Setup Saturday Backtesting Templates Today I will be going over a setup that I am finding and am liking. It is a mean reversion; Low of the Day Buy Setup to take out the High of Day.

I want to trade like Mcdonald's with each setup being a cookie cutter formula. It is either there, or it isn't. I don't want to guess direction or trade

Related futures

Creeping Trend Into 750. Thursday Long Opportunity. My gameplan Thursday is to see how this creeping trend plays out. I am looking for the creeping trend to layer down into 750 near the lows of these 8 Hour candles.

Price is mean reverting around the 1000 level

Creeping trends resolve themselves in one of two ways. They capitulate and blow off in

Mean Reversion Around 00's Short Down to 750I am short at 45,042 after the close of a fat green bar. My bias is down and so I sell into bull bars.

Price is currently mean reverting around 45,000 with the peak formation high above 250. I am looking for price to go down to the next level at 750.

I am using a 100 tick stop and a 265 tick tar

a return to solid solid structure affords =BUYers a cheap entry 1-3 : a swing low is followed by a one sided highly volitile swing high, this creates two set of events, first is that number 2 is now a solid low, due to surpassing the high of 1 they are proven to be stronger then them , second is the slow and controlled(ish) downtrend that follows volitile moves

Daytrading Risk Management Strategy Hold Until CloseAfter reviewing my past 500 trades, the absolute most profitable trade management is to hold until market close. If you study the daily chart, most days will close near the highs/lows of the bar.

By only using just a stop loss and no profit target, one can capture monster moves.

One trade per da

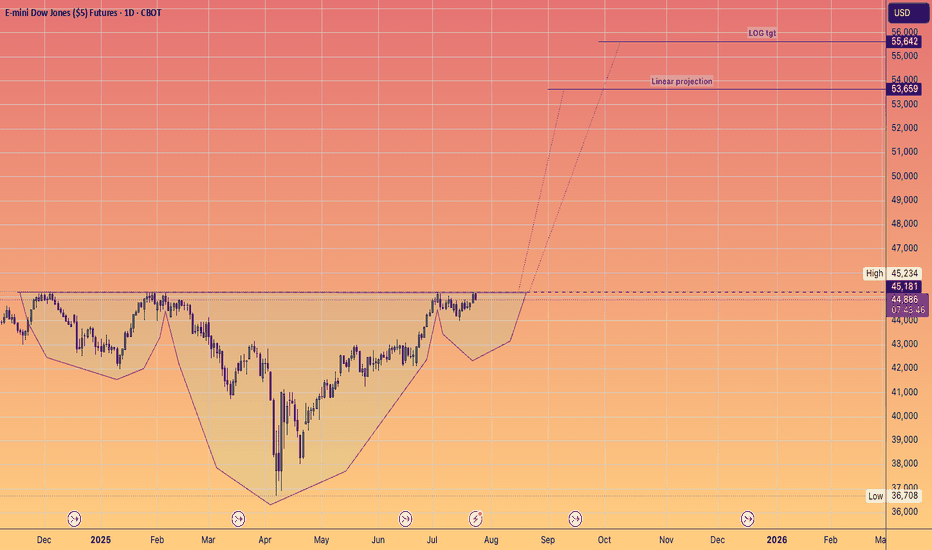

DJIA – U.S. Stock Market Corrects UpwardTrend: Upward correction after rejection from 45,220.0.

Current price: 44,794.0.

⸻

Bullish scenario

• Entry: BUY STOP 45,280.0

• Target: 46,480.0

• Stop: 44,800.0

Bearish scenario

• Entry: SELL STOP 44,190.0

• Target: 42,880.0

• Stop: 44,800.0

⸻

Key levels

Support: 44,190.0, 42,880.0

Res

a return to solid support with bullish activity = BUY 1. sellers push us down after a strong volitile uptrend

2. buyers here push up creating the high 3 , this is higher

than the sellers entrance at 1, therefore 2 is now a solid low,

as it defeated the sellers from 1

3. we get an expected pullback after a one sided highly volitile

move to the upside,

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Micro E-mini Dow Jones Industrial Average Index Futures (Dec 2024) is Dec 20, 2024.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Micro E-mini Dow Jones Industrial Average Index Futures (Dec 2024) before Dec 20, 2024.