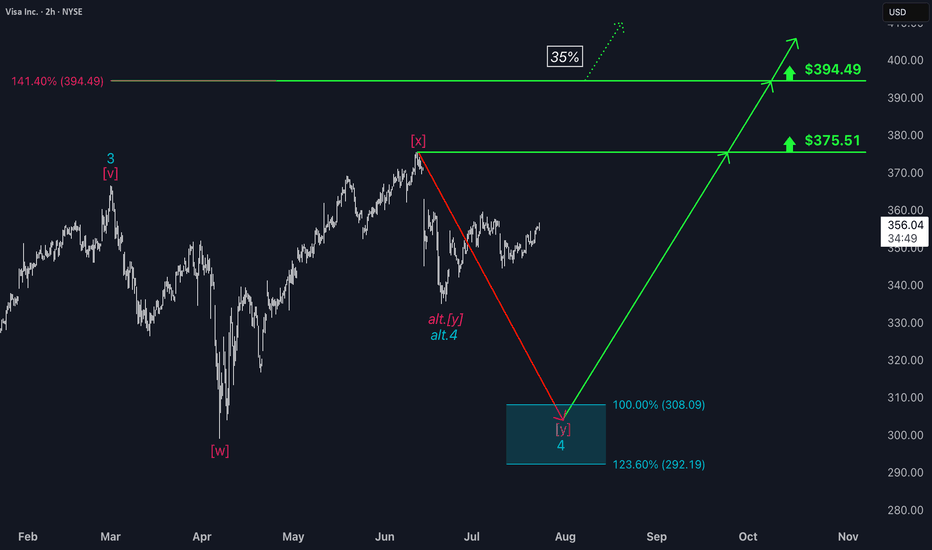

Visa: Waiting in the Wings Visa has entered a phase of sideways consolidation — but this does not affect our primary scenario. We continue to see the stock moving within magenta wave , which is expected to complete the larger turquoise wave 4 inside our turquoise Target Zone between $308.09 and $292.19. After that, we antici

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

344.03 THB

630.70 B THB

1.16 T THB

1.71 B

About Visa

Sector

Industry

CEO

Ryan McInerney

Website

Headquarters

San Francisco

Founded

1958

ISIN

TH0842120808

FIGI

BBG01V583JG5

Visa, Inc. engages in the provision of digital payment services. It also facilitates global commerce through the transfer of value and information among a global network of consumers, merchants, financial institutions, businesses, strategic partners, and government entities. It offers debit cards, credit cards, prepaid products, commercial payment solutions, and global automated teller machines. The company was founded by Dee Hock in 1958 and is headquartered in San Francisco, CA.

Related stocks

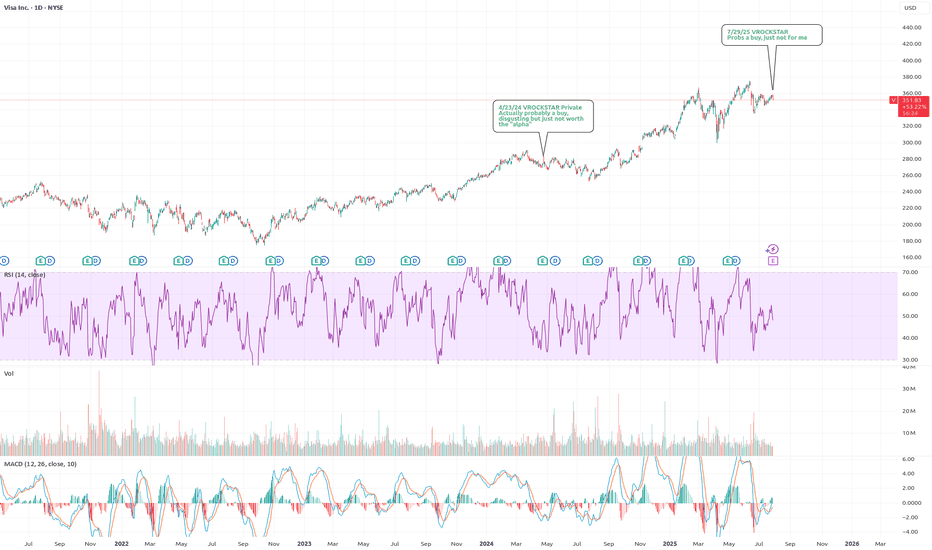

7/29/25 - $v - Probs a buy, just not for me7/29/25 :: VROCKSTAR :: $V

Probs a buy, just not for me

- over 3% fcf yields, growing, consumer spending well

- over time (probably long duration) I think the biz model probably gets eroded, but also mgmt has done a nice job evolving, perhaps they keep up with the times etc.

- don't think anything

VISA - The missing puzzle piece - Suffering from successI've seen a lot of negative sentiment online lately about the impending bubble, but even with social media, crude AI, and the US dollar being the peak of that negativity this whale has been dying slowly and few have taken notice.

VISA has begun to censor what can be bought, overcharge merchants, an

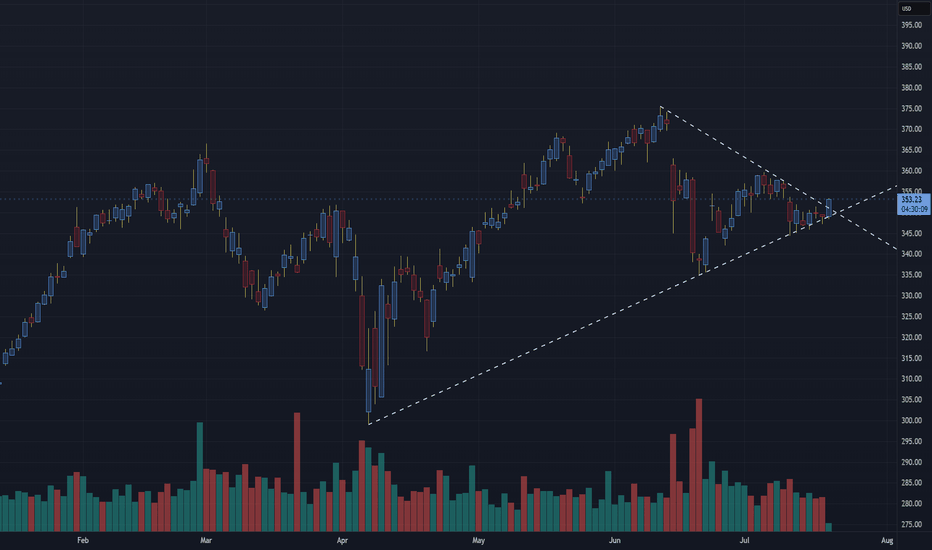

V will be joining crypto soon... BULLISH UPSIDETechnical Analysis: Visa Inc. (V) – Thesis: V will integrate cryptocurrency in the near future.

The chart shows a symmetrical triangle pattern forming on Visa Inc. (V), which is a consolidation pattern often leading to a breakout in the direction of the prevailing trend — which in this case, has

VISA on a strong Bullish Leg targeting $440.Visa Inc. (V) has been trading within a Channel Up pattern since the October 10 2022 market bottom. After December 2022, every test of the 1W MA50 (blue trend-line) has been the most optimal long-term buy opportunity, being also a Higher Low (bottom) of the pattern.

Every Bullish Leg has been +5% s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

US92826CAQ5

VISA 20/50Yield to maturity

7.23%

Maturity date

Aug 15, 2050

3V69

VISA 17/47Yield to maturity

6.09%

Maturity date

Sep 15, 2047

V4972835

Visa Inc. 2.7% 15-APR-2040Yield to maturity

5.90%

Maturity date

Apr 15, 2040

3V68

VISA 15/45Yield to maturity

5.82%

Maturity date

Dec 14, 2045

US92826CAE2

VISA 15/35Yield to maturity

4.95%

Maturity date

Dec 14, 2035

3V67

VISA 15/25Yield to maturity

4.55%

Maturity date

Dec 14, 2025

V5028512

Visa Inc. 1.1% 15-FEB-2031Yield to maturity

4.48%

Maturity date

Feb 15, 2031

V4972836

Visa Inc. 2.05% 15-APR-2030Yield to maturity

4.37%

Maturity date

Apr 15, 2030

US92826CAP7

VISA 20/27Yield to maturity

4.11%

Maturity date

Aug 15, 2027

3V6A

VISA 17/27Yield to maturity

4.10%

Maturity date

Sep 15, 2027

V4972834

Visa Inc. 1.9% 15-APR-2027Yield to maturity

4.10%

Maturity date

Apr 15, 2027

See all VISA06 bonds