You continue to ask "how did he know Xrp would do that"?I like to keep stats on my predictions, and so should you. How else can you tell if someone is worth following? So, here's a recap since my first Xrp post ever, made on July 23rd 2025.

July 23rd- I suggested Xrp could go as low as $2.7 (a -25% dump from that day).

July 28th- As Xrp approached $2.7 I refined my predicition to a WT target of $2.76

Aug 2nd- My $2.76 WT target was hit (within 1%). See below

Aug 7th- I expected a big bounce from my WT target (20+%) and I followed up with a post, as we started to get close to that next top.

Aug 10- I called "the top was in", and I suggested that Xrp would drop to my support range of $3.03-$3.15 within 1-3 days. That target was hit 1.5 days later. I also suggested Xrp would bounce from my red T1 box and retrace up to my T1 green line...and then go lower into my red box. My calls on direction and target for each of these 3 moves were confirmed. See below.

Aug 11th- Xrp went lower into my red box as anticipated.

Notice in all of my charts, I do not simply offer support and resistance zones (as some influencers do). I anticipate the direction the asset will take as it travels through these zones. Simply identifying support and resistance is not enough to execute profitable trades. I hope that my accuracy in determining directionality and precise targets has been of benefit to you. I would like to see us all succeed.

Please note, I'm not sure how much longer I will continue to chart at this pace, being that it takes a lot of time & effort to bring you these free gold nuggets. Let me know if you want me to show you how I draw these maps to the gold mine.

XRPUSD trade ideas

XRP/USD – Cup and Handle Formation Suggests Bullish ContinuationXRP has recently completed a Cup and Handle pattern, which is a strong bullish continuation signal often seen before major upward moves.

Key technical insights:

✅ Cup and Handle structure formed successfully.

✅ Price is currently consolidating inside a falling channel (handle).

✅ A breakout above the handle could trigger bullish momentum toward the $3.80 resistance area.

📈 If buyers sustain momentum, XRP may extend gains toward the psychological $4.00 level.

On the downside, if price fails to hold, support can be found around $2.50–$2.00 levels.

This setup suggests XRP may be gearing up for the next bullish leg if it manages to break and sustain above the handle resistance.

This analysis is for educational purposes only and should not be considered financial advice. Always manage risk properly before entering trades.

Ripple may bounce up from buyer zone to top part of rangeHello traders, I want share with you my opinion about Ripple. The market for Ripple has undergone a significant structural shift, with the prior upward channel giving way to a new phase of horizontal consolidation following a decisive breakdown. This event signaled a pause in the strong bullish momentum and established a new trading range, with the major buyer zone around the 2.9525 support level now acting as the foundational floor for the price. After the initial drop, the price has been trading within this new, more contained range, undergoing a series of corrective movements. Currently, the asset is in another downward leg, heading towards the critical buyer zone for what could be a decisive test of this support. The primary working hypothesis is a long scenario, based on the expectation that demand will overcome supply within this 2.9525 - 2.9000 area. A confirmed and strong rebound from this key support would indicate that the corrective phase is over and that buyers are ready to initiate a new rotation to the upside. Therefore, the TP for this range-based play is logically set at the 3.1830 level. This target corresponds with the top of the current consolidation range and represents the most probable objective for a bullish swing originating from the established support base. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

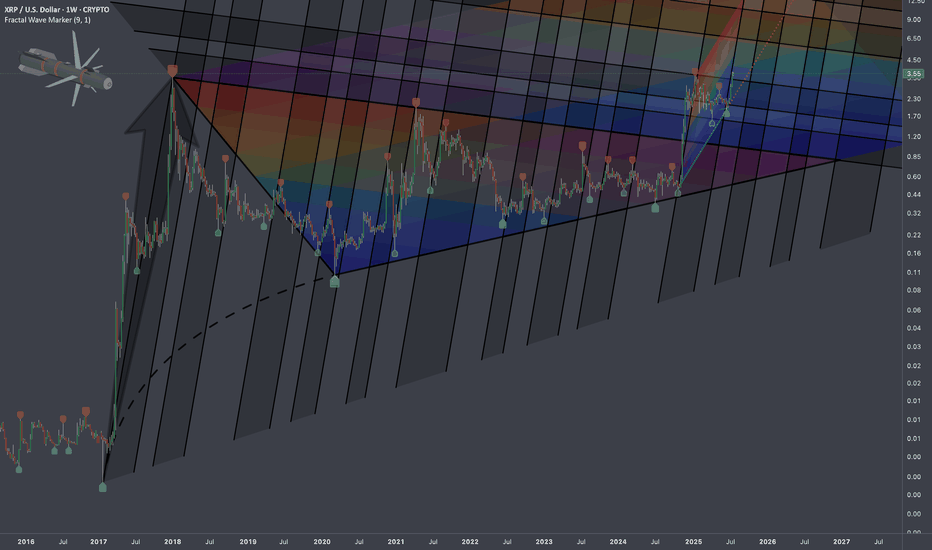

$XRPUSD: Limits of Expansion🏛️ Research Notes

Documenting interconnections where historic area and coordinates of formations are used to express geometry of ongoing cycle.

If we scale out the chart back starting from roughly 2016, we can see more pretext like how the price was wired before decisive breakout from triangle.

Integrating fib channel to the angle of growth phase of the previous super-cycle, so that frequency of reversals match structural narrative.

XRP next 50 day analysis 🔎 Current Market Context is Bullish 🐂

• Price: ~$2.92 (as shown on your chart).

• Trend: Currently retracing after a sharp run-up, consolidating near support.

• Support Zone: Around $2.70- $2.80.

• 50-day SMA: Sloping upward, acting as dynamic support.

• RSI (7 close): Looks like it’s cooling off from an overbought region.

📉 Short-Term (next 10–15 days)

• If XRP holds above the horizontal support & 50-day SMA, buyers may step in.

• Expect sideways to slight upward action → potential retest of ~$3.27 - $3.35

📈 Medium-Term (15–30 days)

• Based on the bullish projection sketched:

• A rally could push XRP toward $3.80–$4.20.

• Likely stair-step pattern: higher highs & higher lows (as drawn).

• If volume increases, a breakout above $4 could attract momentum traders.

🚀 Long-Term (30–50 days)

• Strong bullish case: After a 20 percent pullback to previous resistance of $3.35 it will wave towards $5.

🐻 Bearish case - none of this will happen if the $2.70 support zone is broken downwards.

Xrp - It all comes down to this!🚀Xrp ( CRYPTO:XRPUSD ) has to break structure:

🔎Analysis summary:

After Xrp created the previous all time high in 2018, we have been seeing a consolidation ever since. With the recent all time high retest however, Xrp is clearly showing some considerable strength. It all comes down to bulls being able to push price higher, above the massive horizontal structure.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

SHORT | XRPUSDCOINBASE:XRPUSD

XRPUSD Daily – Bearish Continuation in Play

Trend Structure

Market printed a Higher High near 3.66 but failed to sustain momentum.

Recent price action has shifted into a sequence of Lower Highs, confirming bearish control.

Current structure shows LH → LL pressure, with momentum pointing lower.

EMA Context

Price is already below the 9 EMA, confirming short-term weakness.

The 35 EMA has failed to hold as support.

The 100 EMA aligns with demand and marks a critical inflection point.

Fib + Key Levels

38.2% retracement at 2.995 has been broken — bearish confirmation.

50% retracement at 2.788 is the near-term magnet.

61.8% retracement at 2.580 is a strong support cluster with EMA + demand zone.

Targets

TP1: 2.247 (aligns with 78% retracement + demand)

TP2: 1.909 (major liquidity zone and deeper correction target)

Invalidation

A daily close above 3.25–3.30 would weaken the bearish thesis and shift focus back to range consolidation.

Bias

Short-term to mid-term bearish. Expecting continuation toward 2.78 → 2.58 first, with potential extension into 2.24 and 1.90 if supports fail.

XRP heading to $4 in 5 waves 🔎 Technical Analysis

1. Price Action

• XRP is currently around $2.85–2.86.

• There’s a visible descending trendline showing lower highs, but price is consolidating sideways near horizontal support (~$2.85).

2. Support & Resistance

• Strong support: around $2.80–2.85 (tested multiple times).

• Immediate resistance: around $2.90–2.95, where the descending trendline aligns.

• Major upside target: around $3.05–3.10, if resistance breaks.

3. Indicators

• SMA 50: Price is hovering just below the moving average, suggesting sellers still in control but losing momentum.

• Williams %R: Currently at -66.44, sitting in the bearish zone but close to oversold. This signals downside momentum is weakening.

4. Chart Projection

• The black arrow drawn shows a potential bullish reversal: bounce from support → break trendline → run toward $3.05 and heading towards all time highs and price discovery of $4 plus.

• This would only confirm if XRP breaks and holds above the descending trendline (~$2.90–2.95).

✅ Bullish Scenario

• Hold support at $2.80–2.85.

• Break above $2.95, leading to a push toward $3.05–3.10.

❌ Bearish Scenario

• If $2.80 support fails, price could revisit $2.70 or lower.

XRP to $4 dollars 🔎 Chart Observations

1. Current Price: $3.07

2. Pattern: symmetrical triangle (consolidation before a breakout.)

3. Support: Around $2.98- $3.00

4. Resistance: Descending trendline near $3.20 – $3.33

5. Projected Move: Orange arrow shows breakout toward all time highs and reaching $4.20–$4.40 for the first wave 🌊

Bullish elephant bar 🐘 🚀

XRP. Short term pain followed by a Weekly Wave 5 to $5.20.For me this bull market we're in started on 26th Oct 2024 when the market cemented its prediction of a Trump win at the US elections. Before Trumps win XRP was in limbo. A win for the Dems and Gensler would still be at the SEC, XRP would still be under $1.

Monthly Wave 1 - $0.48 to $3.40:

Wave 1 was frantic especially in the early stages, fueled by euphoria. Corrections were brief as XRP raced to catch up for lost time.

Monthly Wave 2 - $3.40 to $1.61 (the 0.618 retrace was $1.60)

I believe we're currently in a Monthly Wave 3:

Wave 1 - $1.61 to $2.65

Wave 2 - $2.65 to $1.90

Wave 3 - $1.90 to $3.66

Wave 4 - $3.66 to....

Wave 4 looks to be a Zig Zag (descending a-e, a-c, a-e), and as of today 14th Aug we appear to be in the 2nd half of this correction.

My predictions?

Wave 4 will end around $2.65 but I wouldn't be surprised to see the wick as low as $2.55 (Wave 1 closed the day here despite reaching $2.65)

Weekly Wave 5 and the Monthly Wave 3 end to reach the 1.618 extension of our Monthly Wave 1 at $5.20 withe the potential for a massive end of year blow off top. Having said all this I wouldn't be surprised to see Wave 3 extend in which case my target would be $8.10 which is a further extension of Wave 1.

XRP Holds $2.80 Support as Bulls Target BreakoutXRP has pulled back into the $2.80 support zone, a region reinforced by the 50-day moving average and the value area high. Strong buying volume suggests this retest could fuel a move toward new highs.

XRP’s correction has settled into a critical support area that has so far absorbed selling pressure effectively. The $2.80 zone, supported by the 50-day moving average and the value area high, has provided stability for price action in recent sessions. This confluence of technical levels gives buyers a strong foundation to defend, increasing the probability of continuation if the level holds.

The importance of this region lies not only in its structural strength but also in its volume profile. The overlap between high-time frame support and a high-volume trading area suggests that demand is concentrated here. Such zones are often treated as accumulation ranges, where long-term buyers absorb supply and prepare for a new leg upward.

Key Technical Points:

- $2.80 High-Time Frame Support: Aligned with both the 50-day moving average and the value area high.

- Bullish Retest Developing: Current reaction shows resilience, keeping the higher-highs and - higher-lows structure intact.

- Volume Confirmation: Above-average buying volume signals strong demand at this level.

Structurally, XRP continues to respect its bullish market trajectory. Since reclaiming the point of control earlier in the year, the asset has moved in a steady rhythm of higher highs and higher lows. The current bounce from $2.80 underlines that the broader bullish trend remains intact despite short-term volatility.

Volume trends further strengthen the case for continuation. The presence of above-average bullish inflows suggests that the current retest is less a breakdown and more a validation of support. This level of participation shows that market participants are prepared to accumulate XRP at higher price zones, a sign of confidence that often precedes impulsive upside moves.

It is also worth noting that XRP does not need an immediate breakout to remain constructive. Consolidation above $2.80 would serve as a healthy base, helping to stabilize the market while flushing out weak hands. Periods of sideways price action often act as launchpads for stronger moves when buyers eventually regain momentum.

What to Expect in the Coming Price Action

As long as XRP sustains multiple daily closes above $2.80, the bullish case remains intact. Continued strong volume will reinforce the likelihood of an advance beyond the swing high, opening the path toward new all-time highs. The current retest represents a pivotal juncture, and if buyers maintain control, XRP could soon resume its bullish expansion into uncharted territory.

XRPUSD : Wave 4 possibly not yet completed.As of today, I see a new price pattern in XRPUSD.

The counting that is completed as of now seems like wave (A) and wave (B).

The price probably will go to wave (C) in 5 waves if it's going to be a flat pattern (3-3-5).

The other possibilities of wave 4 in the blue circle could be a triangle (ABCDE) or a double zigzag (complex).

I may be wrong. Please make your own analysis prior to placing any trade.

Long!! I opened a leverage long position over the weekend. I am planning to take profit at $4, $4.50 and $5. Stop loss is at $2.7

Reasons for a long position:

1) The price has pulled back and found a clear support at Fib .5 and EMA55.

2)The current chart set up is very similar to that in Jan 2025 (see green vertical line in the chart).

3) RSI is consolidating in the bull zone.

4) MACD lines are bunched up together and moving horizontally. However, the lines are in the bull zone and MACD histogram shows bear momentum is waning. It might be safer to wait for MACD lines to cross to the upside, but there are enough confluences for bullish bias.

5) The daily candle is now moving above Fib 0.236. Fib 0.236 often works as the last line of defence for the bear and if it is breached, it is very likely to move to the upside.

XRPUSD continues to declineXRPUSD continues to decline

XRPUSD has been trading within a descending channel since August 11. The asset trades below the SMA200 on hourly timeframe, breaking through and then retesting the support levels. Currently, the price trades below the SMA50 and has recently retested the former 3.00000 support level. MACD on 1- h timeframe has crossed into the red zone. The further decline towards 2.72000 is expected.