wajahatarif

Pair: GBPUSD Timeframe: 4H Bias: Bearish retracement sell 🔍 Technical Outlook: GBPUSD has retraced sharply from its recent low (1.3137) and is now testing a major resistance zone within the Fibonacci golden pocket (0.618–0.65 retracement) from the recent swing high to low: This zone aligns with prior supply, creating a high-probability short setup. 🧠...

Pair: NZDJPY Timeframe: 4H Bias: Bearish 🔍 Technical Setup: NZDJPY has broken sharply from its recent consolidation and is now testing a critical 4H support zone near 87.00. A decisive break below this zone would open the path toward lower support levels. 📍 Entry Trigger: Break and close below 86.95 🎯 Target 1: 85.95 🛑 Stop Loss: Above 87.35 📉 RSI: Near...

Pair: GBPJPY Timeframe: 4H Bias: Bearish 🔍 Technical Overview: GBPJPY has broken down with high momentum and is now hovering at a 4H support zone (195.30). A clean break and close below this level opens the door for a deeper move toward the next support areas: Entry Trigger: Break below 195.30 🎯 Target 1: 194.05 🎯 Target 2: 192.50 🛑 Stop Loss: Above 195.95...

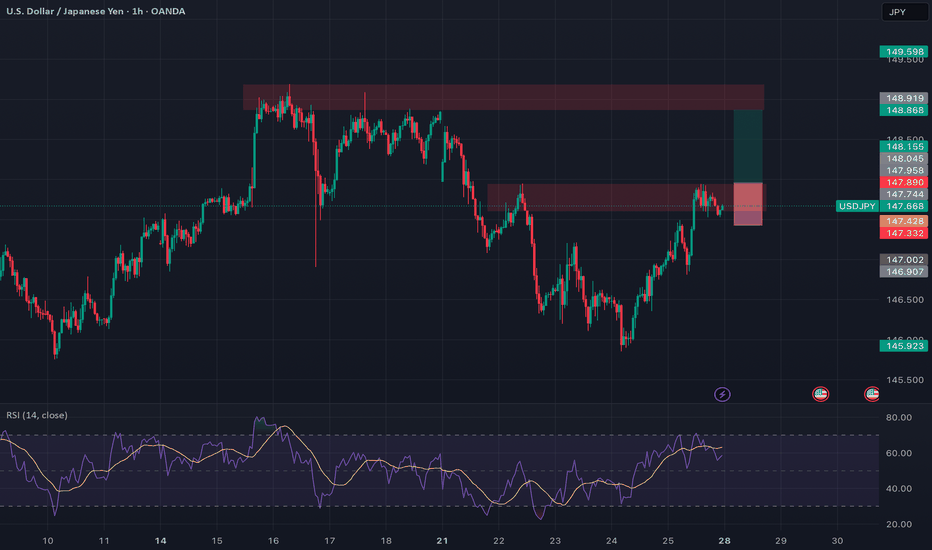

🟢 USDJPY | Breakout Opportunity Above Resistance Timeframe: 1H Bias: Bullish Type: Break and Retest 📊 Technical Setup USDJPY is currently consolidating at a key 4H resistance zone (147.75–147.90). A clean breakout and retest of this area will confirm bullish continuation. • Entry: Above 147.90 (after confirmed candle close + retest) • SL: Below 147.30 • TP:...

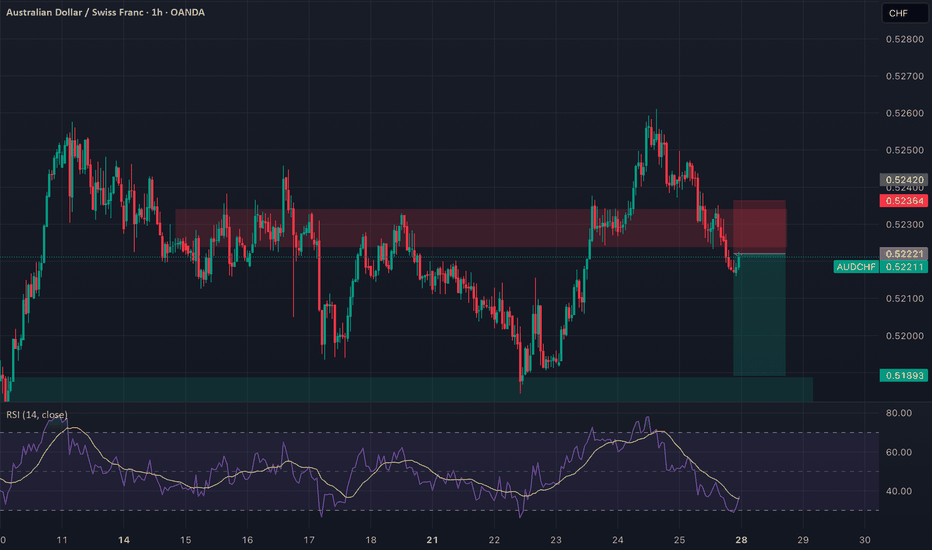

Timeframe: 1H Bias: Bearish Type: Support Turncoat → Breakdown Play 📊 Technical Setup AUDCHF previously broke the 4H resistance (0.5236) which flipped to support. However, price has now broken below this support, confirming it as a failed demand zone. • Entry: Market execution or retest of 0.5236 • SL: Above 0.5245 • TP: 0.5189 • RR: ~1:2 • RSI: Below 50...

🔻 GBPUSD | Sell the Retest of Broken Support Timeframe: 1H Bias: Bearish Type: Break and Retest 📊 Technical Setup GBPUSD has broken a key 4H support zone (~1.3460–1.3494) which now acts as a turncoat resistance. Price is currently pulling back, offering a prime opportunity to sell the retest. • Entry: 1.3460–1.3490 (after confirmation of rejection) • SL: Above...

Timeframe: 1H | 🎯 Bias: Bullish Breakout GBPJPY is testing a key Fibonacci retracement zone (0.5–0.618) from the recent impulse leg (194.00 → 196.195). This golden pocket sits inside strong demand and could launch the next leg higher. 🔍 Technical Confluence Fib Support Zone: 195.270–195.447 (0.618–0.5) Price Action: Consolidating near golden pocket, showing...

🕓 Timeframe: 4H | ⚠️ Bias: Bearish From Supply Zone AUDCAD is rejecting the 0.8940–0.8960 supply zone, a key resistance that's been respected multiple times. With RSI turning over near overbought and CAD fundamentals improving, this looks like a clean short opportunity. 📊 Technical Confluence 🔴 Resistance Zone: 0.8940–0.8960 (historical supply zone) 📉 Bearish...

🔶 Chart: 4H timeframe 🔶 Pattern: Symmetrical Triangle Gold is currently consolidating within a well-defined symmetrical triangle on the 4H chart, marked by a series of lower highs and higher lows — a classic setup indicating a potential breakout is near. 🔍 Technical Breakdown: ✅ Price has respected both trendlines multiple times, confirming the structure. ✅ The...

Bias: ✅ Strong Sell Timeframe: 4H Pair: USDCAD Week: 26–30 May 2025 ⸻ 🔍 Technical Setup: USDCAD just broke a major support zone around 1.3732, opening the door for continued downside into the next demand zone. • Entry: Break and retest or continuation below 1.3732 • Stop Loss: Above resistance at 1.3813 • Take Profit: Next support near 1.3467 • Risk-Reward...

Bias: ✅ Strong Sell Timeframe: 4H Pair: USDJPY Week: 26–30 May 2025 🔍 Technical Setup: USDJPY is sitting on a critical support zone around 142.55. A decisive break and 4H close below this level would confirm a bearish continuation. Entry: Break below 142.55 Stop Loss: Above resistance at 142.80 Take Profit: Major support around 140.05 Risk-Reward Ratio:...

Bias: ✅ Strong Buy Timeframe: 4H Pair: EURUSD Week: 26–30 May 2025 🔍 Technical Analysis: EURUSD has broken through a prior resistance and is currently testing a second resistance zone at 1.13983. I’m looking for a confirmed breakout above this level to enter long. Entry: Break and 4H close above 1.13983 Stop Loss: Below support zone at 1.13545 Take Profit:...

🔹 Pair: NZD/CAD 🔹 Timeframe: 1H 🔹 Direction: Long 🔹 Status: Breakout of resistance → waiting for retest at turncoat support 🔹 Entry Zone (Planned): 0.8250–0.8260 NZD is the top gainer this week with strong conditional momentum and seasonal strength. CAD is stagnating under weak macro support. We're now watching for a pullback to the breakout zone for an ideal...

🔹 Pair: NZD/JPY 🔹 Timeframe: Daily 🔹 Direction: Long 🔹 Status: Price holding Fib 0.786 retracement level (bullish structure intact) 🔹 Entry Zone: ~85.50–85.60 (Live entry) 📊 Fundamental Confluence 🇳🇿 NZD – Bullish Momentum Conditional Score Jump: 🚀 From 8 → 13 (Strongest improvement this week). Seasonality: 🔼 Strong seasonal bias from mid-May onward. CB Stance:...

🔹 Pair: AUD/JPY 🔹 Timeframe: 4H 🔹 Direction: Long 🔹 Status: Retesting Trendline Support 🔹 Entry Zone: 93.20–93.40 (Live Entry Area) ⸻ 📊 Macro & Fundamental Confluence 🇦🇺 AUD – Bullish • Strong Seasonality: Historically bullish May 19 – June 10. • Conditional Score Rise: From 21 → 24 = Positive momentum shift. • Dovish CB, But Risk-On: Supports carry trade...

🔹 Pair: AUD/CAD 🔹 Timeframe: 4H 🔹 Direction: Long 🔹 Strategy: Trend Continuation + Macro Confluence 🔹 Trade Active: 📍 0.8945 (CMP) 📊 Fundamental Bias 🇦🇺 AUD – Bullish • Seasonal Surge: Historically strong from May 19 to June 10. • Conditional Score Gain: AUD rose from 21 → 24 (momentum improving). • Macro View: Inflation stabilizing, dovish stance offset by...

🔥 Setup Summary: Item Details Bias: ✅ Bullish Reasoning: - Fundamentals strong (expectation no interest rate cuts + CPI bullish) - JPY weak + overbought COT - Exogenous: AUD strengthening - Seasonality bearish short-term BUT medium-term bias bullish Primary Entry: 🔑 92.30 (Buy Zone) Dip Buy Zone: 🔄 91.80 – 92.00 (0.5–0.618 Fib retrace) Stop Loss: 🚫 90.54 (below...

Summary CHFJPY short is supported by weak macro + divergence + seasonal timing. CHF is fundamentally the weakest major, while JPY is seasonally strong and technically aligned. 🧠 Fundamental & Seasonal Overview CHFJPY presents a high-probability short opportunity for the second half of April: CHF Fundamentals = Weakest among majors ↳ SNB recently cut rates to...