TTE: Fundamental Analysis +56 %With 2024 revenue of 195,6 billions €, Total Energies ranks among the top 10 largest energy companies in the world. EverStock identifies a fundamental revaluation potential of + 56 %.

Valuation at 7.3x net earnings

Currently valued at 115,7 billions € in market capitalization, Total Energies post

Key facts today

TotalEnergies saw a 1% increase in stock value as European oil and gas stocks rose, driven by rising oil prices amid geopolitical tensions between the U.S. and Venezuela.

TotalEnergies participated in the sale of 10,000 tons of Eurobob E10 gasoline barges, collaborating with BP on the sell side, while Varo acted as the sole buyer.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.79 USD

15.08 B USD

187.21 B USD

1.99 B

About TotalEnergies SE

Sector

Industry

CEO

Patrick Pouyanné

Website

Headquarters

Courbevoie

Founded

1954

Identifiers

2

ISINFR0000120271

TotalEnergies SE is a global integrated energy company, which engages in the production of oil and biofuels, natural gas and green gases, renewables and electricity. It operates through the following business segments: Exploration & Production, Integrated LNG, Integrated Power, Refining & Chemicals, and Marketing & Services. The Exploration & Production segment encompasses oil and natural gas exploration and production activities. The Integrated LNG segment includes the integrated gas chain (including upstream and midstream LNG activities) as well as biogas, hydrogen and gas trading activities. The Integrated Power segment involves in the generation, storage, electricity trading and B2B-B2C distribution of gas and electricity. The Refining & Chemicals segment engages in the activities of refining, petrochemicals and specialty chemicals. This segment also includes the activities of oil supply, trading and marine shipping. The Marketing & Services segment includes the global activities of supply and marketing in the field of petroleum products. The company was founded on March 28, 1924 and is headquartered in Courbevoie, France.

Related stocks

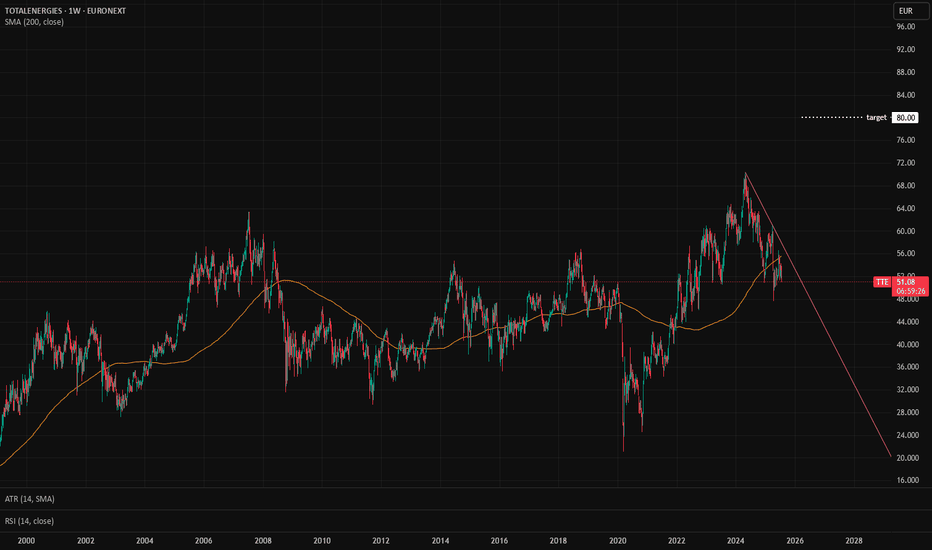

TTE: Ready for a correction if the brent suffers from macro Correlation with Oil Prices:

TTE, being an oil and gas company, is closely correlated with WTI and Brent crude oil prices.

Market Uncertainty:

The fundamentals of industrial production are uncertain due to high commercial tariffs and evolving economic conditions, which could impact demand and slow

TOTAL - BREAK OF THE 63 ? After closing the session on Monday 26.08 up 1.13%, the share is now on a key level.

What's more, the downtrend line was broken yesterday.

The 63 level, which has acted as resistance for several sessions now, is once again under attack by investors. This level is also the one most traded by investo

TTE 1H Long Swing Conservative Trend tradeConservative Trend trade

+ long balance

+ ICE level

- above 1/2 correction

+ biggest volume 2 Sp

+ support level

Calcualted affordable stop loss

1 to 2 R/R take profit

Daily context:

"+ long impulse

+ 1/2 correction

+ SOS level

+ unvolumed 2Sp"

Monthly context:

"Trend Trade

+ long impulse

+ 1/2 c

TotalEnergies Surges Towards New Highs: Breakout WatchThe key technical level to watch is $63 per share. A decisive break above this resistance could trigger a fresh wave of buying, pushing the stock toward uncharted territory. Investors are advised to monitor the price action closely in the coming days to see if a breakout materializes.

TWO very POWERFUL Patterns for Trend Analysis!Hi, fellows!

In this Video we are going to talk about a great trend continuation pattern and also about a great trend reversal pattern, which you can add to your trading analysis!

Please keep in mind, that trading involves risk and that this video is for educational purpose only ;)

TTE TotalEnergies SE Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PTTE TotalEnergies SE prior to the earnings report this week,

I would consider purchasing the 60usd strike price Puts with

an expiration date of 2023-9-15,

for a premium of approximately $1.80.

If these options prove to be profitable prior to the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TOT5885642

TotalEnergies Capital SA 5.425% 10-SEP-2064Yield to maturity

5.83%

Maturity date

Sep 10, 2064

TOT5785230

TotalEnergies Capital SA 5.638% 05-APR-2064Yield to maturity

5.81%

Maturity date

Apr 5, 2064

TOT5785229

TotalEnergies Capital SA 5.488% 05-APR-2054Yield to maturity

5.73%

Maturity date

Apr 5, 2054

TOT5006934

TotalEnergies Capital International SA 3.386% 29-JUN-2060Yield to maturity

5.70%

Maturity date

Jun 29, 2060

TOT5885641

TotalEnergies Capital SA 5.275% 10-SEP-2054Yield to maturity

5.70%

Maturity date

Sep 10, 2054

US89153VAV1

TotalEnergies Capital International SA 3.127% 29-MAY-2050Yield to maturity

5.68%

Maturity date

May 29, 2050

TOT4856890

TotalEnergies Capital International SA 3.461% 12-JUL-2049Yield to maturity

5.68%

Maturity date

Jul 12, 2049

TOT5006933

TotalEnergies Capital International SA 2.986% 29-JUN-2041Yield to maturity

5.33%

Maturity date

Jun 29, 2041

TOT5785399

TotalEnergies Capital SA 5.15% 05-APR-2034Yield to maturity

4.58%

Maturity date

Apr 5, 2034

TOT5885577

TotalEnergies Capital SA 4.724% 10-SEP-2034Yield to maturity

4.56%

Maturity date

Sep 10, 2034

2TID

TotalEnergies Capital International SA 1.66% 22-JUL-2026Yield to maturity

4.55%

Maturity date

Jul 22, 2026

See all TTE bonds

Curated watchlists where TTE is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of TTE is 65.03 USD — it has increased by 2.46% in the past 24 hours. Watch TotalEnergies SE stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange TotalEnergies SE stocks are traded under the ticker TTE.

TTE stock has risen by 0.05% compared to the previous week, the month change is a 0.02% rise, over the last year TotalEnergies SE has showed a 19.36% increase.

We've gathered analysts' opinions on TotalEnergies SE future price: according to them, TTE price has a max estimate of 90.81 USD and a min estimate of 59.73 USD. Watch TTE chart and read a more detailed TotalEnergies SE stock forecast: see what analysts think of TotalEnergies SE and suggest that you do with its stocks.

TTE stock is 1.05% volatile and has beta coefficient of 0.76. Track TotalEnergies SE stock price on the chart and check out the list of the most volatile stocks — is TotalEnergies SE there?

Today TotalEnergies SE has the market capitalization of 140.22 B, it has decreased by −1.24% over the last week.

Yes, you can track TotalEnergies SE financials in yearly and quarterly reports right on TradingView.

TotalEnergies SE is going to release the next earnings report on Feb 11, 2026. Keep track of upcoming events with our Earnings Calendar.

TTE earnings for the last quarter are 1.77 USD per share, whereas the estimation was 1.79 USD resulting in a −1.02% surprise. The estimated earnings for the next quarter are 1.68 USD per share. See more details about TotalEnergies SE earnings.

TotalEnergies SE revenue for the last quarter amounts to 43.84 B USD, despite the estimated figure of 47.42 B USD. In the next quarter, revenue is expected to reach 31.43 B USD.

TTE net income for the last quarter is 3.70 B USD, while the quarter before that showed 2.79 B USD of net income which accounts for 32.54% change. Track more TotalEnergies SE financial stats to get the full picture.

TotalEnergies SE dividend yield was 6.03% in 2024, and payout ratio reached 50.79%. The year before the numbers were 4.89% and 36.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 18, 2025, the company has 102.89 K employees. See our rating of the largest employees — is TotalEnergies SE on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TotalEnergies SE EBITDA is 37.61 B USD, and current EBITDA margin is 18.96%. See more stats in TotalEnergies SE financial statements.

Like other stocks, TTE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TotalEnergies SE stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TotalEnergies SE technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TotalEnergies SE stock shows the buy signal. See more of TotalEnergies SE technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.