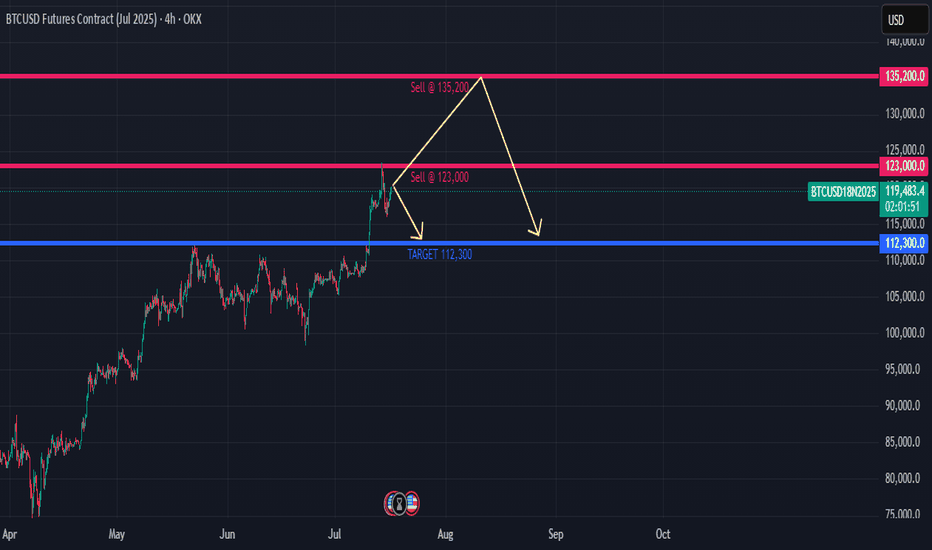

$BTC 5-Wave Impulse > ABC Correction > CME GapCRYPTOCAP:BTC appears to be headed towards an ABC correction after this impulsive 5-wave move to the upside

Would be a great opportunity to fill the CME gap ~$114k

Lines up perfectly with the 50% gann level retracement to confirm the next leg

don't shoot the messenger..

just sharing what i'm s

Related futures

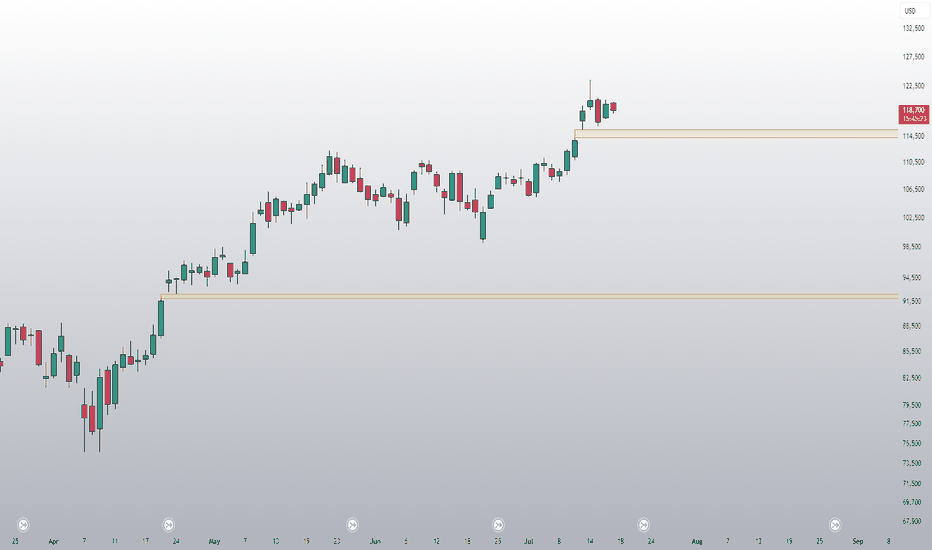

Bitcoin UpdateBitcoin has just broken out above its recent consolidation pattern, staying firmly in an uptrend and finding solid short-term support at its 55-day moving average.

We're now pushing toward the previous high at 112,345, chipping away at that level. Once cleared, our eyes turn to the weekly chart, whi

Bitcoin Breakout: Charting the Next TargetsWe’re taking another look at #Bitcoin, which has surged higher and broken above its long-term channel — a move that’s caught the attention of many market watchers.

🔍 Key technical insights:

✅ The recent consolidation appears to be a midway pause in the uptrend. By measuring the preceding flagpole an

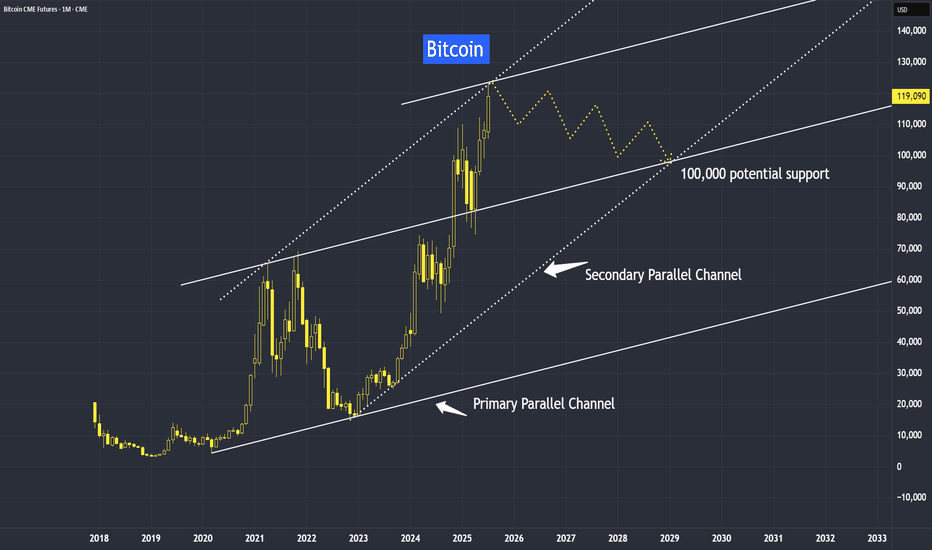

Bitcoin and Upcoming TrendBitcoin’s trend has been growing from strength to strength — and it’s likely to stay that way. Why?

This trend isn’t driven purely by speculation; it’s supported by strong fundamental reasons.

One of the most widely debated topics in finance today is the comparison between Bitcoin and gold. While

ETH: Buying in the DipCME: Micro Ether Futures ( CME:MET1! ), #microfutures

On May 22nd, #Bitcoin reached a new all-time high of $111,814. The king of cryptos rallied as bullish sentiment built up behind the most pro-crypto U.S. administration. As of last Friday, bitcoin realized a one-year return of +90.8%. For compari

Lord MEDZ Trading Update: BitcoinKey Observations:

Breach of the 60-Day Lookback Zone:

Price has fallen below the previously held demand zone, confirming seller dominance.

This breakdown increases the probability of a deeper retracement toward key Fibonacci and smart money interest levels.

Potential Demand Zones & Fibonacci Leve

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BTCUSD Futures Contract is 119,367.8 USD — it has fallen −0.15% in the past 24 hours. Watch BTCUSD Futures Contract price in more detail on the chart.

The volume of BTCUSD Futures Contract is 5.22 M. Track more important stats on the BTCUSD Futures Contract chart.

The nearest expiration date for BTCUSD Futures Contract is Jul 18, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell BTCUSD Futures Contract before Jul 18, 2025.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for BTCUSD Futures Contract. Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of BTCUSD Futures Contract technicals for a more comprehensive analysis.