Lingrid | BNBUSDT Potential Downside Break After Swap RejectionBINANCE:BNBUSDT perfectly played out my previous trading idea . Price is trading below a descending trendline while struggling to reclaim the swap zone, suggesting sellers still control the short-term structure. Recent rebounds appear corrective rather than impulsive, with price repeatedly failing to hold above the broken range. The overall flow continues to favor distribution inside a pressured channel.

If the swap zone around 860–870 acts as resistance again, price could slip back below the channel floor, opening room toward the 790 support band where previous demand was formed. Momentum remains fragile, and a rejection here may accelerate downside continuation.

➡️ Primary scenario: rejection from 860–870 → breakdown toward 790.

⚠️ Risk scenario: sustained acceptance above 870 weakens bearish pressure and shifts focus back toward 920.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Market insights

BNB Looks Bullish (4H)BNB has been making higher lows and continuously forming bullish CHs.

Based on the latest bullish CH, buy/long positions can be considered on pullbacks within the support zones.

We have two entry points where DCA can be applied.

Also, if the lows hold, it is possible that the liquidity pool above the chart could be swept soon.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

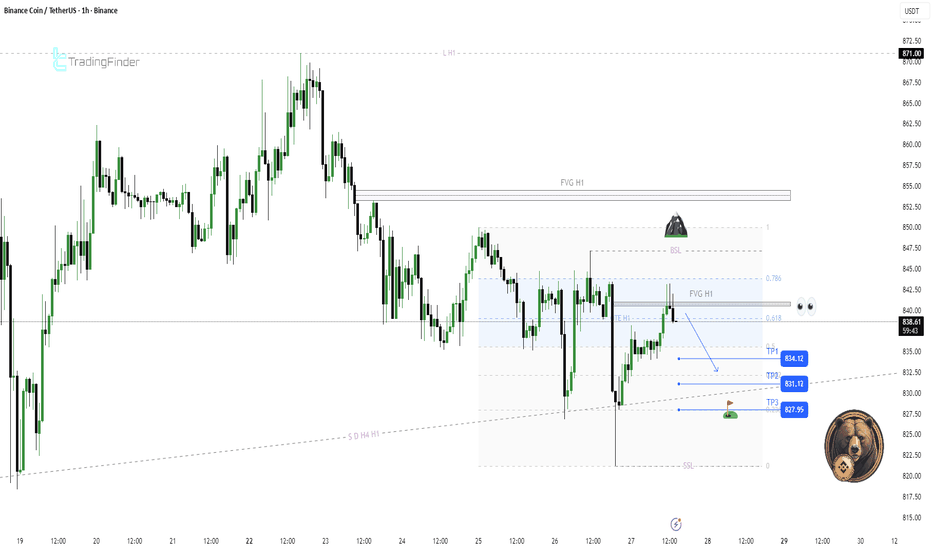

BNB H1 Post-FVG Sweep and Mean Reversion Toward 828📝 Description

BNB on H1 just swept its most recent FVG, triggering a short-term liquidity run. After this sweep, price is showing signs of distribution below HTF resistance, which opens the door for a mean-reversion move lower. Given the current structure, a pullback toward 828 looks like the natural next draw on liquidity.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish pullback

Short Setup (Preferred):

• Entry (Sell): 840

• Stop Loss: Above 844

• TP1: 834

• TP2: 831

• TP3: 827–828 (liquidity target)

________________________________________

🎯 ICT & SMC Notes

• Recent FVG fully swept and imbalance resolved

• Price trading below H1 supply / premium

• BSL failed to hold and weakness confirmed

• SSL resting below current range

________________________________________

🧩 Summary

After cleaning the nearby FVG, BNB looks heavy. As long as price remains capped below the swept zone, odds favor a rotation toward 828 liquidity. Shorts after confirmation make more sense than chasing upside here.

________________________________________

🌍 Fundamental Notes / Sentiment

With broader crypto still reacting to liquidity conditions and macro headlines, continuation moves are less likely without fresh catalysts. For now, technical liquidity levels remain the best guide, manage risk and scale out near targets.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

BNB/USDT at Critical Zone – Trend Continuation or Correction?On the 4-day timeframe, BNB/USDT is currently undergoing a healthy correction following a strong bullish impulse that previously formed a blow-off top near the 1,375 level. Price is now retracing into a critical technical area that will likely determine the next major directional move.

---

Pattern & Market Structure Explanation

1. Strong Impulsive Rally

BNB experienced a sharp, near-parabolic rally, signaling strong bullish momentum and a phase of market euphoria.

2. Blow-Off Top Formation

The peak around 1,375 was followed by aggressive selling pressure, indicating distribution from smart money.

3. Corrective Structure (ABC / Descending Pullback)

The current decline appears corrective rather than a full bearish reversal, characterized by controlled lower highs and orderly price action.

4. Major Demand Zone / Previous Resistance Flip

The yellow zone at 765–720 represents:

A historical consolidation area

A former strong resistance level

A potential support-resistance flip (SR Flip) and high-probability demand zone

---

Key Levels to Watch

Resistance Levels:

892

989

1,135

1,300

1,375 (ATH / Major Supply)

Support Levels:

765 – 720 (Major Demand Zone)

Below 720 → risk of deeper correction

---

Bullish Scenario

Price holds and reacts bullishly within the 765–720 demand zone

Bullish confirmation may include:

Strong rejection

Long lower wicks

Break of minor bearish structure

Upside targets:

892 → 989 → 1,135

If momentum strengthens, a retest of 1,300 – 1,375 becomes highly probable

This scenario confirms the move as a pullback within a larger bullish trend

---

Bearish Scenario

A strong 4D close below 720

Demand zone fails to absorb selling pressure

Price may continue correcting toward lower historical support levels

Market structure shifts into a medium-term bearish continuation

Bearish bias is confirmed if subsequent rallies fail to form a higher low

---

Conclusion

BNB is currently trading at a critical decision zone. The 765–720 area is the key battlefield between buyers and sellers. Price reaction here will determine whether BNB resumes its macro bullish trend or enters a deeper corrective phase. Patience and confirmation are essential before taking any position.

---

#BNBUSDT #BNB #CryptoAnalysis #Altcoin #TechnicalAnalysis #MarketStructure #SupportResistance #DemandZone #SwingTrading #CryptoMarket

BNB About to Crash Hard or Just Faking You Out?Yello Paradisers, is BNB setting up for a major dump, or is this just another trap for impatient traders? This next move could catch a lot of people off guard if they're not paying attention to key levels.

💎BNBUSDT is currently looking bearish, as it's reacting strongly from a key resistance zone. This level is further reinforced by the 200 EMA, making it a significant area of confluence. On top of that, price has recently broken down from an ascending channel, which adds further confirmation to the potential shift in trend direction. When these signals line up like this, the probability of a bearish move increases substantially.

💎Now, ideally, we want to see a pullback into the resistance zone. That would give us a much better risk-to-reward entry for a potential short. However, entering blindly is never the move — we need clear confirmation. Specifically, we’ll be watching for a strong bearish candlestick pattern to form right at the resistance zone. If we get that, we can then expect a move toward the next liquidity zones and support levels below.

💎That said, we must stay objective. If BNB manages to break above the invalidation level and closes a candle beyond that point, it will completely invalidate the current bearish outlook. In that scenario, it's better to stay out and wait patiently for stronger price action to develop. There’s no need to force trades when the setup isn't perfect.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

BNB is drawing a Christmas tree. If you look at BNB without emotions, the current structure looks very telling. After a strong impulse upward, we got a classic distribution phase followed by a gradual price fade. On the chart it looks exactly like that Christmas tree: a sharp rally, a top, and a long descending branch.

The key point is right here. The market can either form a base or break it and move much deeper.

For now:

the structure remains bearish

buyer momentum is weak

all bounces look corrective

For smart money, this is not a “buy and pray” zone. This is an area to watch the reaction. If accumulation appears, volatility decreases, and the level is defended, then we can talk about a recovery scenario. If the zone fails, the next liquidity areas are much lower.

BNB right now is not about aggressive longs. It is about patience and reading the context.

The market has already drawn everything. The only question is whether a buyer will appear under this tree.

BNB Approaching Key Support – Potential Bounce SetupBNB is moving toward a major support zone between $800 – $820. This area has historically served as a demand zone, and we're watching for bullish price action or a potential reversal signal around this level. If support holds, there's a strong chance for price rotation back toward the mid-range of the broader structure.

💡 Trade Setup Idea:

Entry Zone: $800 – $820 (Support)

Take Profit Targets: $890 / $976 / $1168

Stop Loss: $742 (below structure)

A bounce from this level could offer a solid risk-reward setup. Always wait for confirmation (e.g. bullish engulfing, volume spike, or momentum shift) before entering. Manage your risk carefully.

#BNB #Crypto #BinanceCoin #TradingView #CryptoTrading #TechnicalAnalysis #SupportAndResistance #PriceAction

FireHoseReel | BNB Daily Analysis #27🔥 Welcome To FireHoseReel !

Let’s dive into Binance Coin (BNB) analysis.

👀 BNB 1H Overview

After its recent declines, BNB is currently ranging on the 1-hour timeframe between the $850 resistance and the $835 support. A breakout from either side could lead to a move toward the next key resistance or support level.

📊 Volume Analysis

On the 1-hour timeframe, BNB volume looks unclear to me. Volume has dropped significantly and doesn’t provide a strong or reliable signal at the moment, making it difficult to interpret what is happening from a volume perspective.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

A breakout above $850 accompanied by increasing buying volume could trigger a move toward $870, making it a valid long setup.

🔴 Short Scenario:

A breakdown below the $835 support with visible selling volume could push price toward its next maker buyer zone, where we can then reassess market behavior.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

BNB/USDT 1W chart1️⃣ Main trend

• Long-term trend: upwards

The black trend line is respected - the market moves in a higher highs / higher lows structure.

• The recent upward move was expansive and parabolic → it was not a healthy growth, just FOMO.

➡️ Correction was inevitable.

⸻

2️⃣ Current price situation

• Current price ~ USDT 840

• The market rejected the 1020-1160 zone very aggressively

(long wick = smart money distribution)

This does NOT look like:

• continuation of impulse ❌

• only for local peak and market cooling ✅

⸻

3️⃣ Key levels (most important)

🟢 Resistances

• 911–920 → first hard resistance

• 1020–1030 → distribution zone

• 1160 → ATH / extreme (unrealistic without long consolidation)

🔴 Support

• 780–800 → KEY

This is:

• previous resistance

• psychological level

• place of price reaction

• 600–620 → strong HTF support

• ~520–550 → the last line of defense of the trend

⸻

4️⃣ RSI Stochastic (bottom)

• RSI in the oversold zone

• BUT:

• on W1 RSI may stay in oversold for a long time

• this is NOT yet a buy signal in itself

We are waiting for:

• RSI turn up

• preferably bullish cross + price reaction

Binance Coin (BNB): Looking For Break of 200EMABNB is getting pressed between the support zone below and the EMAs above, which is creating a clear zone of pressure. Price has very little room left here, so a volatile move is likely.

Bias stays slightly in favor of buyers. We’re looking for a clean break and acceptance above the 200 EMA. Once buyers manage to secure that level, that would open the door for a long continuation toward the upper zone.

Swallow Academy

#BNBUSDT (4H) — Chart Update#BNBUSDT (4H) — Chart Update

Current Price: ~852 USDT

Major Support: 820–830 (rising trendline + demand zone)

Immediate Resistance: 860–880

Major Resistance Levels:

919 USDT

1,014 USDT

1,060 USDT

Price respected the ascending base and printed a bounce from demand.

Short-term structure is recovering, but still below key resistances.

The projected path suggests a higher-low formation if support holds.

Bullish: Hold above 820–830 → push toward 880 → 919.

Strong Breakout: Acceptance above 919 opens 1,014 → 1,060 zone.

Bearish: Lose 820 → structure weakens, deeper pullback risk.

⚠️ Note: Wait for confirmation above 880 / 919 for safer longs.

Risk management is key.

BNB — Ascending Channels, Shakeout Pattern & Bull Market OutlookIn 2018 BNB formed a clear ascending channel. After moving inside this structure for several years, the market experienced a sharp shakeout in March 2020, which became the final capitulation before a major trend reversal. By late 2020 the price broke out above the channel, confirming the beginning of a strong bull market.

Since 2021 a new ascending channel has been forming. I expect a corrective move toward the lower boundary of this channel in the $300–$350 area. A similar shakeout to what happened in March 2020 may occur again around 2026, potentially acting as a final reset before the next major uptrend.

After this pullback, the next bullish phase could begin, with long-term targets in the $4,000–$5,000 range.

Key points:

2018: formation of the first ascending channel.

March 2020: sharp shakeout → final reset before the bull run.

Late 2020: breakout above the channel → start of the bullish cycle.

2021–present: formation of a new ascending channel.

Expected: retrace to $300–$350 + possible 2026 shakeout.

Long-term target: $4K–$5K after the new bull run begins.

BNB sliding into support... waiting for the signalBNB remains below key moving averages, keeping the short-term bias heavy. Price is compressing after the range breakdown, signaling indecision rather than strength.

The volume profile shows a major demand zone much lower, lining up with long-term support. If current levels fail, that area is where buyers are likely to defend.

Upside needs a clean reclaim of range resistance to flip momentum. Until then, rallies look corrective and downside risk remains.

Watching this level closely.

FireHoseReel | BNB Daily Analysis #21🔥 Welcome To FireHoseReel !

Let’s dive into BinanceCoin (BNB) analysis.

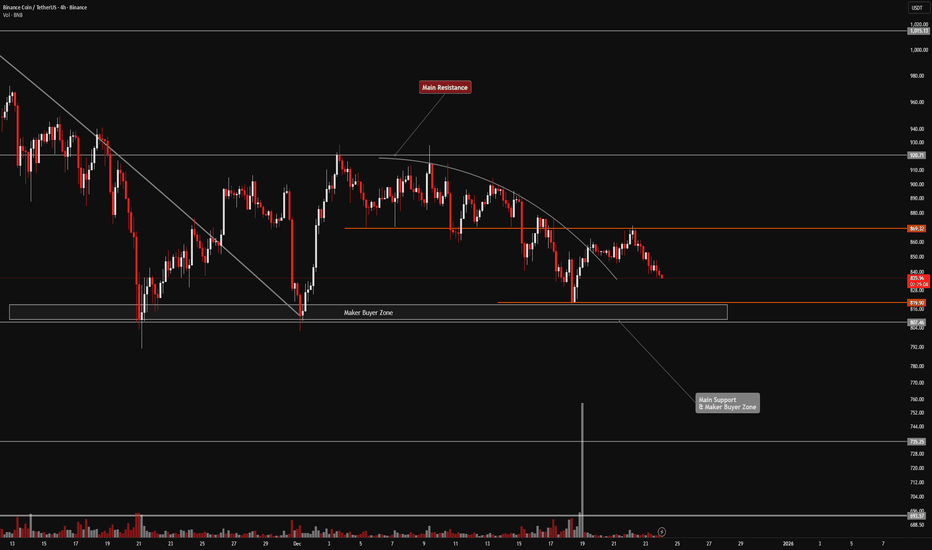

👀 BNB 4H Overview

BNB was trading inside a 4H range where I had marked two trigger zones. The short trigger was activated with a strong sell-off candle, and a new trigger zone has now formed around $849.

📊 Volume Analysis

After losing the multi-timeframe support at $877, BNB’s volume shifted into strong selling pressure. This sell pressure slowed down as market makers stepped in around the $850 area.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

A breakout above the multi-timeframe resistance at $899, supported by rising buy volume, could activate the long trigger. If $923 breaks, the position can be held for continuation.

🔴 Short Scenario:

If the market maker buy zone fails and support at $849 is lost with renewed selling pressure, the short trigger will be activated.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

FireHoseReel | BNB Daily Analysis #28🔥 Welcome To FireHoseReel !

Let’s dive into Binance Coin (BNB) analysis.

👀 BNB 1H Overview

BNB bounced strongly from the vicinity of its maker-buyer zone with a very long upper wick, which clearly highlights a key demand/support area. Price is currently trading below the multi-timeframe resistance at $843.11, which also acts as a pre-breakout zone.

📊 Volume Analysis

Honestly, there’s not much meaningful insight to extract from BNB volume right now. The volume structure is extremely messy and unreliable, making proper analysis difficult. For that reason, I’m choosing not to rely on volume until it normalizes or the underlying cause becomes clear.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

A confirmed breakout above $843.11, accompanied by increasing buy volume, could trigger a high-risk long setup.

🔴 Short Scenario:

If the maker zone breaks with a strong whale candle and heavy selling pressure, followed by continuation and a pullback, we can look for entry opportunities using proper setup candles. If price starts moving in that direction, I’ll update the analysis accordingly.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

FireHoseReel | BNB Daily Analysis #26🔥 Welcome To FireHoseReel !

Let’s dive into Binance Coin (BNB) analysis.

👀 BNB 4H Overview

BNB has reached the vicinity of its key resistance but was rejected after forming a lower high compared to the previous peak. Price is now rotating downward and moving toward the lower boundary of the range (box).

📊 Volume Analysis

As price approached the $876.76 resistance, buying volume weakened and failed to support a breakout. This lack of demand caused a rejection from the level, allowing sellers to take control of price action.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

Our risky pre-breakout trigger has shifted slightly lower and is now located above the newly formed lower high at $869.32. A breakout above this level, accompanied by rising buying volume, would activate our long trigger.

🔴 Short Scenario:

A breakdown of the maker buyer zone, ranging from $819.90 to $807.46, is expected to occur with a strong impulsive (whale) candle. If this level is broken, we will wait for a pullback to enter short positions.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

DeGRAM | BNBUSD is aiming to the $800 level📊 Technical Analysis

● BNB/USD remains in a broader descending structure, with price repeatedly rejecting the falling resistance line after forming a triangle and multiple consolidation ranges. Each rebound shows weaker highs, confirming bearish market control.

● The latest consolidation failed to break upward and price is rolling over toward the rising support line near the 800–820 zone. A breakdown below this area would open the path for continuation toward lower demand levels.

💡 Fundamental Analysis

● Ongoing pressure on major altcoins amid cautious market sentiment and reduced risk appetite continues to limit upside for BNB.

✨ Summary

● Bearish bias intact. Resistance: 860–880. Key support: 820–800. Breakdown below support favors further downside continuation.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

FireHoseReel | BNB Daily Analysis #25🔥 Welcome To FireHoseReel !

Let’s dive into Binance Coin (BNB) analysis.

👀 BNB 4H Overview

BNB is currently trading near a key resistance level and is likely to show a reaction at this zone before attempting a breakout. As you can see, buying volume is gradually increasing, which supports a potential upward move.

📊 Volume Analysis

As mentioned in the previous analysis, a significant amount of capital from buy-side makers was deployed within a single 4-hour candle. With buyers’ momentum continuing, BNB still has the potential to push higher.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

A confirmed breakout above the current resistance around $876.56, accompanied by strong buyer participation and increasing volume. Additionally, the RSI oscillator should break above the 60.68 level to validate the long setup.

🔴 Short Scenario:

A breakdown below the buy-side maker support zone between $819.69 – $808.06 could trigger a sharp downside move. Losing this zone may occur via a whale-driven move, so the preferred entry would be on the pullback after the breakdown.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

BNB at a Critical TestBNB is maintaining a medium-term uptrend while respecting the ascending support trendline. Price is currently consolidating above the 840 - 850 USDT zone, which acts as a key support.

If this area holds, a bullish continuation toward the 900 - 920 USDT range is likely, with potential for further upside. A break below support could delay the bullish scenario, but the overall structure remains constructive for now.