Trade ideas

Bulls Bleed at Proven Resistance - Bears Reload📊 **To view my confluences and linework:**

Step 1️⃣: Grab the chart

Step 2️⃣: Unhide Group 1 in the object tree

Step 3️⃣: Hide and unhide specific confluences one by one

💡 **Pro tip:** Double-click the screen to reveal RSI, MFI, CVD, and OBV indicators alongside divergence markings! 🎯

Title: CRV: Bulls Bleed at Proven Resistance - Bears Reload

The Market Participant Battle:

The bulls made their stand, rallying from the Black Swan low at $0.6447 (Point 3) back to the $0.7924 zone (Point 4) - but here's the critical insight: when price closed below Point 1 at Point 3, it PROVED that Point 2 ($0.7937) is where institutional sellers entered to oppose the rally. Now, price has returned to this exact proven resistance zone where those same sellers are likely reloading. The setup suggests bears who successfully defended this level before are positioned to reject bulls again, triggering a price return back down as the institutional sellers reassert control. This is a classic "return to the scene of the crime" setup where sellers previously won, and the battlefield evidence suggests they're ready to win again.

Confluences:

Confluence 1: Multi-Indicator Bearish Divergence Cluster

The 4H chart reveals a devastating truth for bulls: while price pushed higher highs, RSI, MFI, and CVD all printed equal or lower highs - a textbook bearish divergence cluster. This divergence triplet signals that momentum, money flow, and cumulative delta are all weakening despite the price advance. Divergences mark the footprints of smart money distribution, where institutions sell into retail strength. The RSI showing "Bear" zones at both Point 2 and Point 4 confirms sellers are active at these elevated levels. The CVD (Cumulative Volume Delta) candles showing negative delta on green candles further proves sellers are absorbing bullish pressure. AGREES ✔

Confluence 2: Anchored VWAP Institutional Rejection Signals

The AVWAP from Point 1 shows price crossing above the 1st standard deviation but failing to maintain it, and if we get a lower low on the bar level, it will close below before reaching the 2nd deviation - a classic sign of institutional distribution at premium levels. More critically, the AVWAP from Point 3 (the Black Swan low) shows price crossing under the 2nd deviation after reaching the 3rd deviation. This rejection from the 3rd standard deviation followed by a retreat below the 2nd suggests we're potentially at a pullback before continuing the larger downward structure. These AVWAP levels represent where institutions are willing to enter, and the rejection signatures are clear. AGREES ✔

Confluence 3: Harmonic Pattern Confluence (Bat & Shark)

The chart displays both Bat and Shark harmonic short patterns converging at the current resistance zone. The Bat pattern shows entry at $0.6447, with targets at $0.7235 (T1), $0.7136 (T2), and stop at $0.7981. The Shark pattern also validates short entries from this zone with similar target structures. Multiple harmonic patterns completing at the same price level creates high-probability reversal zones, as these patterns represent market geometry where price historically reverses. The converging harmonic ratios add mathematical precision to the resistance rejection thesis. AGREES ✔

Confluence 4: Volume Profile & Delta Absorption

The volume profile analysis reveals thin volume zones above current price and a concentration of volume at lower levels, suggesting the path of least resistance is downward. The user notes delta absorption at the current high - visible in the CVD candles showing negative readings despite bullish price action. This delta absorption indicates large sellers are meeting buyers with superior size, soaking up demand without allowing price to expand higher. When delta absorption occurs at key resistance, it often precedes sharp reversals as the imbalance tips toward sellers. AGREES ✔

Confluence 5: Trend Strength & Market Structure

The trend indicator shows a strong downtrend of 11° at 2.76% distance on the 4H chart, with the 50-bar trend indicator displaying +46° strong uptrend over the short term. However, the 100-bar shows sideways, and 150-bar shows -14° downtrend, while 200-bar shows -9° downtrend. This creates a conflicting structure where the short-term rally is fighting against the stronger intermediate timeframe downtrend - a classic setup for exhaustion and reversal. The gray background resistance zone has proven to be a ceiling multiple times, reinforcing its significance as supply. PARTIALLY AGREES ⚠️

Web Research Findings:

- Technical Analysis: CRV has resistance levels at $0.7795, $0.7972, and $0.8158 per pivot point analysis, with immediate resistance near $0.7954, where past price reactions have triggered brief rejections . CRV recently broke out of a Falling Wedge pattern on October 4, 2025, with the asset currently trading at $0.775 and showing +17.1% weekly gains, targeting $0.94, $1.04, and $1.16 . The token trades above its 20-day SMA at $0.79 and well above the 200-day SMA at $0.68, indicating longer-term bullish structure remains intact, though it sits below the 50-day SMA at $0.87 .

- Recent News/Earnings: Curve DAO voted to approve Yield Basis in September 2025, a liquidity protocol granting a $60M crvUSD credit line for Bitcoin-stablecoin pools, with the proposal securing 97% approval . CRV was added to Robinhood's U.S. platform on September 4, 2025, exposing DeFi's liquidity backbone to 25M+ users . The community is currently bullish about Curve DAO .

- Analyst Sentiment: For October 2025, analysts expect CRV price might fluctuate between $0.9002 and $0.9002, with forecasts predicting the coin could reach a maximum value of $1.45 by the end of 2025 . With a price increase of 15.40% in the last 7 days, Curve DAO is outperforming the global cryptocurrency market which is up 9.80% . Technical traders eye a potential breakout above $1.10 with the consensus on CRV being mixed, though some watch the $0.66-$0.70 zone for accumulation signals .

- Data Releases & Economic Calendar: No imminent economic data releases or events specific to CRV identified for the next 24-48 hours. Yield Basis launch is expected in Q4 2025, and Forex Pools deployment is anticipated by late 2025 .

- Interest Rate Impact: No direct interest rate impacts identified for CRV specifically, though broader crypto market sentiment remains tied to Federal Reserve policy.

Layman's Summary:

Here's the simple truth: CRV just had a big week, up over 15%, and recently broke out of a falling wedge pattern that many analysts think could push it to $0.94-$1.16. That sounds great for bulls, right? But here's the catch - you're trying to short RIGHT at the resistance level that's been tested multiple times around $0.79-$0.80. Think of it like this: a falling wedge breakout is like a coiled spring releasing, and most traders expect it to bounce higher. Your setup is essentially betting that the spring hit a ceiling and is about to snap back down.

The good news? You've got solid technical reasons: divergences (price going up but momentum indicators going down), harmonic patterns saying "reversal zone," and signs that big sellers are absorbing buyers at this level. The analysts are mixed - some see upside to $0.90+, others note the resistance. The recent Robinhood listing and $60M Yield Basis approval are bullish fundamental developments, but they're already priced in from the recent rally.

Bottom line: This is a COUNTER-TREND trade. You're shorting strength after a breakout, which is riskier than riding the trend. If you're right, you could catch a nice reversal back to $0.72-$0.68. If you're wrong, bulls could push through to $0.85-$0.90 and stop you out. It's not a bad setup - it just requires precision timing and tight risk management.

Machine Derived Information:

- Image 1: 4H chart showing price structure with Points 1-4, trend indicators, and target zones - Significance: Establishes the core narrative of the "return to proven resistance" setup where Point 2 was validated as supply when price failed below Point 1 at Point 3. Shows strong 50-bar uptrend (+46°) conflicting with longer-term downtrends. - AGREES ✔

- Image 2: Same 4H structure with red descending trendline overlay - Significance: Illustrates the downtrend resistance that price is testing, adding another layer of technical resistance confluence. The trendline rejection adds weight to the short thesis. - AGREES ✔

- Image 3: Pattern table showing Black Swan, Bat, Shark, and White Swan patterns with entries, targets, and stops - Significance: Provides precise harmonic pattern parameters with the Black Swan long at $0.6447 showing $0.7235-$0.8813 targets, while Bat, Shark, and White Swan all signal short entries around $0.777-$0.7778 with stops near $0.7981. Risk/Reward ratio of 5.37 on the Black Swan long suggests bulls had their shot already. - AGREES ✔

- Image 4: Zoomed price action showing volume profile (pink/cyan bars on left) and Point 1-4 structure - Significance: Volume profile reveals concentration of volume at lower prices with thinner volume above, indicating weak acceptance at current levels and path of least resistance pointing down. The volume footprint supports the rejection thesis. - AGREES ✔

- Image 5: 4H chart with multiple black trendlines and moving averages overlay - Significance: Shows the complexity of the current structure with multiple trendlines converging at resistance. The moving averages appearing to flatten/roll over could signal momentum exhaustion. AGREES ✔

- Image 6: Same structure with Bollinger Bands visible (cyan upper/lower bands) - Significance: Price approaching or at upper Bollinger Band suggests potential overextension. The bands provide a statistical envelope, and price at the upper band often sees mean reversion pressure. - AGREES ✔

- Image 7: Full indicator panel - OBV, RSI, MFI, CVD candles visible - Significance: CRITICAL EVIDENCE. RSI marked "Bear" at high, showing divergence. MFI declining while price rises. CVD candles showing negative delta (red/green contrast). OBV relatively flat despite price rally. All four indicators confirm distribution and bearish divergence. This is the strongest confluence. - AGREES ✔

- Image 8: Same indicator view with clearer CVD candle detail - Significance: CVD candles crystal clear here - green price candles with underlying red/negative delta, proving sellers are absorbing all buying pressure. This is textbook institutional distribution. - AGREES ✔

- Image 9: Clean 4H chart view showing the basic 1-2-3-4 structure - Significance: Provides clean visual of the setup narrative without clutter. The simplicity shows how obvious the "proven resistance" story is once the pattern is identified. - AGREES ✔

Actionable Machine Summary:

The machine-derived visual analysis provides overwhelming confluence for a short setup: (1) All nine charts show consistent price structure with Points 1-4 clearly marked, establishing the narrative of return to proven resistance. (2) The indicator panels (Images 7-8) deliver smoking-gun evidence of bearish divergence across RSI, MFI, CVD, and OBV - all showing weakness while price climbs. (3) Volume profile analysis indicates thin acceptance at current prices with volume concentration lower. (4) Harmonic patterns (Image 3) mathematically validate the reversal zone with three short patterns converging. (5) Bollinger Band extension suggests statistical overreach. The visual evidence is unanimous: sellers are active, momentum is diverging, and institutional footprints point to distribution. For trade execution, this means: tight entry at current levels ($0.7720-$0.7780), stop above the proven resistance at $0.7981, targets at harmonic levels $0.7235 (T1), $0.7136 (T2), $0.7169 (T2 alternate), with extended targets to $0.5974 if the move extends. The machine confirms: this is a high-probability reversal zone with 5.37:1 R/R per the harmonic calculator.

Conclusion:

Trade Prediction: SUCCESS ⚠️ (WITH CRITICAL WARNINGS)

Confidence: MEDIUM

Here's My Honest Assessment:

This is a TECHNICALLY VALID but COUNTER-TREND setup. Let me be crystal clear about both sides:

**Why This Could Succeed (Key Reasons for Success):**

1. **Proven Resistance Zone**: Point 2 at $0.7937 was validated as supply when price failed below Point 1, and you're shorting the return to this level - this is legitimate price action logic

2. **Quadruple Bearish Divergence**: RSI, MFI, CVD, and OBV all showing weakness while price rallies - this is institutional distribution, period

3. **Harmonic Confluence**: Three separate harmonic patterns (Bat, Shark, White Swan) all converging at this reversal zone is not coincidental

4. **Delta Absorption Evidence**: Negative delta on green candles proves sellers are meeting buyers with size - the footprint doesn't lie

5. **Volume Profile Support**: Thin volume above, concentration below suggests poor acceptance at current levels and easier path down

**Why This Could Fail (Key Risks):**

1. **You're Shorting a Breakout**: CRV just broke out of a falling wedge on October 4th - most analysts are calling for $0.94-$1.16 targets, meaning trend momentum favors bulls SHORT-TERM

2. **Strong Recent Momentum**: +15.40% in 7 days, +17.1% weekly performance shows bulls have conviction and could push through resistance

3. **Bullish Fundamental Catalysts**: $60M Yield Basis approval and Robinhood listing are recent positives that could fuel another leg up

4. **Mixed Analyst Sentiment**: While you have technical confluences, fundamental analysts expect $0.90-$1.45 by year-end, not a crash

5. **Counter-Trend Nature**: Intermediate trend (200-bar) is down, but short-term (50-bar) is up +46° - you're fighting the shorter-term momentum

**Risk/Reward Assessment:**

Per the harmonic patterns, your R/R is 5.37:1 if you use stop at $0.7981 and target $0.7136-$0.5974. That's EXCELLENT risk/reward. However, the trade requires PRECISION - your stop is tight (only ~2.5% above entry), and if bulls push through on momentum, you get stopped quickly.

**What The Data REALLY Says:**

The divergences, harmonic patterns, AVWAP, and delta absorption are ALL REAL and ALL VALID bearish signals. However, you're catching a reversal attempt on a newly-broken bullish pattern. This means:

- If resistance holds → You could see a sharp 8-15% drop to $0.71-$0.68 zone quickly

- If bulls break through → Momentum could carry to $0.85-$0.90 before exhausting

**Final Recommendation: TAKE THE TRADE - BUT WITH REDUCED SIZE & TIGHT RISK MANAGEMENT**

This setup has enough technical merit to take, but given the counter-trend nature and recent bullish breakout, I'd recommend:

- **Position Size**: 50% of normal size due to counter-trend risk

- **Entry**: $0.7720-$0.7780 (current zone)

- **Stop Loss**: $0.7981 (HARD STOP - no exceptions)

- **Target 1**: $0.7235 (take 50% off)

- **Target 2**: $0.7136-$0.7169 (take another 30% off)

- **Target 3**: $0.5974 (let 20% run if it really crashes)

- **Time Horizon**: 1-3 days for initial targets

**The Truth**: Your analysis is solid, your confluences are real, and your technical setup is valid. However, you're trying to catch a knife just after bulls broke out. If you can accept that risk, keep your size small, and honor your stop, this trade has excellent R/R. Just understand: if bulls push through $0.80 with volume, you need to exit immediately - don't fight a breakout with momentum.

**Bottom Line**: Skilled counter-trend setup with 5:1+ R/R, but requires discipline and smaller size due to swimming against recent momentum. The divergences and harmonic patterns say "reversal imminent," but the falling wedge breakout says "one more push higher possible." Trade it, but respect it. 🎯

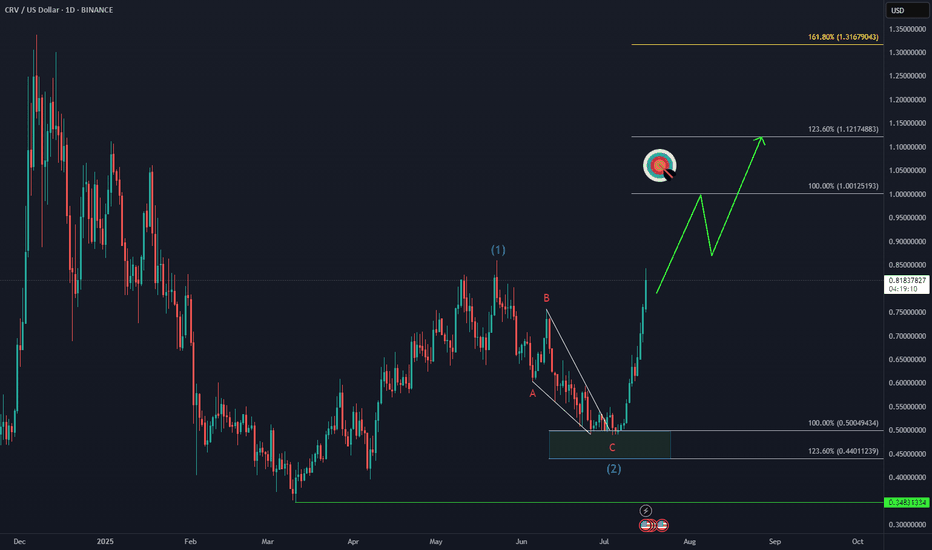

CRV Still CorrectingI don´t see the short pump generated by Powell´s speech as a major momentum change catalyst.

Bearish divergence on RSI: In early August, RSI formed lower highs while price pushed to higher highs—signaling fading bullish momentum. RSI has continued to drift lower since, confirming weakness.

No bullish divergence at recent lows: Recent drops toward the $0.80 support were not accompanied by RSI divergence. Both price and RSI made equal or lower lows, indicating no hidden buying strength.

100% Fibonacci extension target: The 100% extension of the previous bearish leg points to $0.746 as a likely next downside target if support fails.

Strong resistance overhead: Price has been rejected three times from the $1.00–$1.05 zone, marking it as a key supply area. Bears retain control unless bulls break and sustain above this level.

CRVUSDT 3D CURVE DAO TOKENDecided to update the idea. As always, key support and resistance levels are marked on the chart — along with price reactions at those zones.

Currently, we’re observing a potential breakout from a bull flag formation. The mid-term target lies in the $2.3 – $3.4 range, with a possible extension up to $4.8 as a maximum target.

⚠️ Don’t forget: there’s still a chance we get a retest of the bull flag — around the $0.64 level — before any major move to the upside. Manage your entries accordingly

CRV/USD Under Pressure: Breakdown Signals Bearish Continuation

Downtrend in progress: The price is making lower highs and lower lows, confirming a bearish market structure.

Price below key moving averages: The candles are trading below the midline of Bollinger Bands and the moving average, indicating sustained bearish pressure.

Resistance near $0.55–$0.60: Previous support now turned resistance, tested and rejected multiple times.

Support zone near $0.48–$0.45: Recent lows and potential next area of demand.

CRV/USD on Coinbase Daily Chart Shows Strong Turn UpCRV/USD on Coinbase. This is a daily chart. The grey MA is the 200. The green is the 314 MA.

Looking at a 3d chart it is easy to see CRV is making a turn around after long downtrend.

The Daily chart here show a move up after ranging roughly between the 200 and 314ma's.

I have an alert set for a cross about the 200ma on the daily chart. If all looks good on lower time frames (1 and 4 hour) will be a LONG for me.

This is a really nice setup that could run and run. No prediction of take profit area. Just go with it and wait for a turn around. Could also be like the previous spike.

Once Crvusd confirms the invh&s breakout the target is .8737Currently firmly above the neckline of this inverse head and shoulders pattern. Could definitely still find a way back below the neckline but if it does return to the neckline and maintain it as support that is a solid place to go long or add to a position for my own personal strategy. *not financial advice*

CRV about to pull epic moveCRV is lagging behind major cryptos as it had done bigger correction since 2021 (when majors were already falling in 2022, CRV decided to do one more fakeout with new local top and therefore developed lag and need for deeper correction).

Recent bounce up revealing it tested S/R range at fibb 0.5 and then corrected to make higher low (same thing BTC and XRP did before pushing to new ATH).

Next leg for CRV will be push above Jan 2022 high - likely target being fibb 1.272 extension. From there a bit of consolidation before another push higher to test ATH at fibb 1.618 range.

CRV/USD "Curve Dao Token vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.4600) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 3H timeframe (0.3800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.5800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CRV/USD "Curve Dao Token vs U.S Dollar" Crypto Market Heist Plan is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, On Chain analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CRVUSDT Long after Liquidity SweepPrice Action & Range:

The price has been in a downtrend, forming a range low and a range high.

There is a clear liquidity curve, showing a gradual decline in price before stabilizing.

The price recently tested the range low, where manipulation occurred (highlighted in grey).

A potential bullish reversal is anticipated, aiming toward the range high.

Key Levels:

Range Low: The lowest price level in the marked range, acting as strong support.

Range High: The highest price level in the marked range, acting as resistance.

Two intermediate target levels are indicated.

Manipulation Zone:

A grey box at the range low signifies market manipulation, likely a stop-hunt or liquidity grab before a move up.

Future Price Projection:

An upward arrow suggests a forecasted price increase toward the range high.

1M Candle Overview:

The right side of the chart includes a monthly (1M) candlestick, showing significant volatility with a large wick.

Summary:

The chart suggests that CRV is currently at a strong support level, and after a manipulation event, the price is expected to rally towards the range high.

The analysis aligns with a liquidity-based trading strategy, aiming to capture the next big move.

CRV low risk high return? Ou YES!Hello followers and haters,

I figured out that almost everyone here hates longterm analysis so I will post another one.

We can see CRV is in our FIRST BUY ZONE , zone where I personally started accumulating tokens just now and will continue as long as we are in the zone.

IF we drop lower to the ALL IN zone as I call them :D I will be putting even more money in this coin. Hopefully we can see that happen as we broke the trendline.

We are looking to take some profits on the FIRST TP where we can expect anywhere from 220% to 270% depending on our average buy price which is an amazing return imo.

Second TP will bring us around 760% from the first buy zone!

IF we drop lower second TP will bring us an amazing 1260%!!! And that is not even an ATH for CRV!

Just to add something to make you think.

From where price is right now if we drop to ALL IN zone we are talking about -30% to -55% drawdown. Are you will to hold this small drawdown in order to get from 220% to possibly over 1200% gain?

As always please play it smart, do not over risk and invest only what you are willing to lose. And most importantly be patient!

CRV Downtrend Losing SteamWe've fallen 70% from December highs, and the downtrend if beginning to show some weakness.

Price is still grinding down, but we're touching oversold levels, and RSI divergence is starting to show up.

Strong gray resistance could serve as the catalyst for a reversal. Key resistance levels shown in green.

FIRST TRADE EVER!!!I am glad I got to make myself a quick 5% using support and resistance as my confidence booster also as you can see I used a buy limit not a market or a stop loss, reason being if it did reach buy limit or didn't I wouldn't emotionally feel anyway about it YES paper trading still teaches you until you are fully prepared... God bless

Curve DAO with a Comeback in SightTechnical analysis indicates signs of a trend reversal, suggesting renewed investor interest and a potential rebound in CRV's value as DeFi adoption accelerates. This is a pivotal moment for Curve's resurgence.

Curve DAO is a decentralized exchange and automated market maker (AMM) tailored for efficient, low-cost stablecoin trading and liquidity provision. Governed by its token, CRV, Curve is a cornerstone of DeFi, connecting protocols and optimizing liquidity across multiple blockchain ecosystems.

Future Value Proposition

As decentralized finance expands, Curve’s dominance in stablecoin markets and interoperability across chains make it indispensable to the DeFi infrastructure.

Target fib 1.618= $10

CRV appears to breaking up from double bottom necklineIf you zoom in you can see the previous daily candle closed on the neckline with exact body support and now the current candle is having a nice bullish impulse, which suggests that it could validate the double bottom relatively soon. If it has a few days of correction n this zone it will also form a right shoulder to an inv h&s pattern that would then materialize with a neckline slightly above this double bottom neckline as I hypothesized my previous curve idea which I will provide a link to below. That inv h&s pattern would then have a slightly higher breakout target than this double bottom will should it materialize. For now the double bottom is the one to focus on as it seems very close to validating. Curve is likely overextended at this point so it could easily go back and forth on the neckline here before the real lift off. *not financial advice*

CRV built a burj khaifa on its goldencrossCRV easily could just keep going parabolically vertical here but this would also be a very nice place to catch its breath and attempt to complete the right shoulder to an inv h&s pattern. Just in case I will be watching this trendline to see if it can break above it in the next few candles or not *not financial advice*

CRV potentially breaking above a Double bottom neckline hereCurve like any other altcoins has responding very parabolically to its goldencross. It has now gone above a potential double bottom neckline, however, as much as it has pumped recently I would not be surprised to see it correct back down below this neckline for a bit. If it does that it may form another neckline slightly higher for a potential inverse head and shoulders pattern. If it does just continue up fro here instead then the target shown on the above chart is the ost probable one to expect. *not financial advice*