A 10x on APLD ? Applied Digital has confirmed a multi-year symmetrical triangle breakout on the weekly chart, marked by immense volume and a clean breakout above long-term downtrend resistance. The base of the triangle spans several years, with consistent higher lows forming a solid support line.

🔺 Breakout Volume

Applied Digital Corporation Shs Unsponsored Brazilian Depositary Receipt Repr 1 Sh

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−6.209 BRL

−1.33 B BRL

828.22 M BRL

230.42 M

About Applied Digital Corporation

Sector

Industry

CEO

Wesley Carl Cummins

Website

Headquarters

Dallas

Founded

2001

ISIN

BRA1PLBDR008

FIGI

BBG01RN52946

Applied Digital Corp. is a technology company, which engages in the provision of development and operation of data centers which provide computing power. It operates through the Data Center Hosting Business and HPC Hosting Business segments. The Data Center Hosting Business segment provides energized infrastructure services to crypto mining customers. The HPC Hosting Business segment focuses on the designing, constructing, and operating data centers tailored to support high power density applications like HPC and AI. The company was founded by Wesley Carl Cummins and Jason Zhang in May 2001 and is headquartered in Dallas, TX.

Related stocks

Applied Digital Corporation (APLD) AnalysisCompany Overview:

Applied Digital NASDAQ:APLD is an AI and high-performance computing (HPC) infrastructure leader building next-gen data centers purpose-built for GPU computing, AI workloads, and digital assets. It’s positioning itself in the center of the AI infrastructure supercycle.

Key Cataly

APLD: might be starting a new upswing Price is showing a constructive reaction from the 30–26 support zone and might be starting a new uptrend toward the next mid-term resistance area at 60–75.

As long as price continues to hold above the support zone, I’ll keep this trend structure as my main scenario.

Chart:

Can a Crypto Miner Become an AI Infrastructure Giant?Applied Digital Corporation has undergone a dramatic transformation, pivoting from cryptocurrency mining infrastructure to become a key player in the rapidly expanding AI data center market. This strategic shift, completed in November 2022, has resulted in extraordinary stock performance with shares

APLD - Near-term upside, entry coming upAPLD is near the end of a very solid and strong third wave impulse to the upside.

With this end nearing and the price territory of the end of wave 1 being so near, it makes me give this Wave-count confidence rating: Weak

I will be waiting to see what structure and price action comes in the next

$APLD 2027 LEAPS: The Next NVDA? Long-Term AI/HPC Power Play

# 🚀 APLD LEAP Options Setup | AI Mega-Trend Play 💡📊

### 🔥 Trade Thesis

APLD riding the **AI/HPC CoreWeave \$11B partnership** + secular AI infra boom.

Weekly chart = **bullish momentum**, monthly cooling but intact trend.

Low VIX → perfect setup for **LEAP calls**.

---

### 📊 TRADE SETUP

* 🎯 *

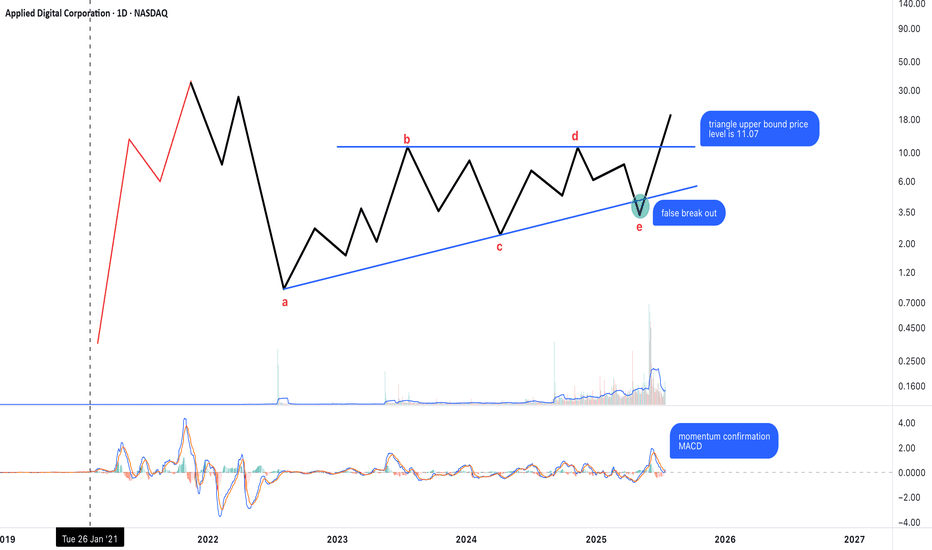

Possible Neutral Triangle Breakout – Key Level at 11.07The chart appears to show a completed neutral triangle (a–b–c–d–e), with a breakout emerging above the upper boundary at 11.07.

Wave a looks like a complex structure (possibly elongated flat or flat + zigzag).

The rest of the legs are mostly zigzag forms, consistent with triangle rules.

False bre

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy