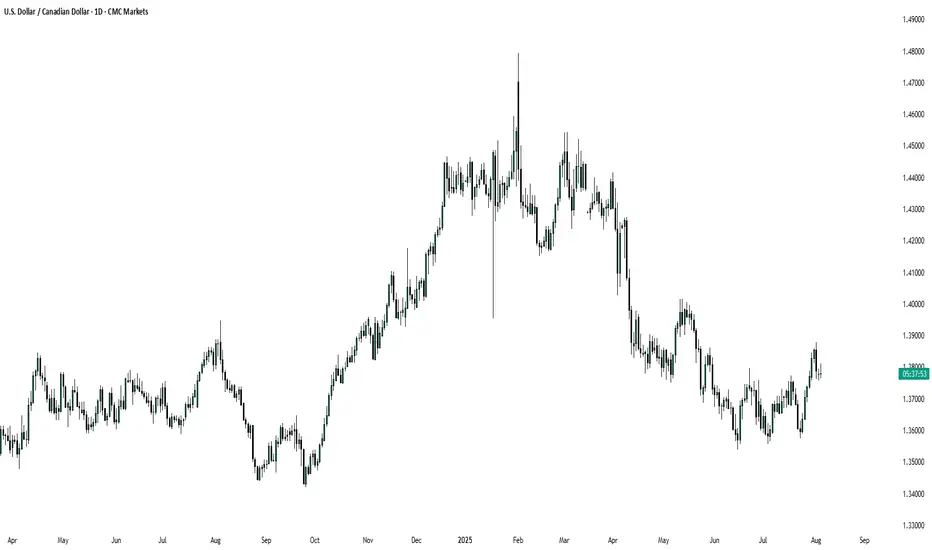

The weaker-than-expected US jobs report on 1 August, along with significant downward revisions, sent shockwaves through the market, and the US dollar was not spared. The stronger upward momentum observed over the past couple of weeks seemed to vanish almost instantly. Although the USDCAD has recently moved lower, it still maintains strong bullish momentum, indicating a potential move back toward higher levels.

The USDCAD formed a rather convincing triple-bottom pattern in June and even moved above a long-term downtrend. Additionally, the currency pair rose above the neckline of the triple bottom at 1.376, which now serves as a support level. Momentum, as measured by the Relative Strength Index, has turned upward and suggests that the USDCAD could move higher.

To further reinforce the bullish trend, the USDCAD remains above its 10-day exponential moving average. Therefore, while the prevailing market sentiment might lead one to believe the dollar will weaken, technical indicators suggest that the Canadian dollar will continue to weaken against the US dollar if support and the moving average around 1.37 hold. A break below this support area would indicate a trend reversal, potentially causing the USDCAD to fall back to lows around 1.358.

However, if the bullish trend persists and the USDCAD manages to hold above support at 1.37, the currency pair could head higher towards 1.397, retesting a resistance level established in mid-May.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

The USDCAD formed a rather convincing triple-bottom pattern in June and even moved above a long-term downtrend. Additionally, the currency pair rose above the neckline of the triple bottom at 1.376, which now serves as a support level. Momentum, as measured by the Relative Strength Index, has turned upward and suggests that the USDCAD could move higher.

To further reinforce the bullish trend, the USDCAD remains above its 10-day exponential moving average. Therefore, while the prevailing market sentiment might lead one to believe the dollar will weaken, technical indicators suggest that the Canadian dollar will continue to weaken against the US dollar if support and the moving average around 1.37 hold. A break below this support area would indicate a trend reversal, potentially causing the USDCAD to fall back to lows around 1.358.

However, if the bullish trend persists and the USDCAD manages to hold above support at 1.37, the currency pair could head higher towards 1.397, retesting a resistance level established in mid-May.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.