vf_investment

Premiumhi traders 🔻 Short Position Setup – Overextended at Resistance ETH/USDT is currently trading near a major resistance zone (~$4,080–$4,330), which historically marks the top of the trading range. This level has acted as strong resistance multiple times in the past, and price is now showing signs of overextension after a sharp upward move. 📊 Technical...

hi Traders, We can see Bullish Signals Developing Bullish Divergence (RSI): A clear bullish divergence is visible between the RSI and price action. While the price made lower lows, the RSI formed higher lows (28.35 vs. previous 24 region), indicating a potential loss of bearish momentum and the emergence of buying pressure at lower levels. Oversold RSI: The RSI...

hi traders The chart suggests that ONT has reached a critical support level around $0.146, which has historically acted as a significant zone for both support and resistance. The price is currently attempting to reclaim this level, and a bullish reversal is expected if it holds. Indicators Analysis: MACD (Moving Average Convergence Divergence): The MACD line has...

hi traders I'm very bullish on ICXUSDT. The chart displays a bullish divergence between the price and the MACD indicator. The price (top panel) has made lower lows (yellow downward arrow), while the MACD (bottom panel) has made higher lows (yellow upward arrow), indicating weakening bearish momentum and potential for a reversal. Entry: Current price around...

hi traders Algorand (ALGO/USDT) is showing a strong bullish continuation pattern following an impulsive price move upward. 🔍 Technical Overview: Current Price: $0.2828 USDT Pattern: Bull Flag A sharp upward move (flagpole) is followed by a period of consolidation within a downward-sloping channel, forming the flag. This is a classic bull flag pattern, often...

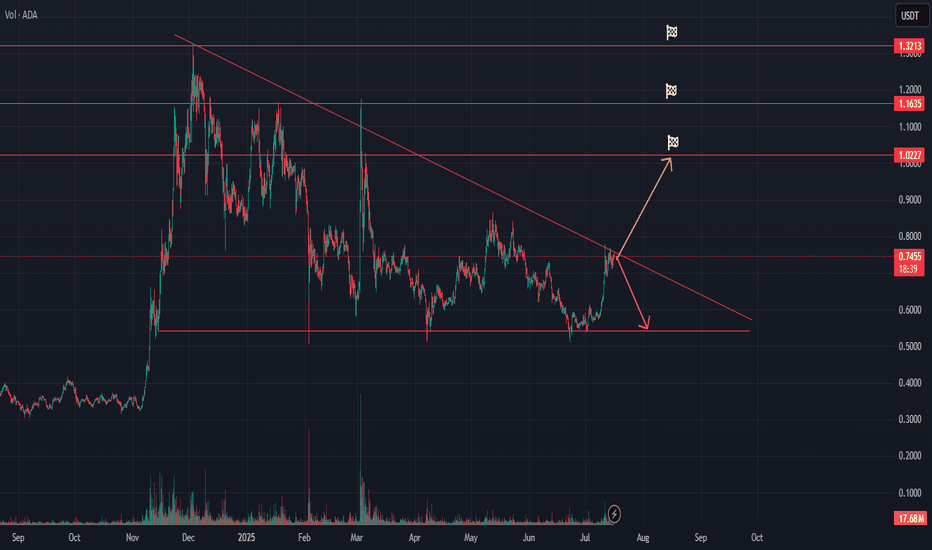

hi traders This technical analysis for Cardano (ADA/USDT) outlines a potential breakout or rejection scenario as the price tests a long-term descending trendline. Key Technical Levels to watch: Resistance: $0.7467 (current test of descending trendline) $1.0227 (primary breakout target) $1.1635 $1.3213 Support: ~$0.60 (horizontal support zone) Trendline:...

hi Traders, Let's have a look at BABA. Alibaba (BABA) appears to be approaching the end of its correction phase within a well-defined ascending channel. Based on the current price action and technical setup, we believe now is a good time to begin dollar cost averaging into this stock. Our identified buy zone lies between $108 and $100, where price intersects...

hi Traders How are you today? Do you like NIO stock today? The price of NIO is currently sitting right at the apex of a narrowing wedge, indicating that a decisive breakout is likely imminent. This technical formation has been building for months, and the price has now tightened into a point where volatility and direction are expected to return soon. The RSI...

This chart of ALGO/USDT presents one of the cleanest and most promising bottom formations in the entire altcoin market. 🔍 Technical Highlights Clear Rounded Bottoms: ALGO has formed multiple rounded bottoms over a long accumulation period, signaling strong base building and exhaustion of sellers. Descending Wedge Breakout: A breakout from the falling wedge...

hi traders The TOTAL3 chart shows a strong breakout from a falling wedge pattern, followed by a bullish push that has reclaimed key Fibonacci levels. Currently sitting around the $961B mark, the market has cleared the 0.236 and 0.382 retracement levels and is approaching a significant technical milestone. In the short term, the next major resistance lies at the...

hi Traders The EOS/USDT chart is currently showing a classic double bottom pattern, a strong bullish reversal signal typically seen after prolonged downtrends. This formation is evident with two distinct troughs forming near the $0.50–$0.55 range, followed by a recent price uptick indicating the start of a potential breakout. The projected target for this...

hi traders, 1. The chart shows REMX has experienced a significant downtrend since late 2021/early 2022, reaching levels last seen around 2020. 2. Entry Strategy (Green Box): The idea is to enter long positions as the price approaches or bounces from this established support area, anticipating a reversal or a significant rebound. 3. Stop-Loss ($30): A stop-loss...

The LAC stock chart suggests a confirmed bottom structure, supported by a clear higher low pattern—a strong technical signal that downward momentum has likely ended and a trend reversal may be underway. After an extended downtrend, the price has formed a rounded bottom with two notable troughs, indicating accumulation and base building. The most recent low is...

hi traders The BNB/USDT chart is displaying a classic ascending triangle pattern, which typically signals a potential bullish breakout. This pattern has formed over the past year, characterized by a series of higher lows (shown by the rising red trendline) while repeatedly testing a strong horizontal resistance zone around $690–$730 (highlighted in green). BNB...

Hi Traders Today we are analysing COMP/USDT (BINANCE) on 4-hour timeframe. The price has been consolidating heavily around $40 support level, showing multiple rejections and signs of potential exhaustion. I recommend waiting for a slight dip below this support zone ($40) to trap late sellers and look for a potential long entry. If the pattern holds, we...

hi traders, 🧠 Chart Overview Asset: TRUMPUSDT Timeframe: Daily 🔍 Technical Analysis Price Structure: We can see a double bottom or rounded bottom formation, suggesting a potential trend reversal from bearish to bullish. RSI Indicator: The RSI has broken out of its long-term downtrend, which is a key early bullish signal. It has also crossed above its moving...

hi Traders, We can see that price is currently trading below a well-defined downsloping trendline. The trendline (blue) has been tested multiple times, confirming its validity as resistance. Price action is showing higher lows, indicating building pressure, usually a bullish sign often seen before breakouts. The breakout seems to be happening right now, so...

hi traders. Today, Binance extended the Monitoring tag to include IDEX. This token's price has been in a major downtrend for a very long time. I don't expect it to change with the bad news that came out today for IDEX. The bounce will be an opportunity to enter a short position. See the setup on the chart. Good luck