AXLUSDT 1D Chart Analysis 18-Dec-25Stop Loss: 0.0112

Entry Point: 0.0872

Take Profit 1: 0.1618

Take Profit 2: 0.2424

Based on 1D and 4H chart analysis, a clear bullish divergence has formed, indicating a potential trend reversal from bearish to bullish. The suggested entry is around 0.0872, with expectations for the price to move to

AXLUSDT Forming Falling WedgeAXLUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume

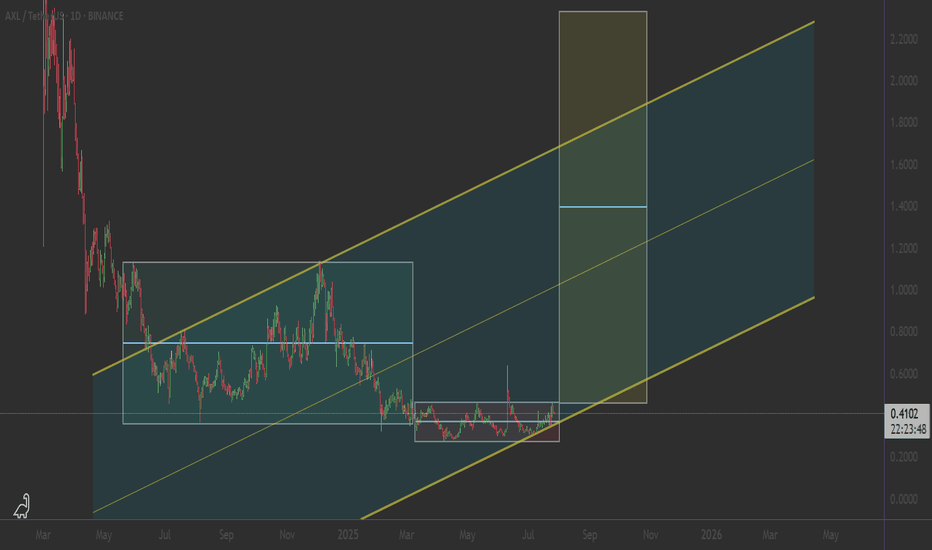

The Big Short AXLUSDT

Market Context

This idea is based on higher timeframe structure and short confluence.

It represents a probability based scenario, not a prediction.

The setup forms near a potential D1 top area.

Strategy

Strategy name: The Big Short

This setup focuses on short signals when multiple conditions a

AXLUSDT Forming falling WedgeAXLUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume

AXLUSDT 1D#AXL is moving inside a falling wedge pattern on the daily chart and has also formed a double bottom pattern.

Short-term targets:

🎯 $0.2317

🎯 $0.2606

In case of a breakout above the wedge resistance, the potential targets are:

🎯 $0.3084

🎯 $0.3470

🎯 $0.3855

🎯 $0.4404

🎯 $0.5104

⚠️ Always remember t

AXLUSDT 1D#AXL is moving within a descending triangle on the daily chart. Recently, it bounced off the support zone and was rejected from the triangle resistance line and the Ichimoku cloud. We believe it will break above the resistance soon. If that happens, the potential targets are:

🎯 $0.4533

🎯 $0.5099

🎯

AXLUSDT — Demand Zone Defense or Bearish Breakdown?📝 Overview

Currently, AXLUSDT (1D, Binance) is trading inside a key demand zone between 0.27–0.33 (yellow box on the chart). This area has been tested multiple times since April 2025, showing strong buying interest whenever price dips into it.

However, the broader structure still shows a clear dow

AXL : THE GENERATIONAL WEALTH CREATOR .. coming⚠️ RISK LEVELS (Know Your Exits)

🛡️ Support 1: $0.35 - Triangle support

🔴 ABORT: $0.25 - Major structure break

⚠️ MAX RISK: Never more than 5% of portfolio

⏰ TIMING IS EVERYTHING: THE COUNTDOWN BEGINS

PRICE TARGETS THAT WILL CHANGE LIVES

🚀 CONSERVATIVE TARGETS (High Probability)

🎯 Target 1: $0.

AXLUSDT Forming Bullish ReversalAXLUSDT is showing clear signs of a bullish reversal pattern on the daily timeframe, indicating a potential shift in market sentiment from bearish to bullish. This pattern is typically characterized by a slowing of downward momentum followed by a breakout to the upside, and AXL is currently forming

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.