Trade ideas

MANTAUSDT Forming Falling WedgeMANTA/USDT is setting up a very interesting technical picture — price is contracting into what looks like a falling-wedge formation, which often signals a potential bullish reversal. The tightening range, combined with volume that’s beginning to pick back up, suggests that accumulation could be building and a breakout to the upside may be imminent. If the wedge’s upper trendline gives way with strength, we could see MANTA run significantly higher.

On the fundamentals side, Manta Network is a multi-modular blockchain ecosystem focused on zero-knowledge (ZK) applications. It has two main chains: Manta Pacific (a Layer 2 chain optimized for EVM-native ZK apps) and Manta Atlantic (a privacy-centric Layer 1). This dual-chain architecture allows for both composability and data privacy, making Manta especially relevant in today’s Web3 infrastructure space.

Tokenomics also support the trade thesis: MANTA has a total supply of 1 billion tokens, with roughly ~449 million circulating currently, and MANTA is used for staking, governance, and network fees.On top of that, a recent partnership with Symbiotic brings “fast finality” to Manta Pacific via restaking mechanics, which could further incentivize users and operators to lock in their MANTA.

MANTAUSDT UPDATE#MANTA

UPDATE

MANTA Technical Setup

Pattern: Falling wedge pattern

Current Price: $0.1216

Target Price: $0.2807

Target % Gain: 100.07%

Technical Analysis: MANTA is breaking out of a falling wedge pattern on the 1D chart, showing early bullish momentum as price pushes above short-term resistance while holding higher lows. The breakout attempt suggests buyers are gradually stepping in, and a confirmed close above the wedge’s upper trendline would strengthen the bullish case. If momentum continues, price may move toward the measured target near $0.2807.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

MANTAUSDT 1D#MANTA is moving inside a falling wedge pattern on the daily chart. It is currently facing resistance from the Ichimoku cloud. Volume has increased, which is a positive sign. If the price breaks out above the Ichimoku cloud and the wedge resistance, the potential upside targets are:

🎯 $0.1508

🎯 $0.1873

🎯 $0.2169

🎯 $0.2464

🎯 $0.2884

🎯 $0.3420

⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

MANTAUSDT Bullish Channel Breakout!MANTA is showing a potential bullish breakout from a descending channel that has been holding price down throughout October. The recent strong recovery and breakout attempt above the upper trendline indicate early signs of trend reversal and possible momentum shift to the upside.

Key Points:

-Price has broken the upper boundary of the descending channel after multiple rejections.

-Volume increase on breakout confirms buyer activity.

- Horizontal volume profile shows a strong liquidity base near $0.10 – $0.11, which could act as solid support.

- Short-term target zone lies between $0.18 – $0.20, aligning with the next major supply area.

- Ideal invalidation below $0.095.

Buy zone : Above $0.115

Stop loss : $0.095

Cheers

Hexa

OMXHEX:MANTA BINANCE:MANTAUSDT

#MANTA/USDT – Bullish Setup Alert ?#MANTA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.190, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.186.

Entry price: 0.196

First target: 0.205

Second target: 0.214

Third target: 0.225

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

MANTA/USDT – Long Setup Alert!MANTA has just broken out of a massive Inverse Head & Shoulders pattern on the 8H chart — a bullish reversal signal that could ignite a strong upside rally. 📈

Setup Details:

Entry: CMP – 0.248

Stop Loss: 0.227 (below neckline retest)

Targets:

🎯 TP1: 0.34

🎯 TP2: 0.42

🎯 TP3: 0.459

Leverage: 5x max (adjust risk accordingly)

Why This Setup?

✅ Clean breakout above neckline after weeks of consolidation

✅ Volume supporting the breakout

✅ Pattern target aligns with strong resistance zone above

⚠️ Risk Management: Stick to your SL. A failed retest can trap late entries.

Bulls are in control — let’s ride this momentum!

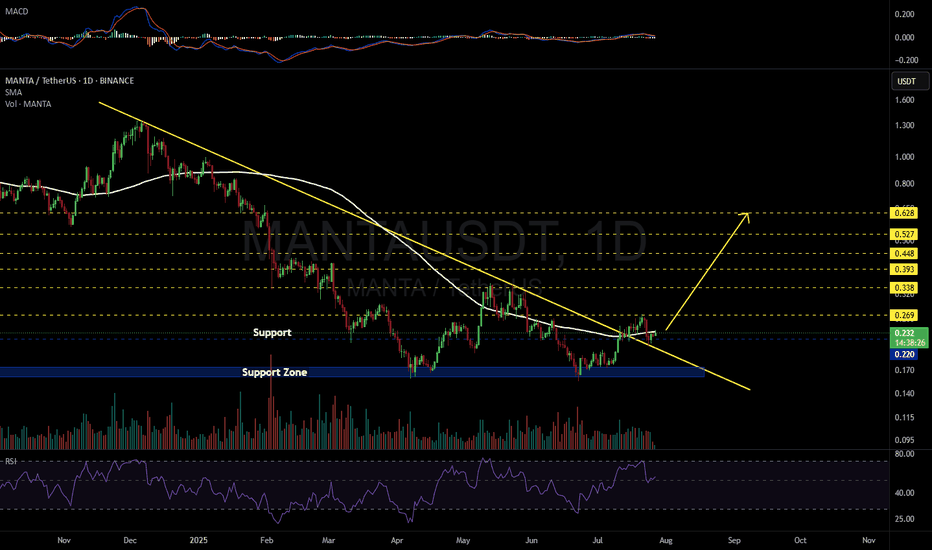

MANTAUSDT 1D#MANTA has broken above the descending resistance on the daily chart, and the retest has been successfully completed. It is now facing the daily SMA100.

In case of a breakout above it, the targets are:

🎯 $0.269

🎯 $0.338

🎯 $0.393

🎯 $0.448

🎯 $0.527

🎯 $0.628

⚠️ As always, use a tight stop-loss and apply proper risk management.

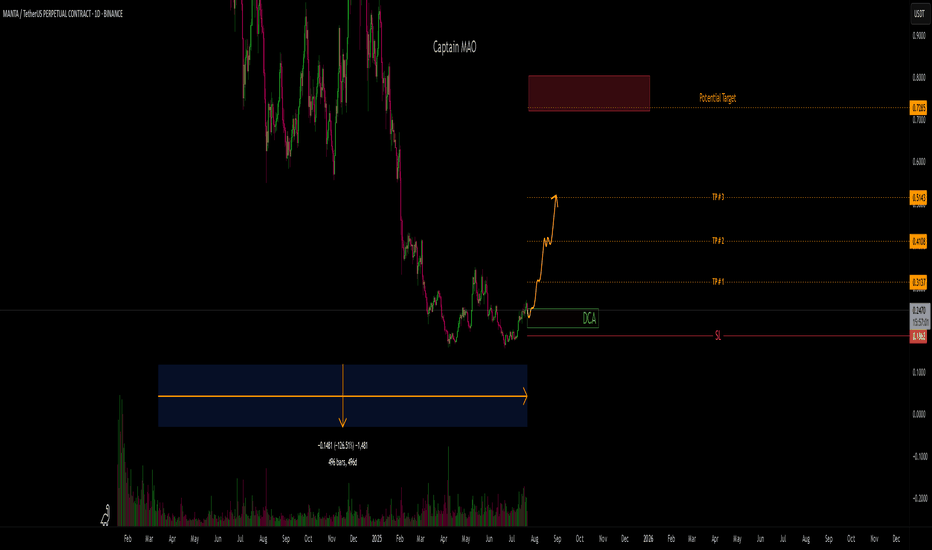

MANTA/USDT +100% has been in a downtrend for near 500 days, but the last 100 days show clear signs of reversal. Price has been ranging between the $0.15–$0.30 zone, indicating accumulation. Now it appears to be gearing up for a trend reversal, with the first breakout leg likely to lead into a much bigger move.

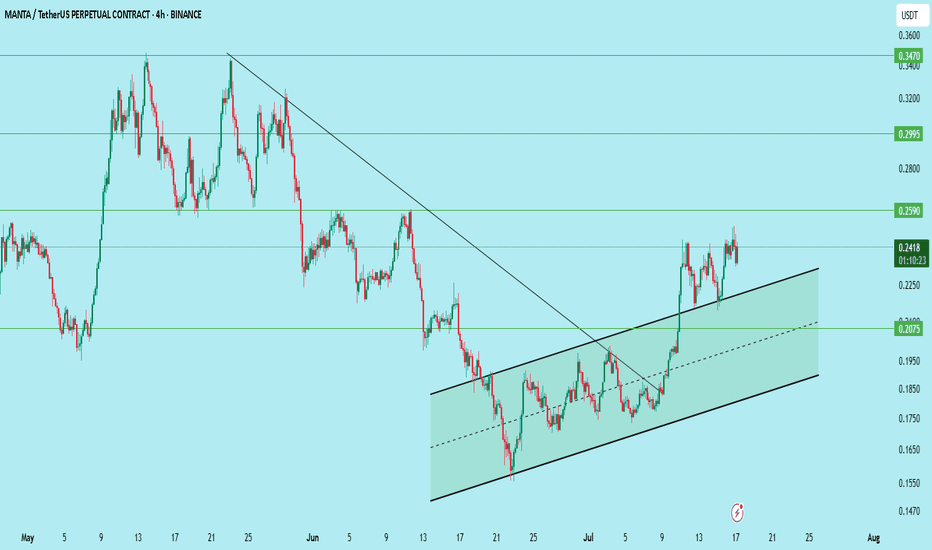

MANTA/USDT – Bullish Setup AlertMANTA has broken out of its long-term downtrend and is now trading within a clear rising parallel channel on the 4H chart.

Structure:

Downtrend broken

Higher highs and higher lows forming

Price respecting channel boundaries

Setup:

Entry: 0.225 (wait for retest)

Stop Loss: 0.2075

Target 1: 0.259

Target 2: 0.2995

Target 3: 0.347

Support: 0.225 / 0.2075

Resistance: 0.259 / 0.2995

Wait for the retest before entering. Risk-reward is attractive if the structure holds.

DYOR. Not financial advice.

MANTAUSDT Forming Descending ChannelMANTAUSDT is shaping up to be one of the more intriguing setups in the market right now, showing a well-defined descending channel pattern. This technical formation often signals a healthy consolidation phase within a broader trend, creating a launchpad for an eventual breakout. With trading volume remaining good and steady, there is a strong foundation for a significant move that could yield an 80% to 90% gain once the channel’s resistance is convincingly broken.

The MANTA project itself is increasingly attracting investor interest, thanks to its innovative approach to DeFi and cross-chain privacy solutions. As the crypto sector continues to look for new ways to scale and protect user data, MANTA stands out as a project that combines real-world use cases with strong tokenomics. This growing community interest can add momentum to the pair’s technical breakout, potentially driving the price rapidly towards its expected targets.

From a technical perspective, the descending channel acts like a coiled spring. When prices repeatedly test the lower support and upper resistance of the channel, traders watch for a breakout confirmation, which can lead to a sharp trend reversal. The combination of this reliable pattern with increasing investor confidence makes MANTAUSDT a pair worth watching closely for bullish signals in the coming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MANTA Holding Rising Support — Eyes on BreakoutMANTA is once again respecting the rising support line and showing early signs of holding the structure.

Price action remains constructive — despite recent volatility, buyers are still defending the trendline well. As long as this rising support continues to hold, the setup remains bullish.

The next key area to watch is the resistance zone above. A breakout through that level could open the door for a much larger move, as visualised in the projected path.

For now, MANTA is in a healthy consolidation phase along the trendline. If momentum builds from here, it could trigger the next leg higher.

#MANTA/USDT#MANTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.290.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.305

First target: 0.329

Second target: 0.348

Third target: 0.373

Manta Classic Bullish Signals = Bull Market Confirmed—PP: 1900%This analysis can be used not only to spot the trading opportunity that is now MANTAUSDT, but also for learning purposes. Let's go back to basics.

Here MANTAUSDT is breaking daily above EMA55. This break is happening with a full green candle and yesterday's candle also closed full green. Today's full green candle has above-average trading volume and is coming after several short-term higher lows. So this is a constellation of signals. One signal, the break of resistance, supported by many additional signals (volume, candles and chart pattern).

The classic signal is the break above EMA55 on the daily timeframe. This confirms a bullish potential for the mid-term, minimum, which means 3 months.

The next signal comes from the RSI, it is super strong. A hyper bullish RSI while a project is trading at bottom prices is another classic bullish strong reversal signal. It is present here.

These together, with marketwide action, what the rest of the market is doing, is more than enough for me to say: Manta is going up.

Thank you for reading.

Namaste.

MANTA: The Pacific#MANTA is one of the Binance Launchpool coins listed in late 2023–early 2024, most of which dumped heavily post-launch, draining liquidity from beginner users.

Despite that, OMXHEX:MANTA may have completed a major zigzag correction after a strong bounce from ATL.

Holding above that low could spark a major bull-run, potentially recovering early investor losses.

#MantaNetwork

Manta Network Bottom Situation—Trading Tips & Tricks (575% Rise)We have a situation here where the market bottom has been confirmed.

Notice that MANTAUSDT is trading above its 11-March low but below its 3-Feb. low. The pairs that are trading above the 3-Feb. low are stronger from a TA perspective and from a trading perspective and likely a fundamental perspective as well, compared to those trading below.

They are stronger first because the recovery is strong and second because the crash was smaller. In both cases, the rise and the drop, the market showed more support and action on these. This is something to keep in mind when choosing your pairs.

Stronger pairs tend to produce better results.

When retraces and corrections happen, they tend to happen all across. So those stronger will continue to outperform and you better choose those when choosing you Altcoins, with some exceptions of course.

There are thousands of Altcoins and it is hard to choose.

For me, I chose on 7-April when the bottom hit, so all are green, but the world (and trading) doesn't end there. The truth is that bottom prices are great but available only for the short-term.

You can use moving averages as well to know which pairs are better than another and which ones are more likely to move next. The ones trading above the longer EMAs are the ones that are stronger.

Just a few tips and tricks to improve your chances of success.

Thank you for reading.

Namaste.

MANTA/USDT – Bullish Structure Forming MANTA/USDT – Bullish Structure Forming

MANTA is showing early signs of a trend reversal, with multiple confluences indicating strength from the bulls. After a prolonged downtrend, the asset has not only broken key resistance levels but also flipped the 50 EMA, a major dynamic resistance, into support.

✅ Key Technical Highlights:

Double Bottom Formation:

The chart has clearly printed a double bottom, one of the most reliable reversal patterns.

This formation suggests that bears are losing control and buyers are starting to step in with conviction.

Breakout Above the 50 EMA:

Price has decisively broken above the 50 EMA (~0.2127), which had previously acted as dynamic resistance during the downtrend.

Notably, the price retested the 50 EMA and successfully bounced, confirming it now as support.

Resistance Flip to Support:

The previous horizontal resistance zone has been breached and retested, reinforcing its role as a demand zone.

Market Structure Shift:

Lower highs and lower lows have now transitioned into higher lows and higher highs, signaling a structural shift from bearish to bullish.

Momentum and Candle Structure:

The bullish candles post-retest show strong momentum with minimal upper wicks — a sign of buyer strength.

MANTA Breakout Trade Setup – Long OpportunityMANTA has broken out of a clean ascending triangle formation, confirming bullish strength. The breakout happened just above a key horizontal resistance and the 50 EMA, flipping both into support.

The chart shows a strong impulse candle on breakout, with a well-placed stop below the ascending trendline and a healthy 4.5R risk-reward to the upside. RSI sits near neutral (50.86), suggesting there's still room for price expansion.

DYOR, NFA