Trade ideas

#ONE/USDT – The Final Shakeout Before Reversal?#ONE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.00652, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.00691

First target: 0.00706

Second target: 0.00721

Third target: 0.00739

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ONE/USDT – The Final Shakeout Before Reversal?The weekly chart of ONE/USDT tells the story of a full crypto market cycle:

from the euphoric highs of 2021 to a prolonged downtrend that has now brought price back into the historical accumulation zone between 0.0055 – 0.0042 — the same area that preceded ONE’s previous bull run.

The breakdown below 0.00915 triggered a wave of panic selling and swept deep liquidity, forming a massive lower wick that pierced the yellow demand zone.

Such movements often mark the capitulation phase, where retail traders capitulate and smart money begins accumulating silently beneath the surface.

---

Structure & Technical Overview

Macro trend: Strong multi-year downtrend with consistent lower highs and lower lows since 2021.

Key demand zone: The yellow block (0.0055 – 0.0042) acts as the last major demand zone and potential base for a new market cycle.

Candle behavior: The large wick suggests a liquidity grab — a common signal that downside exhaustion may be near if confirmed by a strong weekly close above the zone.

Major resistance levels: 0.0130 → 0.01625 → 0.0200 → 0.0240 → 0.0355 — these levels could serve as potential retest or breakout targets if a trend reversal occurs.

---

Bullish Scenario

Main condition: A weekly close back above 0.00915 would signal a key reclaim and potential structural reversal.

Confirmation signals: Rising buy volume and the formation of a higher low above the yellow zone.

Upside targets:

1. 0.0130 – first technical rebound level

2. 0.01625 – 0.0200 – mid-range supply zone

3. 0.0355 – macro target if reversal sustains

Bullish narrative:

“Smart money accumulates when fear dominates. The quiet phase of accumulation might already be underway.”

---

Bearish Scenario

Bearish confirmation: A weekly close below 0.0042 would confirm a full structural breakdown.

Next target: A continuation lower toward the psychological area of 0.0023, entering a deep undervaluation phase.

Bearish narrative:

“If the yellow zone fails, ONE could enter the final leg of its downcycle — a phase only the most patient investors endure.”

---

Strategy & Opportunity

Short-term traders: Wait for a confirmed reclaim above 0.00915 before considering long entries.

Long-term investors: The 0.0055 – 0.0042 range remains a potential accumulation area — but only with disciplined risk management below support.

Core principle:

“True reversals are not born from optimism, but from despair.”

---

Conclusion

ONE stands at a critical multi-year inflection point.

The 0.0055 – 0.0042 range represents the final battleground between capitulation and rebirth.

If the zone holds and price reclaims 0.00915, a new cycle could begin.

If it breaks lower, expect deeper undervaluation before the next accumulation phase forms.

The market is testing patience — separating believers from trend followers.

---

#ONEUSDT #HarmonyONE #CryptoAnalysis #AltcoinReversal #PriceAction #CryptoCapitulation #MarketCycle #TechnicalAnalysis #CryptoMarket #SupportResistance

ONEUSDT UPDATE#ONE

UPDATE

ONE Technical Setup

Pattern: Bullish falling wedge pattern

Current Price: $0.01265

Target Price: $0.01907

Target % Gain: 50.82%

GETTEX:ONE is breaking out of a falling wedge pattern on the 1D timeframe. Current price is $0.01265 with a target near $0.01907, showing about 50% potential upside. The breakout confirms bullish momentum with structure favoring continuation. Always use proper risk management.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

ONE/USDT — The Last Golden Zone: Bounce or Breakdown?Market Snapshot

Harmony (ONE) is currently sitting at a make-or-break level. On the weekly chart, price has reached the critical demand zone at 0.0080 – 0.0103 USDT (yellow box). This area has been tested multiple times since 2023, making it both a strong historical support and a fragile level under constant pressure.

In the past, sharp rejections (long lower wicks) from this zone have sparked significant rebounds. The key question now: will this zone hold again, or will we witness a confirmed breakdown that opens the door to deeper bearish territory?

---

Price Structure & Pattern

Consistent lower highs since mid-2024 → medium-term bias remains bearish.

The 0.0080–0.0103 zone has been tested several times → proven demand, but repeated tests weaken its strength.

Frequent long downside wicks → liquidity sweeps before rebounds, a sign of manipulation or false breaks.

Overall structure: sideways within a horizontal range, but with bearish undertone.

---

Bullish Scenario (Rebound Potential)

If the support zone holds:

Trigger: Weekly close above 0.01035 or bullish reversal candle (hammer / engulfing) around support.

Upside targets:

0.01340 (first resistance, ~+45%)

0.01638 (major resistance, ~+78%)

0.02181 (mid-term target, ~+137%)

If momentum and volume strengthen, further targets extend toward 0.02650 – 0.03500.

Note: Bullish bias remains valid only while weekly closes hold above 0.0080. The longer the zone holds, the stronger the chance of a breakout rally.

---

Bearish Scenario (Breakdown Risk)

If the 0.0080 support fails:

Trigger: Weekly close below 0.0080 with strong selling volume.

Downside targets:

0.00660 as next key support (~−28%).

Below that, psychological levels around 0.0050 may come into play.

Note: A confirmed breakdown here would be a major bearish signal, likely triggering panic selling.

---

Strategic Takeaway

ONE is now trading inside the last golden demand zone that could decide its long-term direction.

Bullish case: Bounce from support could target 0.013 – 0.016 first.

Bearish case: Breakdown below 0.0080 opens a path to 0.0066.

Key confirmation: Watch for weekly candle close and volume reaction — without them, moves may still be false breaks.

---

Harmony (ONE) is at a crucial turning point. The 0.0080–0.0103 demand zone has been a battlefield since 2023.

If bulls hold the line, we could see a rebound toward 0.0134–0.0163. But if sellers win and the level breaks, downside continuation toward 0.0066 is likely.

This is the make-or-break moment that will shape ONE’s trend in the coming months.

---

#ONE #Harmony #ONEUSDT #CryptoAnalysis #Altcoin #TechnicalAnalysis #SupportResistance #PriceAction #CryptoMarket

ONE/USDT — Critical Zone: Major Accumulation or Breakdown Ahead?📌 Overview

Harmony (ONE) is once again testing the multi-year support zone at 0.0078 – 0.0105 USDT, a level that has held the market multiple times since 2023. This zone acts as the last line of defense for the bulls, and the reaction here will determine whether we see a new accumulation phase or a deeper bearish continuation.

Since early 2024, price has been forming lower highs, reflecting ongoing selling pressure. However, the fact that this support continues to hold suggests possible accumulation behavior from long-term buyers.

---

🔎 Technical Structure

Historical Support Zone (0.0078 – 0.0105): retested several times, still holding.

Lower Highs: medium-term trend remains bearish.

Potential Double/Triple Bottom: if price defends this zone and breaks above 0.0125 – 0.0162, it could trigger a major reversal structure.

Key Resistances: 0.0125 → 0.0162 → 0.0192 → 0.0231 → 0.0261 → 0.0358.

---

🚀 Bullish Scenario

1. Support Bounce:

Strong rejection from 0.009 – 0.0105 could send price to 0.0125 (TP1).

Continuation targets: 0.0162 – 0.0192.

2. Confirmed Reversal:

A 4D/weekly close above 0.0162 would confirm a stronger trend reversal.

Upside targets expand toward 0.023 – 0.026 and potentially 0.035.

---

⚠️ Bearish Scenario

1. Breakdown of Support:

A 4D/weekly close below 0.0080 would invalidate the support and confirm bearish continuation.

Next downside target: 0.0059 – 0.0065.

2. Fakeout to the Upside:

If price rallies into 0.0125 – 0.0162 but fails to break through, sellers may regain control, sending price back into the support zone.

---

🎯 Trading Strategy (Example — not financial advice)

Conservative Long: accumulate at 0.009 – 0.0105, SL below 0.0076, TP1 0.0125, TP2 0.0162.

Aggressive Long (Breakout): enter on confirmed 4D/weekly close above 0.0162, targeting 0.019 – 0.026.

Short Setup: wait for a confirmed breakdown below 0.0080, target 0.0059 – 0.0065.

---

📊 Conclusion

ONE/USDT is currently at a make-or-break zone. This support area has historically attracted buyers and could mark the beginning of a larger accumulation phase. However, a breakdown would expose the market to a deeper decline.

Key takeaway: Watch the reaction around 0.0078 – 0.0105.

Strong rejection → accumulation and bullish momentum.

Breakdown → further downside pressure.

---

ONE/USDT — Accumulation or Breakdown?

Price is retesting the multi-year support zone (0.0078–0.0105).

📈 Bullish case: rebound toward 0.0125–0.0162, confirmation above 0.0162 → targets 0.019–0.026.

📉 Bearish case: breakdown below 0.0080 → downside targets 0.0059–0.0065.

This is a critical decision zone for ONE — accumulation or further decline.

#ONE #Harmony #ONEUSDT #CryptoAnalysis #SupportResistance #CryptoTrading #Altcoins #PriceAction

ONEUSDT 30M small step towards reversalHarmony (ONE) is once again reminding traders that even modest altcoins can surprise with sudden moves.

After days of sideways action the price finally found support around 0.0098–0.0099 and is now attempting a breakout. The chart shows a wedge compression, EMAs aligning, and the volume profile confirming a buyer’s zone. If the price secures above 0.0102 the door opens towards 0.0107 as the first solid target.

Fundamentally it’s not the star of the show but with crypto market momentum ticking up ONE could easily catch the wave. Right now it looks like a student before the exam: everything is learned, just needs to answer out loud.

Along with ONE I’m also adding TURBOUSDT, ADAUSDT and XRP (Ripple) to my buy block — they’re setting up for similar bounce opportunities.

one target 0.2Stage | Price Range (USD) | Description

------|------------------|------------

1 | 0.011 – 0.012 | Short-term consolidation, liquidity accumulation

2 | 0.015 – 0.018 | Breaking mid-term resistance, increased trading volume

3 | 0.02 – 0.03 | Initial growth, attracting new investors

4 | 0.05 – 0.08 | Strong upward trend with positive fundamental news

5 | 0.1 – 0.15 | Powerful market movement, broad network adoption

6 | 0.2 | Long-term target, requires consolidation and sustained trend

ONE /USDT: Approaching Trendline resistance , Expecting breakoutONE/USDT is approaching trendline resistance with strong bullish momentum. A breakout here could lead to a solid move towards $0.015. Keep an eye on this key level for a potential rally! I believe this setup holds a lot of upside potential, and patience could pay off with this breakout.

ONE/USDT — Breakout or Breakdown Ahead?📊 Complete Analysis of ONE/USDT (1D)

ONE is currently trading around $0.0111, sitting right at a critical junction between the major support zone ($0.0095–$0.0115) and a descending trendline that has been pressing price down since the December–January peak.

This setup forms a descending triangle pattern — typically a bearish continuation pattern, but under certain conditions it can flip into a strong bullish reversal if price breaks upward with volume.

---

🔍 Technical Details & Pattern

Primary Trend: Bearish since the late 2024 peak, with consistent lower highs.

Key Support Zone: $0.0095–$0.0115 (historical demand zone, tested multiple times since September 2024).

Dynamic Resistance: Descending trendline connecting lower highs.

Important Horizontal Levels:

$0.01375 → Nearest breakout confirmation resistance.

$0.01654, $0.02284, $0.03245, $0.04588 → Potential mid-term upside targets.

$0.00803 → Nearest low and first breakdown target.

Volume Factor: Breakout or breakdown must be confirmed by high trading volume.

---

🟢 Bullish Scenario (Breakout Upward)

If price breaks and closes daily above the descending trendline and clears $0.0138, the likelihood of a reversal increases.

Potential upside targets:

1. $0.0165 → Psychological resistance & minor supply zone.

2. $0.0228 → Major resistance and previous distribution area.

3. $0.0324–$0.0458 → If momentum extends further.

Strategy:

Enter after breakout + successful retest as new support.

Stop loss below $0.0095 to avoid fakeouts.

Watch for volume: without strong volume, risk of a bull trap is high.

---

🔴 Bearish Scenario (Breakdown Lower)

If price breaks and closes daily below $0.0095, the descending triangle pattern confirms as a bearish continuation.

Potential downside targets:

1. $0.00803 → Significant low and possible bounce area.

2. $0.0069 → Historical lowest level since 2023.

3. Below $0.0065 → Potential new lows if selling pressure escalates.

Strategy:

Enter after breakdown + failed retest above $0.0095.

Stop loss above $0.012–$0.013 to avoid short squeezes.

Adjust position size — volatility can spike sharply post-breakout.

---

📌 Key Points to Monitor

Convergence of Buyers & Sellers: The closer price moves toward the triangle’s apex, the higher the chance of a breakout in either direction.

Lengthy Consolidation: Post-breakout moves are often stronger after extended consolidation.

Risk Management: Avoid going all-in before confirmation; consider scaling entries.

Market Sentiment: Watch BTC & ETH — a bearish macro crypto environment increases the risk of a downside move.

---

📍 Conclusion

ONE/USDT is currently at a make-or-break zone.

📌 Bullish breakout → Potential rally toward $0.0165+

📌 Bearish breakdown → Likely drop toward $0.0080 or lower.

Traders should wait for daily close confirmation + strong volume to reduce false breakout risk.

The $0.0095–$0.0115 zone is the last major defense line for buyers in the medium term.

#ONEUSDT #HarmonyONE #CryptoAnalysis #TechnicalAnalysis #PriceAction #DescendingTriangle #Breakout #Breakdown #Altcoins #CryptoTrading

#ONE/USDT Reversal Building#ONE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the descending channel, at 0.01252.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area (in green) at 0.01200, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.01257

First target: 0.01312

Second target: 0.01368

Third target: 0.01444

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

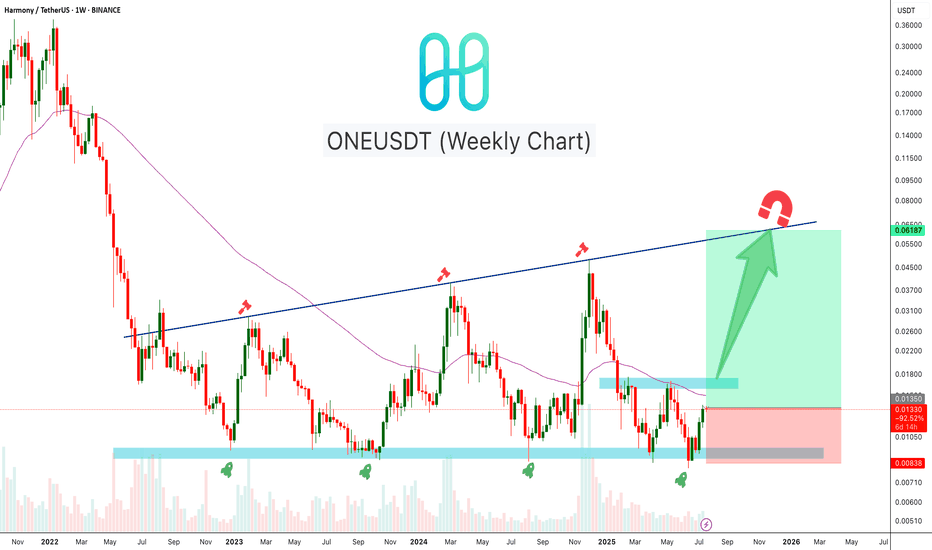

ONEUSDT Reversal BuildingONEUSDT is forming a strong base near the weekly demand zone around $0.009–$0.010, which has held multiple times over the past two years. The chart shows a clear accumulation pattern with higher lows forming. Price is now approaching the mid-range resistance near $0.017. If momentum continues, ONE may revisit the long-term trendline resistance near $0.065–$0.070.

Cheers

Hexa