HCA Healthcare I observe a clear rotation of capital into the healthcare sector, with strong inflows toward medical companies reporting solid earnings and outlooks. Within this rotation, HCA Healthcare appears to be the most attractively valued company, supported by consistent profitability, a strong balance sheet

HCA Healthcare Inc Shs Unsponsored Brazilian Depositary Receipt Repr 0.05 Sh

No trades

16,478.38

0.01 BRL

31.05 B BRL

380.62 B BRL

About HCA Healthcare, Inc.

Sector

Industry

CEO

Samuel N. Hazen

Website

Headquarters

Nashville

Founded

1968

ISIN

BRH1CABDR002

FIGI

BBG00R28TYY7

HCA Healthcare, Inc. is a health care services company engaged in operating hospitals, freestanding surgery centers and emergency care facilities, urgent care facilities, walk-in clinics, diagnostic and imaging centers, radiation and oncology therapy centers, comprehensive rehabilitation and physical therapy centers, physician practices, home health, hospice, outpatient physical therapy home and community-based services providers, and various other facilities. The firm operates general and acute care hospitals that offer medical and surgical services, including inpatient care, intensive care, cardiac care, diagnostic, and emergency services, and outpatient services, such as outpatient surgery, laboratory, radiology, respiratory therapy, cardiology, and physical therapy. The company was founded by Dr. Thomas F. Frist, Jr in 1968 and is headquartered in Nashville, TN.

Related stocks

HCA - Precision Swing Long (Consistent Technical Alignment)🎯 Ticker: HCA (NYSE)

📈 Type: Swing Long

⏰ Timeframe: Daily (D1) & 4H

📊 Multi-Timeframe Technical Analysis:

Daily Trend: BULLISH ✅

Technical Alignment: BUY Signals Across All Timeframes (Daily, 4H, 1H)

Key Support: $450-455 zone (Confluence of SMA 20 & previous resistance)

Momentum: RSI (57.6) sh

HCA - High-Probability Swing Trade with Connors ConfirmationHCA - HCA Healthcare, Inc.

🏥 Strong Buy Signal | Confirmed by Fundamentals, Technicals & Connors RSI2

🎯 Trade Idea Overview

Direction: LONG

Entry Zone: $429 - $433

Stop Loss: $406.70

Take Profit: $484.96

Strategy: Swing to Position Trade (2–6 weeks)

Confidence Level: High (85%)

📊 Why HCA?

✅ F

HCA Healthcare | HCA | Long at $299.00NYSE:HCA Healthcare: P/E of 13x, earnings are forecast to grow 6.01% per year; earnings have grown 10.6% per year over the past 5 years, and trading at good value compared to peers and industry.

From a technical analysis perspective, it dipped to my selected historical simple moving average area a

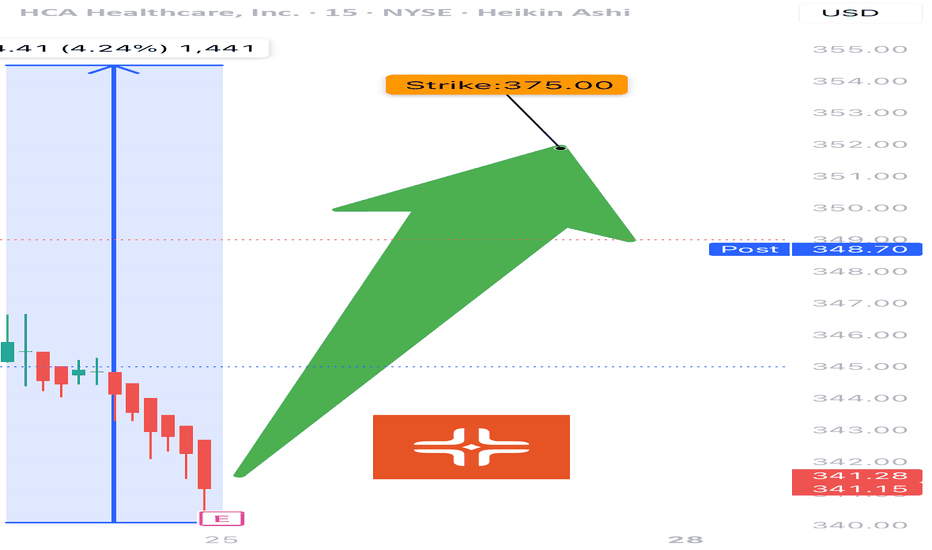

HCA EARNINGS TRADE (07/24)

🚨 HCA EARNINGS TRADE (07/24) 🚨

🏥 Healthcare with earnings tonight after close — high-upside setup brewing.

🧠 Quick Breakdown:

• 📊 Revenue Growth: +5.7% (stable, defensive sector)

• 💸 Margins: Operating 15.6%, EBITDA 19.9% = efficient and strong

• 🧠 Beat Rate: 75% with 6.7% avg surprise → credible

HCA exhibits strong financial health!Technical Analysis

HCA's stock has demonstrated resilience, with a 52-week range between $276.50 and $417.14. The Relative Strength Index (RSI) stands at 58.01, suggesting the stock is neither overbought nor oversold. The Moving Average Convergence Divergence (MACD) is 0.11, indicating a potential

HCA Advances as Tech StumblesHealthcare is the leading sector so far this year, and some traders may see opportunity in hospital operator HCA Healthcare.

Today’s weekly chart considers the all-time high above $410 in October, followed by a substantial pullback. Prices stabilized early this year around $290 (near the low from l

Head & ShouldersThis pattern consists of 2 shoulders that should be in the same ballpark in price but are rarely the exact same price.

The 2 shoulders should be close to the same distance from the head which is a high point between the 2 shoulders.

T1 has just about been met. Sometimes t1 is all we get.

Earnings

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HCA.GF

Columbia/HCA Healthcare Corp. 7.5% 15-NOV-2095Yield to maturity

6.64%

Maturity date

Nov 15, 2095

HCA5372914

HCA Inc. 4.375% 15-MAR-2042Yield to maturity

6.21%

Maturity date

Mar 15, 2042

HCA5372916

HCA Inc. 4.625% 15-MAR-2052Yield to maturity

6.15%

Maturity date

Mar 15, 2052

HCA5757225

HCA Inc. 6.1% 01-APR-2064Yield to maturity

6.13%

Maturity date

Apr 1, 2064

HCA6009047

HCA Inc. 6.2% 01-MAR-2055Yield to maturity

6.07%

Maturity date

Mar 1, 2055

HCA5868805

HCA Inc. 5.95% 15-SEP-2054Yield to maturity

6.05%

Maturity date

Sep 15, 2054

HCA5581318

HCA Inc. 5.9% 01-JUN-2053Yield to maturity

6.04%

Maturity date

Jun 1, 2053

HCA5757224

HCA Inc. 6.0% 01-APR-2054Yield to maturity

6.03%

Maturity date

Apr 1, 2054

HCA4843309

HCA Inc. 5.25% 15-JUN-2049Yield to maturity

6.01%

Maturity date

Jun 15, 2049

HCA6217610

HCA Inc. 5.7% 15-NOV-2055Yield to maturity

6.00%

Maturity date

Nov 15, 2055

HCA5604246

HCA Inc. 4.625% 15-MAR-2052Yield to maturity

5.98%

Maturity date

Mar 15, 2052

See all H1CA34 bonds