#SXP/USDT looking extremely bullish#SXP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.0595. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.0630

First target: 0.0666

Second target: 0.0703

Third target: 0.0748

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

Market insights

#SXP/USDT looking extremely bullish#SXP

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.0882, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.0907

First target: 0.0910

Second target: 0.0952

Third target: 0.0983

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

SXPUSDT Forming Falling WedgeSXP/USDT appears to be forming a classic falling wedge pattern—one that’s showing increased volume and heightened interest from the investing community. The narrowing range and converging trendlines hint at a compression of volatility, which often precedes a breakout to the upside. Given the current accumulation phase and strong volume behind recent dips, this setup looks primed for a potential surge that could deliver a 90% to 100%+ move if bullish momentum kicks in.

On the fundamentals, SXP (Solar) is re-positioning itself as a Layer-1 blockchain with a focus on scalability and real-world use cases, which is gaining traction among investors seeking projects beyond the top tier. While its circulating supply of over 660 million tokens and market cap around US$75 million still classify it as a small-cap crypto, that very characteristic offers higher upside if it catches a breakout and rotates into the spotlight. The rising volume metrics signal rediscovered interest, which may be the catalyst for a strong breakout.

In terms of strategy, traders should look for a clean breakout above the upper boundary of the wedge with convincing volume. That breakout will serve as the trigger to enter long positions, while risk should be defined by placing stops just below the recent swing low or below the support trendline of the wedge. Given the pattern and expected move of near 90% to 100%+, the risk-reward is compelling—but as always, proper position sizing and discipline are key.

In short, SXP/USDT is flashing a high-probability reversal setup with structural, volume, and sentiment alignment now converging. If the breakout confirms, this could be one of the standout altcoin moves to watch. Show your support by hitting the like button and

Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

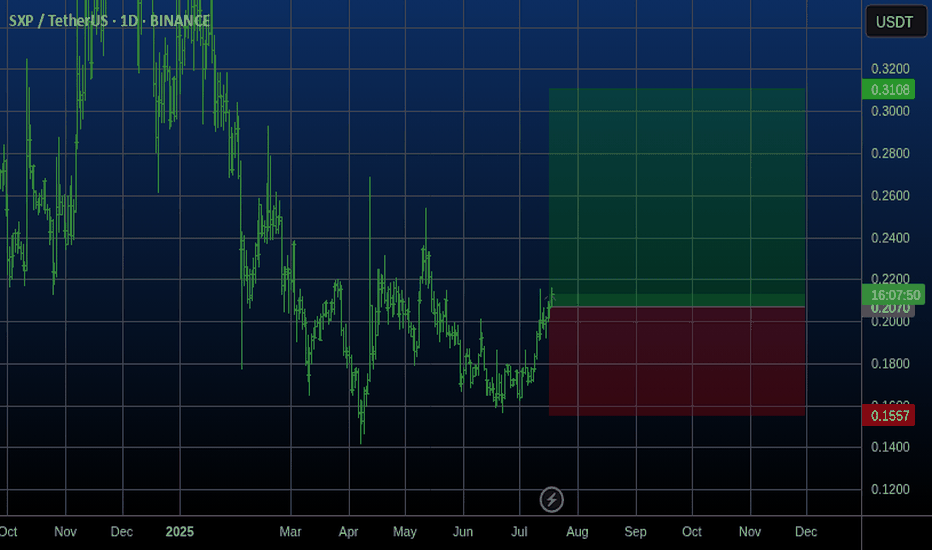

SXPUSDT 1D#SXP is moving inside a falling wedge pattern on the daily chart. Consider buying a small bag here and near the support shown on the chart. In case of a breakout above the wedge resistance, the potential targets are:

🎯 $0.1597

🎯 $0.1995

🎯 $0.2317

🎯 $0.2639

🎯 $0.3097

🎯 $0.3680

⚠️ Always use a tight stop-loss and apply proper risk management.

Scalp Long – SXP💎 Scalp Long – SXP

Price has broken out of the descending channel and completed its retest successfully. RSI is in the buying zone, while buying volume continues to rise sharply, confirming bullish momentum.

🎯 Trade Setup:

→ TP: 0.1108 | SL: 0.098 | RR: 1 : 3.13

Structure, momentum, and volume are aligned — suggesting a strong upside continuation as SXP begins its recovery phase.

Scalp Long – SXP💎 Scalp Long – SXP

RSI is in the buying zone, and price has broken out of the short-term downtrend, confirming a shift in momentum.

Buying volume is increasing across lower timeframes, reinforcing bullish sentiment.

🎯 Plan:

→ Enter after confirmation of breakout strength.

→ TP: 0.1168 | SL: 0.1057 | RR: 1 : 3.89

Momentum aligns with the long side.

Keep entries clean, trail SL as price rises.

Patience and precision — only enter when setup confirms clearly

Scalp Long – SXP💎 Scalp Long – SXP

RSI has broken out from the corrective trend and is now in the strong buy zone.

Price shows strong bullish momentum, breaking through major resistance.

Buying volume is returning, confirming renewed market strength.

The move continues toward testing the local high.

🎯 Plan:

→ Enter after candle confirmation above resistance.

→ TP: 0.1278 | SL: 0.1229 | RR: 1 : 2.14

Momentum favors the long side.

Keep entries precise, trail SL as price gains.

Patience and discipline — wait for the setup to confirm.

#SXP/USDT looking extremely bullish#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.1205, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.1282

First target: 0.1309

Second target: 0.1351

Third target: 0.1394

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#SXP/USDT looking extremely bullish #SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.1580, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.1619

First target: 0.1637

Second target: 0.1662

Third target: 0.1691

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SXP/USDT — Triangle Nearing Breakout, Bullish or Bearish?🔎 Summary

SXP/USDT is currently trading within a long-term contracting triangle pattern that has formed since late 2024. This setup indicates reduced volatility and energy build-up. As the price approaches the apex of the triangle, the probability of a strong breakout — either bullish or bearish — becomes increasingly high.

The latest close is around 0.1809 USDT, right at a critical decision zone.

---

🧩 Pattern & Key Technical Levels

Main pattern: Contracting triangle (lower highs + flat/slightly rising support).

Key support zone: 0.16–0.18 (highlighted yellow box).

Major structural low: 0.1416 USDT.

Step resistances (dashed lines):

0.2244 → 0.2536 → 0.2951 → 0.3836 → 0.4632 (with a major high at 0.4824).

Volume condition: Declining volume indicates market indecision. A confirmed breakout should come with a strong volume spike.

---

🚀 Bullish Scenario

Confirmation:

2D candle closes above 0.19–0.20.

Stronger confirmation once price breaks and holds above 0.2244 with notable volume.

Upside targets:

1. 0.2244 → first resistance.

2. 0.2536 → secondary psychological zone.

3. 0.2951 → major resistance, potential take-profit zone.

4. 0.3836 and 0.4632 → higher upside targets.

5. Measured move (aggressive target): Full triangle breakout could push price toward ~0.52 USDT.

---

🐻 Bearish Scenario

Confirmation:

2D close below 0.16 with failed retest.

Downside targets:

1. 0.1416 (major low).

2. If breakdown continues, market may seek new historical support below 0.13, though no clear structure is visible on this chart.

---

⚖️ Conclusion & Strategy

Neutral bias: As long as price remains inside the triangle, direction is undecided. Wait for breakout confirmation.

Bullish case: Safer entry above 0.2244 with strong volume.

Bearish case: Valid short setup if breakdown occurs below 0.16.

Note: Triangle breakouts often produce false moves (fakeouts) — always wait for candle close and volume confirmation.

---

📌 Key Notes for Traders

Apply risk management: risk only 1–3% of capital per trade.

Triangle breakouts tend to move fast and impulsively — use take-profit targets or trailing stops.

Keep an eye on overall crypto market sentiment, since SXP tends to follow BTC and ETH trends.

---

#SXP #SXPUSDT #Crypto #Breakout #TechnicalAnalysis #Altcoins #CryptoTrading #ChartAnalysis

sxp looking extremely bullish overall consolidating in symmetrical triangle, but recently bounced from bottom of triangle, and cleared multiple hurdles. now expecting rally towards consolidation range descending trendline, then will see price action reaction in that area, and will share further update.

#SXP/USDT moment for try to Buy SXP .

#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.1640, which represents a strong basis for the upside.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.1772

First target: 0.1837

Second target: 0.1924

Third target: 0.2050

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#SXP/USDT moment for try to Buy SXP.#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.1640, which represents a strong basis for the upside.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.1772

First target: 0.1837

Second target: 0.1924

Third target: 0.2050

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Sxpusdt Buy opportunitySXPUSDT is showing signs of a potential falling wedge formation, with price breaking above the setup near the $0.3 level to reach a temporary high around $0.6. Following this, the price has begun a pullback, retesting the trendline of the falling wedge. The current bounce indicates a reaction at a major support level, presenting a favorable accumulation opportunity. The suggested accumulation zone, along with target levels, is marked on the chart.

Let us know your thoughts on this analysis.

SXPUSDT UPDATE

Pattern: Falling Wedge Breakout

Current Price: \$0.1836

Target Price: \$0.2470

Target % Gain: 35.20%

Technical Analysis: SXP has broken out of a falling wedge pattern on the 12H chart with a strong bullish candle and volume spike, confirming the breakout. This setup signals potential continuation to the upside.

Time Frame: 12H

#SXP/USDT#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.1587.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1624

First target: 0.1666

Second target: 0.1736

Third target: 0.1807

SXPUSDT | Clean Demand Zone BelowSXPUSDT is approaching a blue box that looks like a well-structured demand zone. The last reactions from this area were strong, and it may attract buyers again.

If price revisits that zone with low-timeframe confirmation, I’ll be watching closely. It’s not about predicting, it’s about reacting when the structure aligns.

“I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break in the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long.”

Patience here could lead to precision. Let others rush. You wait with intent.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

SXP - Pivoting at 0.2100SXP is trading near 0.2100, which is at the lower end of its recent range between 0.1953 and 0.2357. This level seems to be a key pivot point, as the price is holding above the 100-period moving average, a line that has acted as support so far. However, the price is showing signs of consolidation, and a breakout or breakdown from this 0.2100 level will likely set the next direction. If SXP pushes above 0.2100 with strength, it could target resistance at 0.2258 and 0.2357. On the other hand, a drop below the 100-period moving average might lead to a decline toward support at 0.1953 or even 0.1820. Watch this 0.2100 zone closely for the next move.

Technical Indicators:

The Relative Strength Index (RSI) on the 4H timeframe is sitting at 76.5, which puts it in overbought territory. This suggests that the recent upward momentum might be overstretched, and a pullback could happen soon. Despite this, the price being above the 100-period moving average keeps the short-term outlook somewhat bullish. The overbought RSI, combined with the price nearing the upper part of its range, hints at possible selling pressure ahead. Traders should look for confirmation of direction before jumping in, as the risk of a correction is higher with these levels.

External Factors

The broader crypto market is currently volatile, with major coins like Bitcoin and Ethereum experiencing big swings. This choppiness could influence SXP’s price on the 4H chart, making its movements less predictable. There’s no specific news or event tied to SXP driving its price right now, so its direction will likely follow the overall market mood. Keep an eye on external market trends, as a sudden shift could spark a sharp reaction in SXP.

Potential Scenarios:

For a bullish setup, wait for a strong move above 0.2100 with volume to confirm momentum. If that happens, potential targets are 0.2258 and 0.2357. But with the RSI overbought, consider entering after a dip or clear breakout to avoid chasing. For a bearish setup, a break below the 100-period moving average could signal a short, aiming for 0.1953 and 0.1820 as downside targets.

#SXP/USDT#SXP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.2030, which acts as strong support from which the price can rebound.

Entry price: 0.2115.

First target: 0.2190.

Second target: 0.2258.

Third target: 0.2357.