Crude Oil Rally After Christmas?For quite a bit we have had Bearish momentum going on CL! This could change however due to Geopolitical risk for premium expansion, inventory tightness and seasonal demand etc. Funds are also not heavily invested in oil so far, so if we do gain headlines in the coming months we could see a spike on

Contract highlights

Related commodities

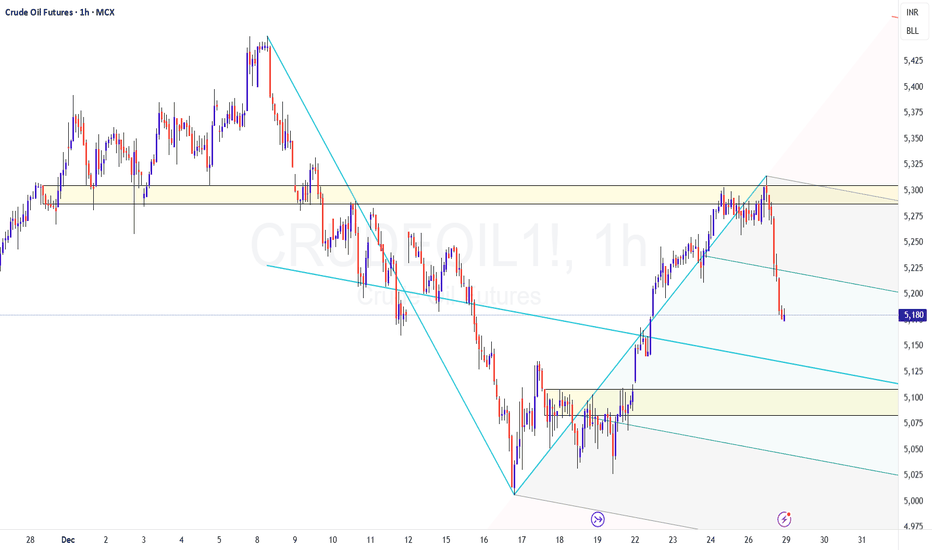

Crudeoil 1 Hr Chart

Price is consolidating in the range of5240-5265 . Main trend is downtrend so far as price has unable to breakout upside as this is a very strong resistance at its Fib level 0.55-0.618.

Sell it below 5240 as it will attract towards the Pivot levels.

Hit the like button to Rock !! Show some energ

CRUDEOIL1! - Pitchfork levels

CMP: 5180

TF: Multiple

On hourly TF, price is getting rejected at the supply zone (5280-5320) and this fall could potentially move a lot lower if it fails to move above/beyond 3530 levels.

The immediate supports are the midpoint of the pitchfork line at 5130 and the previous consolidation zone a

Oil Prices - USA possibly invading Venezuela?What Would Happen to Oil Prices if the U.S. Invaded Venezuela?:

Whenever geopolitical tensions rise, oil markets react fast, often faster than the facts on the ground. Let's cover some ideas:

1)Venezuela Is Not the World’s Biggest Oil Producer:

A common assumption is that any major conflict in

Crude Oil – Sell around 58.90, target 57.00-56.00Crude Oil Market Analysis:

The recommended strategy for today is to sell crude oil. Recent crude oil price fluctuations have been relatively small, and the fluctuations are mostly within a consolidation phase. The recommended strategy is to sell, as chasing this range-bound market is not advisable

Selling Options while WTI Moves within a Narrow BandNYMEX: WTI Crude Oil Options ( NYMEX:CL1! $LO)

Last Friday, Oil prices fell by more than $1 a barrel. Investors weighed a looming global supply glut and a reduced war risk premium, amid hopes of a Ukraine peace deal ahead of talks between the presidents of the United States and Ukraine.

West Tex

Light Sweet Crude Oil pressing major support — oversold bounce

Current Price: $56.74

Direction: LONG

Confidence Level: 60% (Price is sitting on a heavily referenced support zone, downside momentum is stalling, and trader discussion is increasingly focused on rebound scenarios despite a weak broader trend)

Targets:

- T1 = $58.30

- T2 = $60.00

Stop Levels:

-

WTI Crude Oil: Breakout & Retest Confirmation at Macro SupportMarket Setup: WTI Crude Oil ( NYSE:CL ) has shifted from a multi-year bearish regime into a high-probability bullish reversal. After breaking the primary 2022–2025 descending trendline, price action is now providing a textbook confirmation entry.

Follow for more content and valuable insights.

Crude Oil – Sell around 59.20, target 56.00-55.00Crude Oil Market Analysis:

Crude oil has started a slight rebound, but it hasn't broken through the 55 level effectively. Today's strategy remains to sell on rallies and be bearish. Continue selling on rallies. Resistance for crude oil is around 59.20; consider selling near that level. If crude oi

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Crude Oil Futures (Oct 2021) is Sep 21, 2021.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Crude Oil Futures (Oct 2021) before Sep 21, 2021.