Bitcoin SV (BSV): Looking For Breakout Momentum | BullishBSV is trying to build momentum again after holding the local support area. Buyers are currently testing the 100 EMA, and if they manage to secure it, the next logical target would be the 200 EMA.

A clean breakout above that would shift momentum strongly in favor of buyers, opening the door for a move toward the upper target zone. Game plan here stays simple — monitor EMA reaction and look for confirmation before positioning for continuation.

Swallow Academy

Trade ideas

BSV/USDT Volume Box Expansion Could Drive Bitcoin SV Toward $127BSV/USDT — Volume Box Expansion Could Drive Bitcoin SV Toward $127 🚀

Bitcoin SV (BSV) continues to consolidate near $21, forming a base at the lower edge of the volume box zone, which historically has triggered strong impulsive moves once momentum returns.

If BSV confirms strength above $40.9, it would mark a significant shift in structure, opening room for a larger breakout phase with potential targets toward $89.9 and ultimately $127.

📊 Technical Overview:

Support Zone: $21.0

Volume Breakout Level: $40.9

Primary Target: $89.9

Extended Target: $127

Bias: Accumulation → Bullish continuation

This structure suggests that once BSV reclaims $40+ with confirmed volume, it could enter the next high-volume expansion, aligning with the broader recovery cycles observed in major BTC-related assets.

📈 Outlook: Accumulating before potential expansion

🎯 Targets: $40.9 → $89.9 → $127

Bitcoin SV (BSV): Waiting is Key | Expecting Good BounceBSV remains at the low-of-lows zone, where price has been consolidating after that heavy selloff. For now, we wait for buyers to reclaim this zone — that’s the key step needed before any proper recovery can start.

Once we see that reclaim, we’ll be expecting a decent bounce from here, likely leading into a cleaner market structure shift and potential continuation to upper zones.

Swallow Academy

Bitcoin SV (BSV): Could Be Good Buying OpportunityBSV is still recovering from that huge dip we had recently, which dumped the coin by 26%, leading the price towards the major support area.

Since then we have been just consolidating and trading in a sideways smaller channel. What we are looking for now is a proper MSB, which will turn the trend and give us a proper recovery with a possible 1:4 RR trading setup!

Swallow Academy

Bitcoin SV (BSV): Can Explode At Any PointBSV has been stuck in a downtrend for months, with every attempt to reclaim EMAs getting rejected. Now price is sitting at the “low of the lows” zone, a level where we want to see buyers step in and form a proper market structure break.

As long as we stay inside this accumulation area, pressure builds up — the key will be confirmation from buyers breaking out of this range. That would set the stage for a strong leg higher, with plenty of room to recover.

Swallow Academy

CAN SV HIT THE ALL TIME HIGH UP $500 ---> YEES -Mainnet, TeranodCurrently, BSV appears to be stabilizing after a period of decline, and it is trying to reach a potential maximum level of $30–$60.

We also know the power of this coin, when it has interest and building it can increase 100% in a short time frame or more.

The best way to follow a coin is day by day, since there is no guarantee that expectations will be met. This update is based on possibilities and potential effects rather than certainties.

What could allow BSV to reach a new all-time high (ATH)?

The BSV mainnet, Teranode, is designed to handle millions of transactions per second. Tests have already been completed, and the original version is expected to launch in 2025.

This process can take time until there are huge updates and confirmations on the mainnet. same time it proved before that is able to do it from this price in 126 days to ATH

Bitcoin SV (BSV): Expecting Decent Bounce From HereBSV has been forming higher lows here in combination with liquidity sweeps, which might tell us of an upcoming breakout and bullish movement.

As signs are not very clear currently, we are going to wait, wait for that breakout near the EMAs, which would act as confirmation for our buyside scenarios (and that would be the zone where we would be taking a long position as well).

Swallow Academy

Bitcoin SV (BSV): Aiming For Market Structure Break HereBSV might head for some kind of downward movement from here, or at least that's what we are looking for here.

As there is no clear reason for us to long currently, we are playing by the MSB and re-testing the game plan, so that's why we are looking for a proper MSB to form, which could open for us a potential 9% movement to lower zones.

Swallow Academy

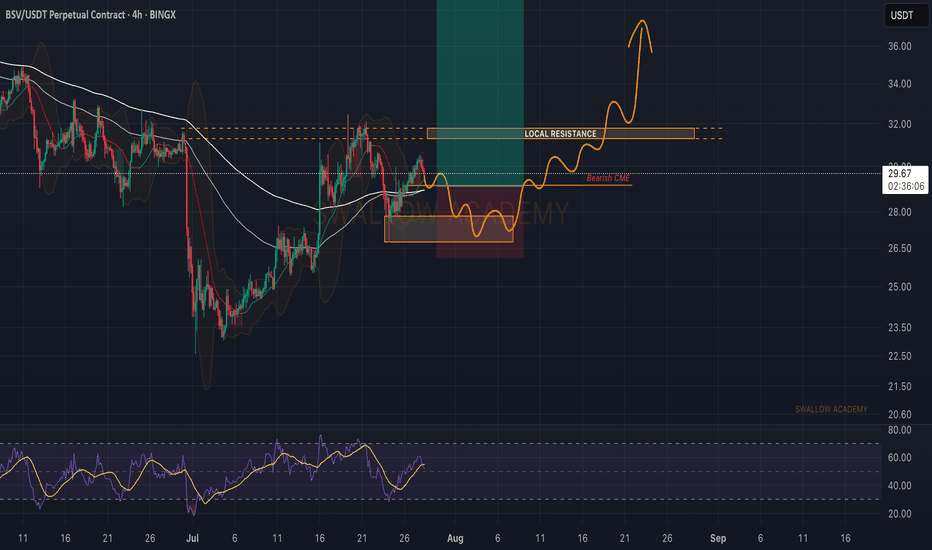

Bitcoin SV (BSV): Expecting Smaller Correction Before BreakoutBSV is going to have a smaller correction most likely which should fill the Bearish CME gap and give us a potential accumulation that we need to breakout from local resistance, which then would open us a potential 50% movement to upper zones.

Swallow Academy

Bitcoin SV (BSV): Possible Bounce Are | Eyes on 200EMABSV has filled the huge FVG that was formed during the bullish candle that we formed on the 25th of April.

As price has now cooled itself down, we are expecting another rally toward the 200EMA, where once we see the proper buyside dominance near $35, we will be going for the long position here!

Swallow Academy

Bitcoin SV (BSV): Looking For Full Recovery | Might Be Good BuyBSV is still undervalued, and after a recent drop, we had a price that still has not filled the FVGs that are sitting in upper zones. We are looking for full recovery from here so let's wait patiently.

For entry, wait for proper BOS on smaller timeframes.

Swallow Academy

BSVUSDT Forming Bullish BreakoutBSVUSDT is currently showing a promising setup that could attract a lot of attention from crypto traders in the coming weeks. The chart displays a clear descending channel, which often acts as a continuation or reversal pattern depending on the breakout direction. The recent price action near the lower trendline, combined with strong volume, suggests that BSVUSDT might be preparing for a bullish breakout that could see significant upside momentum.

With an expected gain projection of 90% to 100%+, this pair offers an attractive risk-to-reward ratio for swing traders and position holders alike. The buying interest around these levels indicates that investors are accumulating, betting on a strong reversal as the broader market sentiment stabilizes. If the price can break and close above the channel’s resistance trendline, it would confirm the pattern and potentially trigger a wave of buying pressure.

This setup is further supported by the overall improvement in market conditions, where traders are increasingly looking for altcoins with technical breakouts and solid fundamentals. BSV’s community and network upgrades continue to spark discussions, which could help sustain momentum after the breakout. Keeping an eye on volume spikes and key support levels will be essential to manage the trade effectively.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Bitcoin SV (BSV): Expecting Sideways Movement + BreakoutBSV has formed a triangle pattern where the price has been bouncing in from one side to another, preparing itself for a breakout from this pattern.

We are looking for further movement in the sideways channel, where at one point we will be looking for a breakout from the triangle pattern, where then we will be looking for slight upward movement.

But keep in mind, if we see the price break the local support zone, then we might be seeing a steep movement to $30.50.

Swallow Academy

Bitcoin SV (BSV): Strong Upside Potential | Big Dump HappenedBSV had recently dumped hardly, where we are seeing a good potential for upward movement to follow the current movement.

The risk is big here but so is the reward, which might lead the price back to the full upper area and also go for the EMAs here.

Pure play of volatility here so let's see!

Swallow Academy

#BSVUSDT #1D (ByBit) Falling wedge breakoutBitcoin Satoshi Vision is pulling back to 100EMA daily support where it seems likely to bounce and resume bullish, mid-term.

⚡️⚡️ #BSV/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (2.0X)

Amount: 4.5%

Entry Targets:

1) 38.05

Take-Profit Targets:

1) 63.54

Stop Targets:

1) 29.54

Published By: @Zblaba

AMEX:BSV BYBIT:BSVUSDT.P #BitcoinSatoshiVision #PoW

Risk/Reward= 1:3.0

Expected Profit= +134.0%

Possible Loss= -44.7%

Estimated Gain-time= 2 months

BSV/USDT Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring BSV/USDT for a buying opportunity around 36.10 zone, BSV/USDT was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 36.10 zone.

Trade safe, Joe.

BSV Rebuy Setup (12H)Since we placed the green arrow on the chart, it seems that the BSV correction has started. This correction was a butterfly diametric pattern that has now completed.

From the point where we placed the green arrow, the bullish phase of BSV appears to have begun, which should have at least 3 waves. It seems the first wave is complete, and we are currently in the second corrective wave.

We are looking for buy/long positions around the green zone to form wave C of the new bullish phase.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

BSV go to 38MBitcoin SV (BSV) has seen various price predictions, but reaching 38,000,000 seems highly unlikely based on current predictions. Analysts predict BSV could reach $168 by December 2024, $265 by 2028, and possibly $374 by 2030. Other sources suggest a more conservative outlook, with BSV potentially ranging between $36.73 and $38.30 in 2025.

Bsv usdtBsv just completed a corrective move after an impulsive move and could be a sign to another incoming impulsive move

Breaking: $BSV Spike 38% Today Amidst Breaking out of A Pennant The price of Bitcoin forked token called Bitcoin SV ticker name ( AMEX:BSV ), saw a notable uptick of about 38% today amidst breaking out of a falling wedge with current market metrics hinting at another leg up.

What Is BSV?

Bitcoin SV (BSV) emerged following a hard fork of the Bitcoin Cash (BCH) blockchain in 2018, which had in turn forked from the BTC blockchain a year earlier following the blocksize wars.

BSV claims to fulfill the original vision of the Bitcoin protocol and design as described in Satoshi Nakamoto’s white paper, early Bitcoin client software and known Satoshi writings. BSV aims to offer scalability and stability in line with the original description of Bitcoin as a peer-to-peer electronic cash system, as well as deliver a distributed data network that can support enterprise-level advanced blockchain applications.

Technical Outlook

Since April high of 2021, that saw the asset deliver a stunning 826% in gains, the asset quickly retraced losing about 94% of market value for over 4 years now. The rise in price today is integral for AMEX:BSV in order to bring back life to the project as the altcoin has been mute lately with no on chain development or ecosystem growth.

However, present market metrics shows we might experience a brief respite before another leg-up as the asset is oversold as hinted by the RSI at 92. Our next support is the $40- $37 zone.

BSV Channel ConvergenceFollowing up on the BSV/BTC chart channel, the BSV/USD chart is also at an interesting juncture. Although spikes down to the $17 area can't be ruled out, longterm this chart is suggesting buys as long as the trendline is respected.