MRS. BECTORS FOOD

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.45 INR

1.43 B INR

18.32 B INR

About MRS BECTORS FOOD SPE LTD

Sector

Industry

CEO

Manu Talwar

Website

Headquarters

Gurugram

Founded

1995

Identifiers

2

ISIN:INE495P01020

Mrs. Bector's Food Specialities Ltd. manufactures and markets biscuits and bakery products. It operates through the following segments: Biscuits and Bakery products. The Biscuits segment manufactures and sells biscuits in the premium and mid-premium segments including a variety of cookies, creams, crackers, digestives, and glucose under its brand Mrs. Bector's Cremica. The Bakery Products segment manufactures and sells premium bakery products in savory and sweets categories for its retail customers such as breads, buns, pizza bases, and cakes under the ‘English Oven’ brand, which caters to the premium segment in Delhi NCR, Mumbai, and Bengaluru. The company was founded by Rajni Bector on September 15, 1995 and is headquartered in Gurugram, India.

Related stocks

BECTORFOOD – RSI Strength with Volume Build-up |BECTORFOOD is showing strength on the daily chart after a prolonged consolidation. The price has formed a rounding bottom structure and is currently testing a key resistance zone.

🔍 Key Observations:

RSI has crossed the 55 level, indicating possible momentum buildup

Volume is rising along with pr

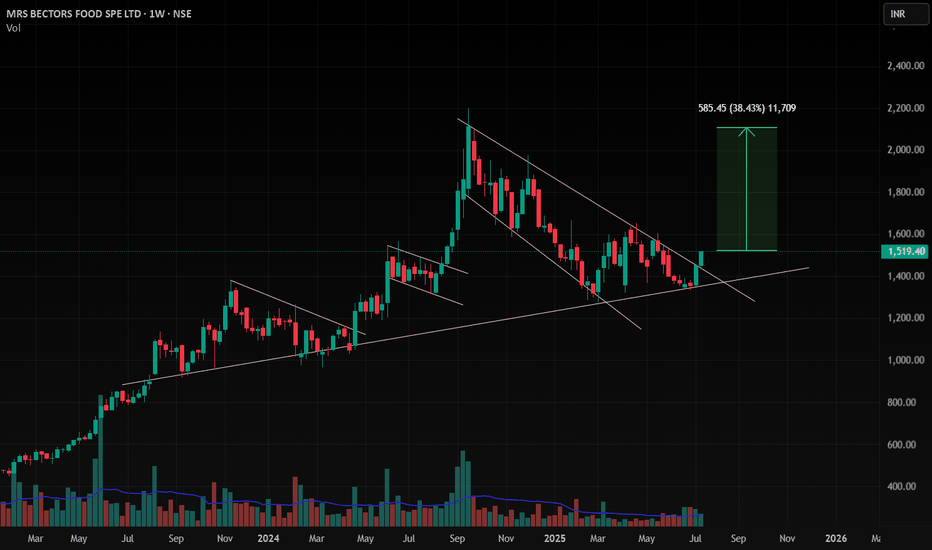

BECTORFOOD : Going long for about 0.625% of the net capitalTechnical Overview :

Took a position for about 0.625% of the net capital from a level closer to the lower trendline of the descending channel. Will be targeting the high of the descending channel for a potential move of about 43% from the current average entry price.

Fundamental Overview :

Mrs

Bector Foods (NSE: BECTORFOODS) - Daily TimeframeTechnical Analysis- Daily Timeframe

Falling Wedge Pattern:

The chart highlights a falling wedge pattern, which is a bullish reversal setup. The stock has broken out of this pattern, signaling the potential for further upside.

The breakout is confirmed by increased buying volume, suggesting str

MRS BECTORS FOOD SPE LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

BECTORFOODS Trading within Demand Zone of ₹1651 to ₹1581.05BECTORFOODS' current price stands at ₹1617, placing it within a demand zone ranging from ₹1651 to ₹1581.05. this may serve as a critical support level. Investors might consider watching this range closely for potential signs of a price reversal or consolidation, which could present a buying opportun

mrs bector food looks good for 1550++Stock coming out of sideways position

1470 looks a resistance area

1500..1550 next targets..

Stop 1400

cmp1465

risk 65 reward 100

Fmcg stocks on momentum!

Volume need to pickup!

Fundamentally good company

Swing positional call!

Not a reco to buy !

Consult your advisor before any positions!!

Mrs. B

mrs bector food looks good for 1550++Stock coming out of sideways position

1470 looks a resistance area

1500..1550 next targets..

Stop 1400

cmp1465

risk 65 reward 100

Fmcg stocks on momentum!

Volume need to pickup!

Fundamentally good company

Swing positional call!

Not a reco to buy !

Consult your advisor before any positions!!

Mrs. B

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BECTORFOOD is 268.45 INR — it has increased by 2.41% in the past 24 hours. Watch MRS. BECTORS FOOD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange MRS. BECTORS FOOD stocks are traded under the ticker BECTORFOOD.

BECTORFOOD stock has risen by 5.30% compared to the previous week, the month change is a 3.73% rise, over the last year MRS. BECTORS FOOD has showed a −28.90% decrease.

We've gathered analysts' opinions on MRS. BECTORS FOOD future price: according to them, BECTORFOOD price has a max estimate of 340.00 INR and a min estimate of 270.00 INR. Watch BECTORFOOD chart and read a more detailed MRS. BECTORS FOOD stock forecast: see what analysts think of MRS. BECTORS FOOD and suggest that you do with its stocks.

BECTORFOOD reached its all-time high on Sep 20, 2024 with the price of 2,196.00 INR, and its all-time low was 245.00 INR and was reached on Jun 20, 2022. View more price dynamics on BECTORFOOD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BECTORFOOD stock is 7.61% volatile and has beta coefficient of 0.78. Track MRS. BECTORS FOOD stock price on the chart and check out the list of the most volatile stocks — is MRS. BECTORS FOOD there?

Today MRS. BECTORS FOOD has the market capitalization of 82.41 B, it has increased by 1.50% over the last week.

Yes, you can track MRS. BECTORS FOOD financials in yearly and quarterly reports right on TradingView.

MRS. BECTORS FOOD is going to release the next earnings report on Feb 5, 2026. Keep track of upcoming events with our Earnings Calendar.

BECTORFOOD earnings for the last quarter are 1.20 INR per share, whereas the estimation was 1.23 INR resulting in a −2.44% surprise. The estimated earnings for the next quarter are 1.26 INR per share. See more details about MRS. BECTORS FOOD earnings.

MRS. BECTORS FOOD revenue for the last quarter amounts to 5.51 B INR, despite the estimated figure of 5.36 B INR. In the next quarter, revenue is expected to reach 5.44 B INR.

BECTORFOOD net income for the last quarter is 365.08 M INR, while the quarter before that showed 308.78 M INR of net income which accounts for 18.23% change. Track more MRS. BECTORS FOOD financial stats to get the full picture.

MRS. BECTORS FOOD dividend yield was 0.41% in 2024, and payout ratio reached 25.22%. The year before the numbers were 0.29% and 13.62% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 13, 2025, the company has 6.11 K employees. See our rating of the largest employees — is MRS. BECTORS FOOD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MRS. BECTORS FOOD EBITDA is 2.45 B INR, and current EBITDA margin is 11.62%. See more stats in MRS. BECTORS FOOD financial statements.

Like other stocks, BECTORFOOD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MRS. BECTORS FOOD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MRS. BECTORS FOOD technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MRS. BECTORS FOOD stock shows the neutral signal. See more of MRS. BECTORS FOOD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.