted immediately, jumping straight to the 0.786 Fib level at 0.0347 a key resistance. This confirms the bullish structure we’ve been tracking: – Golden cross ✅ – Breakout above 200MA ✅ – Push into major resistance ✅ Now all eyes are on...

This is ETH/BTC on the daily chart. A major event is about to unfold: the golden cross, where the 50MA crosses above the 200MA. The last time this happened was in early 2020, around the same price zone, right after a bounce off the 2019 low double bottom and a rejection from the 0.5 Fib level, which sits halfway between the 2019 low and the 0.786 Fib. In 2025,...

ETH on the 4H is confirming the uptrend MLR > SMA > BB Center — trend structure is bullish PSAR has flipped bullish RSI has plenty of room to run MACD has turned green Next resistance: 0.236 Fib and the 50MA. On the macro side: • Fed chair replacement talks • Slower job numbers • CFTC launching “Crypto Sprint” Momentum is building. We’ll be here to watch it...

ETH on the 4H ETH found support right at the midpoint between the 0.382 and 0.236 Fib levels — exactly at yesterday’s close. Price closed above the BB center, and the SMA is also holding above it — early signs of recovery. RSI formed a double bottom in the oversold zone and has now crossed above its moving average. MACD is about to flip bullish. I remain...

ETH on the 4H Bears are having their moment — and that’s fine. Price is heading lower, with the 200MA around $3200 as the next support. If that breaks, the 0.382 Fib near $3000 is the last line before things get ugly. My plan? Watch RSI for signs of bullish divergence. Until then, hold tight. Always take profits and manage risk. Interaction is welcome.

ETH on the 4H Price is pulling back again — mostly due to sticky inflation. Even though YoY CPI came in at 2.8% (vs 2.7% expected), MoM data was on target, so the market may just be pricing in “higher for longer.” Back to the chart — not much has changed. ETH is still holding above both the 0.236 Fib and the 50MA. The next real resistance is around...

ETH on the 4H The Fed noise is gone, now it’s just pure market intent. Price wicked below the 0.236 Fib, but buyers stepped in fast, showing strength at that level. A small bullish divergence is forming on the RSI. If ETH holds above the Fib, that signal could gain momentum. Always take profits and manage risk. Interaction is welcome.

ETH is now in the process of retesting both the 50MA and the 0.236 Fib level. This current candle is closing strong — with solid volume. If momentum holds, both systems are close to flipping bullish: – PSAR is about to flip – MLR and SMA are lining up to cross above the BB center RSI has cooled off, giving room for more upside, and MACD is close to turning...

ETH on the Weekly ETH just closed the week above the 0.236 Fib level at $3738.45. It’s the fourth attempt to conquer this zone since the June 2022 bottom. If price holds above this level, the odds of continuation increase. If it fails, we could see downside. It may also just consolidate here for a while. RSI just touched overbought, and MACD remains green —...

ETH.D on the Daily Next resistance is approaching near the 0.236 Fib level, around 12.60%. In my view, this level will eventually flip to support — but it may take time. Price could need a retest, or wait for the 50MA (maybe even the 200MA) to assist the breakout. Either way, we’ll be here to watch it unfold. Always take profits and manage risk. Interaction...

This is BTC.D on the daily After losing the 50MA in the final days of the first half of the month, BTC dominance found support at the 0.382 Fib level, only to bounce back up and get rejected at 62.25%. From here, it all depends on which level breaks first: the 0.382 support or the 62.25% resistance. Whichever way it goes, we’ll be here to watch it unfold. ...

It’s just the start of the week, and ETH is already printing new highs. But let’s zoom in on a familiar pattern in price action: During the week of June 30 – July 7, ETH floated above the 0.5 Fib and the 200MA early in the week. Then it dipped below both levels, only to bounce back and start holding the Fib as sup port. From there, price slowly climbed alongside...

ETH is about to close the week just above the 0.236 Fib level. The 50MA is crossing this key level, and the 200MA is close behind — showing alignment across moving averages. MLR > SMA > BB Center confirms the current uptrend. Volume is picking up slightly, though it’s Sunday — so expectations remain tempered. RSI is nearing overbought but still has room to push...

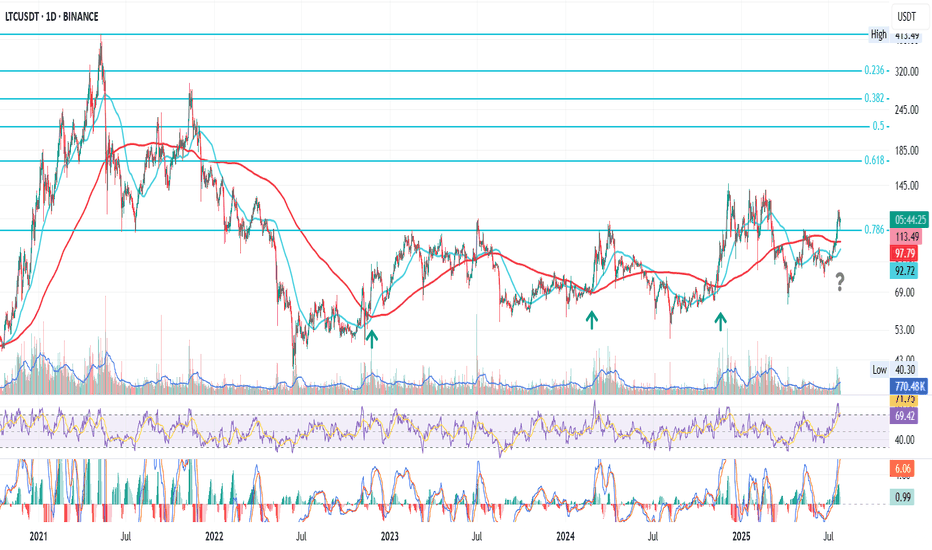

This is LTC on the daily After the bear market bottom in June 2022, LTC had three golden crosses, each followed by a rally into the 0.786 Fib level. To be fair, last time price broke above that resistance, but got pushed back — like everything else — by the macro storms earlier this year. Now we’re approaching another golden cross, but the setup feels...

This is PEPE on the daily Price recently crossed above the 50MA which is currently resting on the 200MA after a golden cross It was rejected at the 0.5 Fib but is now holding above the 0.618 Fib as well as the 50MA and 200MA RSI is finding support at the mid level while MACD just turned bearish Chances are we see a pullback first, a search for support,...