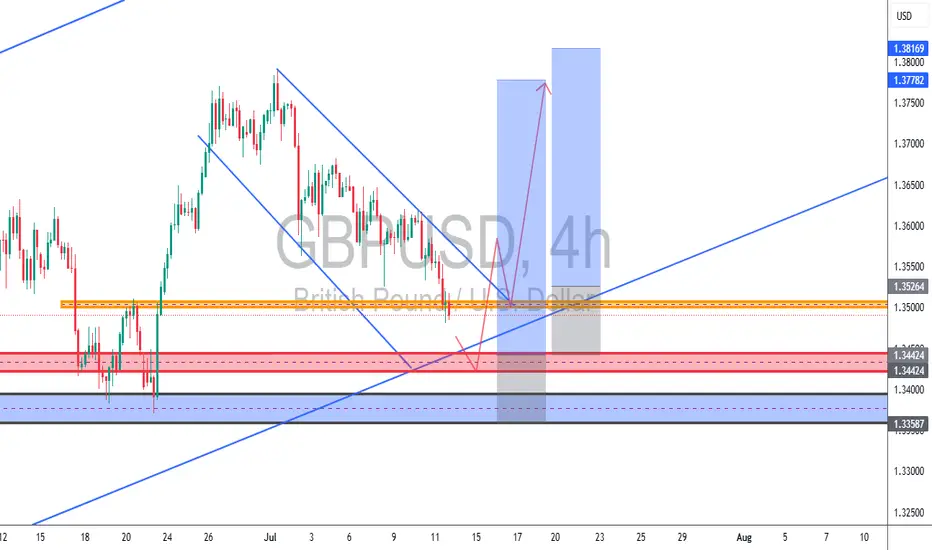

📈 GBPUSD – Countertrend Wedge Setup Near Key Demand (TCB Strategy Setup in Progress)

Timeframe: 4H

Strategy Phase: ✅ Countertrend Phase (Falling Wedge + Liquidity Sweep Potential)

🔍 Analysis:

GBPUSD is currently forming a falling wedge correction within a higher-timeframe bullish trend. Price is approaching a major confluence zone between 1.3442 and 1.3358, which includes:

Stacked demand zones (HTF support)

A rising trendline from the previous bullish leg

The wedge’s lower boundary

Potential liquidity pockets below recent lows

If price sweeps the zone and gives a bullish engulfing or reversal candle, this would trigger a TCB Countertrend entry targeting a breakout and continuation to the upside.

📌 Watchlist Trade Setup:

Entry Zone: 1.3442 – 1.3358 (awaiting confirmation)

Stop Loss: Below 1.3358

Take Profit 1: 1.3526

Take Profit 2: 1.3778

Take Profit 3 (extended): 1.3816

Risk-to-Reward: Potential 1:3 – 1:4+

📋 TCB Strategy Confluences:

Falling Wedge Structure ✅

Demand Zone Support ✅

Trendline Support ✅

Liquidity Trap Potential ✅

Clean Structure to TP ✅

🧠 Waiting for:

Bullish candle confirmation (engulfing/pin bar)

Breakout of wedge or sweep-reversal scenario

Final check for news before entry

📚 Strategy: TCB (Trend – Countertrend – Breakout)

Looking for clean, high-RR reversals from structure with momentum confirmation.

#GBPUSD #Forex #TCB #Breakout #Trend #Countertrend #ForexTrading #TradeSetup #TechnicalAnalysis

Timeframe: 4H

Strategy Phase: ✅ Countertrend Phase (Falling Wedge + Liquidity Sweep Potential)

🔍 Analysis:

GBPUSD is currently forming a falling wedge correction within a higher-timeframe bullish trend. Price is approaching a major confluence zone between 1.3442 and 1.3358, which includes:

Stacked demand zones (HTF support)

A rising trendline from the previous bullish leg

The wedge’s lower boundary

Potential liquidity pockets below recent lows

If price sweeps the zone and gives a bullish engulfing or reversal candle, this would trigger a TCB Countertrend entry targeting a breakout and continuation to the upside.

📌 Watchlist Trade Setup:

Entry Zone: 1.3442 – 1.3358 (awaiting confirmation)

Stop Loss: Below 1.3358

Take Profit 1: 1.3526

Take Profit 2: 1.3778

Take Profit 3 (extended): 1.3816

Risk-to-Reward: Potential 1:3 – 1:4+

📋 TCB Strategy Confluences:

Falling Wedge Structure ✅

Demand Zone Support ✅

Trendline Support ✅

Liquidity Trap Potential ✅

Clean Structure to TP ✅

🧠 Waiting for:

Bullish candle confirmation (engulfing/pin bar)

Breakout of wedge or sweep-reversal scenario

Final check for news before entry

📚 Strategy: TCB (Trend – Countertrend – Breakout)

Looking for clean, high-RR reversals from structure with momentum confirmation.

#GBPUSD #Forex #TCB #Breakout #Trend #Countertrend #ForexTrading #TradeSetup #TechnicalAnalysis

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.