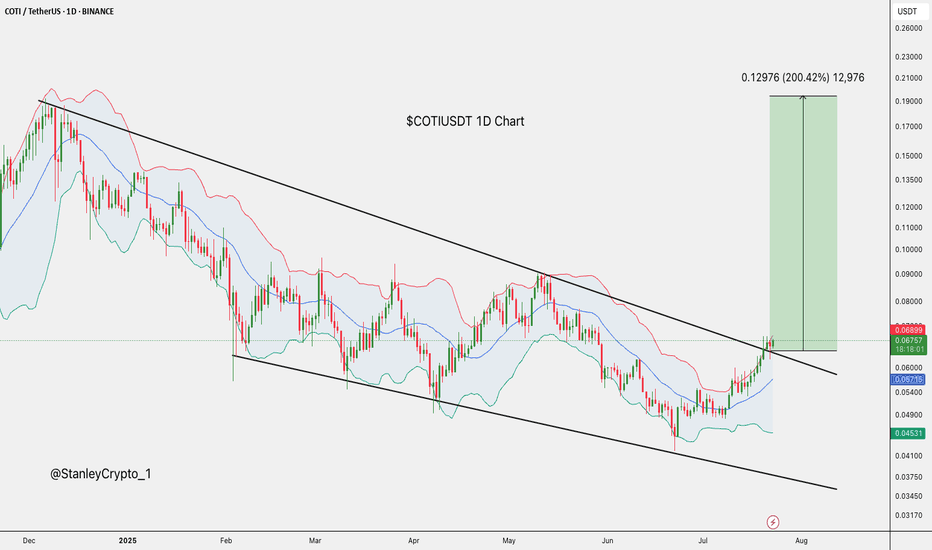

COTIUSDT Forming Falling WedgeCOTIUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 190% to 200% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching COTIUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in COTIUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Trade ideas

COTI/USDT - Smart Money Accumulation or Just a Dead Cat Bounce?After a sharp decline reaching an extreme low around $0.017, COTI has bounced strongly and managed to close back above the key demand zone at $0.047–$0.037.

This yellow zone isn’t just any level — it represents the last stronghold of buyers, a crucial area that has repeatedly held the price since 2021.

Looking closer, the latest weekly candle shows a deep liquidity sweep followed by a massive rejection — a classic sign that big players might have “cleared out stops” and begun stealth accumulation.

---

⚡ Structure & Pattern

Primary trend: Still macro bearish, but a potential double bottom pattern is forming at the major support area.

Momentum: Buyers are showing strength after a strong lower wick rejection from the zone.

Reversal confirmation: A weekly break and close above $0.065 could open the door for a larger rally.

---

🟢 Bullish Scenario

If the price manages to hold above $0.047–$0.037 and break through $0.065, COTI could extend its move upward toward:

🎯 Target 1: $0.090 (weekly resistance)

🎯 Target 2: $0.1855 (psychological resistance & strong supply zone)

🎯 Extended targets: $0.2875 – $0.4670 if strong market momentum and altcoin rotation occur.

The next few weekly candles will be critical in determining whether this is the start of a true macro reversal or just a technical relief bounce.

---

🔴 Bearish Scenario

However, if the price falls back and closes below $0.037, all bullish bias is invalidated.

Such a move could trigger a continuation to the downside toward:

⚠️ $0.018 (previous low and key liquidity zone).

A confirmed breakdown below this main support would indicate that buyers remain weak and the long-term bearish trend continues to dominate.

---

🧩 Pattern Conclusion

COTI is now at a major decision zone.

The $0.047–$0.037 area is a battlefield between buyers and sellers.

If it holds — a potential reversal is on the horizon.

If it breaks — expect another lower low continuation.

---

🔍 Additional Insight

Many major crypto reversals often begin from structures like this:

Strong rejection from multi-year support

Weekly candle with a long lower wick

Gradual increase in accumulation volume

Thus, this zone is not just a technical bounce area — it could mark the early phase of a shift from distribution to accumulation.

---

#COTI #COTIUSDT #CryptoAnalysis #TechnicalAnalysis #AltcoinSetup #SwingTrade #LiquidityHunt #CryptoReversal #SupportZone #CryptoTrading

COTI SHORT1. Chart Context

Pair: COTI/USDT

Timeframe: 1h

Current Price: ≈ 0.03299 USDT

Market has been in a downtrend with lower highs and lower lows. Price recently tested resistance and is now showing rejection.

2. Trade Setup

This is a short position (betting on price to drop).

The red/green rectangle highlights the Risk/Reward (R:R) structure:

Entry Zone: Around 0.0330 USDT (current price, at rejection point).

Stop Loss (SL): 0.03488 USDT (top of the red box).

If price climbs above this level, the short trade setup is invalid.

Take Profit (TP): 0.03043 USDT (bottom of the green box).

Target is a move down into prior support.

3. Risk/Reward Ratio

Risk (SL distance): ~0.0019 USDT

Reward (TP distance): ~0.0026 USDT

R:R ratio ≈ 1.37:1

Moderate setup; reward is larger than risk but not extremely high.

4. Support & Resistance

Resistance Zone: 0.0345–0.0350 (previous rejection area).

Support Zone: 0.0303–0.0305 (green target zone).

The trader expects sellers to defend the resistance and push the price back into the support area.

✅ In summary:

This is a short trade setup on COTI/USDT, where the trader enters around 0.0330, sets a stop at 0.03488, and targets 0.03043. The setup relies on price rejecting resistance and continuing the downtrend toward support.

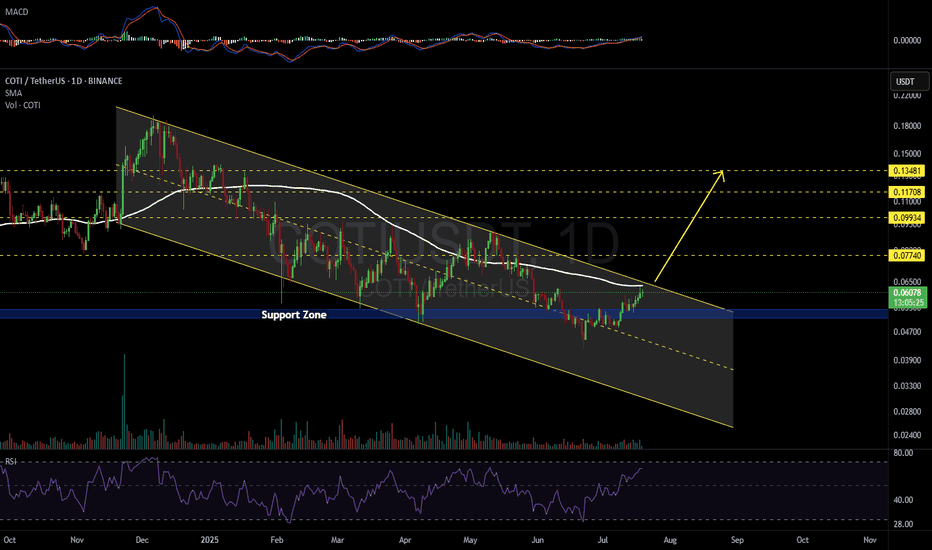

COTIUSDT Forming Falling WedgeCOTIUSDT is showing a Falling Wedge Pattern, one of the most powerful bullish reversal setups in technical analysis. This formation suggests that the ongoing downtrend may be losing momentum, and a strong bullish breakout could be approaching soon. The narrowing structure of the wedge indicates reduced selling pressure and growing demand as buyers gradually step in. COTI has been consolidating for some time, and this compression phase could soon translate into a sharp upward movement.

The volume remains strong, confirming that accumulation is taking place beneath the surface. Once the price breaks out from the upper resistance of the wedge, traders may witness an explosive rally, potentially delivering gains of 50% to 650%+ in the medium term. This kind of setup often attracts both short-term traders and long-term investors looking to capitalize on a high-risk, high-reward opportunity.

Investor sentiment around COTI is improving as the broader market shows signs of strength. The combination of bullish technicals, solid trading activity, and renewed interest makes COTIUSDT a promising candidate for a major price breakout. Keep a close watch on the breakout zone, as momentum could accelerate quickly once confirmation arrives.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

COTI/USDT potential 200%+++COTI/USDT potential 200%+++

Buy zone $0.04 - $0.06

Targets given on the chart 200% to 300%

COTI is a fast and light confidentiality layer on Ethereum. Powered by the breakthrough cryptographic protocol Garbled Circuits and secured by Ethereum, COTI introduces the most advanced and compliant solution for data protection on the public blockchain.

COTIUSDT UPDATE#COTI

UPDATE

COTI Technical Setup

Pattern: Bullish Falling Wedge Pattern

Current Price: $0.0541

Target Price: $0.0875

Target % Gain: 65.96%

OTC:COTI is breaking out of a falling wedge on the 1D timeframe. Current price is $0.0541 with a target near $0.0875, showing almost 66% potential upside. The breakout confirms bullish momentum with structure favoring continuation. Always use proper risk management.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

COTIUSDT 1D#COTI is moving within a symmetrical triangle on the daily chart and is currently facing both the Ichimoku cloud and the triangle resistance. If it breaks out above both, the potential targets are:

🎯 $0.06003

🎯 $0.06563

🎯 $0.07122

🎯 $0.07918

🎯 $0.08932

⚠️ Always remember to use a tight stop-loss and follow proper risk management.

#COTI/USDT - Bottomed out!#COTI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.05325, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.05390

First target: 0.05480

Second target: 0.05580

Third target: 0.05670

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

COTI/USDT – Symmetrical Triangle BreakoutCOTI has been consolidating inside a symmetrical triangle for several months, with lower highs and higher lows squeezing the price action.

🔎 Key Observations

Price has now broken out of the triangle resistance with a strong green daily candle.

Volume increased significantly on the breakout, confirming buyer participation.

RSI (14) is at 55.9, trending upward and above the neutral 50 mark, showing improving momentum.

Price is currently trading at $0.0551, above the key breakout zone around $0.052 – $0.053.

📊 Bullish Scenario

Holding above $0.052 keeps the breakout valid.

First resistance: $0.060

Next resistance: $0.070 (major psychological level).

Break and close above $0.070 could open the path toward $0.080 – $0.090.

⚠️ Bearish Scenario

If price falls back below $0.052, it may re-enter the triangle range.

Key supports:

$0.050 – $0.048

$0.045 (triangle base and crucial support)

A breakdown below $0.045 would invalidate the bullish setup.

COTIUSDT - Bottomed out!Many coins have already reached bottom levels, and one of the strongest among them is COTI.

It has formed a symmetrical triangle pattern and is now sitting at one of its lowest levels, which is a strong support zone — buying here is almost like getting it at “nothing.”

COTI is currently gearing up for a historical rally expected to take place in Q4 2025.

Best Regards:

Ceciliones🎯

COTI/USDT 4H Technical OutlookOn the 4-hour chart, key support and resistance levels have been identified. S1 and S2 mark the downside areas where buyers may step in, providing potential rebound zones. R1 and R2 highlight the upside resistance barriers, where sellers could apply pressure or profit-taking may occur. These zones will guide short-term trading decisions: a break above resistance could indicate bullish momentum, while a drop below support may signal extended weakness. Traders can use these levels for setting entries, stop-losses, and profit targets, while also confirming signals with volume and trend indicators.

COTIUSDT – One Bullet, Not All-InThe blue box looks like a solid area to risk 1R — but let’s keep our feet on the ground.

This isn’t about predicting tops or bottoms. It’s about testing structure with confirmation.

🟦 A single, well-managed attempt is okay — but in case a Q3 correction kicks in, this setup could still get stopped out. So instead of going heavy on leverage, I lean toward spot entries here. Spot buys also good!

All risk-on markets typically experience significant corrections in the third quarter of the year and struggle to recover from this correction until the end of the year.

🧭 Execution Flow

🔔 Alert on the blue box

🕐 Drop to 1H

📈 Look for breakout with rising CDV

✅ One controlled entry — no overexposure.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

COTIUSDT Weekly Analysis Potential Reversal?📍 Current Price Position – On Top of Historical Support!

The COTI/USDT pair is currently testing a crucial support zone between $0.0400 – $0.0517, which has been a key demand zone since early 2021. This isn't just any support — it's a macro psychological area that has repeatedly triggered strong reversals in the past.

We are at a make-or-break level, where the next move could define the mid-term trend.

---

🧩 Price Structure and Pattern

📐 The chart shows a descending triangle pattern with:

Consistently lower highs (marked by the downward yellow trendline),

Flat horizontal base around the major support zone.

This pattern can result in:

A powerful breakout if the trendline is broken, or

A sharp breakdown if the horizontal support fails.

---

📈 Bullish Scenario: Reversal Momentum Building?

If price:

Breaks above the descending trendline (~$0.0719), and

Closes a weekly candle above that resistance zone,

➡️ We could see a breakout move with targets at:

Resistance Level Target

Initial Target $0.1116

Mid-Term Target $0.1863

Strong Zone $0.2446 – $0.2861

Long-Term Bullish $0.35 – $0.4169

📌 A confirmed higher high and higher low structure above $0.11 would strengthen the bullish case.

---

📉 Bearish Scenario: Breakdown from Support

If:

Price fails to hold the $0.0517 – $0.0400 support area,

and prints a weekly close below this zone,

➡️ The next bearish targets could be:

Support Level Target

First Support $0.0260

Psychological Level $0.0200

Extreme Panic Zone $0.0150 – $0.0100

⚠️ This would indicate a capitulation phase, likely to trigger panic selling and deeper lows.

---

🧠 Strategy Notes for Traders

✅ For Position Traders:

The $0.040 – $0.0517 area is a prime watch zone for reversal setups with tight stop-loss below $0.040.

Excellent Risk:Reward potential if reversal confirms.

✅ For Swing Traders:

Breakout above the trendline offers a solid entry signal.

Targets up to $0.1863 look achievable with strong volume.

✅ For Conservative Traders:

Wait for breakout + retest confirmation before entering.

Avoid FOMO — let the weekly candle close guide your decision.

---

⚡️ Final Takeaway

> COTI/USDT is at a tipping point!

This long-standing support is the last line of defense for the bulls. A breakout can trigger a macro trend reversal, while a breakdown will extend the downtrend and invite heavier selling pressure.

Watch for the weekly close, trendline reaction, and volume behavior — the next major move is likely just around the corner.

#COTI #COTIUSDT #CryptoAnalysis #AltcoinWatch #DescendingTriangle #BreakoutTrading #SupportAndResistance #PriceAction #ChartPattern #WeeklyAnalysis

COTI Analysis (1D)The price is breaking out of an important trendline and is also reclaiming a key support zone.

⚠️ Make sure to wait for a daily candle to close above the trendline and the key level, and then enter a position on the pullback.

Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

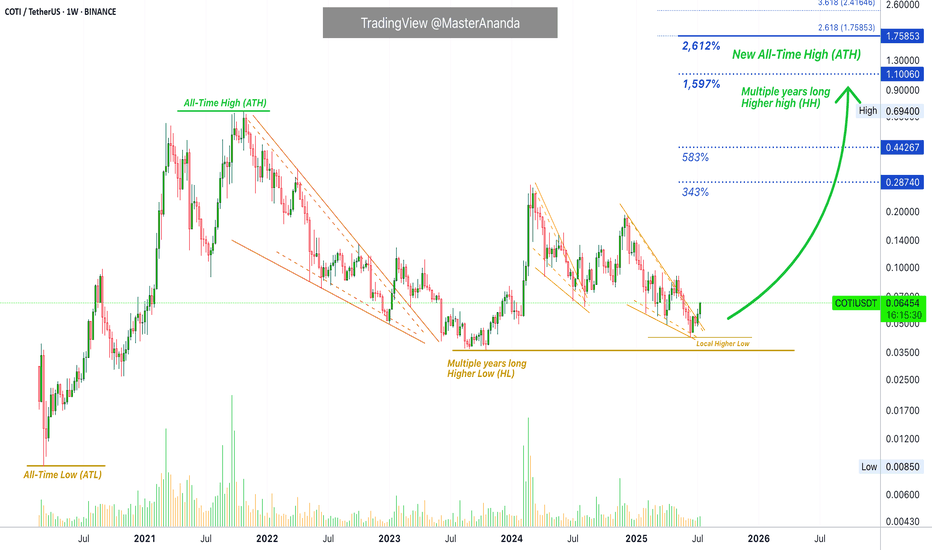

COTI Higher High (All-Time High) Confirmed · 2,612% Pot. ProfitsLet me remind you of one of the classic sayings, "higher lows will lead to higher highs —always."

While some charts are mixed; some projects produce shy lower lows and we don't know if this counts as a true lower low from a TA perspective; other pairs produce lower lows but still have potential for a new all-time high, some pairs produce double-bottoms and the situation becomes mixed; other pairs remain 100% clear. Here we have COTIUSDT with long-term higher lows.

The end of the bear market produced a bottom price that is many times higher compared to the start of the last bull market. A new all-time low (ATL) is simply not a question on this pair. The situation is 100% perfectly clear. Since we have an ultra-strong multiple-years long higher low, we can easily expect a higher high, which simply means a new all-time high (ATH) in the coming months. That's the beauty about TA and Crypto, you can predict the future if you know what to look for.

The easy targets here opens more than 580% profits potential.

COTIUSDT is trading with a full green candle today as it breaks out of a falling wedge pattern. The falling wedge is simply a downtrend. This downtrend is being broken.

On top of the long-term higher lows we have a local higher low, which is between June 2025 and October 2023. This is also long-term but not as long compared to the March 2020 market bottom and all-time low.

All this to say that market conditions are really good for this pair. The chart is super strong. This week we have a full green candle, trading at the top of the range and the session is about to close. When the session closes full green next week will be straight up. You will be witnessing the strongest action on this pair since early 2024 but with a big difference. It will be sustained. In early 2024 the big candles here only lasted three weeks. In 2025 you can have anywhere between 8-16 weeks straight up or even 24-32, etc. Whatever is needed for maximum growth to unravel. You won't be disappointed. You will be happy with the results.

Namaste.

COTI bullish ideaCOTI reacting with the rest of the market seems to have completed 1 & 2 waves in a possible 5 wave elliot wave structure.

If this holds true, there's an opportunity to catch the next retrace and 3,4,5 waves. Possible entry points I would consider would be at POC or even VAL if there is a decent reaction from price, with invalidation below the previous low.

COTI - Crazy Breakout Soooooon- COTI is trading inside the falling wedge pattern

- Price is currently nearing the resistance trendline,

- A clear breakout of this trendline will push the price higher

- we will enter a long trade after the breakout

Entry Price: 0.06696

Stop Loss: 0.03793

TP1: 0.07746

TP2: 0.10366

TP3: 0.14599

TP4: 0.25150

Don't forget to keep stoploss

Cheers

GreenCrypto