APTUSDT.P trade ideas

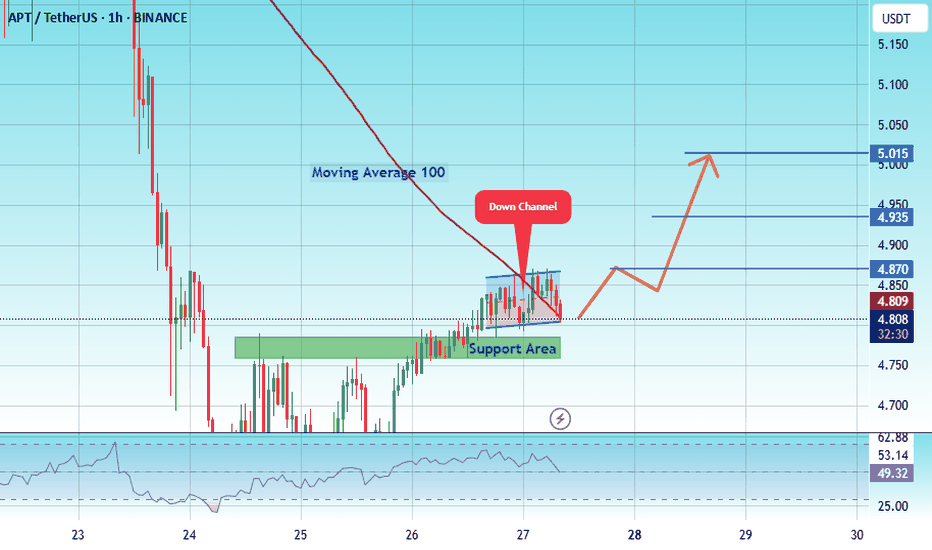

#APT/USDT Buyers Need To Establish Support Zone#APT

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 4.68.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 4.63, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 4.70.

First target: 4.75.

Second target: 4.87.

Third target: 5.00.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

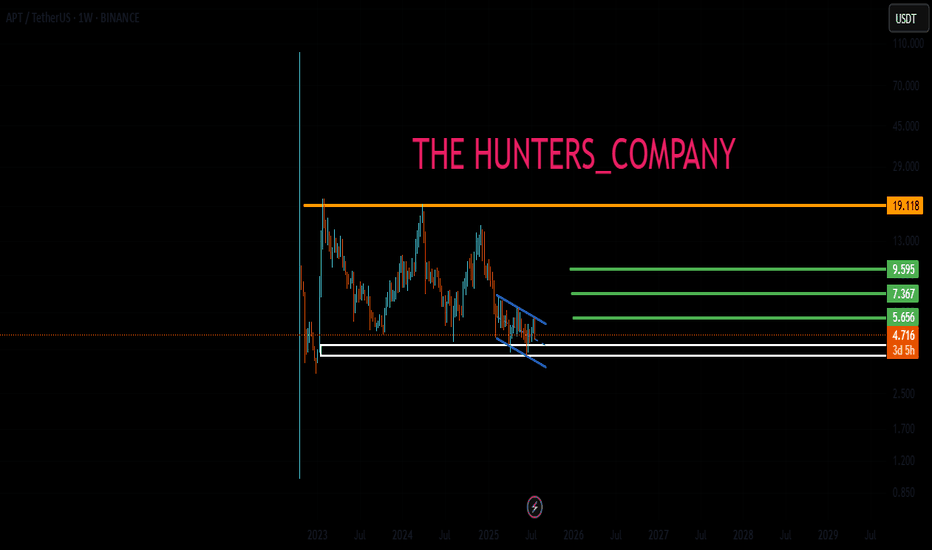

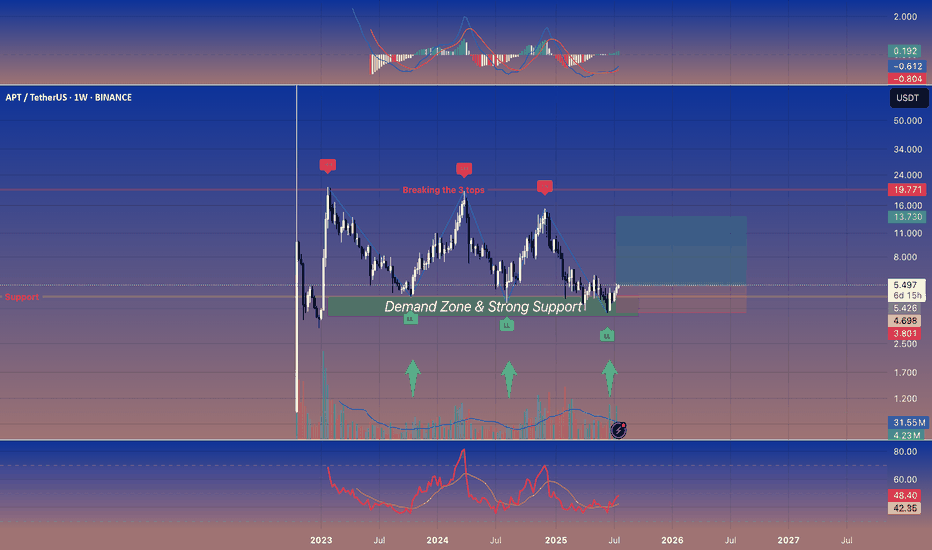

APT/USDT – Price Tests Critical Historical Demand Zone!📌 Quick Summary:

APT is now at a crucial technical crossroad. After a prolonged downtrend from its previous highs, price action is once again testing the strong demand zone that historically acted as a key accumulation area. Is this the start of a new rally, or a breakdown toward uncharted lows?

---

🧱 Major Support / Demand Zone (High-Value Buy Area)

📍 $3.00 – $4.50 zone has acted as a major defensive wall since early 2023. This range represents a high-interest area for smart money accumulation, as shown by multiple strong rejections in the past.

> 🔎 Note: If this zone fails to hold, the long-term structure will flip fully bearish.

---

🧭 Key Resistance Levels (Bullish Targets):

These levels will act as challenges in any bullish recovery:

🔹 $4.49 – Minor resistance, first breakout confirmation.

🔹 $5.14 & $5.86 – Intermediate resistance; breaking above signals mid-trend strength.

🔹 $7.63 & $8.50 – Critical zones where past distribution occurred.

🔹 $10.18 – $12.50 – Gateway to the upper structure.

🔹 $14.51 – $18.27 – Long-term targets, last known macro resistance levels.

---

📈 Bullish Scenario: Rebound from Strong Foundation

Bullish momentum may build up if:

Weekly candlestick closes show bullish reversal patterns (hammer, engulfing, strong wicks),

Increasing buy-side volume on H4, D1, and W1 timeframes,

Clean breakout and retest of the $5.14 – $5.86 zone.

This could initiate a new bullish leg with mid-term targets around $8.00 – $10.00, and potentially higher if market conditions improve (e.g., BTC and ETH uptrending).

> 🎯 Bullish Validation: Weekly close above $7.63.

---

📉 Bearish Scenario: Full Breakdown Risk

If the $3.00 – $4.50 demand zone fails:

Price could drop toward the psychological level of $2.80 and potentially revisit the historical low of $1.00.

The major downtrend structure will be confirmed: lower highs and lower lows.

This may signal a full capitulation phase before the next cycle begins.

> ⚠️ Bearish Risk Trigger: Weekly close below $3.00 with strong volume.

---

🧠 Market Structure & Pattern Watch:

Sideways Accumulation: Multi-week tight range consolidation suggests accumulation by smart money.

Potential Double Bottom: A strong bounce from the $3.00 – $3.50 range could form a bullish reversal base.

Volume Compression: Decreasing volume suggests a buildup phase before a major move.

---

🔮 Strategic Takeaway:

APT is sitting at a make-or-break level. The $3.00 – $4.50 zone is critical for both short- and long-term structure. For swing traders and investors, this zone offers a high risk-reward opportunity — but confirmation is key.

> ⏳ Patience in the demand zone can lead to the best trades. Wait for confirmation, not hope.

#APTUSDT #AltcoinAnalysis #DemandZone #CryptoReversal #TechnicalAnalysis #PriceAction #SwingTrading #CryptoMarket

Feeling Optimistic About $APTI know… it’s been over 8 months. And truth be told, AMEX:APT and I have had our ups and downs—especially between June and Oct 2023. Our relationship isn’t perfect.

But right now? This is a great technical spot. Trend is still technically down, but we’re finally seeing signs of a reversal into a key supply zone. Worth granting a small allocation here.

Main point—just putting some attention on BINANCE:APTUSDT as the market keeps looking better and better.

Apt/usdt Bull Analysis AMEX:APT holders will be smiling very soon ❤️

AMEX:APT is forming a beautiful rounded bottom, showing signs of a potential trend reversal. 📈

I’ll be watching closely for a breakout above the descending trendline — but my entry will only be on confirmation in the marked red zone.

If it plays out, the path toward $6.5–$7.5 could be wide open. 🚀🚀

APTUSDT.PThis coin is also sleeping can be the bottom of the coin.

Lets wait for the bullish confirmation always wait.. patience is the game changer. Always wait for the confirmation on the entry level. Just dont take trade as soon the price touches the level we need to wait for the confirmation ALWAYS..

If entry 1 is solid i will update and tell you guys the t.p and s.l accordingly.

Entry 2 will be sure shot as soon we will see some bullish momentum.

Follow me guys support me to post more and more.

#APT/USDT Buyers Need To Establish Support Zone#APT

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to break strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 4.10.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 4.05, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 4.25.

First target: 4.35.

Second target: 4.46.

Third target: 4.05.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

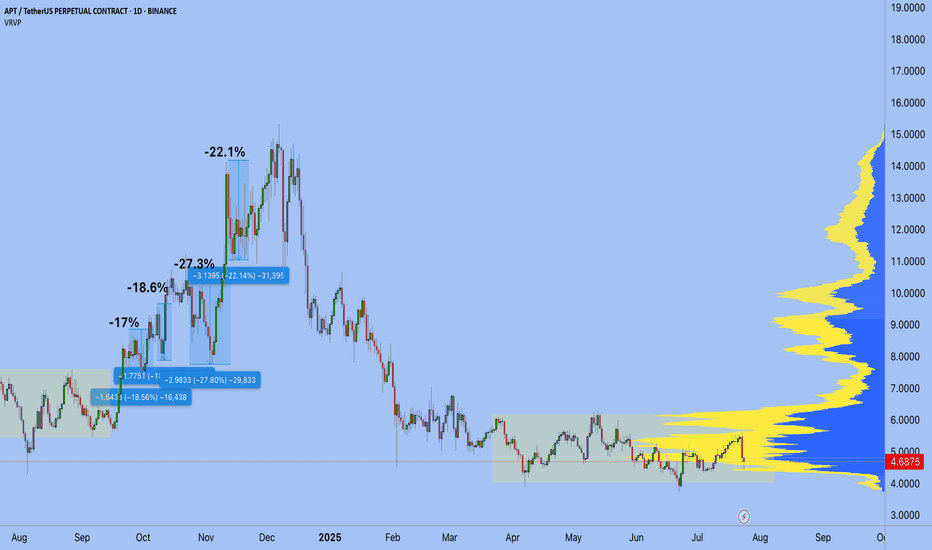

AptusApt usdt Daily analysis

Time frame 4hours

Risk rewards ratio >1.8 👈👌

Technical analysis 👇

After a correction, ApTuS is gathering energy to start an upward movement.🕰🕰

The price has fallen to the gray uptrend line.

This gray line, which acts as a support, as well as another support level marked in dark blue on the chart, have created very strong support.

According to Elliott Wave Analysis, the three-point Elliott wave pattern has ended and we are now ready to start the impulse waves.

The volume chart gives us signs that an accumulation is forming in this area.

We conclude that, considering the three factors mentioned above,

1. The price is in a strong support area,

2. The Elliott wave correction has ended, and 3. Volume chart shows an accumulation area

👇👇👇👇

Based on this, we conclude that the right point and time for a price will increase and good Risk rewards ratio ~2 for traders 👌

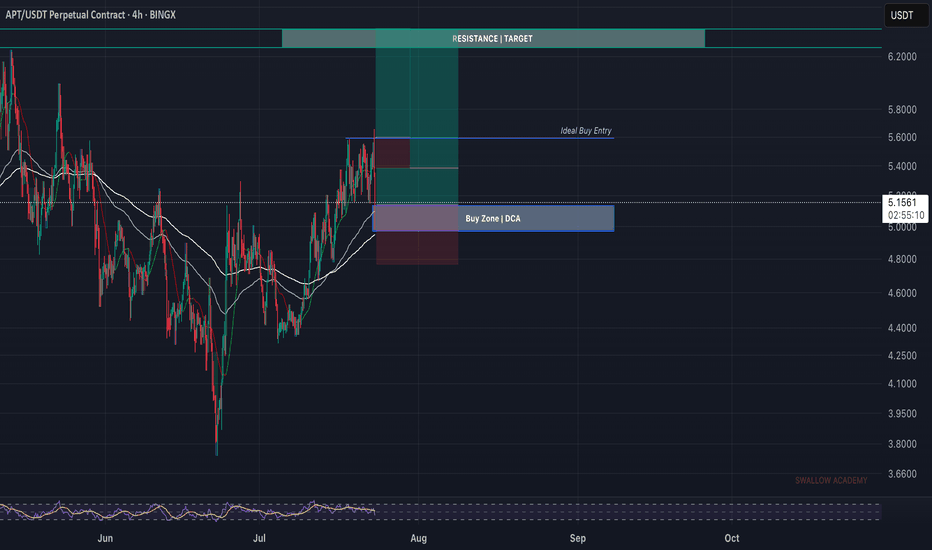

Aptos (APT): Buyers Need To Establish Support ZoneAPT is near a local support area where we will be looking now for some sort of upward bounce from here. We might see a smaller move to lower zones (towards the liquidity line below).

Now, as long as we are between those zones, we wait but overall, what we want to see is break of structure and proper upward movement towards 100 EMA.

Swallow Academy

#APT/USDT#APT

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.1560.

We have a bearish trend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.1555, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1600

First target: 0.1640

Second target: 0.1677

Third target: 0.1719

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

APT : Long term purchaseHello friends🙌

👀You see that the price is in a range and now we are at the bottom of the range. The scenario is simple. The bottom of the range is a good buying opportunity that can be used because 80% of the failures in the range are fake.

⚠So we can buy with risk and capital management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

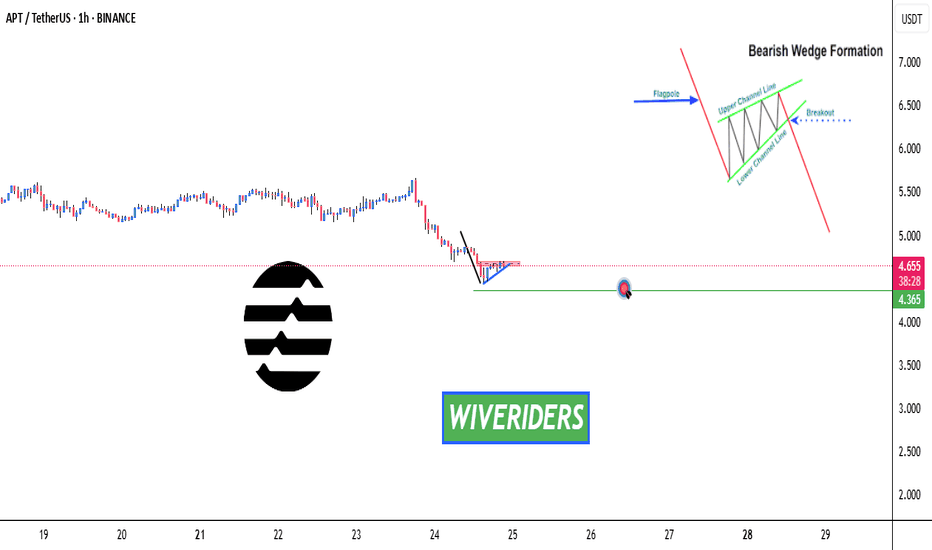

APT Forming Bearish Wedge Pattern – Watch the Support! APT Forming Bearish Wedge Pattern – Watch the Support! ⚠️📉

APT is forming a bearish wedge pattern and is now testing the blue support trendline.

🔻 If the support breaks, we could see a move down to the first green line level.

📊 Stay alert — this setup could trigger soon. Wait for confirmation before reacting.

5/Altseason Live Psychology:My Core Principle,Learned Over Years

This experience is built on analyzing every previous altseason. And here is the main takeaway: altseasons are always short, but incredibly rapid. In this chaos, most people, driven by emotion, make the same mistakes:

- They open too many trades.

-They close a position on the first small move, hoping to "re-enter" another project that's "about to explode."

-They shift capital from a growing asset to one that hasn't moved yet. And it still doesn't move.

The problem is the mindset. You don't invest in what's falling or bet on "dark horses." You invest in what is already growing.

This might sound new to some, but the most important principle in trading, and in life, is to REINFORCE STRENGTH.

This is an attention market. And attention is captured by the speed and power of growth. Everyone is looking at what's pumping. That's where the money flows. Your job is to be in that flow, not to try and catch a falling knife.

And one more thing, the most critical rule for the next two months. I AM BEGGING YOU, DO NOT OPEN SHORT POSITIONS. Any 15-25% correction on a strong project is not a reason to short; it is your buying opportunity. Measure from the peak, and you will see these entry points. The strongest projects will correct even less. This system works.

Of course, this doesn't mean blindly buying everything that's green. You need to understand the narratives. But if your project is old and showing weakness while others are flying, maybe it's time to switch to a leader. As a subscriber wrote in the comments of my last post: in the previous cycle, SUI did a 10x, while APTOS did a 4x. This clearly shows where the market's attention was focused, and consequently, where the results were.

Best regards EXCAVO

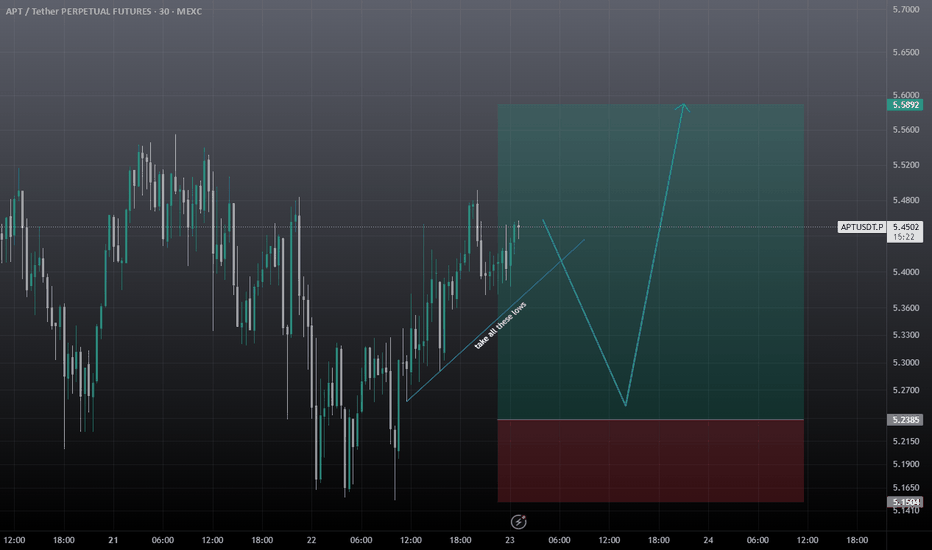

Aptos (APT): Are We Ready To Bounce? | BullishAptos has a good chance for a reversal soon, where the price has had a proper correction currently, leading the price back closer to EMAs, which could be considered a good buying area.

Now we set 2 areas or 2 trades (call it however you want), where one is opening from the current market price, which would mean a lower leverage position with multiple entries.

And the second trade option is on upper zones, where we will be looking for a BOS, so choose for yourself which way you want to go, either a safer trade and more day trading or scalping on upper zones. Both trades are with a good R:R ratio.

Swallow Academy

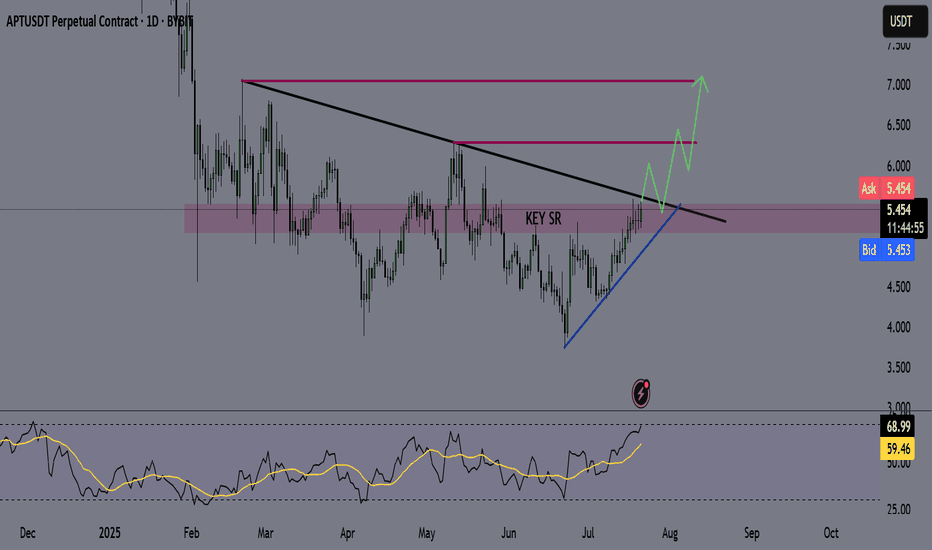

APT - APTOS Coin - Swing Long Idea📌 Fundamental Sentiment:

The entire crypto market is rallying, alongside other risk assets. This momentum is largely driven by U.S. policy expectations — specifically, Trump’s increasing pressure on Powell to resign and aggressively push for rate cuts from the Federal Reserve.

📌 Technical Analysis:

Price is currently testing the HTF supply zone with strong momentum. Additionally, it’s approaching a long-term bearish trendline that has dictated the downtrend since February 2025.

📌 Gameplan:

I want to see:

A clean breakout above the HTF supply zone with daily candle closure.

A confirmed break and close above the HTF bearish trendline on the daily timeframe.

If both confirmations align, I’ll start preparing for swing long setups, potentially riding into the early stages of a 2025 altseason.

—

🔔 Like & Follow for more daily updates. Feel free to drop your thoughts in the comments!

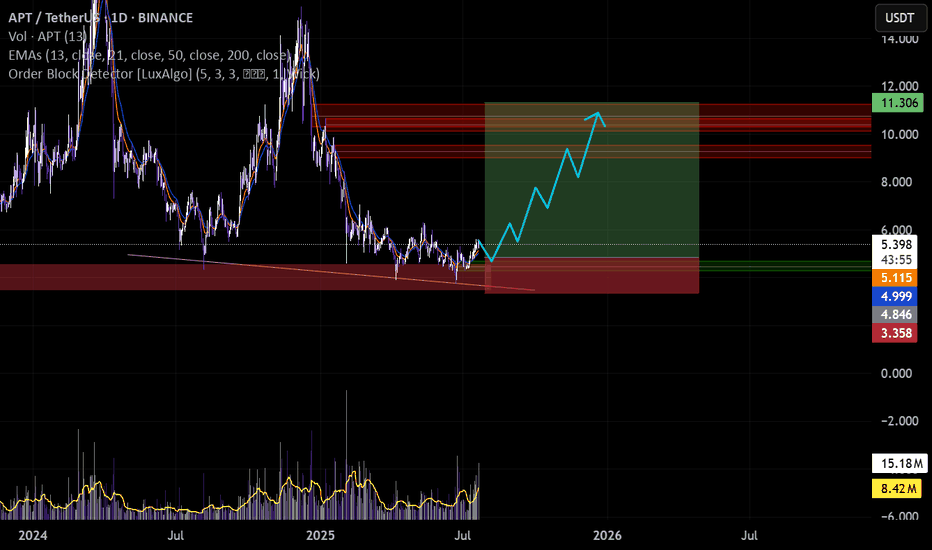

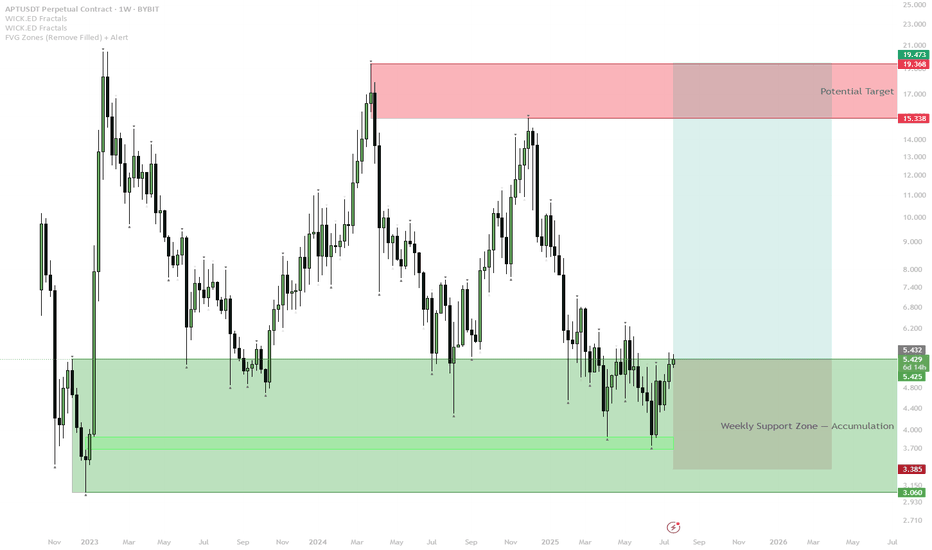

APTOS Weekly Bottom Formation — Early Signs of Reversal

APT has retested and held the long-term weekly support zone (green box) multiple times, confirming strong demand and buyer defense.

Current price action is pushing off the support with a series of higher lows, suggesting the start of a new bullish cycle.

Scenario A (Bullish):

— If APT holds above $5.40 and weekly closes stay above this green zone, expect gradual momentum toward the $15–$19 resistance (red box).

— First target is $15.30, with extension to $19.50 if trend accelerates.

Scenario B (Invalidation/Bearish):

— If price fails to hold $5.40 and breaks back below $3.40, setup is invalidated. In this case, expect retest of lower support at $3.00 or lower.

Aptos is showing a classic bottoming structure on the weekly timeframe, with clear accumulation at major support. Sellers have repeatedly failed to break the lows, while buyers step in on every dip. This increases the probability of a mid-term reversal toward the upper resistance band. Weekly structure remains bullish above support; only a major breakdown below $3.40 would invalidate the scenario.

Aptos: The Sleeping Giant🚀 Aptos: The Sleeping Giant 😴🌋

APT keeps bouncing off a rock‑solid \~\$5 demand zone. If it finally pops above \~\$7.5‑8, the giant could wake up in a hurry. 📈

---

👀 Quick‑Glance Weekly Checklist

| 🔍 Focus | What’s Happening |

| ------------------------ | ------------------------------------------------------------------------------------------- |

| **Demand Zone** 🟢 | Repeated wick rejections + volume spurts every dip into **\$5‑5.2** = buyers camping there. |

| **Structure Squeeze** 🔄 | Series of **LH ➡️ LL ➡️ reclaim** – bears push down, bulls yoink it back. |

| **Momentum Curling** 📈 | MACD & RSI‑style oscillators turning up from oversold = reversal vibes. |

| **R/R Sweet Spot** 🍬 | Long near green box, cut below latest LL, reward toward prior LHs. |

---

🎯 Levels on My Radar

1. $5.00‑5.20 – “Do‑not‑break” support ⚔️

2. $6.00‑6.50 – First speed‑bump zone 🛑

3. $7.50‑8.00 – “Break the 3 tops” 🚪➡️ *Door to trend shift*

---

🛠️ Trade Idea (NFA, DYOR)

Scale‑in: nibble inside the green demand band 🍣

Stop‑out: just under the last LL – keep it tight ✂️

Take‑profit: peel some at **\$6s**, leave a moon‑bag for \$7.5‑8 🌖

---

⚡ Why I Care

APT’s been the kid in the back row while other alts moon. If that stacked high cluster cracks, short fuel + fresh eyeballs could send it sprinting. 🏃♂️💨

---

💬 Want intraday alerts or lower‑TF setups? Drop a comment! Let’s see if this giant wakes up or keeps snoozing. 🛌🔔