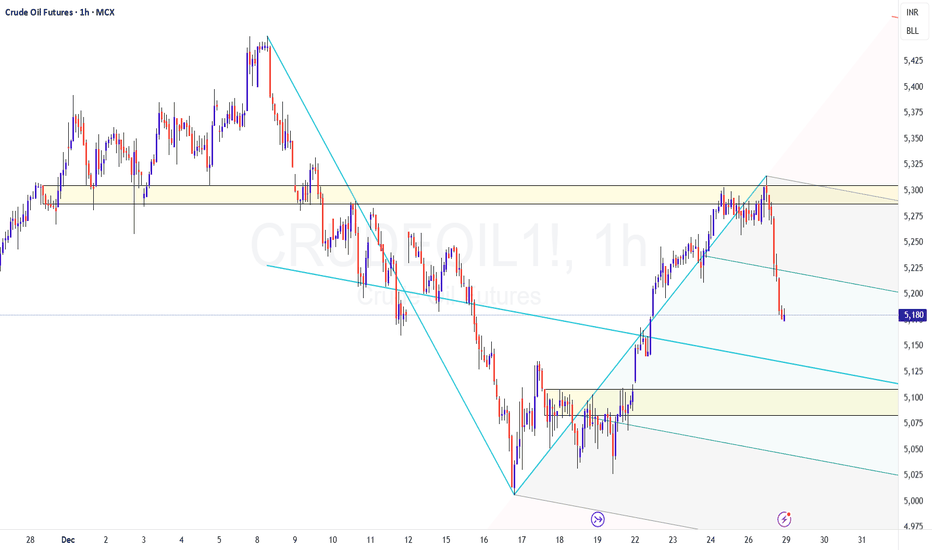

Crudeoil 1 Hr Chart

Price is consolidating in the range of5240-5265 . Main trend is downtrend so far as price has unable to breakout upside as this is a very strong resistance at its Fib level 0.55-0.618.

Sell it below 5240 as it will attract towards the Pivot levels.

Hit the like button to Rock !! Show some energ

Contract highlights

Related commodities

Oil Prices - USA possibly invading Venezuela?What Would Happen to Oil Prices if the U.S. Invaded Venezuela?:

Whenever geopolitical tensions rise, oil markets react fast, often faster than the facts on the ground. Let's cover some ideas:

1)Venezuela Is Not the World’s Biggest Oil Producer:

A common assumption is that any major conflict in

CRUDEOIL1! - Pitchfork levels

CMP: 5180

TF: Multiple

On hourly TF, price is getting rejected at the supply zone (5280-5320) and this fall could potentially move a lot lower if it fails to move above/beyond 3530 levels.

The immediate supports are the midpoint of the pitchfork line at 5130 and the previous consolidation zone a

Selling Options while WTI Moves within a Narrow BandNYMEX: WTI Crude Oil Options ( NYMEX:CL1! $LO)

Last Friday, Oil prices fell by more than $1 a barrel. Investors weighed a looming global supply glut and a reduced war risk premium, amid hopes of a Ukraine peace deal ahead of talks between the presidents of the United States and Ukraine.

West Tex

Harmonic BAT or CRAB formation in CRUDEOIL for 5000 or lowerTF: 60 Minutes

CMP: 5156

I have published an analysis based on Pitchfork set up on Crude and you can read about in the link given below.

Here, I am posting the view based on Harmonic Pattern formation.

Since it has closed and sustained below the recent swing low of 5170, two levels have opened up

Crude Oil Rally After Christmas?For quite a bit we have had Bearish momentum going on CL! This could change however due to Geopolitical risk for premium expansion, inventory tightness and seasonal demand etc. Funds are also not heavily invested in oil so far, so if we do gain headlines in the coming months we could see a spike on

Light Sweet Crude Oil pressing major support — oversold bounce

Current Price: $56.74

Direction: LONG

Confidence Level: 60% (Price is sitting on a heavily referenced support zone, downside momentum is stalling, and trader discussion is increasingly focused on rebound scenarios despite a weak broader trend)

Targets:

- T1 = $58.30

- T2 = $60.00

Stop Levels:

-

WTI Crude Oil: Breakout & Retest Confirmation at Macro SupportMarket Setup: WTI Crude Oil ( NYSE:CL ) has shifted from a multi-year bearish regime into a high-probability bullish reversal. After breaking the primary 2022–2025 descending trendline, price action is now providing a textbook confirmation entry.

Follow for more content and valuable insights.

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Crude Oil Futures (Sep 2018) is Aug 21, 2018.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Crude Oil Futures (Sep 2018) before Aug 21, 2018.