Key facts today

HDFC Bank's Q1 FY26 net profit fell to Rs 16,258 crore from Rs 16,475 crore last year, while standalone net interest income rose 5.4% to Rs 31,438 crore.

HDFC Bank's stock fell about 1% as India's equity markets faced their worst decline in three months, influenced by worries over new U.S. tariffs on Indian goods.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

650 ARS

8.89 T ARS

59.60 T ARS

15.33 B

About HDFC Bank Limited

Sector

Industry

CEO

Kapila Deshapriya

Website

Headquarters

Mumbai

Founded

1994

ISIN

ARDEUT114022

FIGI

BBG000PZ25Y3

HDFC Bank Ltd. engages in the provision of banking and financial services including commercial banking and treasury operations. It operates through the following segments: Treasury, Retail Banking, Wholesale Banking, and Other Banking Business. The Treasury segment is involved in net interest earnings from the investment portfolio, money market borrowing, and lending, gains, or losses on investment operations and on account of trading in foreign exchange and derivative contracts. The Retail Banking segment focuses on serving retail customers through the branch network and other channels. The Wholesale Banking segment provides loans, non-fund facilities, and transaction services to large corporates, emerging corporates, public sector units, government bodies, financial institutions, and medium scale enterprises. The Other Banking Business segment includes income from parabanking activities such as credit cards, debit cards, third party product distribution, primary dealership business, and the associated costs. The company was founded by Aditya Tapishwar Puri in August 1994 and is headquartered in Mumbai, India.

Related stocks

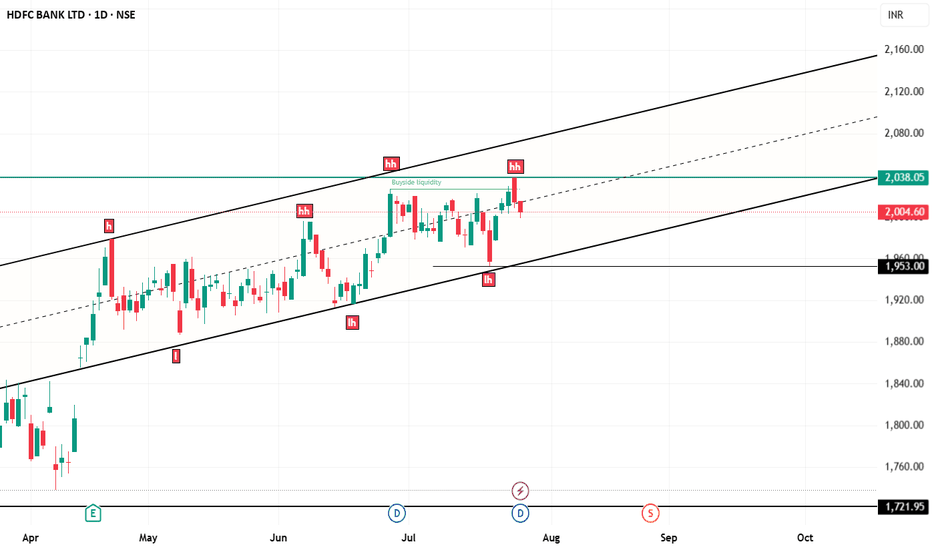

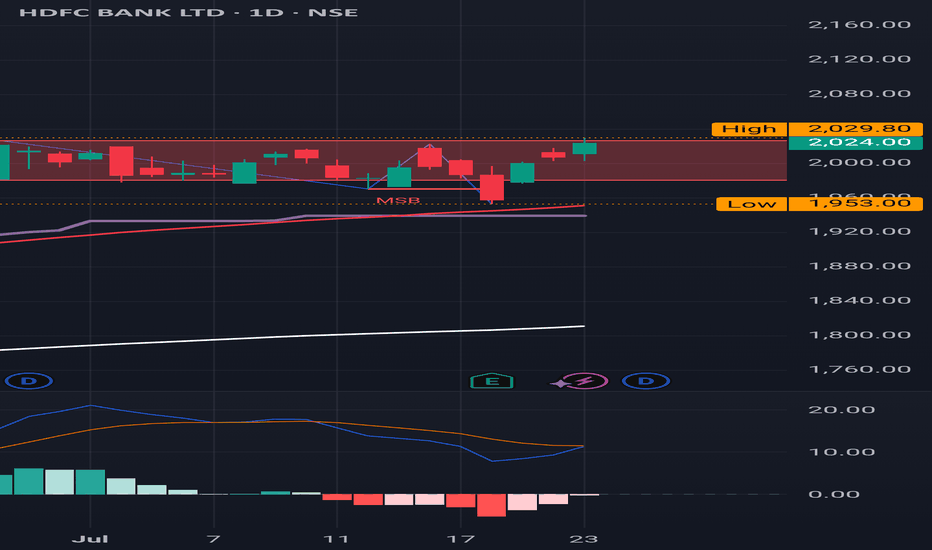

Riding the Ascending Channel — Buy Dips into Cloud SupportSummary

Price continues to respect an ascending channel on the daily chart; Ichimoku cloud is acting as dynamic support.

With Q1 FY26 showing 12% YoY PAT growth, strong capital, and a 1:1 bonus plus ₹5 dividend, dips are being defended while NIM remains the watch item.

Chart Thesis

Structure: Hi

HDFCBankThis is weekly chart of HdfcBank...

looking at the chart,

this is my weekly wave count from 2020 bottom ...

and feels like we have completed wave 5 with a rising wedge...

now as long as this top is not broken ,

I am expecting price to go down and expecting some decent correction in coming weeks.

Risk Management in Options TradingTrading options can be exciting and rewarding—but it's also full of risks. Without proper risk management, even the best strategies can lead to heavy losses. In this comprehensive guide, we'll dive deep into how to manage risk in options trading, covering everything from the basics to advanced techn

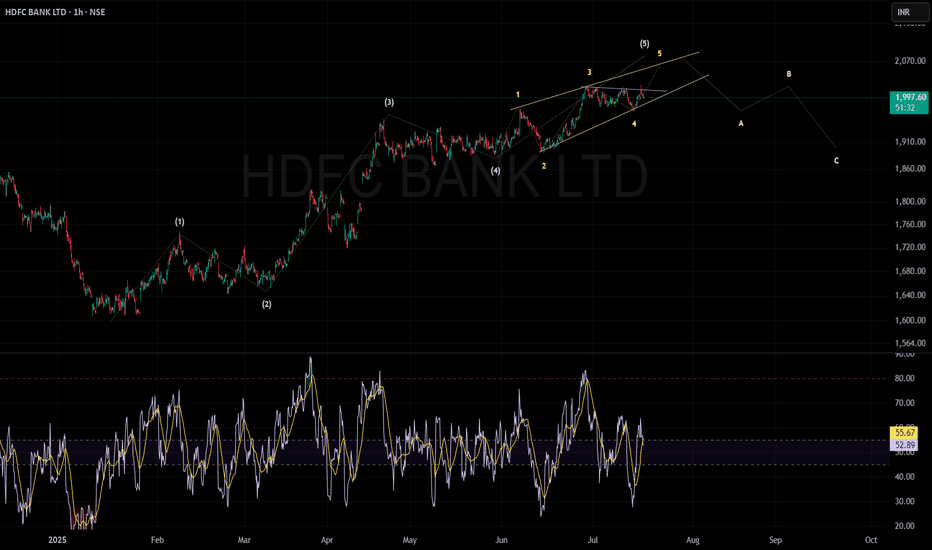

HDFC BANK can move 5th wave upHDFC Bank is currently in the last (5th) wave of an uptrend. This wave is moving inside a narrow, rising wedge pattern called an ending diagonal.

The price can move higher towards ₹2,050–₹2,100 before the trend finishes.

If the price breaks below the bottom of the wedge pattern (ending diagonal),

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HDFB5243078

HDFC Bank Limited 3.7% PERPYield to maturity

—

Maturity date

—

HDB5548686

HDFC Bank Limited 5.686% 02-MAR-2026Yield to maturity

—

Maturity date

Mar 2, 2026

770HDFCB25

HDFC Bank Limited 7.7% 18-NOV-2025Yield to maturity

—

Maturity date

Nov 18, 2025

777HDFCB27

HDFC Bank Limited 7.77% 28-JUN-2027Yield to maturity

—

Maturity date

Jun 28, 2027

784HDFCB27

HDFC Bank Limited 7.84% PERPYield to maturity

—

Maturity date

—

705HDFCB31

HDFC Bank Limited 7.05% 01-DEC-2031Yield to maturity

—

Maturity date

Dec 1, 2031

769HDFCB33

HDFC Bank Limited 7.69% 27-JAN-2033Yield to maturity

—

Maturity date

Jan 27, 2033

786HDFC32

HDFC Bank Limited 7.86% 02-DEC-2032Yield to maturity

—

Maturity date

Dec 2, 2032

644HDFC28

HDFC Bank Limited 6.44% 27-SEP-2028Yield to maturity

—

Maturity date

Sep 27, 2028

784HDFC32

HDFC Bank Limited 7.84% 16-DEC-2032Yield to maturity

—

Maturity date

Dec 16, 2032

765HDFCB33

HDFC Bank Limited 7.65% 25-MAY-2033Yield to maturity

—

Maturity date

May 25, 2033

See all HDB bonds

Curated watchlists where HDB is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks