Market insights

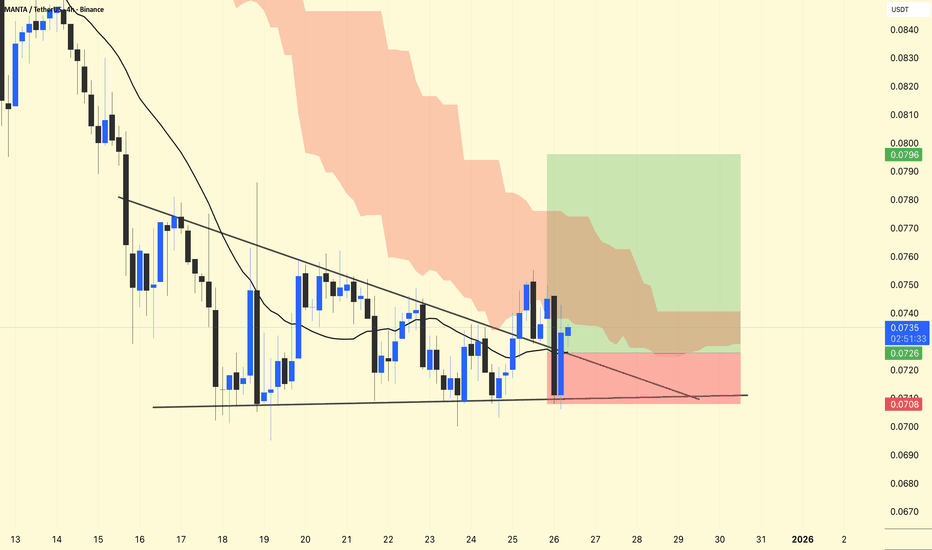

MANTA/USDT – Long Trade Setup (4H)MANTA/USDT – Long Trade Setup (4H)

Structure: Descending wedge/trendline compression

Ichimoku: Price pushing back into the cloud → momentum stabilizing

MA acting as dynamic support

Long Idea

Entry Zone: 0.0725 – 0.0730

Stop Loss: 0.070

Targets:

T1: 0.0760

T2: 0.0790 – 0.0800

DYOR | NFA

#MANTA [RR: 1/5] Price reversal and new growth BINANCE:MANTAUSDT

There is a 5-wave cycle with an elongated 3rd wave and a corrective (protracted) 4th wave.

At the moment, the asset has completed the movement of wave 5 and has shown signs of a reversal in the long direction at the 1.618 extension level.

If we look at W1, we see that the volume nodes (HVN) coincide with the 0.618 Fibonacci retracement level. This adds weight to the argument that the asset has just completed wave 5.

I am considering a move to HVN (0.12), which gives a risk/reward ratio of 1/5.

I do not rule out manipulative movements.

Manta at Discount: Two Scenarios From the 10 Oct WickTwo possible paths for BINANCE:MANTAUSDT based on the Fibonacci levels of the long wick left after the 10 October sell‑off.

Price has been in a steady downtrend and is now trading inside a higher‑timeframe demand zone (blue), which lines up with the 50–61.8% retracement of that October wick move. From here the primary scenario is a bullish reversal: accumulation inside this demand, a higher low, and then an impulsive rally into the daily order block (grey), targeting roughly the 0.12–0.16 region where previous range highs and the main volume POC (point of control)

The alternative scenario is a deeper sweep of liquidity. If the first reaction from the blue zone fails, price can extend toward the lower green demand area, close to the 0.786–0.86 retracement of the same wick. A capitulation into this zone would complete a larger discount before a stronger mid‑term reversal, with the same upside targets later at the grey order block and high‑volume cluster. Invalidation is a clean breakdown below the green zone, while take‑profits are staged first around the mid‑range / “monthly high” and then into 0.12–0.16.

MANTAUSDT Forming Falling WedgeMANTA/USDT is setting up a very interesting technical picture — price is contracting into what looks like a falling-wedge formation, which often signals a potential bullish reversal. The tightening range, combined with volume that’s beginning to pick back up, suggests that accumulation could be building and a breakout to the upside may be imminent. If the wedge’s upper trendline gives way with strength, we could see MANTA run significantly higher.

On the fundamentals side, Manta Network is a multi-modular blockchain ecosystem focused on zero-knowledge (ZK) applications. It has two main chains: Manta Pacific (a Layer 2 chain optimized for EVM-native ZK apps) and Manta Atlantic (a privacy-centric Layer 1). This dual-chain architecture allows for both composability and data privacy, making Manta especially relevant in today’s Web3 infrastructure space.

Tokenomics also support the trade thesis: MANTA has a total supply of 1 billion tokens, with roughly ~449 million circulating currently, and MANTA is used for staking, governance, and network fees.On top of that, a recent partnership with Symbiotic brings “fast finality” to Manta Pacific via restaking mechanics, which could further incentivize users and operators to lock in their MANTA.

MANTAUSDT UPDATE#MANTA

UPDATE

MANTA Technical Setup

Pattern: Falling wedge pattern

Current Price: $0.1216

Target Price: $0.2807

Target % Gain: 100.07%

Technical Analysis: MANTA is breaking out of a falling wedge pattern on the 1D chart, showing early bullish momentum as price pushes above short-term resistance while holding higher lows. The breakout attempt suggests buyers are gradually stepping in, and a confirmed close above the wedge’s upper trendline would strengthen the bullish case. If momentum continues, price may move toward the measured target near $0.2807.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

MANTAUSDT 1D#MANTA is moving inside a falling wedge pattern on the daily chart. It is currently facing resistance from the Ichimoku cloud. Volume has increased, which is a positive sign. If the price breaks out above the Ichimoku cloud and the wedge resistance, the potential upside targets are:

🎯 $0.1508

🎯 $0.1873

🎯 $0.2169

🎯 $0.2464

🎯 $0.2884

🎯 $0.3420

⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

MANTAUSDT Bullish Channel Breakout!MANTA is showing a potential bullish breakout from a descending channel that has been holding price down throughout October. The recent strong recovery and breakout attempt above the upper trendline indicate early signs of trend reversal and possible momentum shift to the upside.

Key Points:

-Price has broken the upper boundary of the descending channel after multiple rejections.

-Volume increase on breakout confirms buyer activity.

- Horizontal volume profile shows a strong liquidity base near $0.10 – $0.11, which could act as solid support.

- Short-term target zone lies between $0.18 – $0.20, aligning with the next major supply area.

- Ideal invalidation below $0.095.

Buy zone : Above $0.115

Stop loss : $0.095

Cheers

Hexa

OMXHEX:MANTA BINANCE:MANTAUSDT

#MANTA/USDT – Bullish Setup Alert ?#MANTA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.190, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.186.

Entry price: 0.196

First target: 0.205

Second target: 0.214

Third target: 0.225

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

MANTA/USDT – Long Setup Alert!MANTA has just broken out of a massive Inverse Head & Shoulders pattern on the 8H chart — a bullish reversal signal that could ignite a strong upside rally. 📈

Setup Details:

Entry: CMP – 0.248

Stop Loss: 0.227 (below neckline retest)

Targets:

🎯 TP1: 0.34

🎯 TP2: 0.42

🎯 TP3: 0.459

Leverage: 5x max (adjust risk accordingly)

Why This Setup?

✅ Clean breakout above neckline after weeks of consolidation

✅ Volume supporting the breakout

✅ Pattern target aligns with strong resistance zone above

⚠️ Risk Management: Stick to your SL. A failed retest can trap late entries.

Bulls are in control — let’s ride this momentum!

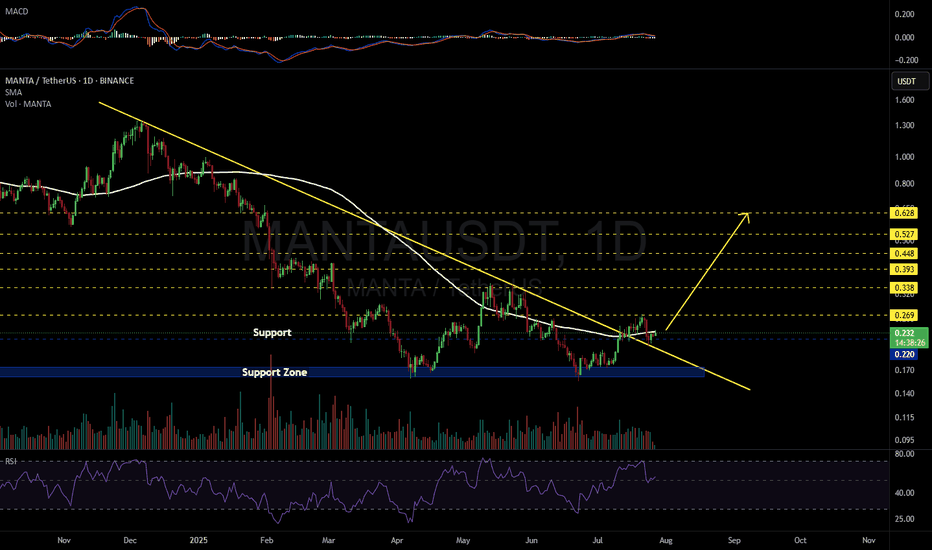

MANTAUSDT 1D#MANTA has broken above the descending resistance on the daily chart, and the retest has been successfully completed. It is now facing the daily SMA100.

In case of a breakout above it, the targets are:

🎯 $0.269

🎯 $0.338

🎯 $0.393

🎯 $0.448

🎯 $0.527

🎯 $0.628

⚠️ As always, use a tight stop-loss and apply proper risk management.

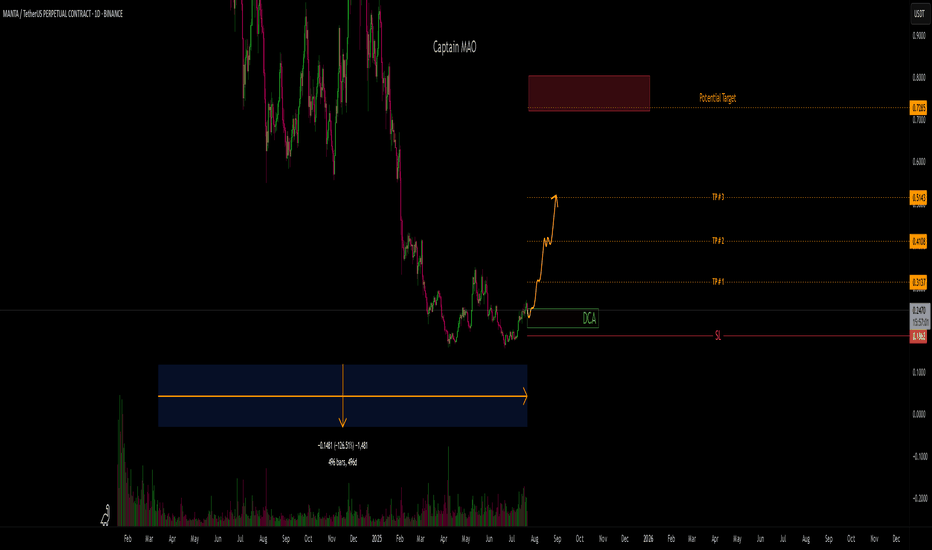

MANTA/USDT +100% has been in a downtrend for near 500 days, but the last 100 days show clear signs of reversal. Price has been ranging between the $0.15–$0.30 zone, indicating accumulation. Now it appears to be gearing up for a trend reversal, with the first breakout leg likely to lead into a much bigger move.

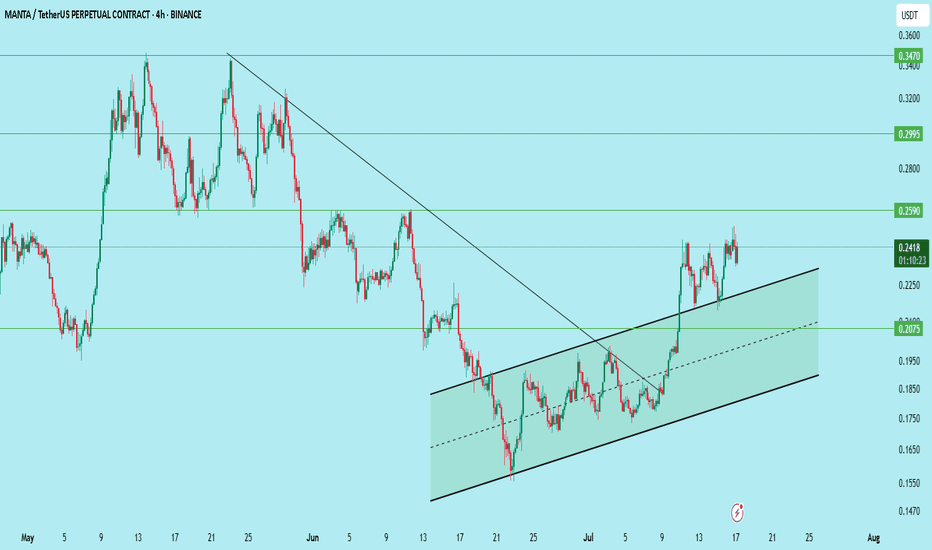

MANTA/USDT – Bullish Setup AlertMANTA has broken out of its long-term downtrend and is now trading within a clear rising parallel channel on the 4H chart.

Structure:

Downtrend broken

Higher highs and higher lows forming

Price respecting channel boundaries

Setup:

Entry: 0.225 (wait for retest)

Stop Loss: 0.2075

Target 1: 0.259

Target 2: 0.2995

Target 3: 0.347

Support: 0.225 / 0.2075

Resistance: 0.259 / 0.2995

Wait for the retest before entering. Risk-reward is attractive if the structure holds.

DYOR. Not financial advice.

MANTAUSDT Forming Descending ChannelMANTAUSDT is shaping up to be one of the more intriguing setups in the market right now, showing a well-defined descending channel pattern. This technical formation often signals a healthy consolidation phase within a broader trend, creating a launchpad for an eventual breakout. With trading volume remaining good and steady, there is a strong foundation for a significant move that could yield an 80% to 90% gain once the channel’s resistance is convincingly broken.

The MANTA project itself is increasingly attracting investor interest, thanks to its innovative approach to DeFi and cross-chain privacy solutions. As the crypto sector continues to look for new ways to scale and protect user data, MANTA stands out as a project that combines real-world use cases with strong tokenomics. This growing community interest can add momentum to the pair’s technical breakout, potentially driving the price rapidly towards its expected targets.

From a technical perspective, the descending channel acts like a coiled spring. When prices repeatedly test the lower support and upper resistance of the channel, traders watch for a breakout confirmation, which can lead to a sharp trend reversal. The combination of this reliable pattern with increasing investor confidence makes MANTAUSDT a pair worth watching closely for bullish signals in the coming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MANTA Holding Rising Support — Eyes on BreakoutMANTA is once again respecting the rising support line and showing early signs of holding the structure.

Price action remains constructive — despite recent volatility, buyers are still defending the trendline well. As long as this rising support continues to hold, the setup remains bullish.

The next key area to watch is the resistance zone above. A breakout through that level could open the door for a much larger move, as visualised in the projected path.

For now, MANTA is in a healthy consolidation phase along the trendline. If momentum builds from here, it could trigger the next leg higher.

#MANTA/USDT#MANTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.290.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.305

First target: 0.329

Second target: 0.348

Third target: 0.373

Manta Classic Bullish Signals = Bull Market Confirmed—PP: 1900%This analysis can be used not only to spot the trading opportunity that is now MANTAUSDT, but also for learning purposes. Let's go back to basics.

Here MANTAUSDT is breaking daily above EMA55. This break is happening with a full green candle and yesterday's candle also closed full green. Today's full green candle has above-average trading volume and is coming after several short-term higher lows. So this is a constellation of signals. One signal, the break of resistance, supported by many additional signals (volume, candles and chart pattern).

The classic signal is the break above EMA55 on the daily timeframe. This confirms a bullish potential for the mid-term, minimum, which means 3 months.

The next signal comes from the RSI, it is super strong. A hyper bullish RSI while a project is trading at bottom prices is another classic bullish strong reversal signal. It is present here.

These together, with marketwide action, what the rest of the market is doing, is more than enough for me to say: Manta is going up.

Thank you for reading.

Namaste.