S&P 500 Obeying Elliott Wave TheoryThis is an update of a previous publication. A Flat occurred for Wave 2(Green) and if Wave 3 is over, we can expect a Zigzag for Wave 4. Zigzags have 3 waves. A confirmation at its current location will trigger a sell for Wave 4(Green).

For more information on the same, go to:

SP500 trade ideas

The Low Is In: Why the S&P 500 Just Confirmed a Bullish Reversal🔥 The Low Is In: Why the S&P 500 Just Confirmed a Major Bullish Reversal 🔥

The market just gave us a gift.

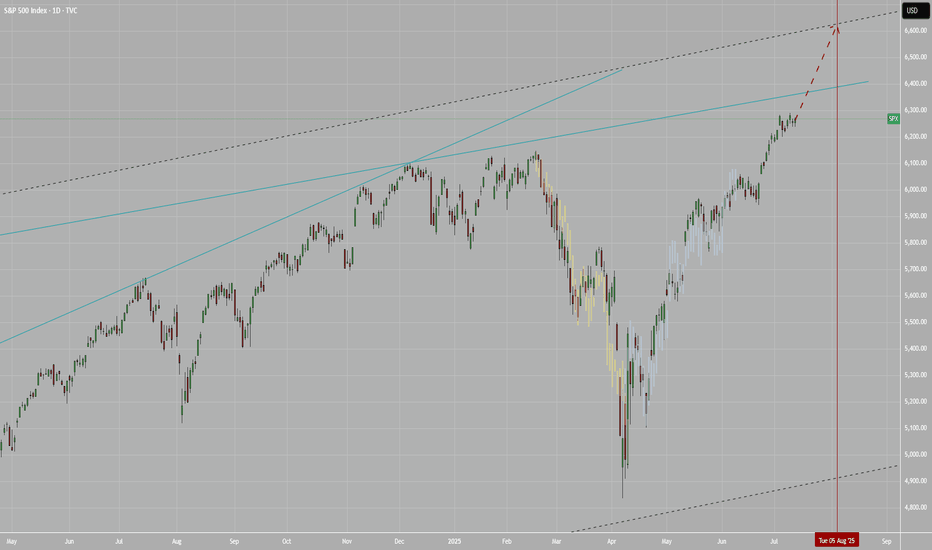

After weeks of drifting lower and sentiment turning cautious, the S&P 500 has touched — and bounced — off a critical rising trendline for the third time since May 2025. That third touch isn't just a technical coincidence… it's often the launchpad for a new impulsive leg higher.

📈 The Power of the 3rd Touch: Trendline Validation Complete

Look at the chart. This isn’t guesswork. Since May, the S&P 500 has been respecting a well-defined ascending trendline, one that connects multiple higher lows during this bull run.

The first touch was the May liftoff after the April consolidation.

The second came in June — a clean retest and bounce.

Now, as of early August, the third touch has held once again, exactly where the bulls needed it most.

This isn’t a random line on a chart. This is institutional flow stepping in to defend structure.

And when a rising trendline holds for a third time after a strong uptrend? That’s a classic continuation signal.

📉 RSI Washout + Structural Support = Perfect Storm for a Bottom

The RSI printed a dramatic dip to ~32, a level that screams “oversold” on the 4-hour timeframe. But notice the context — it happened right at structural support.

This is not weakness. This is accumulation.

Big players shake out weak hands on low timeframes… right before they send it.

🧠 Sentiment Is Offside… Again

Let’s not forget: this retrace came after a huge run-up since March. People expected a deeper correction. Bears started getting loud again.

That’s how bull markets trap you — by convincing you it’s over right before the next leg higher.

And with macro tailwinds (liquidity expansion, fiscal spend, tariff rollbacks), earnings season beats, and global capital rotation into U.S. equities, this setup is ripe for a violent upside squeeze.

🚀 8,700 in Sight: My End-of-Year Price Target Is Very Much in Play

Today’s close around 6,220 means the S&P 500 would need to rally ~40% to hit my target of 8,700 by year-end.

Sounds crazy? Not if you’ve seen what happens during parabolic melt-ups.

This isn’t just hope:

📊 Strong breadth under the surface

🏛️ Dovish policy pivot now expected in Q4

💸 Retail and institutional capital both re-engaging

📉 Bond yields are starting to roll over, supporting equity valuations

When bull markets enter their euphoria phase, they don’t stop at “reasonable” targets. They blast through them.

💡 The Setup Is Textbook — Now It’s About Execution

✅ Trendline defended

✅ RSI reset

✅ Sentiment shaken out

✅ Structure intact

The technicals just aligned with the macro. The low is in — and the runway to 8,700 is wide open.

Strap in. Q4 could be one for the history books.

The worst drops often come later!Don’t be fooled by the first crash… The worst drops often come later in a bear market.

Let’s break down the brutal truth about the 2008 GFC and what it teaches us today. 🧵

1.

In the 2007–2009 bear market, the S&P 500 had 7 failed rallies before finally bottoming.

Every bounce looked like the bottom — and every one was a trap.

👇

2.

The early drops were steep:

🔻 Down 11%

🔻 Down 17%

But the most violent crashes came after those…

Near the END — not the beginning — of the bear market.

3.

Later stage declines:

❌ Down 28%

❌ Down 36%

❌ Down 29%

That’s when capitulation kicked in.

Investors gave up. Fear took over.

4.

Capitulation volume isn’t a guaranteed bottom.

It feels like it’s over.

But if fundamentals haven’t turned and the trend isn’t broken, the bear can still bite — hard.

5.

Final crashes are like cliffs:

Markets are exhausted.

Hope is crushed.

And that’s finally when the real bottom shows up.

6.

The lesson?

Bear markets are full of traps.

Relief rallies can fool even seasoned pros.

Stay patient. Wait for trend confirmation. Don’t chase fake bottoms.

7.

📉 The biggest crashes usually happen at the end of the bear market.

That’s the final flush — and it sets the stage for true opportunity.

Learn from the past. Don’t get trapped. Stay sharp.

Is This the Start of a Market Drop?So, is the drop beginning? It kind of looks that way, but there’s still no solid setup for entering a short position — and there hasn’t been so far.

The trend is still upward for now, and this current pullback might just be temporary.

What I like about the short idea is that August is traditionally a weak month for stocks .

Could this be the start of a big correction on the market? Yes, it’s possible.

It’s just a pity there’s no clean setup for a short. I’d like to enter, but I’d prefer to see a bit more confirmation on the chart itself.

In general, trading the index off of chart setups isn’t easy — perfect entries are rare. That’s exactly the case now. I’m watching and wondering how and when to catch the downside. Maybe I’ll end up sitting through the entire drop without a position :)

Overall, I’m in favor of the short — but for now, I just don’t see a clear entry point.

Correction Ahead? SP500 Prints Reversal Signal at Key Resistance📘 This market moves like a textbook chart

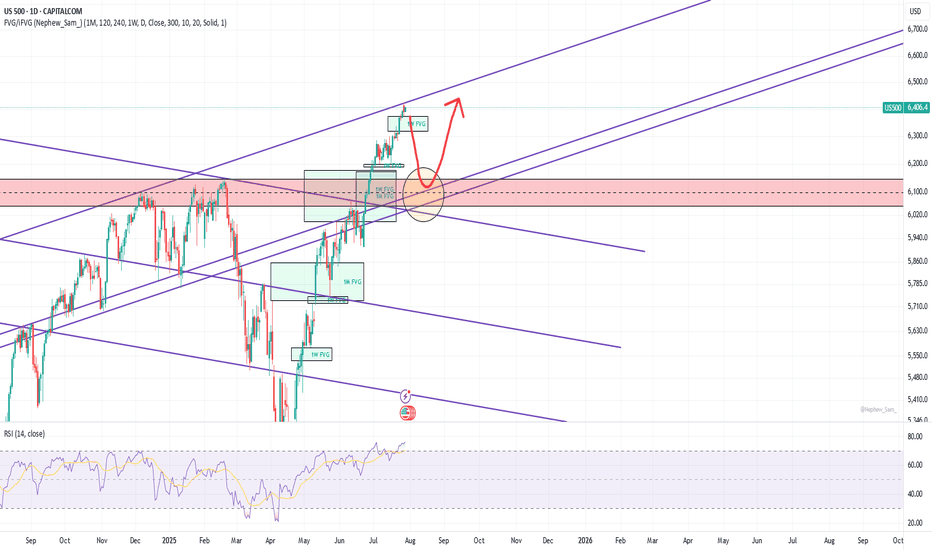

SP500 is acting like a perfect case study from a trading manual. Back in early April, the index dipped just below 5,000, right into a confluence support zone ( I had spoken about this at the time ) – formed by the long-term ascending trendline and the 2022 all-time high. Just like other U.S. indices, the market reversed aggressively from that area.

🚀 A 30% rally in 4 months

From that low, SP500 rallied around 30% in just four months. An incredible move that brought the index straight to the upper boundary of the yearly rising channel.

🕯️ Bearish signal at the top

And just like in NAS100’s case , the index printed a strong Bearish Engulfing candle exactly at that resistance level. This kind of signal, after such a rise, shouldn’t be ignored.

📉 A correction is not only probable – it’s needed

A pullback from here is not just likely, but in my opinion, healthy and necessary . Short-term speculators could look for a move toward the 6,150 zone, which would already offer decent room for profit.

🔍 What if it goes deeper?

I wouldn’t be surprised to see a correction down to 5,750–5,800. That’s about a 10% decline, which wouldn't even classify as a bear market, just a normal reset after a euphoric rally.

🧠 Perspective matters

In a market that gained 30% in four months, a 10% correction is not a crash — it’s discipline being restored.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

A pullback planThe upper trendline starts from Jan 2022 peak. It was broken on normal scale but still holds on log scale. The price may top here or may go higher. In a very bullish scenario the price may bounce much higher from an upper 1W FVG, but I think it will be broken soon. In any case I see a strong support at 6050-6150 area - a horizontal support and 1M/1W FVG are there. The price should return there sooner or later. No negative daily RSI divergence at the moment, but the price can make 4% correction on 2-4h divergence, which will appear at any new ATH. I gonna hold and increase my short position with low leverage untill the price makes a pullback into this area.

SP500 → Countertrend correction before growthFX:SPX500 is correcting against an upward trend. In the second half of the week, the market received fairly positive fundamentals during the reporting period.

S&P 500 futures found support after strong reports from Meta and Microsoft, which exceeded earnings expectations and forecasts thanks to AI. The rise in futures supported demand for the “Magnificent Seven” despite Powell's hawkish comments. The focus is on Apple and Amazon reports in the evening, which could strengthen the tech rally. On Friday, we are seeing a countertrend correction in which the market is testing the 6288 zone of interest.

Support levels: 6288.4, 6262.6

Resistance levels: 6342, 6371

Most likely, the market will form a false breakout of support during the correction. If the bulls keep the index above the key level, we can expect continued growth in the short and medium term.

Best regards, R. Linda!

$SPX Analysis, Key Levels & TargetsThis is how last night’s members chart played out and it was amazing. We opened at the top of the implied move and all of the spreads at the top paid as we dropped back to the 30in 200MA

The spreads I took at 6420/6435 but every spread shown here would have done well.

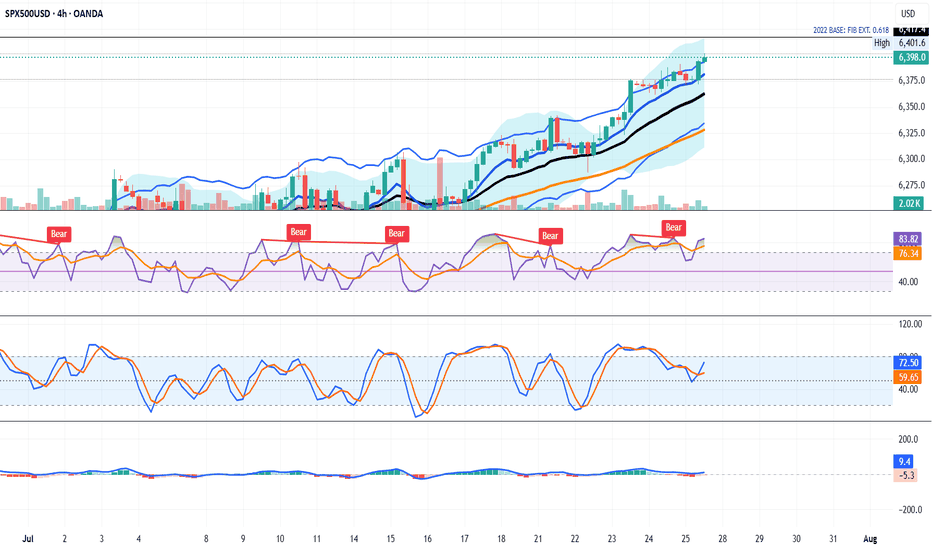

SPX500 NEARING AN IMPORTANT FIB. EXTENSION RESISTANCEIn this weekend's analysis I find the SPX500 to remain BULLISH for next few days as we have strong closings outside the upper KC band and also touching the upper Bollinger band on the higher time frames from Daily to Monthly charts. It's also important to note that declining volume bars is NOT supporting the monthly rally, while MACD, RSI divergences are also sounding warning sirens that it's near a major correction territory which I have measure as the fib extension 0.618 from the October, 2022 base or support on the monthly chart. As signaled last week that we could be getting a capitulation candle soon to the fib target. Once we get a reversal candle on the 4 Hours it will confirm that the intermediate tops is achieved on the SPX500 and a correction is highly probable. So our trade thesis is Bullish until we get a confirmed bearish signal on either the 4H or 1D timeframe with Stop loss at 6377 level. Thanks for visiting my publication and trade idea on the SPX500. Cheers and happy trading to everyone.

S&P Correction Window is official - VOLATILITY AHEADIt's that time of year where the pre-summer push wraps and the summer lull and potential

pause gets underway.

July 31 finished on a bit of a sour note with over 67% of stocks declining today and US indexes finishing RED despite the big gaps and bullish pops on MSFT and META post earnings.f

SPX Key Levels

-watch the 21 day moving average

-watch the 50 day moving average

-more dynamic support in the 100/144/200 moving average cluster

I'll be taking bites at the 5/10/15% correction levels with options and looking for this dip

to be bought by retail and institutions.

Will August 1 US Tariff Deadline matter? After Japan and Eurozone came in and said a deal is being done, I was thinking this would be a dud. BUT, Dr. Copper says "maybe" on the global

tariff deadline with the largest single day move in history (bearish). Being the perfect time of year for a correction (the other being Feb-Apr), and the technicals looking so clean for an

orderly pullback, VIX may float higher and make things more interesting in the next 30-60 days.

Strategies matter, I'll be trading risk defined, but there are great opportunities ahead. A pullback is sure better than literally watching all-time highs every single day.

Thanks for watching!!!

S&P 500 ETF & Index Hit Resistance – A Technical Warning Shot 📉⚠️ S&P 500 ETF & Index Hit Resistance – A Technical Warning Shot 🔍🧠

Following up on the video I just posted , I had to share this updated chart of the VOO ETF (Vanguard S&P 500) and US500 Index , now that both are testing key resistance levels.

On the left: AMEX:VOO has reached the very top of a multi-year ascending channel—a zone that has historically triggered sharp corrections. The level at 590.85 marks a major resistance zone.

On the right: The US500 Index is showing a similar technical overextension, trading just under 6,450, with 5,928.25 as the nearest support below.

🎯 Technicals at play:

VOO could retrace toward 526.17 and potentially 465.72, both of which are solid technical supports within this channel.

This setup doesn't mean panic—but it does argue for caution, especially after such an extended run.

🧠 And yes, the Buffett Indicator (Stocks-to-GDP) continues to point toward an overheated market . While it's not a timing tool, it adds macro weight to the technical signals.

In the video, I also touched on:

Taking profits on NASDAQ:NVDA after a near-perfect technical rejection at target.

Reviewing Rolls Royce nearing upper channel resistance.

Gold and Silver at inflection points—likely to be impacted if equities begin to unwind.

Rotational potential into Bitcoin and Ethereum, which may benefit from macro shifts.

This is how I trade: respect structure, stay proactive, and prepare before the move—not after. Let me know how you’re positioning or if you’re sitting on hands waiting for a dip.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈