Red Pill or Blue Pill?Red Pill first - let’s stick to some harsh realities, but using technical analysis only.

Why the harsh crash?

We were rejected at the Value Area high at $972, followed by another rejection at the 0.786 Fibonacci level at $916, along with the top of the flag pattern of this giant bull flag. This wa

Key facts today

The Trump administration announced a pilot program to include weight loss drugs like Mounjaro in Medicare and Medicaid, starting in 2026 and 2027, which may boost Eli Lilly's market access.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

15.11 USD

10.59 B USD

45.04 B USD

848.74 M

About Eli Lilly and Company

Sector

Industry

CEO

David A. Ricks

Website

Headquarters

Indianapolis

Founded

1876

FIGI

BBG000BNBDC2

Eli Lilly & Co. engages in the discovery, development, manufacture, and sale of pharmaceutical products. The firm's products consist of diabetes, oncology, immunology, neuroscience, and other products and therapies. The company was founded by Eli Lilly in May 1876 and is headquartered in Indianapolis, IN.

Related stocks

LLY Ready to Break Out? Here's What the Chart Tells Us🚨 LLY Ready to Break Out? Here's What the Chart Tells Us

Back in November 2024, we shared an idea warning that Eli Lilly (LLY) was facing some serious headwinds.

Since then, the market has confirmed it, NYSE:LLY has spent nearly a year moving sideways , showing little strength to push th

LLY Is Overbought ---$615 Put Play**💊 LLY WEEKLY TRADE IDEA — BEARISH PRESSURE BUILDING**

📉 **Sentiment:** Strong bearish lean (70% confidence) — low RSI, high volume distribution.

📊 **Institutional Flow:** 1.7x weekly volume, puts stacking near key strikes.

⚠ **Risk:** Gamma risk + oversold → expect high volatility.

**🛠 Setup:**

Rare Discount Below $700LLY’s sell-off today is driven by underwhelming data from its new oral GLP‑1 drug—but it came on the heels of an otherwise stellar earnings report and outlook upgrade. If you believe in Lilly’s leadership in obesity and diabetes treatments, its strong cash flows, and long-term drug development pipel

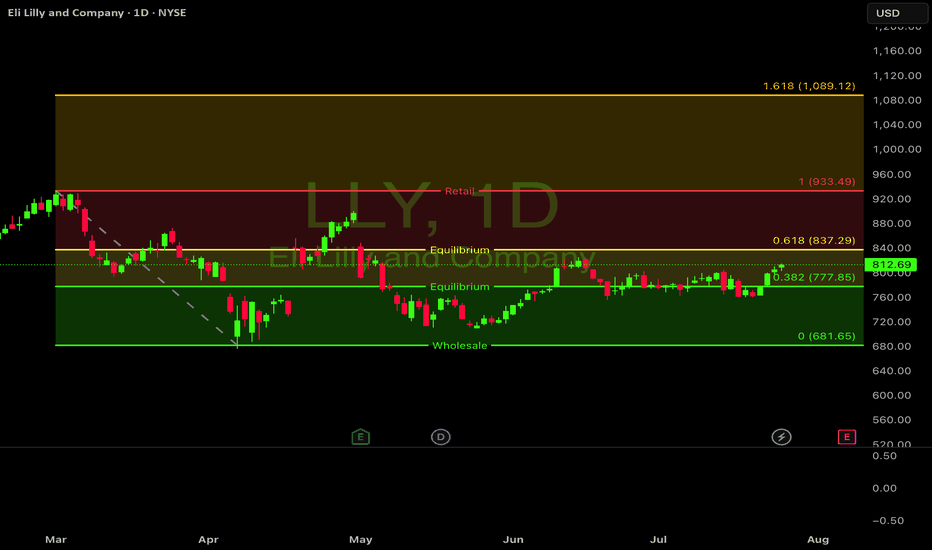

Conservative Bullish Case for Eli Lilly: A Pharmaceutical LeaderEli Lilly (LLY) is currently trading at $812.95, having recently shown strength by climbing from the mid-$700s to over $800 in the past month. The stock has established a key support zone in the $760-780 range while testing resistance around the current price level.

Fundamental Strength

LLY's rece

LLY - Earnings upcoming, recent news makes this appealing📈 LLY — Eli Lilly & Co.

Ticker: LLY | Sector: Biotech / Pharmaceuticals

Date: July 26, 2025

Current Price: ~$813

Resistance Zone: $825

Support Zone: $740–$750

🧪 Recent Drug News

1. EMA Backs Alzheimer’s Drug Donanemab (Kisunla)

The European Medicines Agency’s advisory committee has issued a positiv

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS238628644

ELI LILLY 21/43Yield to maturity

7.69%

Maturity date

Sep 14, 2043

US532457BY3

ELI LILLY 20/50Yield to maturity

7.06%

Maturity date

May 15, 2050

US532457BZ0

ELI LILLY 20/60Yield to maturity

6.94%

Maturity date

Sep 15, 2060

US532457BU1

ELI LILLY 19/59Yield to maturity

6.13%

Maturity date

Mar 15, 2059

US532457BT4

ELI LILLY 19/49Yield to maturity

6.06%

Maturity date

Mar 15, 2049

LLY4099975

Eli Lilly and Company 4.65% 15-JUN-2044Yield to maturity

5.95%

Maturity date

Jun 15, 2044

LLY4217068

Eli Lilly and Company 3.7% 01-MAR-2045Yield to maturity

5.88%

Maturity date

Mar 1, 2045

LLY4492882

Eli Lilly and Company 3.95% 15-MAY-2047Yield to maturity

5.86%

Maturity date

May 15, 2047

US532457BS6

ELI LILLY 19/39Yield to maturity

5.81%

Maturity date

Mar 15, 2039

LLY5547405

Eli Lilly and Company 4.95% 27-FEB-2063Yield to maturity

5.78%

Maturity date

Feb 27, 2063

LLY5750032

Eli Lilly and Company 5.1% 09-FEB-2064Yield to maturity

5.74%

Maturity date

Feb 9, 2064

See all LLY bonds

Curated watchlists where LLY is featured.

Frequently Asked Questions

The current price of LLY is 625.65 USD — it has decreased by −2.37% in the past 24 hours. Watch Eli Lilly and Company stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Eli Lilly and Company stocks are traded under the ticker LLY.

LLY stock has fallen by −16.22% compared to the previous week, the month change is a −20.18% fall, over the last year Eli Lilly and Company has showed a −28.50% decrease.

We've gathered analysts' opinions on Eli Lilly and Company future price: according to them, LLY price has a max estimate of 1,190.00 USD and a min estimate of 675.00 USD. Watch LLY chart and read a more detailed Eli Lilly and Company stock forecast: see what analysts think of Eli Lilly and Company and suggest that you do with its stocks.

LLY stock is 5.19% volatile and has beta coefficient of 0.65. Track Eli Lilly and Company stock price on the chart and check out the list of the most volatile stocks — is Eli Lilly and Company there?

Today Eli Lilly and Company has the market capitalization of 592.15 B, it has decreased by −15.93% over the last week.

Yes, you can track Eli Lilly and Company financials in yearly and quarterly reports right on TradingView.

Eli Lilly and Company is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

LLY earnings for the last quarter are 6.31 USD per share, whereas the estimation was 5.60 USD resulting in a 12.70% surprise. The estimated earnings for the next quarter are 6.24 USD per share. See more details about Eli Lilly and Company earnings.

Eli Lilly and Company revenue for the last quarter amounts to 15.56 B USD, despite the estimated figure of 14.70 B USD. In the next quarter, revenue is expected to reach 15.81 B USD.

LLY net income for the last quarter is 5.66 B USD, while the quarter before that showed 2.76 B USD of net income which accounts for 105.14% change. Track more Eli Lilly and Company financial stats to get the full picture.

Yes, LLY dividends are paid quarterly. The last dividend per share was 1.50 USD. As of today, Dividend Yield (TTM)% is 0.90%. Tracking Eli Lilly and Company dividends might help you take more informed decisions.

Eli Lilly and Company dividend yield was 0.67% in 2024, and payout ratio reached 44.39%. The year before the numbers were 0.78% and 77.91% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 10, 2025, the company has 47 K employees. See our rating of the largest employees — is Eli Lilly and Company on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Eli Lilly and Company EBITDA is 24.33 B USD, and current EBITDA margin is 41.75%. See more stats in Eli Lilly and Company financial statements.

Like other stocks, LLY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Eli Lilly and Company stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Eli Lilly and Company technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Eli Lilly and Company stock shows the sell signal. See more of Eli Lilly and Company technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.