99% of people buying $NVDA don't understand this:🚨99% of people buying NASDAQ:NVDA don't understand this:

NASDAQ:GOOGL : “We’re boosting AI capex by $10B.”

Wall Street: “Cool, that’s like $1B or 0.06 per share for $NVDA.”

So from $170.50 at the time of news to $170.56 right?

No.

NASDAQ:NVDA trades at 98× earnings. So that $0.06? Turns in

Key facts today

Nvidia can now sell its H20 AI GPUs to China after U.S. approval. These GPUs, while less powerful, are key for Nvidia to keep about 20% of its global market share.

Nvidia's market value hit around $4.34 trillion as of Wednesday, becoming the first company to exceed a $4 trillion valuation on July 9, 2025, marking a significant rise in a year.

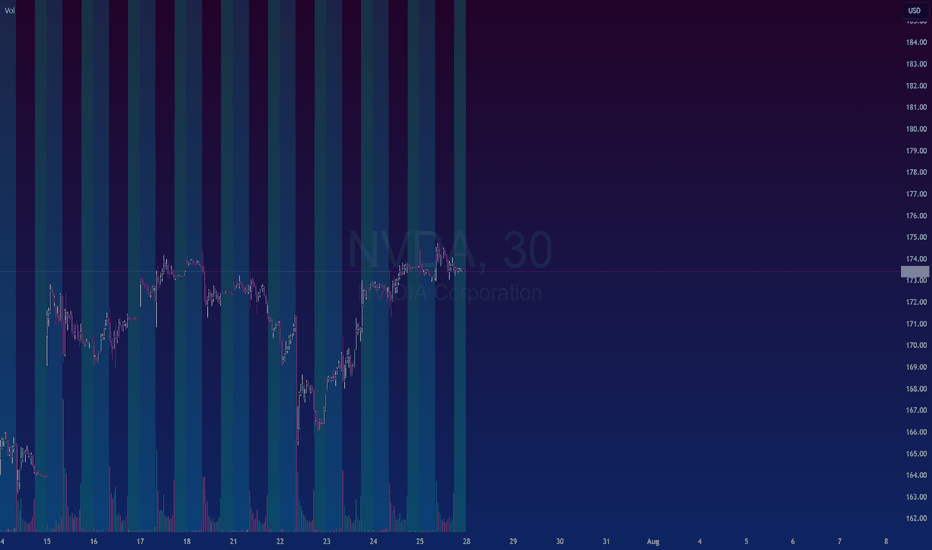

Nvidia (NVDA) rose 0.8% to $176.45 in pre-market trading on July 30, recovering from a 0.7% drop, as investors anticipate earnings from Microsoft and Meta that may affect chip demand.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.133 USD

72.88 B USD

130.50 B USD

23.41 B

About NVIDIA

Sector

Industry

CEO

Jen Hsun Huang

Website

Headquarters

Santa Clara

Founded

1993

FIGI

BBG01QSBFNB7

NVIDIA Corp engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software. It operates through the following segments: Graphics Processing Unit (GPU), Tegra Processor, and All Other. The GPU segment comprises of product brands, which aims specialized markets including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. The Tegra Processor segment integrates an entire computer onto a single chip, and incorporates GPUs and multi-core CPUs to drive supercomputing for autonomous robots, drones, and cars, as well as for consoles and mobile gaming and entertainment devices. The All Other segment refers to the stock-based compensation expense, corporate infrastructure and support costs, acquisition-related costs, legal settlement costs, and other non-recurring charges. The company was founded by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem in January 1993 and is headquartered in Santa Clara, CA.

Related stocks

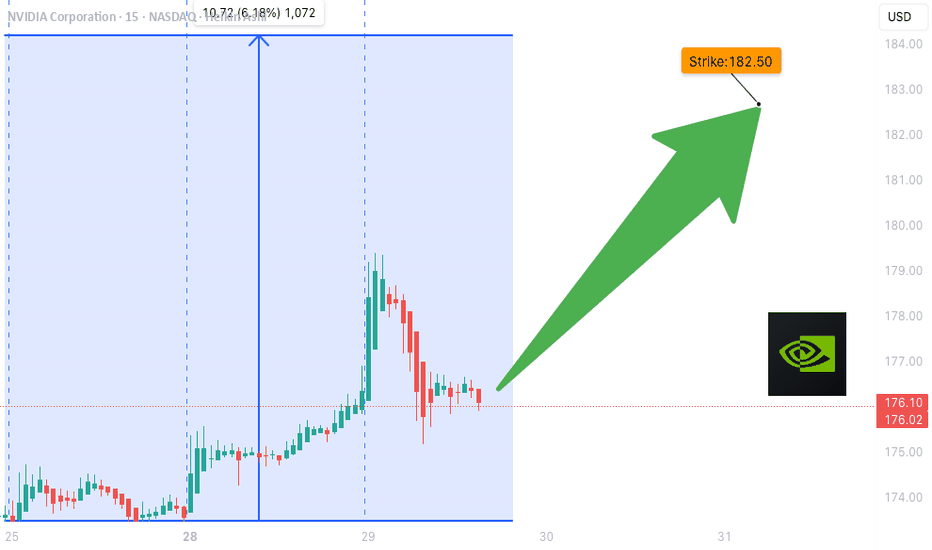

NVDA Bullish Weekly Trade Setup** – 2025-07-29

📈 **NVDA Bullish Weekly Trade Setup** – 2025-07-29

🚀 *"Momentum meets money flow!"*

### 🔍 Market Snapshot:

* 💥 **Call/Put Ratio**: 2.47 → Bullish sentiment confirmed

* 🧠 **RSI**: Rising on Daily & Weekly → Momentum building

* 🔕 **Low VIX**: Favors call strategies (cheap premiums)

* ⚠️ **Caution*

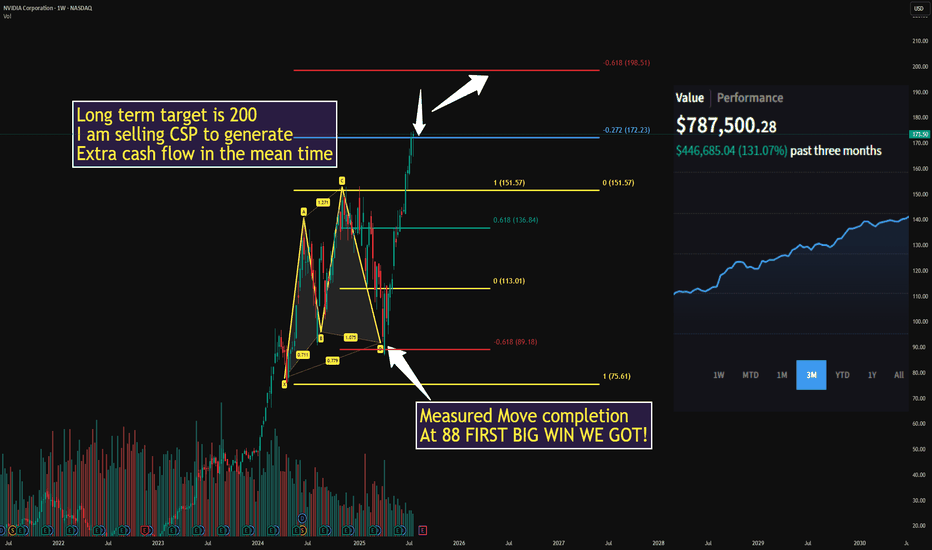

Nvidia Just Under Major SupportNvidia seems to have been pulled down by the Dow just like Apple as both are just under major support. I'm sorry for my previous Nvidia chart that drew support near 140, I recognize where I screwed up, but this chart should be good. Fortunately actual 117 support wasn't that far below and my NVDA is

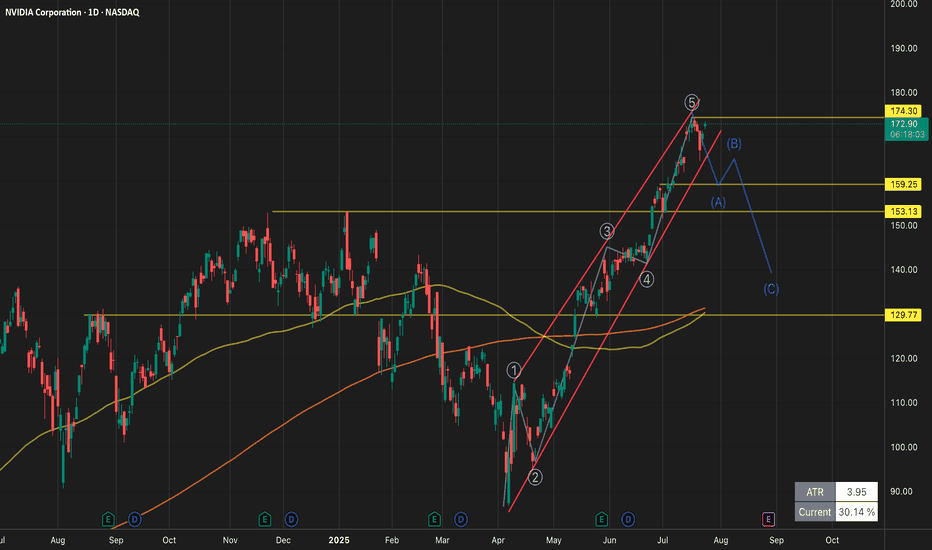

NVIDIA Riding the 50 EMA — Trend Still IntactNVDA continues to respect the rising channel while price holds above the 50, 100, and 200 EMAs — with each 50 EMA touch offering solid entries.

📌 Bullish EMA structure: 20/50/100/200 stacked clean

📌 50 EMA = key support and entry zone

⏱️ Timeframe: 1H

#nvda #stocks #ema #swingtrading #bullishtrend

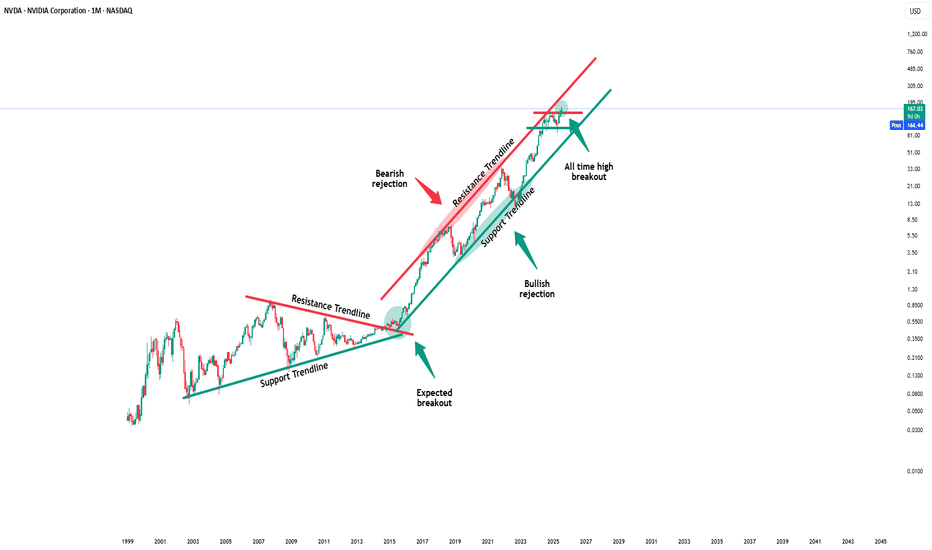

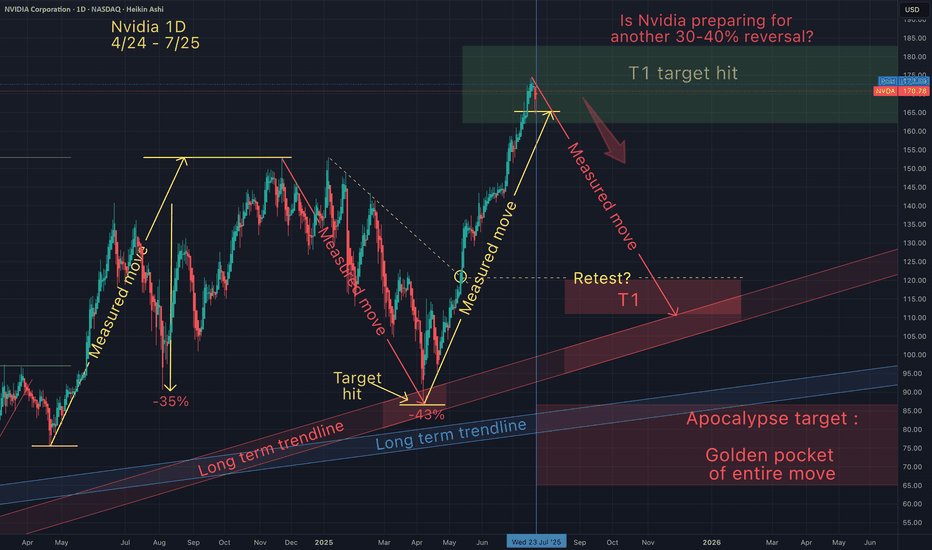

Nvidia - This is clearly not the end!📐Nvidia ( NASDAQ:NVDA ) will confirm the breakout:

🔎Analysis summary:

Over the past couple of months, Nvidia managed to rally about +100%, reaching top 1 of total market cap. Most of the time such bullish momentum just continues and new all time highs will follow. But in order for that to hap

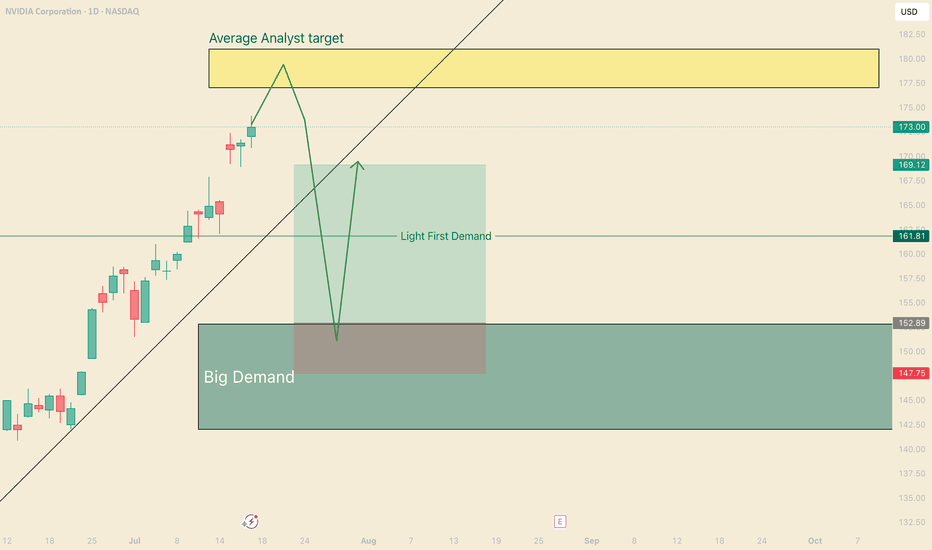

Catch the bounce on NVDAHi, I'm The Cafe Trader.

We’re taking a deeper dive into NVIDIA (NVDA) — one of the leaders in the MAG 7 — with a short-term trade setup you can apply to both shares and options.

Setup Context:

NVDA is pushing into all-time highs, and we’re now approaching the average analyst price target (around

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NVDA4971918

NVIDIA Corporation 3.5% 01-APR-2050Yield to maturity

6.06%

Maturity date

Apr 1, 2050

NVDA4971919

NVIDIA Corporation 3.7% 01-APR-2060Yield to maturity

6.05%

Maturity date

Apr 1, 2060

NVDA4971917

NVIDIA Corporation 3.5% 01-APR-2040Yield to maturity

5.48%

Maturity date

Apr 1, 2040

US67066GAN4

NVIDIA 21/31Yield to maturity

4.60%

Maturity date

Jun 15, 2031

US67066GAE4

NVIDIA 2026Yield to maturity

4.34%

Maturity date

Sep 16, 2026

NVDA4971916

NVIDIA Corporation 2.85% 01-APR-2030Yield to maturity

4.25%

Maturity date

Apr 1, 2030

NVDA5203204

NVIDIA Corporation 1.55% 15-JUN-2028Yield to maturity

4.18%

Maturity date

Jun 15, 2028

See all NVDA bonds

Curated watchlists where NVDA is featured.

Frequently Asked Questions

The current price of NVDA is 175.570 USD — it hasn't changed in the past 24 hours. Watch NVIDIA CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange NVIDIA CORP stocks are traded under the ticker NVDA.

NVDA stock has risen by 4.82% compared to the previous week, the month change is a 12.41% rise, over the last year NVIDIA CORP has showed a 52.52% increase.

We've gathered analysts' opinions on NVIDIA CORP future price: according to them, NVDA price has a max estimate of 250.00 USD and a min estimate of 100.00 USD. Watch NVDA chart and read a more detailed NVIDIA CORP stock forecast: see what analysts think of NVIDIA CORP and suggest that you do with its stocks.

NVDA reached its all-time high on Jul 17, 2025 with the price of 173.670 USD, and its all-time low was 94.000 USD and was reached on Apr 4, 2025. View more price dynamics on NVDA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NVDA stock is 1.39% volatile and has beta coefficient of 2.28. Track NVIDIA CORP stock price on the chart and check out the list of the most volatile stocks — is NVIDIA CORP there?

Today NVIDIA CORP has the market capitalization of 4.37 T, it has increased by 5.21% over the last week.

Yes, you can track NVIDIA CORP financials in yearly and quarterly reports right on TradingView.

NVIDIA CORP is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

NVDA earnings for the last quarter are 0.81 USD per share, whereas the estimation was 0.74 USD resulting in a 9.89% surprise. The estimated earnings for the next quarter are 1.00 USD per share. See more details about NVIDIA CORP earnings.

NVIDIA CORP revenue for the last quarter amounts to 44.06 B USD, despite the estimated figure of 43.33 B USD. In the next quarter, revenue is expected to reach 45.70 B USD.

NVDA net income for the last quarter is 18.77 B USD, while the quarter before that showed 22.09 B USD of net income which accounts for −15.01% change. Track more NVIDIA CORP financial stats to get the full picture.

Yes, NVDA dividends are paid quarterly. The last dividend per share was 0.01 USD. As of today, Dividend Yield (TTM)% is 0.02%. Tracking NVIDIA CORP dividends might help you take more informed decisions.

NVIDIA CORP dividend yield was 0.03% in 2024, and payout ratio reached 1.16%. The year before the numbers were 0.03% and 1.34% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 31, 2025, the company has 36 K employees. See our rating of the largest employees — is NVIDIA CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NVIDIA CORP EBITDA is 88.25 B USD, and current EBITDA margin is 63.85%. See more stats in NVIDIA CORP financial statements.

Like other stocks, NVDA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NVIDIA CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NVIDIA CORP technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NVIDIA CORP stock shows the strong buy signal. See more of NVIDIA CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.