Grade A Copper Futures (Jul 2031)

No trades

Related commodities

Copper at a Historic Barrier

Short-Term Technical Analysis (Weeks to Months)

On the monthly timeframe, copper futures are testing a major multi-decade resistance, represented by the purple trendline connecting historical highs. Price reaction here will define the medium-term direction.

The rising moving average (orange line

COPPER IS PRIMED AND READYSo this decade precious metals have finally shown volatility. Gold and Silver have been a highlight especially with the past Administration boasting EV, GREEN-NEW DEAL, and now with AI; Precious metals are showing that people as of right now prefer a physical safe haven asset rather than “code” lik

The Next Metal Sitting on the Launch Pad - CopperDemand Drivers,

electric vehicles (EVs) using up to four times more copper than traditional cars, renewable energy infrastructure like solar and wind, and power grid upgrades. AI data centers, electrification projects, and defense spending add further pressure, while emerging markets like India saw

LME COPPER: The Grand Finale – Targeting $12,900 (Wave 5)Ticker: CA1! (LME Copper) Timeframe: Weekly (1W)

Key Observations

1. Wave Structure

The global benchmark is strictly following a multi-year Rising Parallel Channel.

We are currently in Wave 5, which is the final impulsive leg of this super-cycle. This phase is typically explosive but ends with a

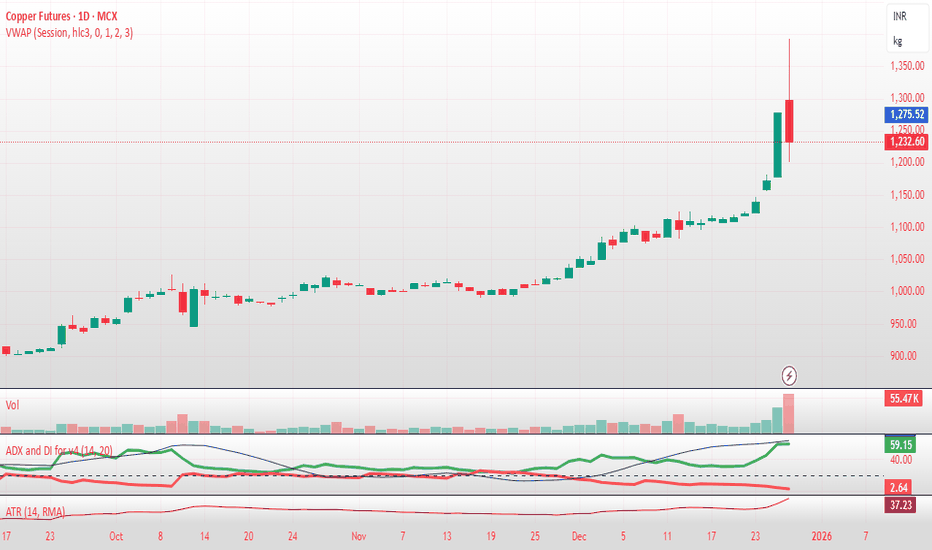

Copper MCX Future - Weekly Analysis - 15-19 Dec., 25MCX:COPPER1!

Copper MCX Futures — Chart Pathik Weekly Levels for 15–19 Dec. 2025

(If these levels add value to your trades, a quick boost or comment goes a long way in supporting this free content and keeping our trading community thriving!)

Copper Futures are trading near 1,098 after a sharp i

Copper Shows Steady Relative Strength Against Equities (HG1!/SPYCopper continues to show steady relative strength against the S&P 500 on the daily timeframe.

Because copper is highly sensitive to economic activity, this ratio often provides an early read on underlying growth trends and industrial demand.

Key observations from today’s structure:

• Price remains

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Grade A Copper Futures (Jul 2031) is 12,212.50 USD / TNE — it has risen 0.84% in the past 24 hours. Watch Grade A Copper Futures (Jul 2031) price in more detail on the chart.

Track more important stats on the Grade A Copper Futures (Jul 2031) chart.

The nearest expiration date for Grade A Copper Futures (Jul 2031) is Jul 16, 2031.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Grade A Copper Futures (Jul 2031) before Jul 16, 2031.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Grade A Copper Futures (Jul 2031) this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Grade A Copper Futures (Jul 2031) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Grade A Copper Futures (Jul 2031). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Grade A Copper Futures (Jul 2031) technicals for a more comprehensive analysis.