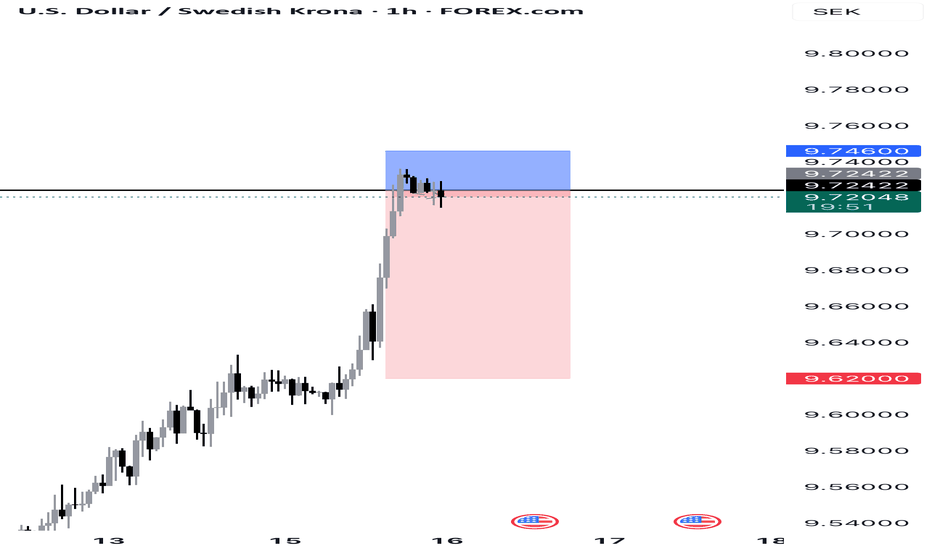

Lower Time-Frames on USD/SEKIn the analysis of the USD/SEK pair on lower time-frames, there is a potential for a selling movement.

Although the pair has experienced several periods of consolidation and an extended bullish trend, there is a possibility of a downside correction, associated with the context of U.S. monetary poli

About U.S. Dollar / Swedish Krona

The U.S. Dollar vs. the Swedish Krona. At times of market stress the U.S. dollar can act as a safe-haven asset, but swings in broad-based investor trends can make the USD/SEK exchange rates very sensitive. The pair can also sensitive to relative monetary policy expectations for the Federal Reserve vs. the Riksbank, Sweden’s central bank.

Related currencies

Bullish Case for USD/SEK: A Technical PerspectiveOANDA:USDSEK showing strong reversal from key support at 9.60 level after major breakdown. Currently consolidating in the 9.60-9.70 zone with positive momentum building on multiple timeframes. This could be the start of a significant recovery after the sharp decline from 11.00 resistance. #Forex #U

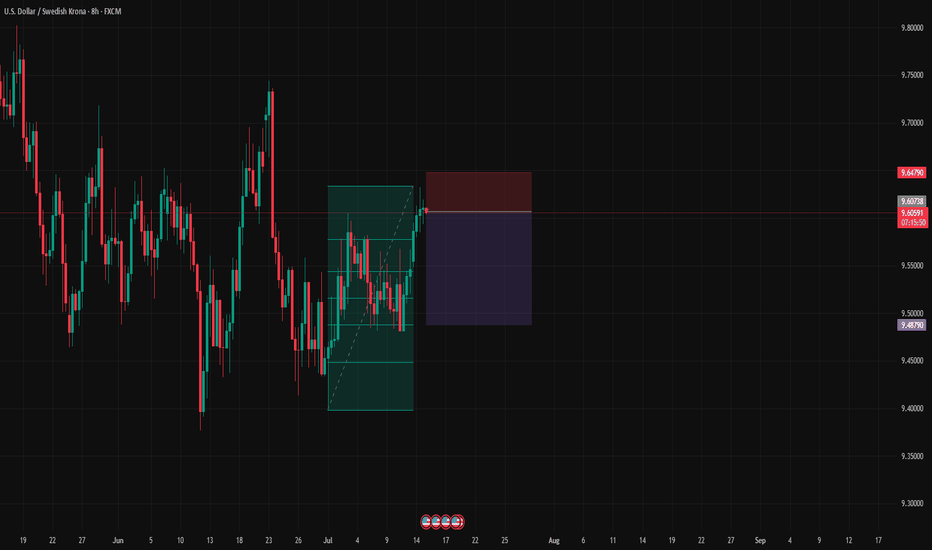

#010: USD/SEK SHORT Investment Opportunity

At the opening of the 8-hour candle, the price touched the 200-mark moving average with surgical precision on volume compression, signaling the exhaustion of the bullish movement underway since the end of June.

🔍 What strengthened the short position:

The price hit a key area defended by institut

USDSEK Bullish Breakout from Support📈 Overview from Weekly Time Frame

USDSEK is stalling at a key weekly support zone, showing signs of rejection from the downside. This level has acted as a reliable demand zone in the past.

📊 Daily Chart Explanation

Price has broken the internal bearish structure and is now holding firmly above t

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDSEK is 9.53228 SEK — it has increased by 0.02% in the past 24 hours. See more of USDSEK rate dynamics on the detailed chart.

The value of the USDSEK pair is quoted as 1 USD per x SEK. For example, if the pair is trading at 1.50, it means it takes 1.5 SEK to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDSEK has the volatility rating of 0.98%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDSEK showed a −0.41% fall over the past week, the month change is a 0.34% rise, and over the last year it has decreased by −6.73%. Track live rate changes on the USDSEK chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDSEK right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDSEK technical analysis. The technical rating for the pair is strong sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDSEK shows the sell signal, and 1 month rating is sell. See more of USDSEK technicals for a more comprehensive analysis.